- Home

- »

- Pharmaceuticals

- »

-

Hepatitis Therapeutics Market Size, Industry Report, 2033GVR Report cover

![Hepatitis Therapeutics Market Size, Share & Trends Report]()

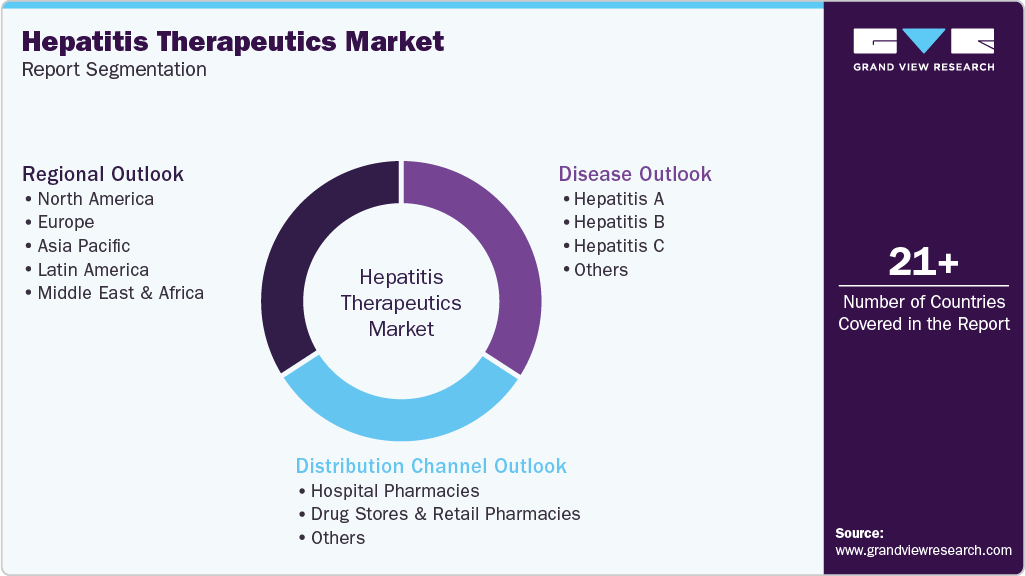

Hepatitis Therapeutics Market (2025 - 2033) Size, Share & Trends Analysis Report By Disease (Hepatitis A, Hepatitis B, Hepatitis C), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-449-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hepatitis Therapeutics Market Summary

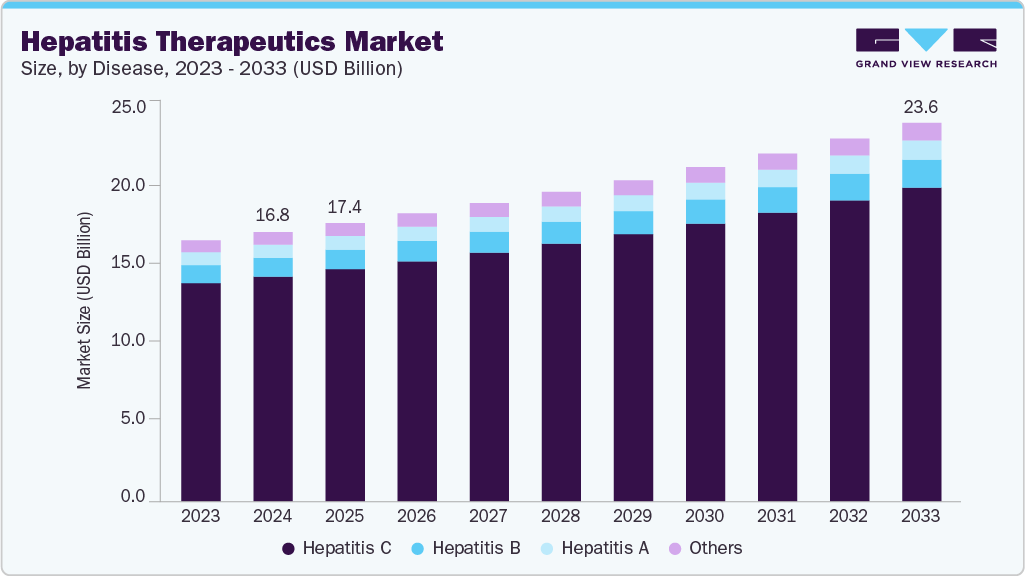

The global hepatitis therapeutics market size was estimated at USD 16.80 billion in 2024 and is projected to reach USD 23.62 billion by 2033, growing at a CAGR of 3.9% from 2025 to 2033. The global market is expanding as the prevalence of hepatitis B and C infections continues to pose a significant health challenge.

