- Home

- »

- Clinical Diagnostics

- »

-

Hepatitis Diagnostic Tests Market Size & Share Report, 2030GVR Report cover

![Hepatitis Diagnostic Tests Market Size, Share & Trends Report]()

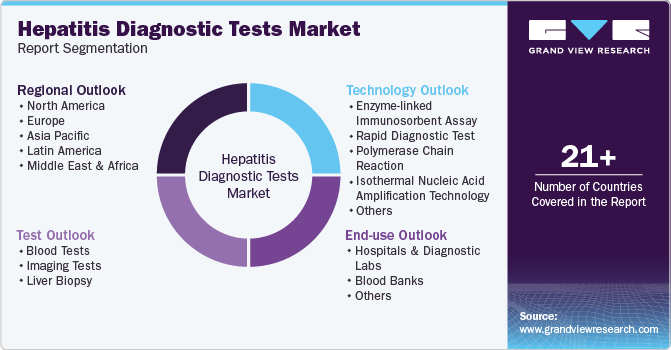

Hepatitis Diagnostic Tests Market Size, Share & Trends Analysis Report By Test (Blood Test, Imaging Tests, Liver Biopsy), By Technology (ELISA, Rapid Diagnostic Test, PCR), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-369-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hepatitis Diagnostic Tests Market Trends

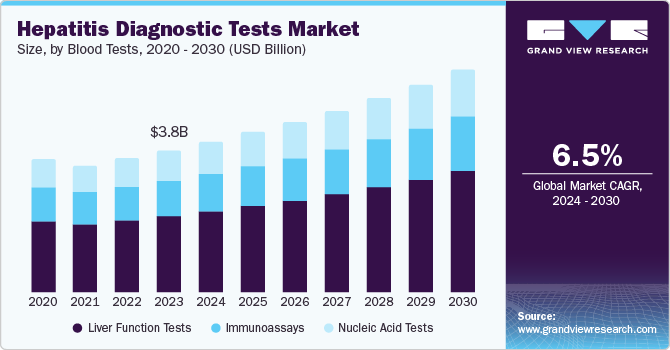

The global hepatitis diagnostic tests market size was valued at USD 3.82 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. Hepatitis is a medical condition in which patients experience pain and inflammation in the liver. Depending on the patient's profile, the condition can be acute or chronic. Estimated clinical data represent a high mortality rate arising from hepatitis. Around 300-350 million people are carriers of Hepatitis B and C virus infections. In addition, a majority of these carriers can remain asymptomatic for decades. Therefore, diagnostic tests offer screening and testing for such patients to understand the severity of the condition.

The introduction of molecular diagnosis for hepatitis and increasing awareness propels the significance of hepatitis diagnostic tests in the forecast period. The growing cases of Hepatitis B and C in adults and children have necessitated the demand for diagnostic solutions. For instance, worldwide, in 2023, there were more than three million estimated cases of chronic Hepatitis C in adolescents and children. This has created a huge need for treatment and diagnosis of viral infection. The World Health Organization conducts awareness campaigns to educate common people to understand viral hepatitis and follow precautionary measures.

Technology Insights

Enzyme-linked immunosorbent assay (ELISA) dominated with a substantial market share of 59.7% in 2023. It is a well-established and reliable method, presenting consistent results for detecting antibodies or antigens related to hepatitis viruses. This is essential in diagnosing viral infections. Secondly, ELISA is essential for large-scale screening. It is a cost-effective approach and can be implemented for diverse applications.

The rapid diagnostic tests segment is expected to witness the fastest-growing CAGR of 7.6% during the forecast period. The demand for rapid diagnostic test (RTD) kits is high because they cater to clinics, and hospitals in qualitative and quantitative analysis of antibodies, and antigens. These kits have become essential in identifying chronic diseases enabling doctors and healthcare workers to pursue clinical decisions and the line of treatment. In addition, the rise in demand for PoC diagnostics, and clinical innovations are the key factors that encourage the segment growth.

