- Home

- »

- Power Generation & Storage

- »

-

Heat Recovery Steam Generator Market Size Report, 2030GVR Report cover

![Heat Recovery Steam Generator Market Size, Share & Trends Report]()

Heat Recovery Steam Generator Market Size, Share & Trends Analysis Report By Design (Horizontal Drum, Vertical Drum), By Mode Of Operation (Cogeneration, Combined Cycle), By Power, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-461-1

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

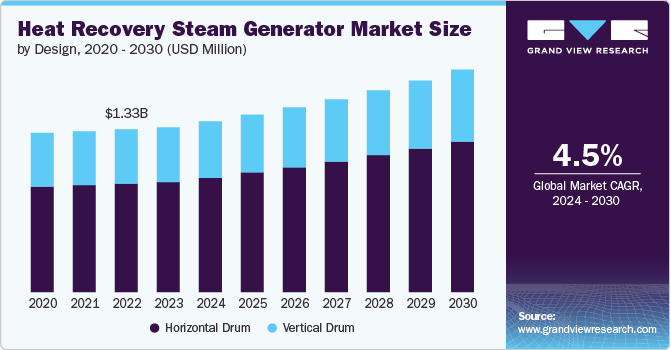

The global heat recovery steam generator market size was estimated at USD 1,345.2 million in 2023 and is projected to reach USD 1,817.0 million by 2030 and is anticipated to grow at a CAGR of 4.5% from 2024 to 2030. There is a significant push toward improving energy efficiency and reducing greenhouse gas emissions. Heat Recovery Steam Generator (HRSGs) are pivotal in achieving these goals as they allow power plants to maximize energy output from the same amount of fuel, reducing overall fuel consumption and emissions.

The escalating global demand for energy, driven by industrialization, urbanization, and increasing population, has heightened the need for more efficient power generation technologies. HRSGs play a crucial role in enhancing the efficiency of power plants by recovering waste heat, which is essential for meeting growing energy needs sustainably.

Drivers, Opportunities & Restraints

The expansion of industrial sectors, particularly those with high heat generation processes such as chemical, petrochemical, and metal industries, increases the demand for HRSG systems. These industries use HRSGs to capture waste heat from their operations, improving energy efficiency and reducing operational costs.

A significant restraint is the high initial investment required for HRSG systems. These units are complex and expensive to install, which can be a barrier for smaller companies or those operating with tight budgets. In addition, there is a need for advanced maintenance and operational expertise, which can further increase costs and complicate the implementation process.

As global energy demand continues to rise, there is an increasing need for technologies that enhance efficiency and reduce fuel consumption. HRSGs are well-positioned to meet this demand by improving the performance of power plants and industrial processes. Furthermore, advancements in HRSG technology, such as more durable materials and improved design, are making these systems more cost-effective and easier to implement, which can drive broader adoption.

Design Insights

“The horizontal drum segment is expected to grow at a significant CAGR of 4.7% from 2024 to 2030 in terms of revenue”

Horizontal Drum HRSGs are widely favored for their compact design and ease of maintenance. Their horizontal orientation allows for more straightforward integration into existing power plants, particularly where space is limited. The horizontal drum design is especially advantageous in combined cycle power plants where maximizing the footprint efficiency is critical. Additionally, these HRSGs often offer better steam separation and can handle higher pressure applications, making them suitable for a broad range of industrial and power generation uses.

The vertical drum segment held a 33.2% market share in 2023. Vertical Drum HRSGs are preferred for their space-saving vertical arrangement, which is beneficial in facilities where height is less of a constraint than floor space. The vertical design allows for a more compact unit that can be easily incorporated into smaller or retrofit projects. This design is often chosen for applications requiring lower pressure and temperature ranges or where the installation environment necessitates a smaller footprint. Vertical drum HRSGs are also advantageous in terms of reducing the length of the gas path, which can enhance heat recovery efficiency in certain setups. These benefits associated with vertical drum HRSGs are fostering the segment’s growth.