Key Market Trends & Insights

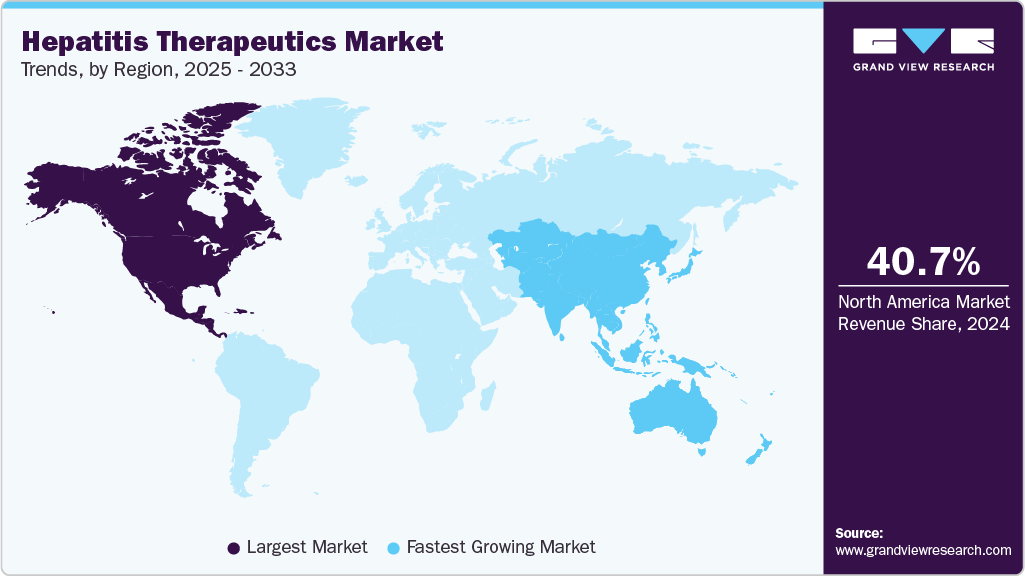

- North America hepatitis therapeutics market held the largest share of 40.70% of the global market in 2024.

- The hepatitis therapeutics industry in the U.S. is expected to grow significantly over the forecast period.

- By disease, the hepatitis C segment held the highest market share of 83.56% in 2024.

