- Home

- »

- Advanced Interior Materials

- »

-

Heat Pump Market Size And Share, Industry Report, 2033GVR Report cover

![Heat Pump Market Size, Share & Trends Report]()

Heat Pump Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Air Source, Water Source), By Capacity (Up to 10 kW, Above 1000 KW), By Application (Residential, Industrial), By Operation (Electric, Hybrid), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-589-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Heat Pump Market Summary

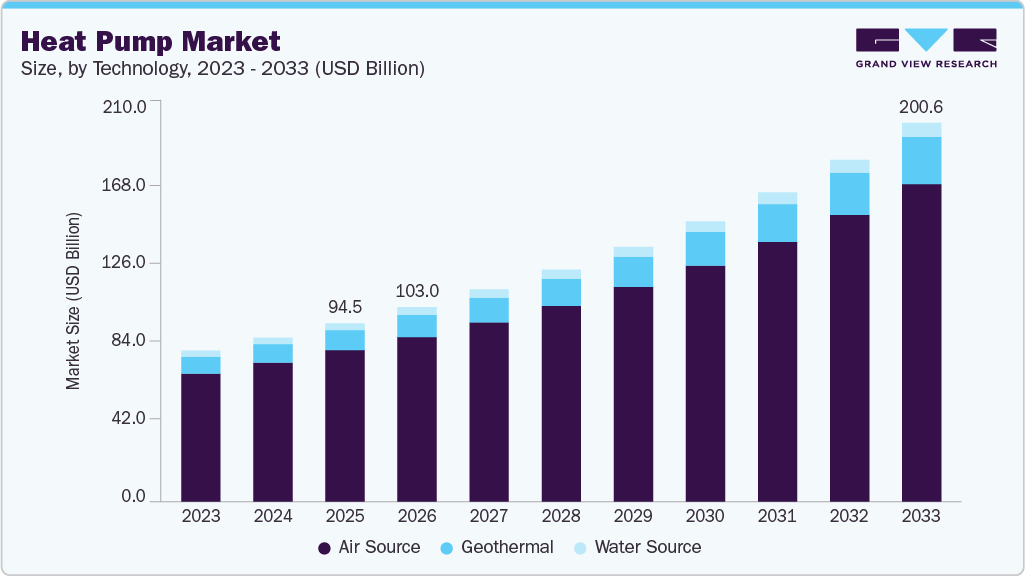

The global heat pump market size was valued at USD 94.53 billion in 2025 and is projected to reach USD 200.65 billion by 2033, growing at a CAGR of 10.0% from 2026 to 2033. The market is driven by the global push to reduce carbon emissions and improve energy efficiency in buildings. Governments across regions are promoting low-carbon heating through incentives, rebates, and stricter emission norms for fossil-fuel-based systems.

Key Market Trends & Insights

- Asia Pacific dominated the heat pump industry with the largest revenue share of 58.0% in 2025.

- The heat pump industry in the U.S. is expected to grow at a substantial CAGR of 10.6% from 2026 to 2033.

- By technology, the geothermal segment is expected to grow at a considerable CAGR of 11.3% from 2026 to 2033 in terms of revenue.

- By capacity, the up to 10 kW segment is expected to grow at a considerable CAGR of 11.1% from 2026 to 2033 in terms of revenue.

- By application, the residential segment is expected to grow at a considerable CAGR of 10.2% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 94.53 Billion

- 2033 Projected Market Size: USD 200.65 Billion

- CAGR (2026-2033): 10.0%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing region

Heat pumps offer higher efficiency compared to conventional boilers, helping users lower long-term energy costs. This makes them attractive for both new constructions and retrofit projects.

Rising electricity penetration from renewable sources is also supporting heat pump adoption. As power grids increasingly integrate solar and wind energy, electric heat pumps become a cleaner heating and cooling option. Growing awareness about lifecycle cost savings and environmental benefits further boost demand. In addition, advancements in cold-climate and high-capacity heat pump technologies are expanding their use across residential, commercial, and industrial applications.

