- Home

- »

- Advanced Interior Materials

- »

-

Heat Treating Market Size, Share, Industry Report, 2033GVR Report cover

![Heat Treating Market Size, Share & Trends Report]()

Heat Treating Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Steel, Cast Iron), By Process (Case Hardening, Hardening & Tempering), By Equipment (Electrically Heated Furnace), By Application (Automotive, Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-287-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Heat Treating Market Summary

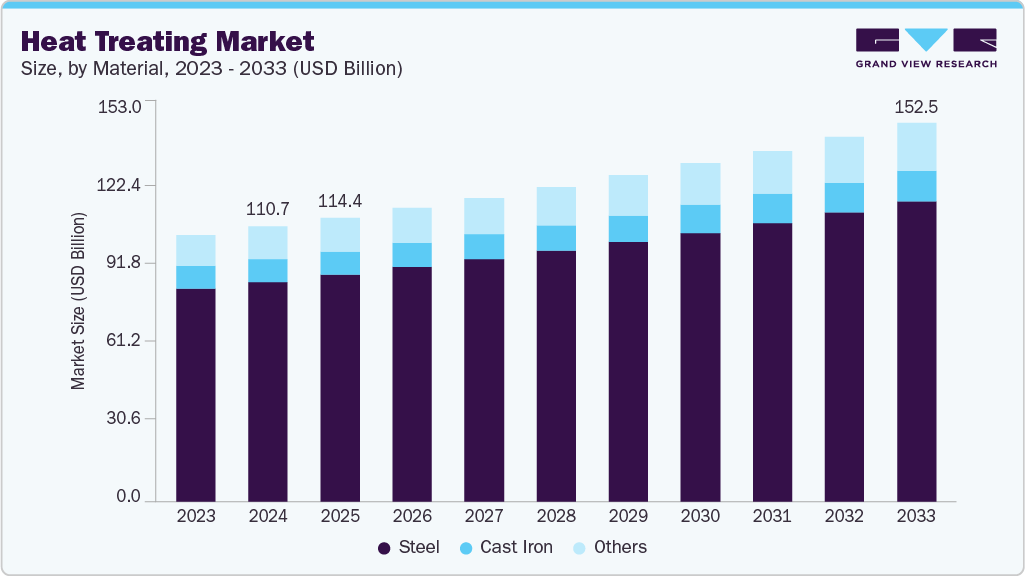

The global heat treating market size was estimated at USD 110.68 billion in 2024 and is expected to reach USD 152.51 billion by 2033, growing at a CAGR of 3.7% from 2025 to 2033. The global market is witnessing steady growth, driven by the increasing demand for high-performance materials in automotive, aerospace, construction, and industrial manufacturing sectors.

Key Market Trends & Insights

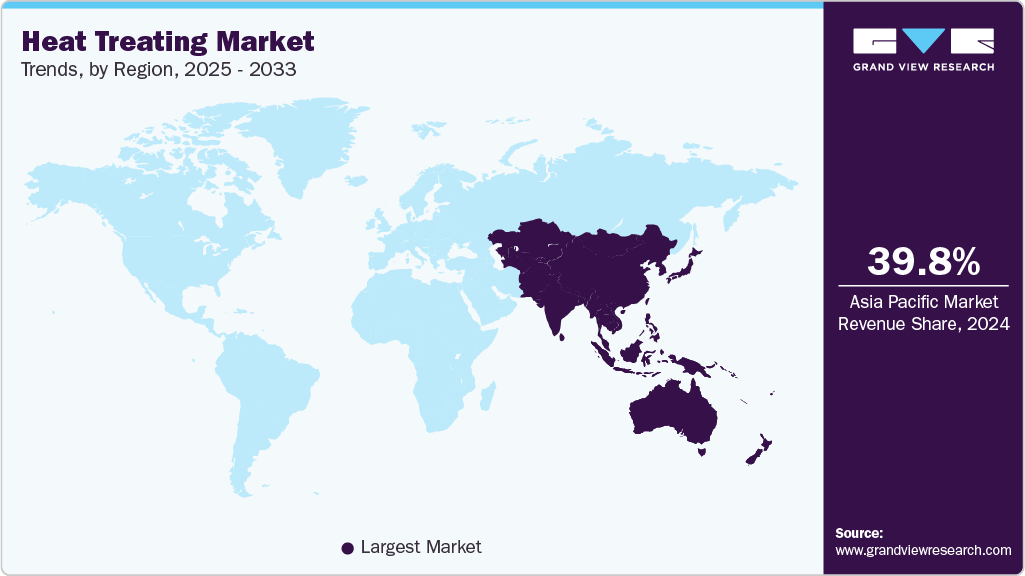

- Asia Pacific dominated the heat treating market with the largest revenue share of 39.8% in 2024.