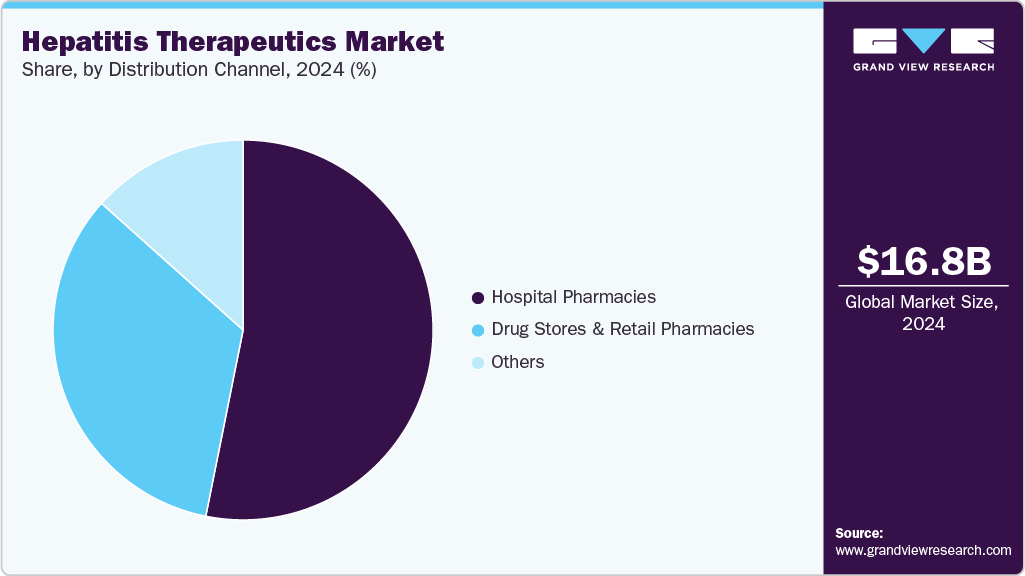

- By distribution channel, the hospital pharmacies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.80 Billion

- 2033 Projected Market Size: USD 23.62 Billion

- CAGR (2025-2033): 3.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Improved screening and rising clinical awareness have accelerated early diagnosis, supporting timely treatment initiation. Demand for antivirals, direct-acting antivirals, and immunomodulators remains strong, forming the backbone of current therapies. For instance, the Hepatitis B Foundation reported FDA approval of seven medications for chronic hepatitis B, including five oral antivirals: Viread, Vemlidy, Baraclude, Epivir-HBV, and Hepsera, along with two injectable immune modulators: Pegasys and Intron A. The foundation emphasized that treatment decisions should consider liver disease activity and cirrhosis, with regular specialist monitoring recommended. Rising adoption of curative hepatitis C therapies further strengthens growth prospects.Another key driver is the rise in liver-related complications associated with untreated hepatitis infections, such as cirrhosis and hepatocellular carcinoma, which is pushing demand for advanced therapeutic approaches. The increasing burden of comorbid conditions in aging populations has heightened reliance on antiviral regimens with proven efficacy and safety. Pharmaceutical companies are actively investing in clinical research to address these needs through therapies with higher cure rates and improved tolerability. For instance, in August 2025, Applied Clinical Trials Online reported that Aligos Therapeutics had initiated dosing in its Phase II B-SUPREME trial of ALG-000184, a first-in-class oral capsid assembly modulator, in approximately 200 treatment-naïve adults with chronic hepatitis B, including both HBeAg-positive and HBeAg-negative patients. The randomized, double-masked study was designed to compare ALG-000184 monotherapy with tenofovir disoproxil fumarate over 48 weeks, with primary endpoints focusing on HBV DNA suppression and secondary outcomes assessing safety, pharmacokinetics, and antigen reductions. Interim findings were expected in 2026, and topline results in 2027, while earlier Phase I data had already demonstrated sustained antiviral activity, favorable safety, and no new safety signals, reinforcing the momentum of clinical innovation in hepatitis therapeutics.

The emergence of cell-based immunotherapies is driving growth in the hepatitis therapeutics market, particularly for patients with advanced liver complications from chronic infections. For instance, in May 2025, OncLive reported that SCG101, an autologous HBV-specific T-cell therapy, delivered antiviral and antitumor activity in advanced HBV-related hepatocellular carcinoma. In a Phase I trial, 94% of patients achieved notable HBsAg reductions within 28 days, with sustained control for up to one year, while 23.5% achieved complete HBsAg loss. Tumor responses were observed in 47% of patients, and median overall survival had not been reached. Safety remained manageable, with transient ALT elevations and cytokine release syndrome being the most common events. These outcomes underscore the role of innovative immunotherapies in addressing unmet needs and strengthening market expansion.

Pipeline Analysis for the Hepatitis Therapeutics Market

NCT Number

Sponsor

Phases

Completion Date

NCT03933384

Taichung Veterans General Hospital

PHASE4

12/31/2030

NCT05182463

Third Affiliated Hospital, Sun Yat-Sen University

PHASE4

11/30/2029

NCT05630807

GlaxoSmithKline

PHASE3

5/8/2026

NCT05630820

GlaxoSmithKline

PHASE3

5/8/2026

NCT04704024

University of Alabama at Birmingham

PHASE3

12/31/2026

NCT07090759

Fujian Akeylink Biotechnology Co., Ltd.

