Heavy-duty Electric Trucks Market Size, Share & Trends Analysis Report By Vehicle Class, By Propulsion Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-354-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Heavy-duty Electric Trucks Market Trends

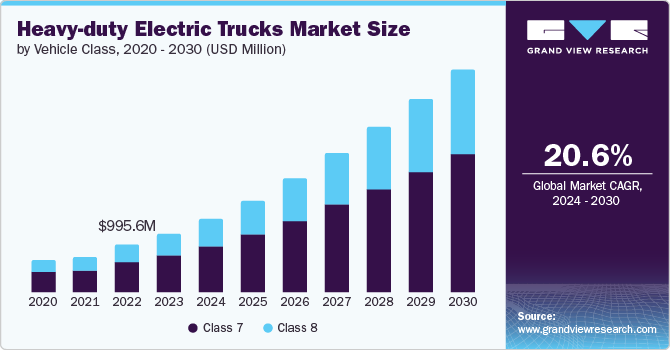

The global heavy-duty electric trucks market size was estimated at USD 1.22 billion in 2023 and is expected to grow at a CAGR of 20.6% from 2024 to 2030. Heavy-duty electric trucks are the electric counterparts of conventional diesel-powered trucks used for long-distance freight hauling and construction and mining dump trucks. With the growing emphasis on sustainable and eco-friendly practices, heavy-duty electric trucks are becoming increasingly prevalent in the freight, logistics, construction, and transport industries, providing a modern approach to meeting the demands of cargo transportation.

Heavy-duty electric trucks are transforming the transportation industry with their numerous benefits. Some benefits include reduced carbon footprint, enhanced performance, operational efficiency, quieter operations, economic advantages, and reduced maintenance needs. Heavy-duty electric trucks make a substantial impact on reducing CO2 emissions, thereby contributing to a cleaner environment. They provide a smoother driving experience with superior torque and acceleration than diesel trucks. In urban settings, particularly with frequent stops, heavy-duty electric trucks provide greater efficiency than their diesel counterparts. Their minimal noise levels enable operation with less disturbance, making them suitable for noise-sensitive areas and nighttime operations. Such benefits of heavy-duty electric trucks are expected to improve the market’s growth.

Furthermore, governments worldwide provide incentives for purchasing heavy-duty electric trucks, such as tax credits, rebates, and grants, to lower the initial acquisition costs of these vehicles. For instance, the Inflation Reduction Act established a tax credit to incentivize the adoption of electric medium-duty and heavy-duty commercial vehicles. The Qualified Commercial Clean Vehicle tax credit provides up to USD 40,000 in tax credits for purchasing eligible electric trucks and other large commercial vehicles acquired and placed into service on or after January 1, 2023. Thus, rising government support to promote the adoption of electric heavy-duty vehicles such as electric trucks is further propelling the market's growth.

The sales of heavy-duty vehicles, including all medium- and heavy-duty trucks, are gradually increasing globally. According to a report published by the International Energy Agency (IEA), electric truck sales saw a 35% increase in 2023 compared to 2022. China remains the major market, accounting for 70% of global sales in 2023, down from 85% in 2022. In Europe, electric truck sales nearly tripled in 2023, surpassing 10,000 units. The U.S. also experienced a threefold increase in electric truck sales, reaching 1,200 units. Thus, the growing production and sales of electric trucks across the globe are expected to contribute to the market’s growth.

Despite the various benefits of heavy-duty electric trucks, high upfront costs, limited daily range, and higher operating costs under certain conditions could hamper the market's growth. Highway driving impacts the heavy-duty electric truck's battery, often requiring frequent replacements. In addition, heavy-duty electric trucks have a limited range, demanding regular recharging of their batteries. This limitation can pose challenges for long-haul trucking operations requiring prolonged driving periods without access to charging stations. However, with ongoing advancements in heavy-duty electric truck technology, the market's growth is expected to increase from 2024 to 2030.