- The heat treating market in the India is expected to grow at a substantial CAGR of 5.5% from 2025 to 2033.

- By material, the steel segment is expected to grow at a considerable CAGR of 3.6% from 2025 to 2033.

- By process, the annealing segment is expected to grow at a considerable CAGR of 4.2% from 2025 to 2033.

- By equipment, the electrically heated furnace equipment segment is expected to grow at a considerable CAGR of 4.1% from 2025 to 2033.

- By application, the aerospace segment is expected to grow at a considerable CAGR of 4.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 110.68 Billion

- 2033 Projected Market Size: USD 152.51 Billion

- CAGR (2025-2033): 3.7%

- Asia Pacific: Largest market in 2024

Technological advancements in furnace design, automation, and process control have significantly improved efficiency, energy consumption, and output quality, further fueling market expansion. Moreover, expanding industrialization in emerging economies such as China, India, and Brazil is significantly boosting the demand for heat-treated components. The construction, heavy machinery, and energy sectors require durable parts, which rely on heat treatment for enhanced durability. Continuous advancements in furnace technologies and energy-efficient systems are also attracting industry adoption. Furthermore, stringent quality standards in manufacturing processes are increasing reliance on precise and controlled heat treatment techniques.

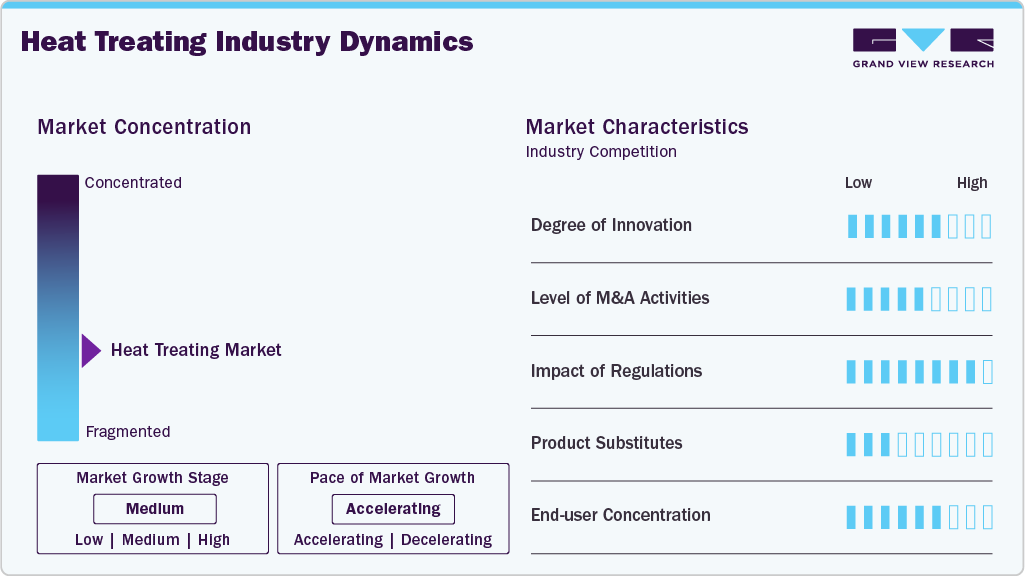

Market Concentration & Characteristics

The global heat treating market is moderately fragmented, with the presence of several regional and international players competing across various segments. While a few large companies hold significant market share, numerous small and mid-sized firms operate in niche areas or specific geographies. This competitive landscape drives innovation and price competition among players. However, ongoing consolidation trends may gradually increase market concentration over time.