PHASE3

3/1/2027

NCT03753074

Young-Suk Lim

PHASE4

12/31/2031

NCT04035837

Third Affiliated Hospital, Sun Yat-Sen University

PHASE4

6/30/2026

NCT07098481

ANRS, Emerging Infectious Diseases

PHASE4

6/30/2028

NCT05410496

Taichung Veterans General Hospital

PHASE4

7/30/2027

NCT06368882

First Affiliated Hospital of Wenzhou Medical University

PHASE4

12/31/2028

NCT07071636

Shenzhen Third People's Hospital

PHASE4

9/30/2029

NCT06221657

Yonsei University

PHASE4

12/31/2026

NCT05905172

Beijing Continent Pharmaceutical Co, Ltd.

PHASE3

10/20/2028

Source:ClinicalTrials.gov

Opportunity Analysis for Hepatitis Therapeutics Market

Opportunity Area

Description

Recent Verified Instance

Functional Cure Therapies for Hepatitis B

Emphasis on therapeutic vaccines aimed at achieving durable immune control or functional cure.

TherVacB, a therapeutic vaccine for chronic HBV, commenced a Phase 1b/2a multi-center trial in June 2025, enrolling its first patient.

RNAi Therapeutics for HBV

Gene silencing strategies designed to suppress viral proteins and enable functional cure.

Arbutus’ imdusiran (AB-729) reported in late 2024 that 50% of patients in Cohort A1 achieved functional cure when combined with pegylated interferon.

Expanded Use of DAAs for Acute Hepatitis C

Broader application of existing antiviral regimens to newly diagnosed acute HCV cases.

In June 2025, the FDA approved an expanded indication for AbbVie’s MAVYRET (glecaprevir/pibrentasvir) to treat acute HCV infections with an 8-week regimen and ~96% cure rate.

Market Concentration & Characteristics

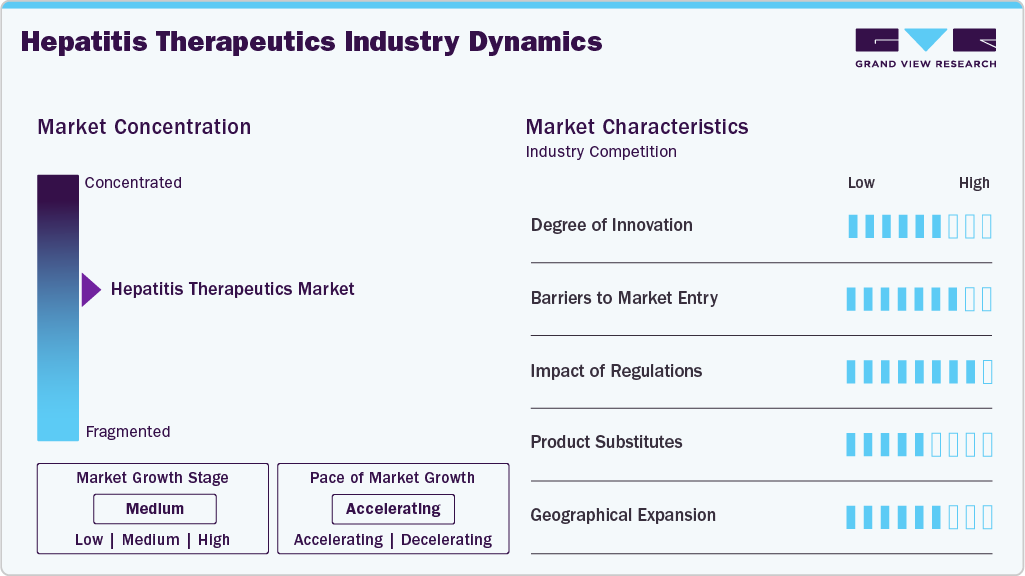

Innovation in the hepatitis therapeutics market is centered on next-generation antivirals and curative regimens, especially for hepatitis C. Companies such as Gilead Sciences and AbbVie have led breakthroughs with direct-acting antivirals that significantly shorten treatment duration. Research is also advancing in monoclonal antibodies and long-acting formulations for hepatitis B. Combination therapies targeting multiple viral pathways are under development to reduce resistance. The industry’s innovation is highly concentrated in specialized drug classes with strong intellectual property protection.