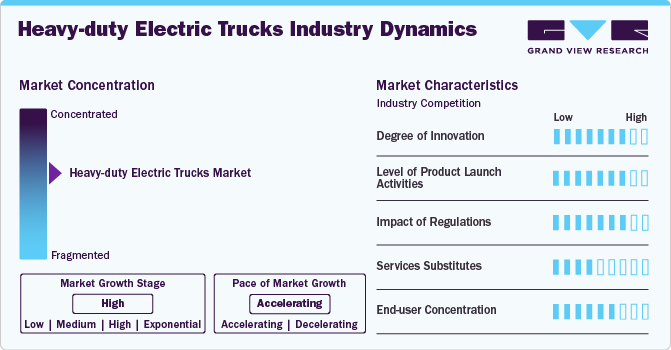

Market Concentration & Characteristics

The industry's growth stage is high, and the pace of its growth is accelerating. The heavy-duty electric truck industry can be characterized by a high degree of innovation. Innovation is pivotal in driving the adoption of heavy-duty electric trucks, with advancements in battery technology being a key focus area.

The industry is also characterized by a high level of new product launch activities by key companies. Major companies focus on R&D activities to improve battery durability and charging efficiency and reduce charging times, aiming to tackle primary concerns related to electric vehicles (EVs).

Regulatory trends play a substantial role in influencing the global industry. These trends include a shift towards sustainable transportation solutions driven by stringent emission regulations and the increasing adoption of zero-emission heavy-duty vehicles.

There are no direct substitutes available for heavy-duty electric trucks in terms of features and benefits. However, ICE trucks can be considered substitutes for heavy-duty electric trucks. However, heavy-duty electric trucks are a cleaner, greener, and more efficient option for logistics and freight transportation, driven by their environmental benefits, cost savings, and transformative potential.

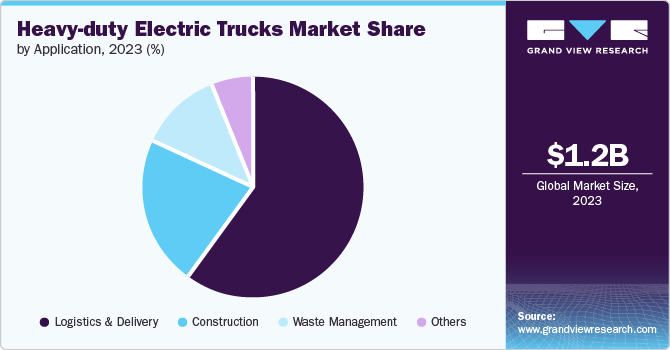

The market has a moderate to high concentration of end users. The industry is expanding with diverse applications across industries, such as logistics & delivery, construction, waste management, and others. These trucks are increasingly used in these industries due to their low noise levels and zero emissions, making them suitable for urban environments.

Vehicle Class Insights

The class 7 segment dominated the market in 2023 and accounted for a 63.04% share of the global revenue. Class 7 heavy-duty electric trucks have a gross vehicle weight rating (GVWR) between 26,001 pounds and 33,000 pounds. Rising government initiatives to increase the adoption of class 7 EVs can be attributed to the segment’s growth. For instance, in April 2024, the US Environmental Protection Agency (EPA) launched the 2024 Clean Heavy-Duty Vehicles Grant Program to support the transition of Class 7 and Class 6 vehicles to zero emissions. This program will provide nearly USD 1 billion to support replacing certain non-zero-emission vehicles with zero-emission vehicles and to support zero-emission vehicle fueling infrastructure and workforce training and development. Thus, increasing government initiatives to tackle climate change and reduce air pollution boosts the segment’s growth.

The class 8 segment is projected to witness significant growth from 2024 to 2030. Class 8 heavy-duty electric trucks have a GVWR of 33,001 pounds and over. Increasing adoption of class 8 electric trucks for applications such as long-haul freight transportation, construction material hauling, and mining operations can be attributed to the segment’s growth. In addition, the vast availability of class 8 electric trucks in the global market is further fueling the segment’s growth. For instance, companies, such as AB Volvo and Kenworth Truck Company, offer class 8 electric truck models, such as VNR Electric and T680E, respectively.

Propulsion Type Insights

The Hybrid Electric Vehicle (HEV) segment dominated the market in 2023. Hybrid heavy-duty trucks combine the advantages of both electric powertrain and traditional combustion engine powertrain, offering a versatile vehicle capable of operating emission-free when required. These trucks can achieve an extended range when running on HVO or Biodiesel, providing flexibility and sustainability in various operating conditions. The increased development of hybrid heavy-duty trucks by prominent companies can be attributed to the segment’s growth. For instance, in June 2023, FAMCO launched the first-ever heavy-duty electric truck in the Middle East, strengthening their position as industry pioneers and their commitment to sustainable transportation solutions.