The heat treating market demonstrates a steady pace of innovation, driven by the need for energy-efficient, precise, and automated systems. Developments in advanced furnace designs, real-time monitoring, and smart control technologies are reshaping operations. Integration of AI and IoT is enhancing process, optimization, and quality assurance. These innovations are helping manufacturers meet evolving performance and sustainability standards.

Mergers and acquisitions in the heat treating industry are moderate but growing, as larger players seek to expand capabilities and geographic reach. Companies are acquiring specialized firms to enhance their technological edge and service offerings. M&A activity is also fueled by the need to access emerging markets and consolidate fragmented supply chains. This trend supports business scalability and competitiveness.

Environmental regulations play a significant role in shaping the heat treating industry, particularly regarding emissions and energy use. Governments are enforcing stricter standards to reduce carbon footprints and improve workplace safety. Compliance drives adoption of cleaner technologies and modernized equipment. Regulatory pressure encourages sustainable practices but can increase operational costs for smaller firms.

Drivers, Opportunities & Restraints

The global heat treating market is driven by rising demand from automotive, aerospace, and industrial machinery sectors for durable and high-performance components. Growth in electric vehicle production is further boosting the need for specialized thermal processing. Technological advancements in furnace design and process automation also support market expansion. Additionally, the trend toward lightweight materials requires advanced heat treatment solutions.

Emerging economies offer significant growth opportunities due to rapid industrialization and infrastructure development. Increasing adoption of Industry 4.0 technologies opens new possibilities for smart heat treating systems. Demand for customized heat treatment services is rising among end users with specific material requirements. Expansion into renewable energy and defense sectors also presents new avenues for market players.

High initial investment and maintenance costs of advanced heat treating equipment can limit adoption, especially among small-scale firms. Stringent environmental regulations may increase operational burdens and require costly upgrades. Lack of skilled labor in handling complex thermal processes poses a challenge in several regions. Additionally, fluctuations in raw material prices can impact overall profitability.

Material Insights

The steel material segment led the market and accounted for 79.9% revenue share in 2024. This dominance is primarily driven by the rising demand for heat-treated steel components across key industries, particularly construction, automotive, and heavy machinery. Countries such as the U.S., China, and India are witnessing a surge in infrastructure development, which in turn is fueling the need for high-strength, wear-resistant steel parts. Heat treatment is essential in enhancing the mechanical properties of steel, including strength, surface hardness, wear resistance, and machinability. These advantages make steel the most widely treated material in the industry, and continued demand from downstream sectors is expected to further propel the growth of this segment over the forecast period.

Cast iron is expected to witness growth at a significant rate in the heat treating market over the forecast period, owing to its rising use in heavy-duty applications such as engine blocks, machinery bases, and piping. Improvements in heat treating techniques have enabled better control over cast iron’s strength and brittleness. Its cost efficiency and ability to withstand high-temperature conditions make it attractive for industrial use. Growing demand from foundries and energy sectors is accelerating its adoption.

Process Insights

Case hardening processes dominated the heat treating market and accounted for 28.2% share in 2024, due to their ability to create a hard, wear-resistant surface while maintaining a tough, ductile core. This makes it ideal for high-stress components like gears, shafts, and fasteners in the automotive and machinery industries. The process enhances fatigue strength and extends component life. Its widespread industrial use and reliability contribute to its leading market position.

Annealing is the significantly growing process segment in the market, driven by increasing demand for improved ductility and stress relief in metals. It is particularly important in electronics, construction, and metal fabrication industries. Advancements in controlled atmosphere annealing are enabling better quality and efficiency. The process supports the production of softer, more workable materials suited for further manufacturing.

Equipment Insights

Electrically heated furnaces led the heat treating equipment market and accounted for 46.4% share in 2024, due to their precise temperature control, energy efficiency, and cleaner operation. They are widely used in industries where consistency and environmental compliance are critical. These furnaces support automation and are well-suited for small to medium-sized components. Their low emissions and reduced operating costs contribute to their dominant position.

Fuel-fired furnaces are the significantly growing segment, driven by their high heating capacity and cost-effectiveness for large-scale industrial applications. They are preferred in heavy industries such as steel, foundries, and power generation due to faster processing times. Technological improvements are enhancing combustion efficiency and emission control. Their ability to handle large batches makes them attractive in high-volume production settings.