Entry barriers in the hepatitis therapeutics space are high due to substantial R&D costs and complex clinical trial requirements. Established players such as Merck and Bristol-Myers Squibb hold strong patents that restrict new entrants. Manufacturing of antivirals requires advanced capabilities in biologics and chemical synthesis. Global distribution networks through hospital pharmacies and retail drug stores are already dominated by leading pharmaceutical companies. As a result, new firms face significant challenges in establishing presence and scale.

Regulatory frameworks strongly shape the hepatitis therapeutics market by defining safety, efficacy, and approval timelines. Stringent requirements from agencies such as the FDA and EMA have slowed the entry of low-cost generics in advanced therapies. Labeling restrictions and post-marketing surveillance obligations increase compliance costs for players. Gilead, AbbVie, and Roche maintain competitive advantages due to their established regulatory expertise. Regulations thus serve as both a safeguard for patient safety and a barrier favoring incumbents.

Substitutes in hepatitis treatment are limited, as antivirals and biologics remain the core therapeutic approach. Preventive vaccines are available for hepatitis A and B, but they do not replace drug therapy for existing infections. Herbal and alternative therapies are used in some regions but lack clinical validation. Generics from companies such as Teva and Cipla act as functional substitutes for branded antivirals, mainly in price-sensitive markets. However, no true alternative exists for curative therapies in hepatitis C.

Geographical expansion is a key growth lever, with major players targeting high-prevalence regions in Asia Pacific, Africa, and Latin America. Gilead and Cipla have established access programs to supply affordable antivirals in India and sub-Saharan Africa. North America and Europe remain lucrative due to advanced healthcare infrastructure and premium pricing. Local companies such as Zydus and Lupin are expanding their distribution networks across emerging economies. The market shows a dual concentration: innovation in developed markets and volume growth in developing regions.

Disease Insights

The hepatitis C segment dominated the market with the largest revenue share of 83.56% in 2024, driven by the widespread adoption of direct-acting antivirals (DAAs) that deliver high cure rates and shorter treatment durations of 8-12 weeks. These regimens have improved adherence, reduced relapse risks, and strengthened patient outcomes, making them the preferred therapeutic option. Leading companies such as Gilead Sciences and AbbVie continue to generate substantial revenue from blockbuster drugs, including sofosbuvir-based therapies and glecaprevir-pibrentasvir combinations. For instance, in June 2025, AbbVie via PR Newswire reported that the U.S. FDA approved an expanded indication for MAVYRET (glecaprevir/pibrentasvir) as the first and only eight-week oral treatment for both acute and chronic hepatitis C in adults and children aged three years and older, supported by Phase III trial results showing a 96% cure rate. With rising awareness of hepatitis C complications, earlier diagnosis, and growing availability of affordable generics, the segment has firmly established its dominance in the global market.

The hepatitis B segment is projected to grow at the fastest CAGR of 4.6% over the forecast period, due to the chronic nature of the infection requiring long-term therapy. Antiviral drugs such as tenofovir and entecavir are widely prescribed, ensuring continuous market demand. Pharmaceutical companies are advancing research on functional cures through RNA interference therapies and therapeutic vaccines. For instance, in August 2025, the Centers for Disease Control and Prevention (CDC) reported that approximately 640,000 adults in the U.S were living with chronic hepatitis B, with the highest rates observed among non-Hispanic Asian/Pacific Islander individuals, at 9.9 times higher than non-Hispanic White individuals. In 2023, there were 17,650 newly reported cases (6.1 per 100,000 population), and 52% of acute cases occurred in individuals aged 40-59, with non-Hispanic Black persons experiencing 1.7 times higher rates than non-Hispanic Whites. Rising prevalence in Asia-Pacific and Africa, migration trends, lifestyle-related risk factors, and growing use of combination therapies collectively support the accelerated growth of the hepatitis B therapeutics market segment.