Mode Of Operation Insights

"The demand for the cogeneration segment is expected to grow at a rapid CAGR of 4.2% from 2024 to 2030 in terms of revenue”

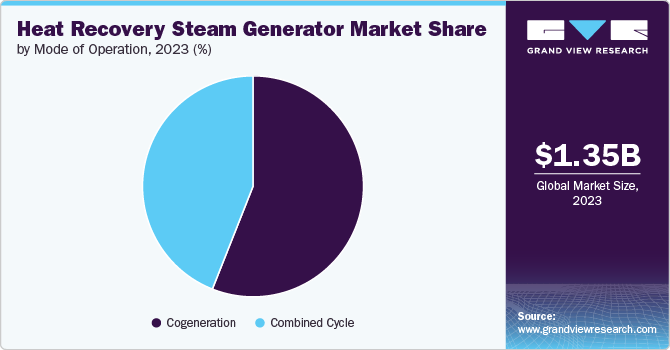

Cogeneration involves the simultaneous production of electricity and useful heat from the same energy source, such as natural gas or biomass. This mode of operation is driven by its efficiency and cost-effectiveness in utilizing waste heat for additional energy generation. Cogeneration systems are highly valued in industrial settings, such as chemical plants and refineries, where they can use waste heat from industrial processes to produce both power and steam. The ability to provide reliable and efficient energy solutions while reducing overall energy costs and emissions makes cogeneration a highly sought-after option for many industrial and commercial applications thereby driving segment growth.

The combined cycle segment accounted for 44.0% of the market share in 2023. In this case, power plants use both steam and gas turbines to generate electricity more efficiently. In this mode, the waste heat from the gas turbine is recovered by the HRSG to produce steam, which then drives a steam turbine for additional power generation. The combined cycle approach significantly enhances the overall efficiency of power plants, reaching efficiencies above 60% in some cases. This mode is particularly appealing for large-scale power generation where maximizing fuel efficiency and reducing operational costs are critical. As global energy demands increase and the push for more efficient energy systems grows, combined cycle power plants are becoming more prevalent, further driving the demand for HRSGs designed for this mode of operation.

Power Insights

"The growth of the Above 300 MW segment is expected to grow at a significant CAGR of 5.0% from 2024 to 2030 in terms of revenue”

The demand for above 300 MW (million watts) power generation units is driven by the need for large-scale, efficient power generation systems. These high-capacity HRSGs are essential in major power plants where maximizing energy output and efficiency is crucial. The growing global energy demand, coupled with the expansion of industrial and urban infrastructures, necessitates the development of large-scale power generation facilities. HRSGs in this category are often employed in combined cycle power plants, which can achieve high efficiency and large power outputs. Their ability to handle significant amounts of waste heat and their role in improving the overall efficiency of power plants make them vital for meeting the demands of large energy consumers and grid operators.

The up to 30 MW segment accounted for 24.5% of the market share in 2023. HRSGs with power levels up to 30 MWs cater to smaller-scale power applications and are increasingly important in niche markets. These units are ideal for smaller industrial processes, commercial facilities, and distributed generation systems where space and budget constraints are a consideration. As industries and commercial enterprises seek to improve their energy efficiency and reduce operational costs, the use of smaller, more adaptable HRSG systems becomes more prevalent. In addition, technological advancements have made these smaller units more efficient and cost-effective, further driving their adoption in regions and sectors that require flexible and scalable energy solutions.

End-use Insights

"The growth of the refineries segment is expected to expand at a considerable CAGR of 5.8% from 2024 to 2030 in terms of revenue”

For the refineries sector, HRSGs are driven by the need to enhance energy efficiency and reduce operational costs. Refineries, which are energy-intensive operations, generate significant amounts of waste heat during their processes. HRSGs enable refineries to capture this waste heat and convert it into additional steam or electricity, optimizing their energy usage and lowering fuel costs. Furthermore, regulatory pressures and environmental concerns push refineries to adopt more efficient and sustainable technologies. By integrating HRSG systems, refineries can better manage their energy consumption and reduce their carbon footprint, aligning with global environmental standards and improving their overall operational efficiency.