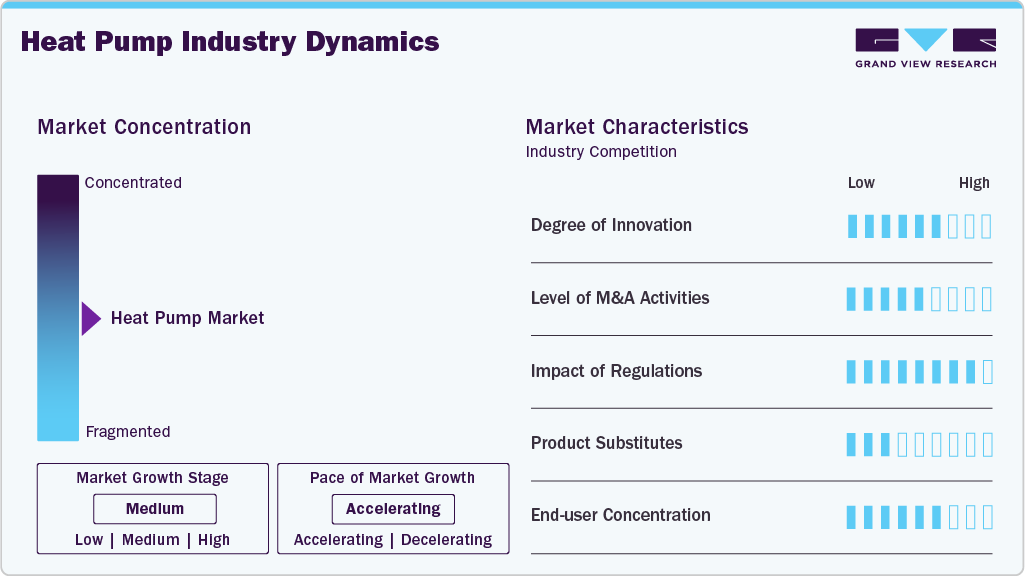

Market Concentration & Characteristics

The heat pump industry is moderately fragmented, with a mix of large multinational players and numerous regional manufacturers. Global companies compete on technology innovation, system efficiency, and integrated heating-cooling solutions, while local players focus on price competitiveness and regional climate needs. The market also includes specialized firms targeting geothermal or high-capacity industrial systems. Ongoing mergers, partnerships, and capacity expansions are gradually increasing consolidation, especially in developed markets.

The market shows a high level of innovation, driven by the need for better efficiency and wider climate suitability. Manufacturers are investing in advanced compressors, smart controls, and low-GWP refrigerants to improve performance and compliance. Innovations in cold-climate heat pumps and hybrid systems are expanding adoption in extreme weather regions. Digital monitoring and integration with renewable energy systems are also becoming standard features.

Regulations strongly influence the market through energy efficiency mandates and decarbonization policies. In Europe, directives such as the Energy Performance of Buildings Directive (EPBD) and national bans on new fossil-fuel boilers are accelerating heat pump adoption. Many countries also offer subsidies under renewable heating schemes and carbon-neutral targets for 2030-2050. In addition, refrigerant rules under F-gas regulations are pushing manufacturers toward low-GWP refrigerants, shaping product design and technology choices.

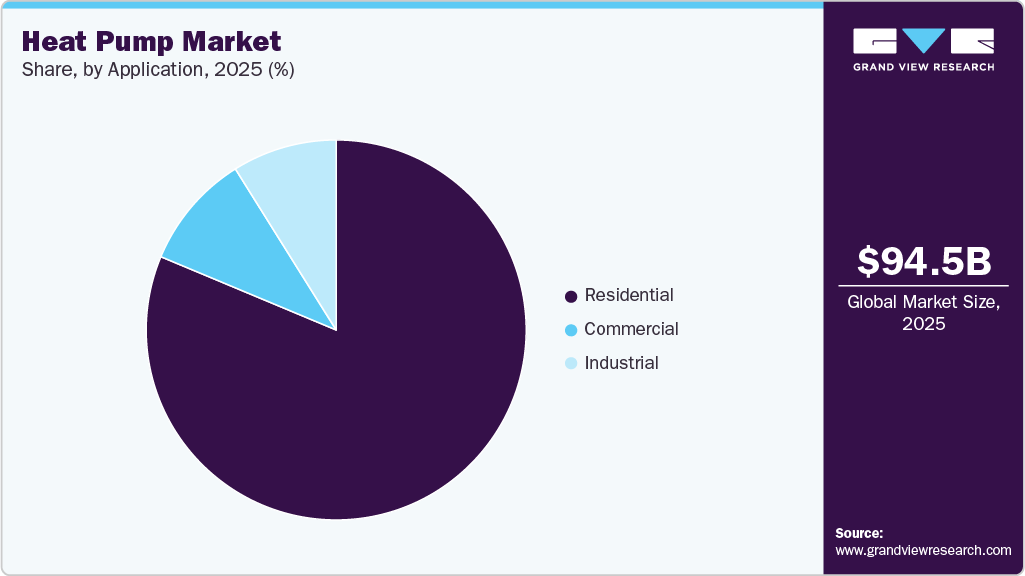

End user concentration in the heat pump industry is relatively low, with demand spread across residential, commercial, and industrial segments. Residential users account for a large volume of installations, especially in urban and suburban housing. Commercial demand comes from offices, retail spaces, and public buildings, while industrial adoption is more specialized. This diversified demand base reduces dependency on any single end use segment.