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share of 53.15% in 2024, driven by the predominance of specialist-led prescribing and complex treatment protocols. Hepatitis therapies often require careful monitoring, including liver function tests and viral load assessments, which are typically conducted in hospital settings. High-cost branded therapies such as DAAs and biologics are frequently distributed through hospital networks to ensure controlled dispensing. Patients with advanced liver disease or comorbidities are more likely to be treated in hospitals, driving higher pharmacy sales. Hospital pharmacies maintain stronger relationships with manufacturers, enabling access to newly launched therapies earlier than retail outlets. Institutional purchasing agreements also favor hospital channels by ensuring bulk supply at negotiated prices. This channel’s dominance reflects its central role in delivering advanced hepatitis treatments.

The drug stores and retail pharmacies segment is projected to grow at the CAGR of 3.1% over the forecast period, driven by increasing demand for accessible treatment options. The availability of generic antivirals from companies such as Teva, Cipla, and Lupin is widening access through retail outlets. Simplified oral regimens with lower toxicity profiles are more suitable for distribution outside hospitals. Rising patient preference for convenience is leading to greater reliance on local retail pharmacies for prescription refills. Expansion of pharmacy chains in urban and semi-urban areas is strengthening distribution networks. Retail pharmacies are increasingly integrating digital platforms, enabling online ordering and doorstep delivery of hepatitis medications. These shifts position retail channels as a fast-growing access point for hepatitis therapeutics globally.

Regional Insights

North America hepatitis therapeutics market held the largest share of in 2024, accounting for 40.70% of global revenue, due to strong adoption of advanced antivirals and biologics. High disease burden of hepatitis C and B in select populations has driven consistent treatment demand. Major pharmaceutical leaders such as Gilead Sciences, AbbVie, and Merck are headquartered in the region, strengthening market penetration. Well-established diagnostic infrastructure ensures earlier detection, which translates into timely initiation of therapy. Rising incidence of liver cancer linked to chronic hepatitis is further expanding the therapeutic need.

U.S. Hepatitis Therapeutics Market Trends

The U.S. accounts for the largest share within North America due to early approval of novel hepatitis drugs and strong commercial presence of global players. Expansive insurance coverage supports access to costly direct-acting antivirals and combination regimens. High prevalence among high-risk groups such as intravenous drug users has sustained treatment uptake. Academic centers and hospitals frequently participate in clinical trials, accelerating availability of next-generation therapies. The country also leads in generic penetration for older antivirals, ensuring both premium and affordable market segments. This dual structure positions the U.S. as the most dynamic hepatitis therapeutics market globally.

Europe Hepatitis Therapeutics Market Trends

Europe represents a significant market supported by rising hepatitis prevalence in migrant populations and aging demographics. Direct-acting antivirals from Roche, AbbVie, and Gilead maintain strong adoption across multiple EU countries. Increased emphasis on screening programs has improved early identification of infections, driving prescription volumes. Pharmaceutical collaborations with regional distributors are ensuring steady supply across diverse healthcare systems. Growing demand for pangenotypic regimens is improving treatment efficiency across varied patient groups. Europe thus remains a mature but steadily expanding hepatitis therapeutics hub.

The UK market is characterized by a structured healthcare environment that supports systematic adoption of hepatitis therapies. High uptake of oral regimens with shorter treatment cycles has strengthened adherence rates. Strategic partnerships between academic institutions and pharma companies drive clinical research on novel drug classes. Hepatitis C elimination targets have stimulated greater prescription of direct-acting antivirals in recent years. Increasing reliance on retail pharmacy chains is expanding patient access to maintenance drugs. This creates a favorable environment for continued market growth in the UK.

Germany contributes strongly to the European hepatitis therapeutics market due to its advanced hospital infrastructure and specialist-driven care. High prescription rates for innovative antivirals reflect physician confidence in novel regimens. A well-developed reimbursement system supports patient access to high-cost therapies. Rising cases of hepatitis B among immigrant populations have elevated demand for long-term antiviral drugs. Biopharmaceutical firms are actively conducting clinical studies in Germany, expanding treatment options. The country remains a leading European hub for both research and commercial adoption.

