- Home

- »

- Clinical Diagnostics

- »

-

Hepatitis E Diagnostic Tests Market, Industry Report, 2030GVR Report cover

![Hepatitis E Diagnostic Tests Market Size, Share & Trends Report]()

Hepatitis E Diagnostic Tests Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (ELISA HEV IgM Test, Rapid Diagnostics Test), By End-use (Hospitals, Blood Banks), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-373-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hepatitis E Diagnostic Tests Market Summary

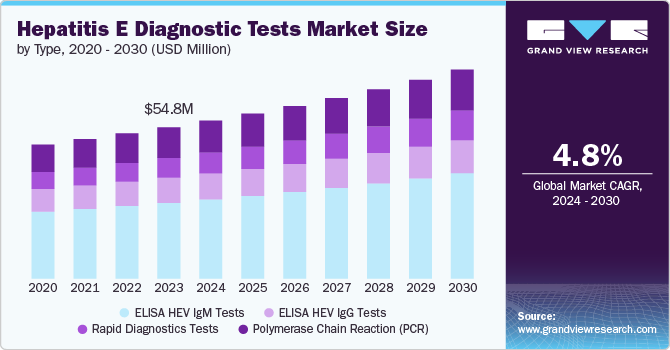

The global hepatitis E diagnostic tests market size was estimated at USD 57.1 million in 2024 and is projected to reach USD 75.6 million by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The growing prevalence of Hepatitis E globally, especially in developing regions, significantly drives the demand for diagnostic tests.

Key Market Trends & Insights

- The Asia Pacific hepatitis E diagnostic tests market dominated with the largest revenue share of 36.9% in 2024.

- The North America hepatitis E diagnostic tests market is anticipated to witness the fastest CAGR of 3.5% over the forecast period.

- Based on type, the ELISA HEV IgM tests segment captured the largest revenue share of 50.2% in 2024.

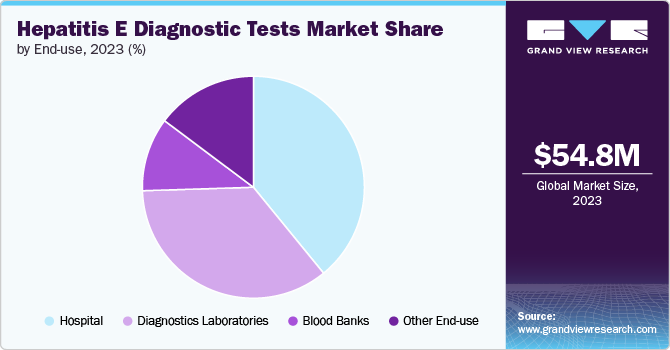

- Based on end-use, the hospitals segment generated the largest revenue share of 38.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 57.1 Million

- 2030 Projected Market Size: USD 75.6 Million

- CAGR (2025-2030): 4.8%

- Asia Pacific: Largest market in 2024

As the awareness surrounding Hepatitis E increases due to public health campaigns and improved access to information, more individuals are seeking early detection and treatment. This heightened awareness is boosting the adoption of diagnostic tests, contributing to the market's expansion. Additionally, the emphasis on preventing outbreaks and improving healthcare infrastructure further stimulates the growth of the Hepatitis E diagnostic test market, with continued advancements in testing technology.

In addition, innovations in diagnostic technologies, such as advanced molecular techniques, rapid testing platforms, and point-of-care (POC) solutions, significantly enhance the detection of hepatitis E. These advancements offer faster, more accurate, cost-effective diagnostics, which are expected to increase market demand. The surge in preference for POC diagnostics, driven by the need for quick results in remote or resource-limited areas, further boosts market growth. As healthcare systems prioritize early diagnosis and timely interventions, the hepatitis E diagnostic tests market is poised for substantial expansion in the years ahead.

Type Insights

Based on type, the ELISA HEV IgM tests segment captured the largest revenue share of 50.2% in 2024, owing to its high sensitivity, ease of use, and cost-effectiveness. ELISA tests are widely preferred for detecting IgM antibodies, which indicate recent infection with the hepatitis E virus. This diagnostic method is trusted for its reliability and ability to deliver quick results, making it a standard tool in clinical settings. Its extensive use in both endemic and non-endemic regions and surging demand for accurate diagnosis has driven its dominant market share.

The rapid diagnostics tests segment is expected to witness the fastest CAGR of 6.0% over the forecast period. As the demand for quicker, more accessible testing solutions rises, RDTs offer the advantage of fast, accurate results at the point of care, facilitating early detection and prompt intervention. The surging prevalence of hepatitis E and advancements in testing technologies drive the adoption of RDTs across developed and developing regions. This trend is projected to expand the market, providing cost-effective solutions and improving disease management.