Drivers, Opportunities & Restraints

The heat pump industry is primarily driven by the shift toward low-carbon heating and cooling solutions. Rising energy prices are pushing consumers to adopt high-efficiency systems with lower operating costs. Government incentives and building efficiency regulations further support installations. Technological improvements have also increased reliability and performance across different climate conditions.

Growing construction activity and large-scale building renovation programs create strong opportunities for heat pump adoption. Integration of heat pumps with solar PV, smart grids, and energy storage systems opens new growth avenues. Expanding demand for district heating and industrial waste heat recovery also supports market expansion. Emerging economies offer untapped potential due to increasing electrification and urbanization.

High upfront installation costs remain a key challenge, especially for residential users in price-sensitive markets. Retrofitting older buildings can be complex and costly due to insulation and space requirements. Performance limitations in extremely cold regions can still affect user confidence. In addition, a shortage of skilled installers may slow adoption in some regions.

Technology Insights

Air source heat pumps dominated the market, accounting for 84.9% share in 2025, due to their lower installation costs and easier integration into existing buildings. They require less space and infrastructure compared to other technologies, making them suitable for residential and small commercial applications. Continuous improvements in efficiency and cold-climate performance have expanded their geographic adoption. Strong policy support and faster payback periods further reinforce their leading position.

Geothermal heat pumps are projected to be the fastest-growing segment over the forecast period, driven by their high efficiency and stable year-round performance. Although installation costs are higher, long-term energy savings and lower operating expenses attract commercial and institutional users. Increasing focus on net-zero buildings and sustainable infrastructure supports adoption. Government incentives for ground-source systems are also encouraging market growth.

Capacity Insights

The 10-20 kW capacity segment dominated the market, accounting for 36.5% share in 2025, due to its wide use in residential buildings and small commercial spaces. This range offers a balanced mix of heating capacity, efficiency, and cost, making it suitable for multi-family homes and small offices. It fits well with retrofit projects as well as new constructions. Strong demand from urban housing developments continues to support its leading position.

The up to 10 kW segment is anticipated to be the fastest growing segment over the forecast period, driven by rising adoption in single-family homes and compact apartments. Increasing focus on energy-efficient housing and low-energy buildings boosts demand for smaller systems. Government incentives for residential electrification further encourage uptake. Advancements in compact and quiet heat pump designs are also supporting rapid growth.

Operation Insights

The hybrid segment is expected to grow at a considerable CAGR of 9.1% from 2026 to 2033 in terms of revenue. Electric heat pumps dominated the market, accounting for 83.6% share in 2025, due to their high energy efficiency and compatibility with renewable power sources. They are widely supported by government policies aimed at reducing dependence on fossil fuels. Lower operating costs over the system lifecycle make them attractive across residential and commercial applications. Ongoing improvements in electric compressors and controls further strengthen their market position.

Hybrid heat pumps are growing significantly as they combine electric operation with conventional heating systems for flexibility. These systems are preferred in regions with colder climates or older buildings where full electrification is challenging. They help reduce energy consumption while maintaining performance during peak demand. Rising retrofit activity and transitional decarbonization strategies are driving their adoption.

Application Insights

The residential segment dominated the market, accounting for 81.3% share in 2025, due to rising demand for energy-efficient home heating and cooling solutions. Government incentives and subsidies for household electrification are accelerating installations. Increasing construction of new housing and renovation of existing homes also support demand. Heat pumps’ lower operating costs and environmental benefits make them a preferred choice for homeowners.

The industrial segment is growing significantly as industries seek to reduce carbon emissions and energy costs. Heat pumps are increasingly used for process heating, waste heat recovery, and space conditioning. Stricter emission regulations and corporate sustainability targets are encouraging adoption. Advancements in high-capacity and high-temperature heat pumps are further expanding industrial applications.

Regional Insights

North America Heat Pump Market Trends

North America heat pump industry is anticipated to be the fastest-growing market globally with a CAGR of 10.5% over the forecast period, driven by strong policy support for electrification and decarbonization. Rising replacement of gas and oil-based heating systems is boosting heat pump installations. Financial incentives at federal and state levels are improving affordability. Technological advances in cold-climate heat pumps are further supporting market growth.