The Battery Electric Vehicle (BEV) segment is projected to grow significantly from 2024 to 2030. Increasing adoption of battery-powered heavy-duty trucks for applications such as deliveries for retailers and logistics companies and hauling materials to and from construction sites is driving the segment's growth. In addition, the growing demand for battery-powered heavy-duty trucks from automotive manufacturers to transport vehicles between ports, manufacturing facilities, and distribution warehouses is driving the segment's expansion. In February 2023, Nissan Corporation started using two heavy-duty BEV, Class 8 trucks to transport vehicles from the Port of Los Angeles to the Los Angeles region’s dealerships. The two major manufacturers of electric heavy-duty trucks involved in this program are Nikola Corporation and Kenworth Truck Company, each providing trucks to pull traditional car haulers for this transportation endeavor. Such initiatives are expected to bode well for the market’s growth.

Application Insights

The logistics & delivery segment dominated the market in 2023. The shift toward electric trucks in the transportation industry aims to enhance the efficiency of goods deliveries. Advancements in battery technology and the emergence of next-generation motors are poised to promote the utilization of EVs in urban logistics. Various logistics and delivery companies and e-commerce companies are adopting heavy-duty electric trucks for delivery across the first, middle, and last mile. For instance, in May 2024, Amazon expanded its fleet of heavy-duty electric trucks in California, U.S., with plans to deploy nearly 50 Volvo VNR Electric trucks across its Southern California operations. This initiative marks a crucial milestone in Amazon’s efforts to eliminate carbon emissions throughout all stages of the delivery process, encompassing first, middle, and last-mile operations. Such initiatives are expected to improve the growth of the segment.

The construction segment is projected to witness considerable growth from 2024 to 2030. The construction industry’s need for heavy-duty electric transportation is on the rise, driven primarily by the establishment of zero-emission zones in urban areas and the imperative for construction companies to align with climate targets. Furthermore, in February 2023, Volvo Trucks, a truck manufacturing division of AB Volvo, introduced a range of heavy electric trucks tailored specifically for the construction industry. By utilizing electric trucks, companies can fulfill the growing demand for vehicles with zero exhaust emissions and reduced noise levels in and around urban construction sites. Thus, several manufacturers are developing heavy-duty electric trucks, enabling customers in the construction sector to transition towards more sustainable transportation, boosting the segment’s growth.

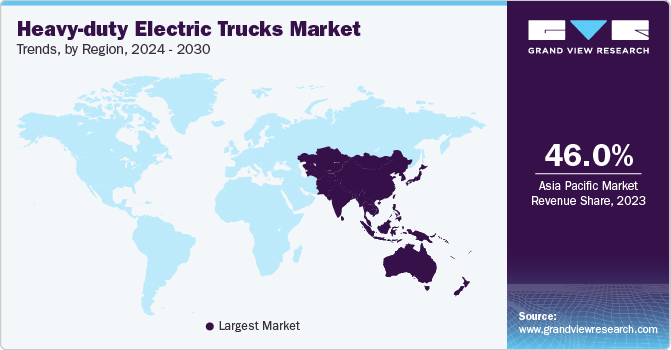

Regional Insights

The heavy-duty electric trucks market in North America is expected to witness notable growth from 2024 to 2030 due to increasing government incentives to promote the adoption of zero-emission heavy-duty vehicles and growing technological advancements.

U.S. Heavy-duty Electric Trucks Market Trends

The U.S. heavy-duty electric trucks market is expected to register the highest CAGR of 16.7% from 2024 to 2030. The electrification of heavy-duty vehicles is accelerating in the U.S., driven by major manufacturers' commitments to mass-produce zero-emission vehicles (ZEVs) as early as 2030. State policies like California's Advanced Clean Trucks rule, federal incentives from the Inflation Reduction Act, and the U.S. joining the Global Commercial Drive to Zero (aiming for 100% ZEV sales by 2040) have all contributed to increased adoption of zero-emission technologies in the heavy-duty vehicle sector in the country.