End-use Insights

The hospitals segment generated the largest revenue share of 38.9% in 2024, attributed to the increasing occurrence of hepatitis E infections, especially in regions with poor sanitation. Hospitals provide comprehensive diagnostic services, including advanced testing technologies and expert medical care, making them the primary setting for hepatitis E diagnosis. In addition, the growing number of hospital-based healthcare initiatives, improved disease awareness, and government investments in healthcare infrastructure contribute to the escalating demand for diagnostic tests in hospitals, expanding their market share.

The diagnostics laboratories segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. Increasing awareness of hepatitis E and its growing prevalence globally are pushing demand for accurate and reliable diagnostic solutions. Laboratories are central to providing advanced testing services, including serological, molecular, and antigen-based tests essential for early detection and effective treatment. Moreover, technological breakthroughs in diagnostic tools and increased healthcare investments are expected to accelerate market growth, solidifying the role of diagnostics labs in managing hepatitis E outbreaks.

Regional Insights

North America hepatitis E diagnostic tests market is anticipated to witness the fastest CAGR of 3.5% over the forecast period, fueled by increasing outbreaks of hepatitis E, improved healthcare facilities, and sizable investments in medical research. The region is witnessing a surging focus on early disease detection and monitoring, propelling demand for advanced diagnostic solutions. Moreover, the high prevalence of hepatitis E in specific populations and innovations in molecular diagnostics and rapid testing technologies are poised to fuel market growth further. Regulatory support and advancements in healthcare technologies are also expected to contribute to this booming trend.

U.S. Hepatitis E Diagnostic Tests Market Trends

The U.S. hepatitis E diagnostic tests market held the largest revenue share in North America in 2024 due to increasing awareness, improved healthcare access, and an escalating focus on infectious disease management. Rising incidences of hepatitis E, particularly in travelers and immunocompromised individuals, are fueling the demand for accurate and reliable diagnostic tools. Advanced technologies, such as ELISA and PCR tests, are gaining traction in the U.S. healthcare system. Besides, ongoing research and government support for infectious disease control initiatives are expected to fuel further the growth of the hepatitis E diagnostic tests market in the region.

Increased awareness of liver diseases and advancements in healthcare infrastructure are projected to make Canada a crucial market contributor by 2030. With a surge in government initiatives to address viral hepatitis and surging healthcare spending, diagnostic testing for Hepatitis E is gaining more attention. Canada’s well-established healthcare system, coupled with rising awareness about Hepatitis E’s potential risks, is poised to drive market growth. In addition, the availability of advanced diagnostic technologies and increased focus on early detection are expected to fuel the demand for Hepatitis E testing in the country.

Europe Hepatitis E Diagnostic Tests Market Trends

The growth of the Europe hepatitis E diagnostic tests market can be attributed to its advanced healthcare infrastructure, widespread awareness, and early adoption of diagnostic technologies. The region has seen a rise in hepatitis E cases, driving the demand for efficient and accurate diagnostic tests. Furthermore, Europe's strong focus on research and development in infectious diseases has improved testing methods, such as ELISA and LISA HEV IgM tests. Government initiatives and well-established healthcare systems further contribute to the region's dominance in the hepatitis E diagnostics market.

The UK hepatitis E market is anticipated to witness a CAGR of 5.9% over the forecast period, driven by the escalating incidence of the virus, particularly among travelers and high-risk groups, including pregnant women and immunocompromised individuals. Increased awareness about hepatitis E and advancements in diagnostic technologies are accelerating the demand for efficient testing methods. The robust healthcare infrastructure, government initiatives, and ongoing research regarding hepatitis E contribute to market growth in the country. As detection and early intervention become a priority, the demand for hepatitis E diagnostic tests is set to rise.

Germany is poised to establish a notable presence in the hepatitis E diagnostic tests market by 2030, spurred by its advanced healthcare infrastructure, increasing awareness of infectious diseases, and a rising focus on early detection. The country's strong investment in medical research and diagnostics technology is propelling innovation in hepatitis E testing methods. Germany's well-established healthcare system also supports the widespread adoption of advanced diagnostic tools. As the prevalence of hepatitis E rises and preventive measures gain traction, Germany is expected to see substantial growth in demand for diagnostic tests, positioning it as a booming market.

