Heated Tobacco Products Market Size, Share & Trends Analysis Report By Product (Stick, Leaf), By Distribution Channel (Offline, Online), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-412-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Heated Tobacco Products Market Trends

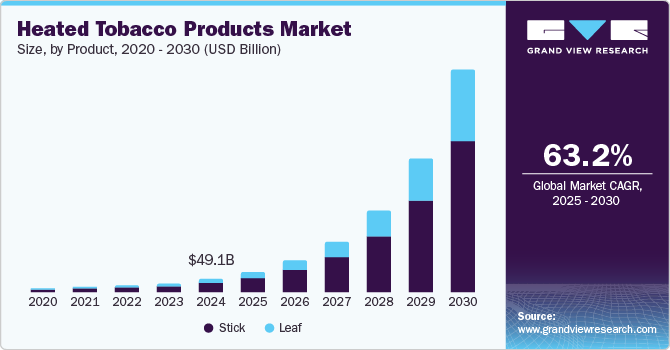

The global heated tobacco products market size was valued at USD 49.14 billion in 2024 and is projected to grow at a CAGR of 63.2% from 2025 to 2030. The major factors driving the market growth include steadily decreasing sales of conventional cigarettes globally and a growth in demand for tobacco products that present lower health risks. Heated tobacco products (HTPs) are perceived to contain low levels of nicotine and chemicals, boosting their popularity among the smoking demographic. Many smokers consider them to be a potentially less harmful alternative to traditional smoking because they involve heating tobacco rather than burning it. This process generates fewer harmful chemicals compared to conventional cigarettes, does not produce smoke, and can be used multiple times, which are notable advantages for shifting people to these solutions.

Governments worldwide have started to implement stricter smoking regulations, including higher taxes on cigarettes, smoking bans in public places, and restrictions on tobacco advertising. These regulations are potentially driving consumers toward different alternatives, including HTPs. Some governments have been more lenient with heated tobacco products, offering a less restrictive environment for their consumption, manufacturing, marketing, and sales, which supports their demand. For instance, in the UK, Public Health England (PHE) and the Office for Health Improvement and Disparities (OHID) have expressed agreeable opinions concerning heated tobacco products. A review by PHE in 2018 stated that HTPs expose smokers to comparatively lower levels of harmful compounds and particulate matter when compared to conventional cigarette smoke. The UK Committee on Toxicity (COT), meanwhile, assessed that these items are likely to present lower health risks in comparison to cigarettes to smokers. Such inferences are expected to present growth opportunities for companies in the heated tobacco products industry to launch their offerings.

Continuous innovations and improvements in heated tobacco products, such as better design, improved taste, and convenience for smokers, are playing a crucial role in ensuring industry expansion. The development of user-friendly devices and better-quality tobacco sticks or capsules has enhanced the popularity of these products for consumers. Accordingly, major brands such as IQOS and glo have made significant investments in developing their products, which has helped increase brand awareness and availability in various regions. A number of regional brands have also emerged in recent years, launching innovative solutions to improve product efficiency and user satisfaction. For instance, China-based REJO has aimed to address the issues of lower puffs provided per stick and thin cloud densities seen in existing brands through the launch of the REJO Mate Air. According to the company, their product deploys a reverse heating technology called 'round heating', which substantially increases the heating surface and leads to the generation of more clouds in less time. REJO states that this technique helps improve the number of puffs from 12 to 14 or 16 that can be extracted out of each stick.

There has been a steady growth in the number of smokers seeking alternatives to traditional cigarettes, driven by changing social norms and attitudes towards smoking. Simultaneously, there has also been a notable rise in demand for products that offer a similar sensory experience to cigarettes while avoiding the harmful byproducts of combustion. Younger consumers are more likely to explore alternatives to traditional smoking, including heated tobacco and vaping, which is expected to present growth avenues for the industry. Major tobacco companies have greatly improved their marketing efforts for heated tobacco products, often positioning them as modern, less harmful alternatives to cigarettes. Through targeted marketing and advertising campaigns, companies have been able to build consumer awareness and create demand for these products while also following regulatory policies. Social media and influencer partnerships are other notable factors anticipated to play an important role in promoting HTPs, especially among younger and technologically aware demographics.