The utilities segment held a 48.7% market share in 2023. In the utilities industry, HRSGs are crucial for improving the efficiency of power generation facilities, particularly in combined cycle power plants. Utilities seek to maximize the efficiency of their power generation processes to meet increasing energy demands while managing operational costs and complying with environmental regulations. HRSGs play a key role by recovering waste heat from gas turbines and converting it into steam for additional electricity generation. This not only enhances the efficiency of the power plant but also reduces fuel consumption and emissions. The continuous growth in electricity demand and the push for more efficient and cleaner energy production methods drive the adoption of HRSGs in utility applications, making them a critical component in modern power generation strategies.

Regional Insights

In North America, HRSG market growth is driven by stringent regulations aimed at reducing greenhouse gas emissions and enhancing energy efficiency. The U.S. and Canada focus on upgrading aging infrastructure and incorporating advanced HRSG systems into combined cycle power plants to improve waste heat utilization. The push for cleaner energy solutions and technological advancements in HRSGs further supports their adoption in new projects and facility retrofits.

Asia Pacific Heat Recovery Steam Generator Market Trends

“India to witness fastest market growth at 6.2% CAGR”

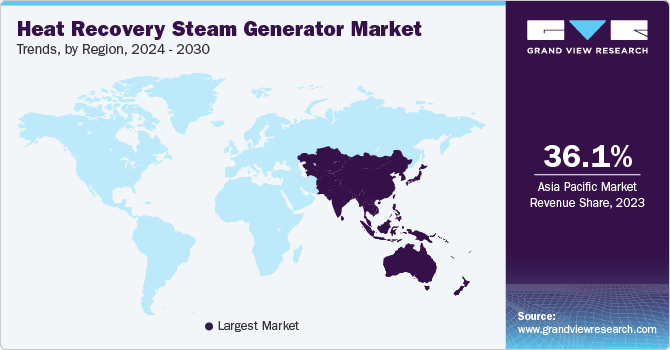

In the Asia Pacific region, the HRSG market is experiencing robust growth due to rapid industrialization, urban expansion, and increasing energy consumption. Countries such as China, Japan, and South Korea are investing heavily in infrastructure and power generation to support their growing economies. HRSGs play a crucial role in enhancing the efficiency of power plants by capturing waste heat and improving overall energy output. In addition, the region’s focus on reducing greenhouse gas emissions and transitioning to cleaner energy sources drives the adoption of HRSG technology. Government policies and incentives aimed at promoting energy efficiency and sustainable development are further accelerating market growth. The combination of economic development, regulatory support, and technological advancements positions the Asia Pacific region as a key growth area for HRSGs.

The heat recovery steam generator market in India, is estimated to grow at 6.3% over the forecast period. The growth of the Heat Recovery Steam Generator (HRSG) market is significantly driven by the country's expanding energy demands and the need for improved energy efficiency. With rapid industrialization and urbanization, India faces an increasing need for reliable and efficient power generation solutions. HRSGs are well-suited to address this demand by enhancing the efficiency of combined cycle power plants and are becoming more prevalent in India's energy mix.

Europe Heat Recovery Steam Generator Market Trends

In Europe, the HRSG market benefits from ambitious carbon reduction targets and energy efficiency goals. The European Union's Green Deal and national policies promote sustainable energy practices, with HRSGs playing a key role in enhancing the efficiency of combined cycle power plants and reducing fuel consumption. Strong regulatory support and technological innovation drive the growth of HRSG systems in Europe, making it a leading market for these technologies.Top of FormBottom of Form

Key Heat Recovery Steam Generator Company Insights

Some of the key players operating in the market include John Cockerill and Thermax Limited among others.