End-use Insights

Hospitals & diagnostic labs dominated with a market share of 65.9% in 2023 as they are a one-stop solution for diagnosis and treatment. These units are well-equipped with advanced generation such as ELISA testing machines and screening for liver biopsies. In addition, they offer complete and dependable diagnostic solutions. Furthermore, the growing dependence on hospitals for routine check-ups and the adoption of advanced imaging techniques encourage patients to opt for early diagnosis.

The blood banks segment is expected to grow a rapid CAGR of 7.6% over the forecast period.The rising need for blood transfusion in the elderly population, the increasing number of surgeries, and the high prevalence of chronic diseases contribute to the significance of blood banks. In addition, the growing awareness of blood donation and initiatives for blood collection and storage infrastructure is expected to enlarge the demand for blood banks.

Test Insights

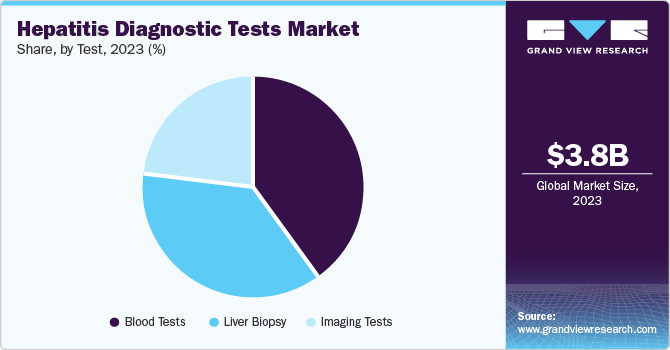

The blood tests segment dominated with a market share of 52.1% in 2023 as they are widely used to diagnose Hepatitis A, B, and C. These tests are often done as preliminary tests to determine the liver and establish the evidence of hepatitis. Developments such as PCR (polymerase chain reaction) tests, and serological assays offer higher accuracy for detecting hepatitis C. An HCV antibody, also known as an ELISA screen, checks the antibodies to fight the virus. In addition, the growing significance of ELISA in evaluating hepatitis condition contributes to the segment growth.

The liver biopsy segment is expected to expand at a steady CAGR during the forecast period. Liver biopsy plays a vital role in diagnosing hepatitis conditions. The liver biopsy system is a diagnostic procedure that extracts a small sample of liver tissues for microscopic examination. This minimally invasive detection identifies liver diseases such as fibrosis, hepatitis, cirrhosis, and fatty livers. The inspection is usually performed under local anesthesia, wherein the biopsy guides the medical professionals to plan further treatment. Furthermore, introducing advanced imaging techniques, such as multiparametric MRI and elastography, fuels the segment's growth.

Regional Insights

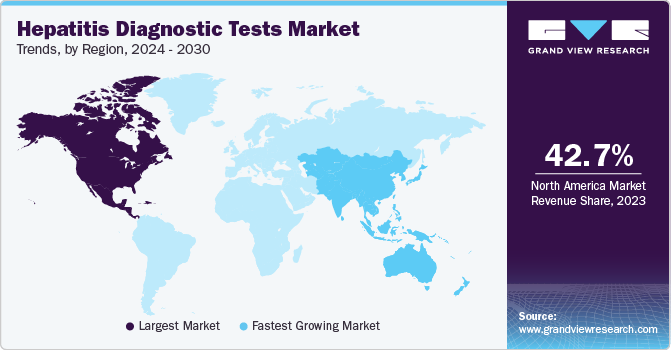

North America hepatitis diagnostic tests market dominated in 2023 with a revenue share of 42.7%. The region has witnessed a high incidence of hepatitis B and C in the past few years. This has resulted in a huge demand for diagnostic tests and solutions for hepatitis infections. In addition, the highly developed healthcare system and awareness boost the demand for clinical solutions. The presence of several leading biotechnology and pharmaceutical companies drives innovation in diagnostic technologies.