Product Insights

The stick segment accounted for the largest revenue share of 72.0% in the heated tobacco products industry in 2024. The rising adoption of HTPs among modern consumers and their perception as a premium and less risky option has led to the increased production of heated tobacco sticks. Moreover, the increasing global presence of notable manufacturers and the availability of sticks in different flavors is expected to help maintain a strong share of this segment in the coming years. In some countries, regulations have been more supportive of heated tobacco products compared to other alternatives, such as e-cigarettes, which can lead to greater market penetration for heated tobacco sticks. The steady expansion of global tobacco companies into emerging economies that witness high consumption of traditional cigarettes has further helped improve the market outlook, with brands introducing heated tobacco products as a less harmful alternative to traditional methods of tobacco consumption.

Meanwhile, the leaf segment is expected to advance at the highest CAGR in the global market for heated tobacco products from 2025 to 2030, aided by the effective pricing of loose-leaf products. Additionally, these products are easier to manufacture when compared to their stick variants, making them more appealing for smaller companies entering this industry. Advances in heating technology, which allow for more efficient and consistent heating of tobacco leaves, contribute to the appeal of these products. Devices that offer better temperature control and less odor make heated tobacco leaf products more appealing to users.

Distribution Channel Insights

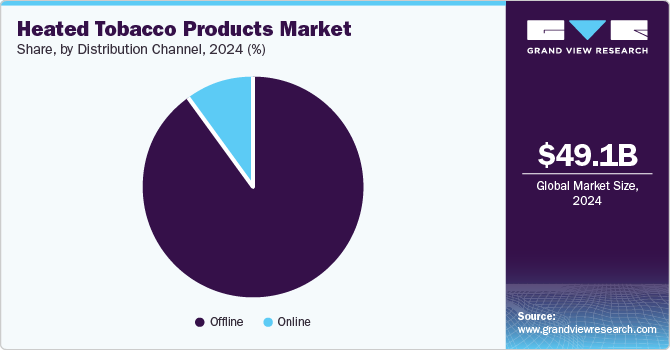

The offline segment accounted for a dominant revenue share in the global heated tobacco products industry in 2024. The easy availability and convenience offered to consumers in terms of selection and purchase, along with the launch of attractive packaging options by manufacturers, have created a major sales channel for these products through physical stores. In economies where sales of alternative smoking options are permitted, specialty vape shops sell heated tobacco products along with other alternatives such as e-cigarettes and vapes. These stores typically deploy a knowledgeable staff who can help customers understand the differences between various HTPs and provide product recommendations, encouraging consumers to make a purchase.

On the other hand, the online segment is expected to advance at the fastest CAGR during the forecast period in this industry. Online platforms allow consumers to purchase heated tobacco devices and accessories anywhere and anytime, and it is more convenient than having to visit physical stores with limited operating hours. Moreover, online retailers often carry a wider variety of heated tobacco devices, tobacco sticks, and accessories compared to physical stores. This provides consumers with more options and allows them to choose from different brands, models, and price ranges. This channel further provides detailed product descriptions, specifications, and comparison tools, helping consumers make more informed decisions. Such advantages have helped create a strong demand for HTPs through online distribution channels among users in recent years.

Regional Insights

Asia Pacific accounted for a dominant revenue share of 68.9% in the global market for heated tobacco products in 2024. High smoking rates in regional economies such as Japan and China have resulted in increasing concerns about the health risks associated with conventional cigarettes. Heated tobacco products, which are perceived to produce fewer harmful chemicals compared to combustible tobacco, are increasingly being seen as a better alternative among smokers in these countries, boosting their demand. Additionally, the presence of several well-established companies developing HTPs, such as Philip Morris International and Japan Tobacco International, has led to increased sales and awareness regarding these products in this region.