France’s hepatitis therapeutics market is shaped by strong demand for hepatitis C treatments and widespread use of generic antivirals. National focus on reducing liver-related mortality has supported greater treatment initiation across multiple patient categories. Pharmaceutical companies maintain robust collaborations with French research institutions to evaluate new therapies. Patient compliance is enhanced by simplified oral regimens with reduced side-effect profiles. The country also sees consistent adoption of hepatitis B drugs, given its sizable patient population. France is expected to sustain steady growth within the European market landscape.

Asia Pacific Hepatitis Therapeutics Market Trends

Asia Pacific hepatitis therapeutics market is expected to register the significant CAGR of 6.7% over the forecast period, driven by high hepatitis B and C prevalence rates. China and India represent large untreated populations, creating significant therapeutic opportunities. Rising affordability of generics from local companies such as Zydus, Cipla, and Lupin is fueling access. Increasing focus on hospital-based treatments is boosting antiviral and biologic adoption. Migration and lifestyle-related risk factors are contributing to a sustained disease burden. This dynamic environment makes Asia Pacific the fastest-evolving hepatitis therapeutics market globally.

Japan represents a mature hepatitis therapeutics market with strong focus on hepatitis C treatments. Widespread adoption of direct-acting antivirals has significantly reduced the untreated patient base. Domestic players collaborate with global firms to expand innovative therapy pipelines. Rising elderly population is contributing to higher rates of chronic hepatitis-related complications. Hospitals remain the primary treatment centers, supporting specialist-led care. Japan continues to be a key contributor to Asia Pacific’s revenue share in hepatitis therapeutics.

China has one of the largest hepatitis B patient population worldwide, driving substantial therapeutic demand. The country has seen rising adoption of antivirals such as entecavir and tenofovir, supported by strong local manufacturing capabilities. Pharmaceutical firms are expanding partnerships with Chinese distributors to increase drug availability. High prevalence of liver cancer linked to chronic hepatitis further strengthens demand for sustained treatment regimens. Retail pharmacies are gaining traction with broader distribution of low-cost generics. China remains a critical growth engine in the Asia Pacific hepatitis therapeutics market.

Latin America Hepatitis Therapeutics Market Trends

Latin America shows growing adoption of hepatitis therapies, driven by increasing diagnostic awareness and rising infection rates. Brazil and Mexico lead the region with significant investments in treatment availability. The market is supported by the presence of generics, making therapies more affordable across diverse income groups. Migration patterns and unsafe medical practices contribute to sustained hepatitis prevalence. Pharmaceutical firms are expanding their networks through local distributors to improve regional access. Latin America presents an emerging market with steady expansion prospects.

Brazil is the largest hepatitis therapeutics market in Latin America, with high prevalence of hepatitis B and C infections. Strong demand for oral antivirals is driving prescription volumes across both public and private sectors. Local production of generics is expanding patient access to cost-effective options. Hepatitis-related liver disease remains a pressing health issue, elevating therapeutic demand. Partnerships with global firms are introducing advanced direct-acting antivirals to the market. Brazil is expected to maintain a dominant role within Latin America’s regional growth.

Middle East & Africa Hepatitis Therapeutics Market Trends

MEA presents growth potential with rising hepatitis prevalence across both urban and rural populations. Limited diagnostic infrastructure has delayed treatment initiation, creating unmet demand. Global players are expanding supply networks to penetrate underserved markets in sub-Saharan Africa. Antiviral therapies are gradually gaining adoption as awareness of liver-related complications increases. Local firms are entering into licensing agreements with multinationals to distribute generics. This creates a pathway for steady expansion of hepatitis therapeutics in the region.