Europe Hepatitis Diagnostic Tests Market Trends

Europe hepatitis diagnostic test market accounted for a significant market share in 2023. High prevalence of Hepatitis C (HCV) in the population owing to dependence on drugs and substances. However, the introduction of direct-acting antiviral (DAA) therapy has significantly enhanced the clinical management of HCV infection. At regional levels, the European Union and its members are committed to sustainable development goals and focused on eliminating viral hepatitis by 2030. In this regard, WHO and EASL (European Association for Study of Liver) have developed clinical guidelines recommending therapies for patients suffering from HCV infection, regardless of their disease stage.

Asia Pacific Hepatitis Diagnostic Tests Market Trends

Asia Pacific hepatitis diagnostic test market is expected to witness the fastest CAGR of 6.9% over the forecast period due to a larger population with asymptomatic hepatitis. The clinical industry in the Asia Pacific region is projected a fast growth attributed to high medical awareness and the adoption of modern imaging technologies. The policies adopted by the respective governments support the development of clinical solutions and enable ease of accessibility for patients.

Key Hepatitis Diagnostic Tests Company Insights

The key players of the market include Siemens Ag, F. Hoffmann La-Roche, Abbott Laboratories; DiaSorin S.p.A; bioMeriuex, MedMira, Inc.; Hologic, Inc.; Danaher Corporation, and Bio-Rad Laboratories, etc. Strategies such as mergers and acquisitions, partnerships with small/local players are widely adopted by key players to sustain the competition.

-

Abbott Laboratories is a global healthcare company that manufactures and distributes medical devices, diagnostics, nutritional products, and branded generic pharmaceuticals. The company offers tests for various hepatitis viruses including hepatitis B and C.

-

Bio-Rad Laboratories Inc., manufactures and markets a wide range of innovative products for life science research and clinical diagnostics markets. It offers several key products, including serological and molecular diagnostic tests for hepatitis B and C. Their product line includes the BioPlex 2200 System, which provides multiplex testing capabilities for various infectious diseases, including hepatitis.

Key Hepatitis Diagnostic Tests Companies:

The following are the leading companies in the hepatitis diagnostic test market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Bio-Rad Laboratories Inc

- BioMerieux SA

- F. Hoffmann-La Roche AG

- Siemens Healthineers

- Diasorin S.p.A

- Qaigen

- Sysmex Corporation

- VWR International, LLC

- Hologic Inc

Recent Developments

-

In June 2022, Ohio State Wexner Medical Centre And Siemens Healthineers strategically collaborated to exchange the most advanced imaging and treatment technologies. This partnership also delivers state-of-the-art radiation oncology modalities with AI-driven personalized care solutions for patients.

Hepatitis Diagnostic Tests Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.05 billion

Revenue forecast in 2030

USD 5.90 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2018 to 2030

Report coverage

Revenue Forecast; company share; competitive landscape; growth factors and trends

Segments covered

Test, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; Thailand; South Korea; Malaysia; Brazil; Argentina; UAE; South Africa; Kuwait; Saudi Arabia

Key companies profiled

Abbott Laboratories; Bio-Rad Laboratories Inc; BioMerieux SA; F. Hoffmann-La Roche AG; Siemens Healthineers; Diasorin S.p.A; Qaigen; Sysmex Corporation; VWR International, LLC; Hologic Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hepatitis Diagnostic Tests Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hepatitis diagnostic tests market report based on test, technology, end-use, and region.

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Tests

-

Liver Function Tests

-

Immunoassays

-

Nucleic Acid Tests

-

-

Imaging Tests

-

Liver Biopsy

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzyme-linked Immunosorbent Assay (ELISA)

-

Rapid Diagnostic Test

-

Polymerase Chain Reaction (PCR)

-

Isothermal Nucleic Acid Amplification Technology (INAAT)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Labs

-

Blood Banks

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."