The heavy-duty electric trucks market in Canada is expected to grow at a notable growth rate from 2024 to 2030. In July 2022, to encourage the adoption of zero-emission medium- and heavy-duty vehicles by Canadian businesses, the Government of Canada introduced the Incentives for Medium- and Heavy-Duty Zero-Emission Vehicles (iMHZEV). This initiative provides incentives of up to CAD 200,000 (USD 146,112) per vehicle to help offset the higher upfront costs of zero-emission trucks and buses. Such government initiatives are expected to contribute to the market growth in Canada.

Asia Pacific Heavy-duty Electric Trucks Market Trends

The Asia Pacific heavy-duty electric trucks marketdominated the global market in 2023 and accounted for a share of 46.04%. Governments in countries like China, Japan, India, and South Korea are promoting the adoption of EVs, including heavy-duty trucks, through subsidies, tax incentives, and supportive regulatory frameworks. In addition, there’s a significant focus on advancing battery technology, charging infrastructure, and vehicle efficiency to improve the range and performance of heavy-duty electric trucks. Such factors are expected to contribute to the market’s growth in the region.

The heavy-duty electric trucks market in China is expected to witness a steady growth rate from 2024 to 2030. There is increasing demand for heavy-duty electric trucks in China, particularly in the logistics and construction sectors. Companies are transitioning fleets to electric models to meet environmental regulations and operational efficiency goals.

The India heavy-duty electric trucks market is anticipated to grow at a significant growth rate from 2024 to 2030. Factors such as supportive government policies, advancements in EV infrastructure, and the increasing emphasis on sustainable transportation are expected to contribute to the market’s growth in the country.

The heavy-duty electric trucks market in Japan is expected to register the highest CAGR from 2024 to 2030 in the APAC regional market. There is a growing demand for eco-friendly transportation solutions among Japanese consumers and businesses. This demand is pushing logistics and transportation companies to adopt electric trucks to align with the increasing emphasis on sustainability.

Europe heavy-duty electric trucks Market Trends

The Europe heavy-duty electric truck market is expected to grow at a CAGR of 19.2% from 2024 to 2030 due to a strong presence and proactive initiatives of major companies, such as AB Volvo, Daimler Truck AG, Scania, Tevva Motors Ltd., and DAF Trucks. These companies actively engage in collaborations, partnerships, and new product launches to accelerate the transition to heavy-duty electric trucks, fostering a robust market expansion in the region.

The heavy-duty electric trucks market in the UK is expected to grow at a notable CAGR from 2024 to 2030. In October 2023, the UK government invested GBP 200 million (approximately USD 253 million) to accelerate the deployment of zero-emission trucks across the country. This funding will support the rollout of up to 370 zero-emission vehicles in the country. Thus, increasing government investment to boost the adoption of zero-emission heavy-duty vehicles drives the market growth.

The Germany heavy-duty electric trucks market is a leading market in Europe. It is expected to grow at the highest CAGR from 2024 to 2030 due to stringent emission regulations and the transition towards zero-emission vehicles.

MEA Heavy-duty Electric Trucks Market Trends

The heavy-duty electric trucks market in MEA is anticipated to grow at a steady CAGR of 16.5% from 2024 to 2030. In October 2023, Emirates Global Motor Electric signed an agreement with the Chinese multinational heavy machinery and truck manufacturer SANY Group, becoming the exclusive distributor of SANY Group’s light and heavy-duty electric trucks in the UAE. Such initiatives are expected to bode well for the market’s growth.

The KSA heavy-duty electric trucks market is expected to witness the highest CAGR from 2024 to 2030. Saudi Arabia's efforts to diversify its economy away from oil dependence include significant investments in infrastructure. This development fosters increased demand for heavy-duty electric trucks, particularly in the logistics and construction sectors.

Key Heavy-duty Electric Trucks Company Insights

Some of the key companies operating in the market include AB Volvo, Scania, BYD Motors Inc., and Daimler Truck AG.

-

AB Volvo manufactures trucks, buses, construction equipment, and marine & industrial engines. The company also offers comprehensive financing and service solutions, catering to the diverse needs of its customers worldwide

-

Daimler Truck manufactures commercial vehicles. The company’s truck product range includes light, medium, and heavy-duty trucks for distribution, construction, and long-haul applications, specialized vehicles primarily used in the municipal sector, and industrial engines. The company operates significant production facilities in Germany, France, Japan, India, Brazil, Turkey, Mexico, and the U.S., and locations across most countries worldwide

Nikola Corporation, Navistar, Inc., Kenworth Truck Company, DAF Trucks, SAIC HONGYAN Automotive Co., Ltd., and Tevva Motors Limited, are some of the emerging companies in the heavy-duty electric trucks market.

