- Home

- »

- Next Generation Technologies

- »

-

Heat-Not-Burn Market Size & Share, Industry Report, 2030GVR Report cover

![Heat-Not-Burn Market Size, Share & Trends Report]()

Heat-Not-Burn Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Capsules, Devices, Loose-leaf, Sticks, Vaporizers, Others), By Distribution Channel (Online, Retail Store), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-733-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Heat-Not-Burn Market Summary

The global heat-not-burn market size was estimated at USD 19.95 billion in 2023 and is projected to reach USD 165.11 billion by 2030, growing at a CAGR of 35.9% from 2024 to 2030. The market is primarily driven by the continuous decline in consumption of traditional cigarettes and the growing inclination towards alternatives such as reduced-risk products (RRPs).

Key Market Trends & Insights

- Asia Pacific heat-not-burn market dominated the global market with a revenue share of 52.5% in 2023.

- The Japan heat-not-burn market held a significant revenue share of the regional industry in 2023.

- By component, the sticks segment dominated the market and accounted for a revenue share of 29.0% in 2023.

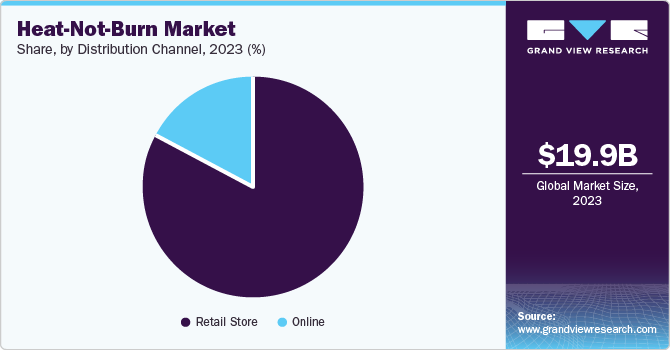

- By distribution channel, the retail store distribution segment held the largest revenue share of the global industry in 2023.

Market Size & Forecast

- 2023 Market Size: USD 19.95 Billion

- 2030 Projected Market Size: USD 165.11 Billion

- CAGR (2024-2030): 35.9%

- Asia Pacific: Largest market in 2023

- Europe: Fastest growing market

Increasing awareness regarding the increased risk of premature death and chronic illnesses such as lung cancer, numerous consumers have shifted to substitutes and adopted a change of modes for tobacco consumption. This is expected to significantly influence the demand for the heat-not-burn market during the forecast period.

According to World Health Organization (WHO), tobacco kills nearly half of the user who do not quit the consumption in their lifetime. For instance, smoking and exposure to secondhand smoke results in more than 480,000 deaths in the U.S. annually. This has significantly influenced the intensity of awareness among users in recent times. With increased mindfulness about the mode of consumption and awareness initiatives adopted by the governments and multiple other organizations, the demand for heat-not-burn products in growing at lucrative rate.

The growing demand for the products and low risks associated with their use as compared to traditional products are expected to encourage multiple companies to invest in the heat-not-burn market in the approaching years. For instance, in July 2024, Philip Morris International Inc. (PMI), one of the key players in tobacco products and smoke-free future industry, announced a memorandum of understanding with KT&G, a major market participant from South Korea in tobacco and nicotine-based products. The agreement aims to collaborate for regulatory submissions of newly developed heat-not-burn products selected by the PMI to be marketed in the U.S. market during the next few years. PMI’s strategic vision, which includes delivering a smoke-free, smoke-free future, is expected to have a greater influence on such partnerships. These aspects are anticipated to increase demand for the heath-not-burn market during the forecast period.

Component Insights

The sticks segment dominated the market and accounted for a revenue share of 29.0% in 2023. The product positioning strategy of marketing the sticks as premium heat-not-burn offering primarily drives the growth of this segment. These products are also characterized with numerous flavors and additives which attracts greater number of consumers with different preferences in terms of flavors or tastes. Entry of various key market players from traditional tobacco products industry that offer innovation backed newly developed products is expected to fuel growth for this segment during forecast period.

The loose-leaf segment is expected to experience the fastest CAGR during the forecast period. Affordable pricing is one of the key factors for growth in demand for this segment. Ease of availability, ease of use hassle f, and hassle-free manufacturing process ticks are also contributing to the development of this segment. The characteristic of being active with no addition of chemicals or other synthetic elements has attracted a large number of loose-leaf users.

Distribution Channel Insights

The retail store distribution segment held the largest revenue share of the global industry in 2023. Heat-not-burn devices are available for purchase in retail outlets such as convenience stores, drug stores, grocery stores, newsstands, and tobacco stores, allowing for maximum availability of these devices. The vast distribution networks established by the key companies in the industry primarily influence the growth of this segment. The major market participants prefer distributing their products through retail stores as it offers enhanced brand visibility.

The online distribution channel is anticipated to experience a significant CAGR over the forecast period. Advantages provided by the online shopping platforms such as ease of access, competitive prices, additional discount offers, and a larger range of products have fueled growth of this segment. In addition, the added services associated with the online shopping such as doorstep delivery, return & refund policy, multiple payment alternatives, and detailed product reviews mentioned by the previous buyers have encouraged large number of customers in recent years. Discretion and privacy have also contributed to the growth of this segment.