Saudi Arabia contributes significantly to the MEA market, with growing incidence of hepatitis B and C linked to lifestyle factors. The country has strong hospital infrastructure, supporting adoption of advanced antivirals and biologics. Rising prevalence of liver disease is fueling continuous treatment demand. Private healthcare expansion is enhancing distribution of branded and generic therapies. Pharmaceutical collaborations with regional distributors are strengthening market reach. Saudi Arabia is emerging as a key growth market in the Middle East hepatitis therapeutics landscape.

Key Hepatitis Therapeutics Company Insights

Teva Pharmaceutical Industries Ltd. supports the hepatitis therapeutics market with a broad generics portfolio that enhances affordability, while Bristol-Myers Squibb Company maintains influence through antiviral innovation and research in hepatitis B. F. Hoffmann-La Roche Ltd contributes with advanced diagnostics and established therapeutic expertise, and Zydus Group leverages strong manufacturing to deliver cost-effective options in emerging economies. GSK plc. advances antiviral therapies with a focus on combination regimens, whereas AbbVie Inc. leads hepatitis C treatment with its successful direct-acting antivirals. Gilead Sciences, Inc. dominates with curative regimens targeting multiple hepatitis C genotypes, and Merck & Co., Inc. expands through antiviral innovations addressing resistance challenges. Lupin strengthens access via its generics portfolio and retail networks, while Cipla enhances affordability and reach with competitive alternatives across Asia Pacific and Africa.

Key Hepatitis Therapeutics Companies:

The following are the leading companies in the hepatitis therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical Industries Ltd.

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd

- Zydus Group

- GSK plc.

- AbbVie Inc.

- Gilead Sciences, Inc.

- Merck & Co., Inc.

- Lupin

- Cipla

Recent Developments

-

In August 2024, Bristol Myers Squibb announced that the U.S. FDA accepted the supplemental Biologics License Application (sBLA) for Opdivo (nivolumab) plus Yervoy (ipilimumab) as a potential first-line treatment for adults with unresectable hepatocellular carcinoma.

-

In February 2024, GSK announced that the U.S. Food and Drug Administration (FDA) granted Fast Track designation to bepirovirsen, an investigational antisense oligonucleotide, for treating chronic hepatitis B (CHB).

-

In July 2023,Gilead Sciences announced a USD 8 million grant through its Relink program to re-engage individuals in the U.S. living with hepatitis C or B who are not in care. The CDA Foundation will distribute funds to healthcare organizations implementing evidence-based interventions. Approximately 2.4 million people have HCV, and 850,000 have HBV in the U.S., many untreated.

Hepatitis Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.36 billion

Revenue forecast in 2033

USD 23.62 billion

Growth rate

CAGR of 3.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Disease, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Teva Pharmaceutical Industries Ltd.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd; Zydus Group; GSK plc.; AbbVie Inc.; Gilead Sciences, Inc.; Merck & Co., Inc.; Lupin; Cipla

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hepatitis Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hepatitis therapeutics market report based on disease, distribution channel, and region:

-

Disease Outlook (Revenue, USD Million, 2021 - 2033)

-

Hepatitis A

-

Hepatitis B

-

Hepatitis C

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Drug Stores and Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hepatitis therapeutics market size was estimated at USD 16.80 billion in 2024 and is expected to reach USD 17.36 billion in 2025.

b. The global hepatitis therapeutics market is projected to grow at a CAGR of 3.9% from 2025 to 2033 to reach USD 23.62 billion by 2033.

b. Based on disease, hepatitis C segment led the market with the largest revenue share of 83.56% in 2024, driven by the widespread adoption of direct-acting antivirals (DAAs) that deliver high cure rates and shorter treatment durations of 8-12 weeks.

b. Some key players operating in the hepatitis therapeutics market include Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb Company, F. Hoffmann-La Roche Ltd, Zydus Group, GSK plc., AbbVie Inc., Gilead Sciences, Inc., Merck & Co., Inc., Lupin, Cipla.

b. Key factors that are driving market growth include rising prevalence of hepatitis B and C infections, which continues to pose a significant health challenge. Another key driver is the rise in liver-related complications associated with untreated hepatitis infections, such as cirrhosis and hepatocellular carcinoma, which is pushing demand for advanced therapeutic approaches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.