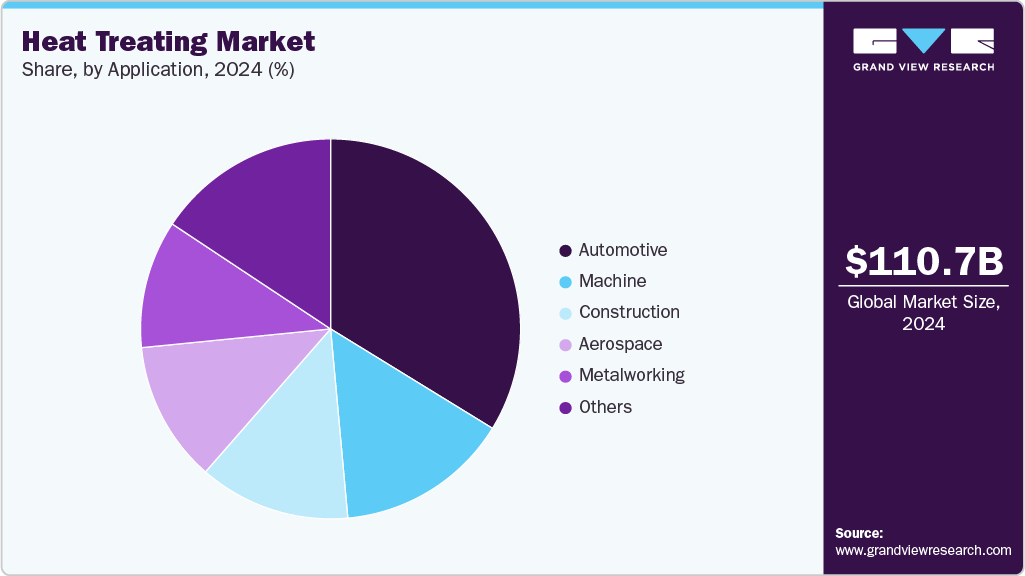

Application Insights

The automotive sector dominated the heat treating market and accounted for 33.8% share in 2024, due to its high demand for durable, high-performance metal components. Heat treatment is essential for parts like gears, crankshafts, and suspension systems to improve strength and wear resistance. The growing production of vehicles, including electric models, continues to fuel this demand. Cost-effective and scalable processes make heat treatment a key step in automotive manufacturing.

The aerospace industry is projected to grow fastest in the application segment over the forecast period, driven by the need for lightweight yet high-strength components. Heat treating processes are critical for ensuring the reliability and fatigue resistance of aircraft parts under extreme conditions. Increasing global air travel and defense investments are boosting the production of aircraft and related components. Strict quality standards in aerospace further amplify the need for advanced heat treatment solutions.

Regional Insights

North America heat treating market is growing at a significant CAGR of 3.1% in the global market, driven by strong automotive, aerospace, and defense industries. The presence of advanced manufacturing facilities and a focus on technological innovation drive demand. Strict quality and environmental regulations encourage the adoption of efficient heat treating processes. The U.S. remains the primary contributor due to its well-established industrial base.

U.S. Heat Treating Market Trends

The U.S. dominates the North American market due to its strong presence in automotive, aerospace, and defense manufacturing. Advanced technologies and high production standards drive consistent demand for thermal processing. The country has a well-developed industrial infrastructure and a skilled workforce. Additionally, investments in R&D and automation support its leading position.

Canada heat treating market is witnessing steady growth, supported by its expanding automotive and heavy machinery sectors. The country’s focus on advanced manufacturing and export-oriented industries is boosting demand for treated metal components.

Europe Heat Treating Market Trends

Europe heat treating market is a key player in the global market, driven by the region’s focus on high-precision engineering and sustainable manufacturing. Countries like Germany, France, and Italy have strong automotive and aerospace sectors requiring advanced thermal processing. Technological upgrades and energy-efficient practices are widely adopted across the region. Supportive regulations and R&D investments further strengthen Europe’s market position.