Asia Pacific Hepatitis E Diagnostic Tests Market Trends

Asia Pacific hepatitis E diagnostic tests market dominated with the largest revenue share of 36.9% in 2024, owing to the region's high prevalence of Hepatitis E, especially in developing countries with limited sanitation and healthcare infrastructure. The widespread occurrence of hepatitis E in countries such as India, China, and Bangladesh has heightened the need for effective diagnostic solutions. Increasing awareness, government initiatives, and ample regional healthcare investments have further boosted demand for Hepatitis E testing. Also, the focus on improving early detection and treatment is contributing to the market's growth in Asia Pacific.

The Asia Pacific hepatitis E diagnostic tests market is anticipated to grow at a CAGR of 5.6% over the forecast period, fueled by the high prevalence of the disease in the region, particularly in countries with limited healthcare infrastructure. The widespread occurrence of hepatitis E, driven by factors such as contaminated water and inadequate sanitation, has intensified the need for effective diagnostic solutions. Also, growing healthcare awareness and government initiatives to combat infectious diseases are catalyzing market growth. The region's ample investment in healthcare infrastructure further boosts the adoption of diagnostic tests, cementing its dominance in the market.

The Japan hepatitis E diagnostic tests market is projected to grow at a significant CAGR of 5.6% over the forecast period, propelled by its strong healthcare infrastructure and emphasis on infectious disease control. With advancements in medical technology and rising awareness of hepatitis E, Japan is fueling demand for more efficient diagnostic tools. The country’s aging population, which is more vulnerable to infections, further amplifies the need for early detection and prevention. Furthermore, Japan’s commitment to public health initiatives and government-backed healthcare innovations position it for significant growth in the hepatitis E diagnostic tests industry.

The China hepatitis E diagnostic tests market growth can be attributed to the increasing prevalence of hepatitis E, spurred by factors such as poor sanitation and contaminated water sources in certain areas. As awareness of the disease grows and the Chinese government strengthens public health initiatives, the demand for effective diagnostic solutions is escalating. Moreover, the advancements in testing technologies and greater healthcare access in urban and rural regions contribute to market growth. The rising focus on early detection and improved healthcare infrastructure is expected to drive demand for hepatitis E diagnostic tests in China.

Key Hepatitis E Diagnostic Tests Company Insights

Some of the key companies in the hepatitis E diagnostic tests market include Wantai BioPharm, MP Biomedicals LLP, PerkinElmer, Inc., and Dia.Pro Diagnostic Bioprobes srl, ELITechGroup, Primerdesign Ltd, F. Hoffmann-La Roche Ltd, Mikrogen GmbH, Altona Diagnostics, and Fortress Diagnostics, among others.

-

F. Hoffmann-La Roche Ltd offers various diagnostic solutions, including advanced molecular and serological tests for infectious diseases such as hepatitis E, focusing on precision medicine and automation.

-

PerkinElmer, Inc. provides comprehensive diagnostic tools and innovative testing solutions, specializing in molecular diagnostics, immunoassays, and screening platforms that aid in the early detection and monitoring of various diseases, including hepatitis E.

Key Hepatitis E Diagnostic Tests Companies:

The following are the leading companies in the hepatitis E diagnostic tests market. These companies collectively hold the largest market share and dictate industry trends.

- Wantai BioPharm

- MP Biomedicals LLP

- PerkinElmer, Inc

- Dia.Pro Diagnostic Bioprobes srl

- ELITechGroup

- Primerdesign Ltd

- F. Hoffmann-La Roche Ltd

- Mikrogen GmbH

- Altona Diagnostics

- Fortress Diagnostics

Recent Developments

-

In November 2023, Roche unveiled the Elecsys Anti-HEV IgM and IgG immunoassays for identifying hepatitis E in CE-mark countries. These automated serology tests, including one for acute HEV, are recommended in the 2023 WHO Essential Diagnostics List.

-

In April 2023, Altona Diagnostics partnered with Velsera to integrate its AI-based automated analysis solution into the AltoStar Molecular Diagnostics Workflow, enhancing its capabilities for improved diagnostic efficiency and accuracy.

Hepatitis E Diagnostic Tests Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.7 million

Revenue forecast in 2030

USD 75.6 million

Growth Rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Wantai BioPharm, MP Biomedicals LLP, PerkinElmer, Inc, Dia.Pro Diagnostic Bioprobes srl, ELITechGroup, Primerdesign Ltd, F. Hoffmann-La Roche Ltd, Mikrogen GmbH, Altona Diagnostics, Fortress Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hepatitis E Diagnostic Tests Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hepatitis E diagnostic tests market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ELISA HEV IgM Tests

-

ELISA HEV IgG Tests

-

Rapid Diagnostics Tests

-

Polymerase Chain Reaction (PCR)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics Laboratories

-

Blood Banks

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.