United States Heat Pump Market Trends

The United States heat pump industry dominated the North American region in 2025, due to strong policy support and large-scale residential adoption. Federal tax credits and state-level incentives are accelerating the shift away from fossil-fuel heating systems. High replacement demand for aging HVAC equipment also supports market leadership. Continuous innovation in cold-climate and high-efficiency heat pumps strengthens adoption across regions.

Canada heat pump industry is growing steadily, driven by increasing focus on low-emission heating in cold climates. Government programs promoting electrification and energy-efficient home upgrades are boosting installations. Rising awareness of long-term cost savings is improving consumer acceptance. Advancements in cold-weather heat pump performance are further supporting market growth.

Europe Heat Pump Market Trends

Europe heat pump industry continues to grow steadily due to strict emission regulations and aggressive climate targets. Many countries are phasing out fossil-fuel boilers and promoting renewable heating solutions. High energy prices are encouraging consumers to shift toward efficient heat pump systems. Strong retrofit activity in residential buildings supports sustained demand.

France heat pump industry dominated the European market in 2025, due to strong government support for renewable heating. Programs such as financial incentives for heat pump installations have accelerated residential adoption. A well-developed nuclear-based electricity mix also supports low-carbon electrification. High demand from single-family homes and renovations sustains market leadership.

Germany heat pump industry is growing rapidly, driven by its energy transition policies and plans to reduce dependence on fossil fuels. Stricter building energy regulations are encouraging the replacement of gas boilers with heat pumps. Rising energy prices are pushing households toward efficient electric heating solutions. Strong investments in green building and retrofit projects support continued growth.

Asia Pacific Heat Pump Market Trends

Asia Pacific heat pump industry dominated the global market, accounting for 58.0% share in 2025, due to rapid urbanization, strong construction activity, and rising energy demand. Countries such as China, Japan, and South Korea have large manufacturing bases and supportive government policies. Growing awareness of energy efficiency and air quality is accelerating adoption. The region also benefits from cost-effective production and a wide consumer base.

China heat pump industry dominated the Asia Pacific market in 2025, due to its large construction sector and strong manufacturing base. Government-backed programs promoting clean heating and electrification are driving large-scale installations. Heat pumps are widely adopted in residential, commercial, and district heating applications. Domestic production capabilities also help reduce system costs and support widespread adoption.

India heat pump industry is growing steadily as energy efficiency and decarbonization gain policy attention. Rising urbanization and expanding commercial infrastructure are supporting demand for modern heating and cooling systems. Heat pumps are increasingly used in water heating and industrial process applications. Supportive initiatives for renewable energy and electrification are expected to accelerate future adoption.

Middle East & Africa Heat Pump Market Trends

The Middle East and Africa heat pump industry is witnessing growing adoption of heat pumps in commercial and residential projects. Rising construction activity and demand for efficient cooling and heating systems support growth. Government initiatives promoting energy efficiency are gaining momentum. Extreme climate conditions are also encouraging the use of advanced heat pump technologies.

Saudi Arabia heat pump industry is emerging as a growing market for heat pumps, supported by large-scale construction and infrastructure projects. Rising demand for energy-efficient cooling and water heating systems is encouraging adoption. Government initiatives under Vision 2030 promote energy efficiency and reduce carbon intensity in buildings. Increasing investment in commercial complexes and residential developments further supports market growth.

Latin America Heat Pump Market Trends

Latin America heat pump industry is growing gradually, supported by increasing urban development and rising electricity access. Demand is mainly driven by residential and light commercial applications. Growing focus on energy efficiency in new buildings is improving adoption. However, higher upfront costs still limit widespread penetration.

Brazil heat pump industry is a growing market for heat pumps, driven by increasing urban development and residential construction. Rising electricity availability and interest in energy-efficient water heating support adoption. Heat pumps are gaining traction in hotels, commercial buildings, and industrial applications. Gradual policy focus on energy efficiency and sustainability is expected to strengthen future demand.

Key Heat Pump Company Insights

Some of the key players operating in the market include Carrier and Daikin Industries, Ltd. among others.

-

Carrier. is a global provider of heating, ventilation, air conditioning, and refrigeration systems. The company offers a wide range of products and services, including commercial and residential HVAC systems, refrigeration equipment, heat pumps, building automation systems, and aftermarket parts and services. Carrier is known for its innovative products and solutions and has a long history of technological advancements in the HVAC industry.

-

DAIKIN INDUSTRIES Ltd. primarily manufactures and sells air conditioning systems. The company owns 313 consolidated subsidiaries worldwide and offers air-conditioning systems, room heating & heat pumps, hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings.