Regional Insights

Asia Pacific heat-not-burn market dominated the global market with a revenue share of 52.5% in 2023. The changing lifestyles and growing disposable income levels in countries such as India, China and Japan are contributing to the increased interest in heat-not-burn products. An increase in availability of the heat-not-burn products, enhanced accessibility through online portals, entry of various brands in the region that offer heat-not-burn products are some of the factors that are expected to generate greater growth for this regional market during forecast period. Large number of existing consumers of smoke-based tobacco products are actively seeking smoke - free alternatives, which in turn has developed lucrative opportunities for the heat-not-burn market in the region.

The Japan heat-not-burn market held a significant revenue share of the regional industry in 2023. This market is mainly driven by factors such as rising income levels in the country, changing lifestyles, and higher excise tax for cigarettes, which are anticipated to drive the demand for premium consumer goods, including HNB devices. The intensifying competition between market players in the traditional tobacco industry to adjust to changing consumer preferences has also contributed to the growth of this market in recent years.

North America Heat-Not-Burn Market Trends

North America was identified as a lucrative region for the global heat-not-burn market in 2023. The growth of this regional industry is primarily influenced by aspects such as growing recognition of the health advantages of heat-not-burn devices over conventional cigarettes and increasing awareness regarding the chronic illnesses that smoking might lead to. The presence of multiple companies that are developing or have launched products in heat-not-burn products is also expected to drive demand for this market in the approaching years.

U.S. Heat-Not-Burn Market Trends

The U.S. heat-not-burn market dominated the regional industry and accounted for the revenue share of 78.8% in 2023. Presence of multiple organizations from traditional tobacco products industry that are investing in research & development of innovative heat-not-burn products, increasing awareness regarding the ill-effects of smoking, rising number of the consumers shifting to smoke-free alternatives, and regulatory approvals for some of the heat-not-burn products are primarily driving the growth of this market.

Europe Heat-Not-Burn Market Trends

Europe heat-not-burn market is anticipated to experience the fastest CAGR during forecast period. One of the key aspects that influence the growth of this regional industry is the positive and supportive regulatory scenario for heat-not-burn products in Europe. In addition, consumers in the region are increasingly shifting from traditional tobacco products to smoke-free alternatives and heat-not-burn products such as sticks. Ease of availability and effective marketing strategies adopted by the key market participants are expected to fuel the growth of this regional industry in the approaching years.

The UK heat-not-burn market held a substantial revenue share of the regional industry in 2023. The UK is one of the few countries legally permitting the sale of heat-not-burn products in its market. The public health awareness initiatives and programs implemented by other organizations in the country have resulted in increased awareness regarding the illnesses caused by smoking and the risks associated with the use of traditional tobacco products. These factors have driven the growth of the heat-not-burn market in the UK.

Key Heat-Not-Burn Company Industry

Some of the key companies in the heat-not-burn market include Altria Group, Inc., BAT, Firefly Vapor (SLANG WORLDWIDE), Imperial Brands plc, Japan Tobacco Inc., and others. Key players in the industry implement various business strategies such as introducing new products, expanding capacities, securing endorsements, marketing initiatives, and mergers & acquisitions to attract a wide customer base.

-

Philip Morris Products S.A. (PMI), an international tobacco company, specializes in smoke-free products that are better alternatives to cigarette smoking. PMI offers its flagship IQOS heat-not-burn tobacco product portfolio, consisting of IQOS ILUMA, IQOS ORIGINALS, and others; E-vapor products, including VEEV ONE and VEEV NOW*; and oral smoke-less products such as ZYN nicotine pouches.

-

British American Tobacco (BAT) is a multinational tobacco company that specializes in developing and commercializing heat-not-burn tobacco products. The company provides its flagship glo tobacco-heated brand, which includes glo Hyper Pro and Hyper+ models, and vapor products, including Vuse and Velo, a global brand of oral nicotine pouches.

Key Heat-Not-Burn Companies:

The following are the leading companies in the heat-not-burn market. These companies collectively hold the largest market share and dictate industry trends.

- Altria Group, Inc.

- BAT

- Firefly Vapor (Slang Worldwide)

- Imperial Brands plc

- Japan Tobacco Inc.

- KT&G Corp.

- PAX Labs, Inc.

- Philip Morris Products S.A.

- Shenzhen Yukan Technology Co., Ltd. (iuoc2.com)

- Vapor Tobacco Manufacturing LLC

Recent Developments

-

In January 2024, BAT, one of the major market participants in the heat-not-burn industry, introduced a new product in the heating devices category from the glo range. The glo is a smart alternative provided by the company, which entails heating the tobacco and not burning it, resulting in fewer emissions of toxicants found in smoke-based products.

-

In August 2024, the Japan Tobacco Inc., announced that it had agreed to acquire Vector Group Ltd. (VGR), the fourth largest tobacco company in the U.S., for approximately USD 2.4 billion. The acquisition, which is expected to be completed by the end of JT's current fiscal year, will significantly expand JT's presence in the U.S. market and add a growing and historically profitable business to its portfolio.

Heat-Not-Burn Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.22 billion

Revenue forecast in 2030

USD 165.11 billion

Growth rate

CAGR of 35.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Germany, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa

Key companies profiled

Altria Group, Inc.; BAT; Firefly Vapor (Slang Worldwide); Imperial Brands plc; Japan Tobacco Inc.; KT&G Corp.; PAX Labs, Inc.; Philip Morris Products S.A.; Shenzhen Yukan Technology Co., Ltd. (iuoc2.com); Vapor Tobacco Manufacturing LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat-Not-Burn Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heat-not-burn market report based on component, distribution channel, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Devices

-

Loose-leaf

-

Sticks

-

Vaporizers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail Store

-

Convenience Store

-

Drug Store

-

Grocery Store

-

Newsstand

-

Tobacconist Store

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.