-

Nikola Corporation manufactures and designs zero-emission hydrogen-electric and battery-EVss, electric drivetrains, vehicle components, energy storage systems, and hydrogen station infrastructure. The company has two components: the Energy business unit and the Truck business unit. The Truck business unit manufactures and sells BEV trucks and commercializes and develops FCEV trucks that offer cost-effective, environmentally friendly solutions to the trucking sector

-

Tevva Motors Limited is a truck manufacturer and technology company. The company specializes in producing zero-tailpipe emission EVs and long-range hydrogen EVs.

Key Heavy-duty Electric Trucks Companies:

The following are the leading companies in the heavy-duty electric trucks market. These companies collectively hold the largest market share and dictate industry trends.

- AB Volvo

- BYD Motors Inc.

- Nikola Corporation

- Daimler Truck AG

- Navistar, Inc.

- Scania

- Tevva Motors Limited

- Kenworth Truck Company

- DAF Trucks

- SAIC HONGYAN Automotive Co., Ltd.

Recent Developments

-

In May 2024, Volvo Financial Services and Volvo Trucks North America partnered to launch Volvo on Demand, an initiative to increase the adoption of BEVs. Through the initiative, the company offers an accessible solution for acquiring BEVs, reducing the need for significant upfront investments

-

In May 2024, BAE Systems and Eaton Corp. expanded their partnership to encompass EV solutions for heavy-duty trucks. The partnership aims to provide original equipment manufacturers and commercial vehicle modifiers with a comprehensive, efficient, advanced, and adaptable EV system suitable for various zero-emission platforms

-

In January 2022, Volvo Trucks introduced an enhanced version of Volvo VNR Electric, featuring up to 85% increase in range and faster charging capabilities. The Volvo VNR Electric is specifically designed for the North American market. The new Volvo VNR Electric reduces charging times, with its 250kW charging capability delivering an 80% charge in 90 minutes for the six-battery package and in 60 minutes for the four-battery version

Heavy-duty Electric Trucks Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.53 billion |

|

Revenue forecast in 2030 |

USD 4.70 billion |

|

Growth rate |

CAGR of 20.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in units, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle class, propulsion type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

AB Volvo; BYD Motors Inc.; Nikola Corp.; Daimler Truck AG; Navistar, Inc.; Scania; Tevva Motors Ltd.; Kenworth Truck Company; DAF Trucks; SAIC HONGYAN Automotive Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Heavy-duty Electric Trucks Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the heavy-duty electric trucks market report based on vehicle class, propulsion type, application, and region:

-

Vehicle Class Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Class 7

-

Class 8

-

-

Propulsion Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-in Hybrid Electric Vehicle (PHEV)

-

Hybrid Electric Vehicle (HEV)

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Logistics & Delivery

-

Construction

-

Waste Management

-

Others

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global heavy-duty electric trucks market size was estimated at USD 1.22 billion in 2023 and is expected to reach USD 1.53 billion in 2024.

b. The global heavy-duty electric trucks market is expected to grow at a compound annual growth rate of 20.6% from 2024 to 2030, reaching USD 4.70 billion by 2030.

b. The class 7 segment dominated the market in 2023 and accounted for a 63.04% share of the global revenue. Class 7 heavy-duty electric trucks have a gross vehicle weight rating (GVWR) between 26,001 pounds to 33,000 pounds. Rising government initiatives to increase the adoption of class 7 electric vehicles can be attributed to the segment’s growth.

b. Some of the key companies operating in the market include AB Volvo, Scania, BYD Motors Inc., Daimler Truck AG, Nikola Corporation, Navistar, Inc., Kenworth Truck Company, DAF Trucks, and SAIC HONGYAN Automotive Co.,Ltd., and Tevva Motors Limited

b. With the growing emphasis on sustainable and eco-friendly practices, heavy-duty electric trucks are becoming increasingly prevalent in the freight, logistics, construction, and transport industries, providing a modern approach to meeting the demands of cargo transportation.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."