Japan Heated Tobacco Products Market Trends

Japan accounted for the largest revenue share in the regional market in 2024. The country is a leading producer and consumer of tobacco products, with around 19 million people in the economy considered to be tobacco users in 2022. As a result, government initiatives aiming to reduce smoking rates have provided an avenue for developers of alternative products, such as HTPs and e-cigarettes, to launch their offerings. Japan has been one of the early adopters of these products, with Japan Tobacco introducing its 'Ploom' HTP through the online channel in 2013, followed by Philip Morris (IQOS) and British American Tobacco (glo) entering this space in 2014 and 2016, respectively. As a result, awareness regarding the market has grown substantially over the past decade, with the Tobacco Institute of Japan stating that around 40% of overall tobacco sales domestically in 2023 were accounted for by HTPs.

North America Heated Tobacco Products Market Trends

North America accounted for a healthy revenue share in the overall HTPs market in 2024, owing to improving perception regarding these products among smokers aiming to quit cigarette smoking. The growth of online shopping has made it easier for consumers to purchase heated tobacco products, particularly those who prefer discretion and convenience. Economies such as the U.S., Canada, and Mexico have implemented regulations that are expected to shape product development and initiatives in this market during the forecast period. For instance, in Canada, according to different sections in the Tobacco and Vaping Products Act, sales of heated tobacco products are subject to a minimum consumer age and specific packaging requirements. The Act further determines channels for product sales, with the province of Quebec prohibiting online sales by mandating the presence of both consumer and seller during sales of HTPs. Such scenarios are expected to influence market strategies in the region.

The U.S. heated tobacco products market is expected to advance at the fastest CAGR in the regional market during the forecast period. Rising awareness regarding HTPs among younger consumers in the economy and increased exposure through online channels are expected to impact product sales. Furthermore, government regulations are expected to play an important role in creating opportunities for companies involved in this market. The Centers for Disease Control and Prevention (CDC) started tracking the usage of HTPs among adults in the country in 2017, finding that 0.7% of this population claimed to have used the product. This number grew to 2.4% in 2018, indicating the growing popularity of this market. Moreover, an article published by the CDC stated that in 2023, a combined 1.0% of high and middle school students stated to have used HTPs in the preceding 30 days. Such instances showcase the significant revenue potential for brands to enter into this market with innovative products in the coming years.

Europe Heated Tobacco Products Market Trends

Europe is expected to advance at the fastest CAGR in the global heated tobacco products industry from 2025 to 2030. Tobacco companies in regional economies are advertising the potential of these products to reduce exposure to harmful chemicals such as tar and carbon monoxide, which are produced by traditional cigarettes. A number of economies in the region are recognizing HTPs as modified-risk tobacco products, similar to e-cigarettes. This regulatory shift enhances the credibility of HTPs as a safer alternative, creating opportunities for market players to expand their geographical presence. According to a report by Tobacco Tactics, the use of HTPs increased significantly in Europe between 2015 and 2022, with economies such as Italy, Germany, and Poland contributing significantly to this trend. The increasing proliferation of companies such as Japan Tobacco International (JTI), Philip Morris International (PMI), and British American Tobacco is expected to create positive growth avenues for the overall industry.

Italy accounted for a leading revenue share in the European market for HTPs in 2024. The economy still has a substantial population of smokers and individuals addicted to nicotine. According to a report by Global Action to End Smoking, in 2022, over 10 million Italians aged 15 years and above used tobacco products, placing the country as the 19th largest tobacco-consuming economy globally. HTPs are marketed as an effective way for consumers to maintain their nicotine habits while reducing exposure to the harmful chemicals exhaled while smoking cigarettes. Over the past decade, the economy has witnessed the implementation of several major regulations that have influenced market expansion. For instance, the country was the first choice for PMI to conduct trials of its IQOS product due to beneficial tax policies for these products implemented by the Italian government, along with more lenient marketing and packaging regulations.