Germany heat treating market is a key growth market in Europe due to its strong engineering, automotive, and aerospace sectors. The country’s focus on precision manufacturing drives demand for advanced heat treating processes. Continuous investment in industrial automation and green technologies supports market expansion. Additionally, Germany’s export-oriented economy boosts the need for high-quality, heat-treated components.

The United Kingdom heat treating market is experiencing growth, driven by its aerospace, defense, and automotive industries. Increased adoption of advanced materials and manufacturing technologies is fueling demand for specialized thermal treatment. Government support for innovation and sustainable manufacturing is aiding the industry’s development. The presence of global OEMs and high-value production further strengthens market prospects.

Asia Pacific Heat Treating Market Trends

Asia Pacific heat treating market is a dominant market and accounted for the 39.8% share in 2024, owing to rapid industrialization and the large-scale presence of automotive and electronics manufacturing. China, Japan, South Korea, and India are major contributors with expanding production capacities. Cost-effective labor and increasing investments in infrastructure support market growth. Rising demand for consumer goods and machinery further fuels the need for heat treating services.

China is experiencing strong growth in the heat treating market due to its massive manufacturing base across the automotive, electronics, and machinery sectors. Rapid industrialization and infrastructure development continue to drive demand for treated metal components. Government initiatives to upgrade industrial capabilities and promote high-end manufacturing are boosting technology adoption. Domestic demand and export growth are key factors propelling the market forward.

India heat treating market is growing steadily, supported by expanding automotive, railways, and heavy engineering industries. The government's "Make in India" initiative is encouraging local manufacturing and foreign investments in industrial sectors. Rising demand for cost-effective and durable metal components is fueling the adoption of heat treating processes. Additionally, improvements in infrastructure and technology accessibility are accelerating market development.

Middle East & Africa Heat Treating Market Trends

The Middle East and Africa heat treating market is experiencing steady growth due to infrastructure development and investments in the oil & gas and construction sectors. Countries like Saudi Arabia and South Africa are adopting more advanced manufacturing technologies. The need for corrosion-resistant and high-performance components is boosting heat treating demand. However, limited local manufacturing capacity presents challenges to faster market expansion.

Saudi Arabia heat treating market is witnessing growth, driven by expanding oil & gas, construction, and infrastructure sectors. The country's push for industrial diversification under Vision 2030 is encouraging investments in manufacturing and metal processing. Demand for corrosion-resistant and high-strength components is rising in energy and heavy equipment applications.

Latin America Heat Treating Market Trends

The Latin America heat treating market is witnessing gradual growth, driven by developments in the automotive and mining industries. Brazil and Argentina are emerging as key markets with increasing industrial activity. Demand for durable and heat-treated components is rising alongside regional manufacturing expansion. However, growth is moderated by economic and infrastructure challenges.

Brazil heat treating market is experiencing growth due to its expanding automotive, mining, and agricultural machinery industries. Rising domestic manufacturing and infrastructure projects are boosting demand for durable metal components. The country’s industrial sector is increasingly adopting modern thermal processing technologies to improve product quality. Government efforts to attract foreign investment further supporting market development.

Key Heat Treating Company Insights

Some key players operating in the market include Bluewater Thermal Solutions LLC, American Metal Treating Inc., and East-Lind Heat Treat Inc.

-

Bluewater Thermal Solutions operates a network of specialized heat treating and brazing facilities across North America. The company caters to various sectors, including automotive, aerospace, and energy, offering localized processing capabilities. Its services range from vacuum heat treating and carburizing to specialized processes like boronizing and fastener treatment. By tailoring services to regional market demands, it ensures both technical precision and quick turnaround.

-

Based in North Carolina, American Metal Treating Inc. focuses on precision thermal processing for high-performance components. It utilizes advanced vacuum furnaces and high-pressure quenching to minimize distortion in critical alloys. The company primarily serves industries such as defense, aerospace, and motorsports, where quality and reliability are essential. Their use of controlled digital systems ensures consistent results and compliance with strict customer specifications.

Key Heat Treating Companies:

The following are the leading companies in the heat treating market. These companies collectively hold the largest market share and dictate industry trends.

- Bluewater Thermal Solutions LLC

- American Metal Treating Inc.

- East-Lind Heat Treat Inc.