-

John Cockerill is a Belgian mechanical engineering group that develops large-scale technological solutions for the energy, defense, industry, environment, transport, and infrastructure sectors. The company offers heat recovery steam generators, industrial boilers, thermal storage, and several other products and has a geographical presence globally across five continents.

-

Thermax Limited is an engineering company specializing incooling, heating, specialty chemicals, and water and waste management. The company has 14 production facilities and 29 international offices. Its sales presence spans across 88 nations and its network is spread over South East Asia, Asia, the Americas, Middle East & Africa, and Europe.

Key Heat Recovery Steam Generator Companies:

The following are the leading companies in the heat recovery steam generator market. These companies collectively hold the largest market share and dictate industry trends.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Thermax Limited.

- GE Vernova and/or its affiliates.

- Bharat Heavy Electricals Limited

- LARSEN & TOUBRO LIMITED.

- Isgec Heavy Engineering Ltd.

- Kawasaki Heavy Industries, Ltd.

- Siemens Heat Transfer Technology (Siemens)

- John Cockerill.

- BHI Co., Ltd.

- Alstom SA

- Rentech Boiler Systems, Inc.

- CN CO., LTD.

- Mutares SE & Co. KGaA

Recent Developments

-

In April 2024, CN CO., LTD. announced plans to construct a new factory dedicated to producing Heat Recovery Steam Generators (HRSGs). The facility will focus on enhancing production capabilities to meet the rising global demand for efficient energy solutions.

-

In June 2022, Mutares SE & Co. KGaA completed the acquisition of Siemens Energy B.V.'s heat transfer technology. This acquisition strengthens Mutares's portfolio in the energy sector, particularly in heat transfer solutions, and supports its strategy of expanding its industrial technology capabilities. The move enhances Mutares's position in the market by integrating advanced heat transfer technologies into its operations.

Heat Recovery Steam Generator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.39 billion

Revenue forecast in 2030

USD 1,817.0 million

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Design, mode of operation, power, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil;

Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

MITSUBISHI HEAVY INDUSTRIES, LTD.; Thermax Limited.; GE Vernova and/or its affiliates.; Bharat Heavy Electricals Limited; LARSEN & TOUBRO LIMITED.; Isgec Heavy Engineering Ltd.; Kawasaki Heavy Industries, Ltd.; Siemens Heat Transfer Technology (Siemens); John Cockerill.; BHI Co., Ltd.; Alstom SA; Rentech Boiler Systems, Inc.; CN CO., LTD.; Mutares SE & Co. KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Recovery Steam Generator Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global heat recovery steam generator market on the design, mode of operation, power, end-use, and region:

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Horizontal Drum

-

Vertical Drum

-

-

Mode Of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Cogeneration

-

Combined Cycle

-

-

Power Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 30 MW

-

31 to 100 MW

-

101 to 200 MW

-

201 to 300 MW

-

Above 300 MW

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Chemical

-

Refineries

-

Utilities

-

Pulp & Paper

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global heat recovery steam generator market size was estimated at USD 1.35 billion in 2023 and is expected to reach USD 1.39 billion in 2024.

b. The global heat recovery steam generator market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 1.82 billion by 2030.

b. Based on end-use, Utility segment led the global heat recovery steam generator market in 2023 with a revenue share of about 48.7%. Utilities seek to maximize the efficiency of their power generation processes to meet increasing energy demands while managing operational costs and complying with environmental regulations.

b. The key players in the heat recovery steam generator market include Baker Hughes, Siemens AG, Mitsubishi Heavy Industries, Ltd, John Wood Group PLC, among others

b. Introduction of encouraging government strategies toward development of combined cycle power plants generating sources joined with the rising consumer leaning toward supportable cogeneration technologies will certainly impact the HRSGs market share.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."