Key Heated Tobacco Products Company Insights

Some major companies involved in the global heated tobacco products industry include Philip Morris International, British American Tobacco, and Japan Tobacco International, among others.

-

British American Tobacco (BAT) is a multinational organization developing tobacco and other advanced tobacco-related products. The company is known mainly through its cigarette brands, such as Kent, Dunhill, Rothmans, Lucky Strike, and Pall Mall. It also develops vapor products (Vuse), heated tobacco products (glo), and oral nicotine pouches (Velo). The glo HTP brand includes a handheld electronic device with a lithium-ion battery that powers a heating chamber. glo products, which include Pro, Hyper, Hyper+, and Hyper X2 models, are available in 30 global markets, with around 8.8 million customers using these products as of 2022, as stated by the company.

-

Philip Morris International (PMI) is a multinational tobacco company that manufactures and sells cigarettes and smoke-free products, including e-vapor, heated tobacco, and oral smokeless products, in more than 180 markets. The company aims to shift from conventional cigarettes through improved distribution of its IQOS line of HTPs, the VEEV electronic vapor product range, and ZYN nicotine pouches. Under the HTP product line, PMI is known for its IQOS ILUMA products, IQOS ORIGINALS, BONDS BY IQOS, lil SOLID Ez, and lil HYBRID. The company's smoke-free products are available in 95 countries, with PMI claiming that over 22 million adult smokers have stopped smoking by switching to HTPs.

Key Heated Tobacco Products Companies:

The following are the leading companies in the heated tobacco products market. These companies collectively hold the largest market share and dictate industry trends.

- BAT

- Philip Morris Products S.A.

- JT International S.A.

- PAX Labs, Inc.

- Vapor Tobacco Manufacturing LLC

- Shenzhen Yukan Technology Co., Ltd.

- KT&G Corp.

- China National Tobacco Corporation

- Imperial Brands plc

- Altria Group, Inc.

Recent Developments

-

In March 2024, British American Tobacco announced the opening of the cutting-edge 'Innovation Centre' facility at the company's Southampton-based R&D headquarters. The facility would speed up the development of the company's New Category, Reduced Risk Products, through nine technical spaces. Products to be developed include heated tobacco products, vapor product liquids and flavors, and modern oral nicotine pouches. Research would also be conducted on the stimulation and well-being of users beyond nicotine, packaging, engineering, and system integration. The development supports BAT's 'Build a Smokeless World’ strategy to generate 50% of its overall revenue from non-combustible solutions by 2035.

-

In March 2024, Philip Morris International launched the 'IQOS ILUMA i' range of heated tobacco products in Japan, marking a decade since the company first introduced its IQOS portfolio in the country. Similar to other devices in this range, the new products emit 95% fewer harmful chemicals on average when compared to conventional cigarettes. Devices in this line include the IQOS ILUMA i PRIME, IQOS ILUMA i, and IQOS ILUMA i ONE, all of which use PMI's bladeless SMARTCORE INDUCTION SYSTEM. They also feature a touchscreen on the device holder, a Pause Mode to optimize stick usage, and FlexBattery to improve battery usage and reduce e-waste generation.

Heated Tobacco Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 77.61 billion |

|

Revenue forecast in 2030 |

USD 898.86 billion |

|

Growth Rate |

CAGR of 63.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Rest of the World |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea |

|

Key companies profiled |

BAT; Philip Morris Products S.A.; JT International S.A.; PAX Labs, Inc.; Vapor Tobacco Manufacturing LLC; Shenzhen Yukan Technology Co., Ltd.; KT&G Corp.; China National Tobacco Corporation; Imperial Brands plc; Altria Group, Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Heated Tobacco Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heated tobacco products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stick

-

Leaf

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Rest of the World

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."