Key Heat Pump Companies:

The following are the leading companies in the heat pump market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier

- Daikin Industries, Ltd

- Robert Bosch GmbH

- Lennox International

- Johnson Controls, Inc.

- Midea Group

- Hitachi, Ltd.

- Ingersoll Rand Plc.

- Rheem Manufacturing Company

- HAIER(GENERAL ELECTRIC)

- Panasonic Holdings Corporation

- Danfoss

- Fujitsu

- LG Electronics, Inc.

- Samsung

Recent Developments

-

In October 2025, Mitsubishi Heavy Industries introduced new air-to-water heat pumps for the European market using R290, a low-impact natural refrigerant. The compact monobloc design simplifies installation by eliminating the need for refrigerant piping indoors. These systems support space heating, cooling, and hot water supply. The launch aligns with Europe’s push toward cleaner alternatives to conventional boilers.

-

In August 2025, Carrier launched a new modular, reversible heat pump designed for efficient heating and cooling in commercial buildings. The modular architecture allows flexible capacity expansion to match different project needs. It is engineered to deliver high performance while reducing energy consumption and emissions. The product supports the shift toward low-carbon HVAC solutions in commercial applications.

-

In March 2025, Daikin Applied showcased a new modular air-to-water heat pump at ISH, designed around propane as a low-GWP refrigerant. The modular setup allows systems to be scaled easily for different building sizes and load requirements. It targets high efficiency while meeting strict European environmental regulations. This solution is aimed mainly at commercial and large residential applications seeking low-carbon heating.

Heat Pump Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 103.02 billion

Revenue forecast in 2033

USD 200.65 billion

Growth rate

CAGR of 10.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion & volume in Thousand Units and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, capacity, application, operation, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Finland; Sweden; Germany; France; Spain; Italy; Norway; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Carrier; Daikin Industries, Ltd; Robert Bosch GmbH; Lennox International; Johnson Controls, Inc.; Midea Group; Hitachi, Ltd.; Ingersoll Rand Plc.; Rheem Manufacturing Company; HAIER(GENERAL ELECTRIC); Panasonic Holdings Corporation; Danfoss; Fujitsu; LG Electronics, Inc.; Samsung

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Pump Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global heat pump market report based on technology, capacity, application, operation, and region:

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Air Source

-

Air to Air

-

Air to Water

-

-

Water Source

-

Geothermal

-

-

Capacity Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Up to 10 kW

-

10 -20 kW

-

20 -50 kW

-

50 - 100 kW

-

100 - 200 kW

-

200-500KW

-

500-1000KW

-

Above 1000 KW

-

-

Operation Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Electric

-

Hybrid

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Up to 10 kW

-

10 -20 kW

-

20 -50 kW

-

50 - 100 kW

-

100 - 200 kW

-

200-500KW

-

500-1000KW

-

Above 1000 KW

-

-

Industrial

-

Upto 10 kW

-

10 -20 kW

-

20 -50 kW

-

50 - 100 kW

-

100 - 200 kW

-

200-500KW

-

500-1000KW

-

Above 1000 KW

-

-

Commercial

-

Up to 10 kW

-

10 -20 kW

-

20 -50 kW

-

50 - 100 kW

-

100 - 200 kW

-

200-500KW

-

500-1000KW

-

Above 1000 KW

-

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Sweden

-

Germany

-

France

-

Norway

-

Spain

-

Italy

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global heat pump market size was estimated at USD 94.53 billion in 2025 and is expected to reach USD 103.02 billion in 2026.

b. The heat pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2033 to reach USD 200.65 billion by 2033.

b. Asia Pacific dominates the heat pump market and accounting for 58.0% share in 2025, due to rapid urbanization, strong construction activity, and rising energy demand. Countries such as China, Japan, and South Korea have large manufacturing bases and supportive government policies.

b. Some of the key players operating in the market are Carrier, Daikin Industries, Ltd, Robert Bosch GmbH, Lennox International, Johnson Controls, Inc., Midea Group, Hitachi, Ltd., Ingersoll Rand Plc., Rheem Manufacturing Company, HAIER(GENERAL ELECTRIC), Panasonic Holdings Corporation, Danfoss, Fujitsu, LG Electronics, Inc., and Samsung

b. Key factors driving the heat pump market include the increasing demand for energy-efficient and sustainable heating and cooling solutions, supported by government incentives and stricter environmental regulations. Technological advancements and growing consumer awareness of environmental impacts also contribute to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.