- General Metal Heat Treating, Inc.

- Shanghai Heat Treatment Co. Ltd.

- Pacific Metallurgical, Inc.

- Nabertherm GmbH

- Unitherm Engineers Limited

- SECO/WARWICK Allied Pvt. Ltd.

- Triad Engineers

- HighTemp Furnaces Limited

- Deck India Engineering Pvt. Ltd.

- Sourabh Heat Treatments

- AFECO Heating Systems

- THERELEK

Recent Developments

-

In July 2025, Nitrex began expanding its Aurora, Illinois facility in July 2025 to support rising demand in heat treatment services. The new building will include a modern low-pressure carburizing furnace with oil quenching. This upgrade targets high-spec needs in automotive and aerospace sectors. Full operations are expected to start after construction completion.

-

In November 2024, FPM Heat Treating expanded its capacity by adding a high-performance vacuum furnace from Solar Manufacturing. The system meets strict industry standards and handles heavy loads at high temperatures. This upgrade strengthens FPM’s service offerings across key industries like aerospace, automotive, and medical.

-

In January 2024, SECO/WARWICK expanded its production capacity in 2023 to meet rising global demand for heat treating equipment. The company enhanced its facilities and added new production lines across key technology segments. This move aims to boost delivery efficiency and support long-term growth.

-

In December 2023, SECO/WARWICK has supplied a Vector vacuum furnace to Yalman Knives, a Turkish manufacturer specializing in knives and industrial rolls. The equipment will be used for hardening and tempering tool steel with high precision. This custom solution supports Yalman’s need for consistent heat treatment quality. It reflects SECO/WARWICK’s commitment to serving specialized production needs with advanced technology.

Heat Treating Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 114.38 billion

Revenue forecast in 2033

USD 152.51 billion

Growth rate

CAGR of 3.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, process, equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; Japan; India; South Korea; Australia; Argentina; Brazil; Saudi Arabia; South Africa; UAE

Key companies profiled

Bluewater Thermal Solutions LLC; American Metal Treating Inc.; East-Lind Heat Treat Inc.; General Metal Heat Treating, Inc.; Shanghai Heat Treatment Co. Ltd.; Pacific Metallurgical, Inc.; Nabertherm GmbH; Unitherm Engineers Limited; SECO/WARWICK Allied Pvt. Ltd.; Triad Engineers; HighTemp Furnaces Limited; Deck India Engineering Pvt. Ltd.; Sourabh Heat Treatments; AFECO Heating Systems; THERELEK.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Treating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global heat treating market report based on material, process, equipment, application, and region.

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Steel

-

Cast iron

-

Others

-

-

Process Outlook (Revenue, USD Billion, 2021 - 2033)

-

Case hardening

-

Hardening & tempering

-

Annealing

-

Normalizing

-

Others

-

-

Equipment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Electrically heated furnace

-

Fuel-fired furnace

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

Machine

-

Construction

-

Aerospace

-

Metalworking

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global heat treating market size was estimated at USD 110.68 billion in 2024 and is expected to be USD 114.39 billion in 2025.

b. The global heat treating market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2033 to reach USD 152.51 billion by 2033.

b. Steel material segment led the market and accounted for 79.9% in 2024. Growing demand for heat-treated steel parts in the construction industry, especially in the U.S., China, and India, is expected to propel the demand for heat treating for steel over the forecast period. Steel is undergone heat treating to obtain certain mechanical properties including strength, wear properties, and surface hardness.

b. Some of the key players operating in the heat treating market include Bluewater Thermal Solutions LLC, American Metal Treating Inc., East-Lind Heat Treat Inc., General Metal Heat Treating, Inc., Shanghai Heat Treatment Co. Ltd., Pacific Metallurgical, Inc., Nabertherm GmbH, Unitherm Engineers Limited, SECO/WARWICK Allied Pvt. Ltd., Triad Engineers, HighTemp Furnaces Limited, Deck India Engineering Pvt. Ltd., Sourabh Heat Treatments, AFECO Heating Systems, THERELEK

b. The rapid growth of the electric vehicle industry, coupled with the growing demand for metallurgical alterations to suit specific applications, is expected to boost the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.