- Home

- »

- Pharmaceuticals

- »

-

Heart Transplantation Therapeutics Market Size Report, 2030GVR Report cover

![Heart Transplantation Therapeutics Market Size, Share & Trends Report]()

Heart Transplantation Therapeutics Market Size, Share & Trends Analysis Report By Drug Type (Immunosuppressants, Anti-infectives, Analgesics), By Distribution Channel (Hospital Pharmacies), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-349-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

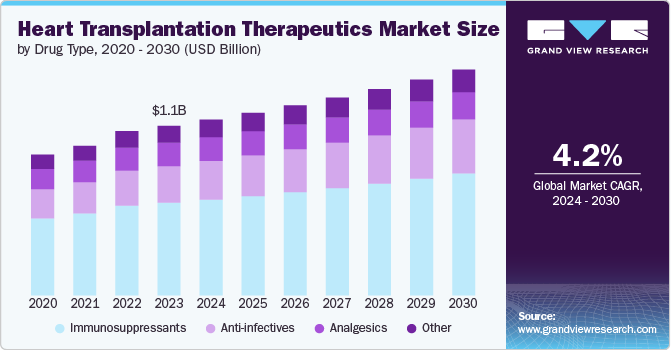

The global heart transplantation therapeutics market size was estimated at USD 1.08 billion in 2023 and is anticipated to grow at a CAGR of 4.25% from 2024 to 2030. The rising incidence of cardiovascular diseases (CVDs), such as heart failure, coronary artery disease, and cardiomyopathy, majorly drives this growth. For instance, according to the PCR online, CVD continues to be the primary cause of death for both men and women worldwide. As of 2023, the global population is 8 billion, with approximately 620 million individuals living with heart and circulatory diseases. Each year, approximately 60 million people worldwide develop heart or circulatory diseases.

Furthermore, the increasing prevalence of hypertrophic cardiomyopathy (HCM)is one of the major factors contributing to the growth of the market for heart transplantation therapeutics. It is considered the most common inherited cardiomyopathy worldwide. As per the Cleveland Clinic[, the prevalence of HCM is estimated to affect approximately 1 in 500 individuals worldwide. This condition can lead to various complications, including arrhythmias, heart failure, and sudden cardiac death.Apart from hypertrophic cardiomyopathy, other genetic types of cardiomyopathies impact the market growth effectively. These include dilated cardiomyopathy, restrictive cardiomyopathy, and arrhythmogenic right ventricular cardiomyopathy. Dilated cardiomyopathy is more prevalent than HCM, affecting about 1 in 2,000 to 2,500 individuals.

The growing efforts to raise awareness about organ donation and transplantation have led to more individuals consenting to donate their organs after death. For instance, in May 2023, the Minister for Health, Stephen Donnelly, launched Organ Donor Awareness Week 2023, focusing on the progress made in organ donation and transplantation services in Ireland. In his speech, he highlighted the system's recovery from the impact of COVID-19, with 250 transplants performed in the previous year and a remarkable start to 2023 with 81 transplants in the first quarter. The Minister expressed gratitude to all involved in the process, including transplant centers, ICU staff, organ donor nurse managers, and Organ Donation and Transplant Ireland. This has helped alleviate the shortage of donor hearts available for transplantation, thereby supporting the growth of the heart transplantation therapeutics market.

Moreover, the rising geriatric population worldwide is a common factor but significantly boosts market growth. The prevalence of age-related cardiovascular conditions that may necessitate heart transplantation is on the rise. Older individuals are more likely to develop heart failure or other cardiac issues that could benefit from heart transplant therapy, thereby driving the market growth.According to the National Center for Health Statistics, in 2020, 6.3% of adults aged 18 years and over had been diagnosed with heart disease in the U.S. This estimate is based on household interviews of a sample of the civilian, noninstitutionalized U.S. population.

In 2023, findings from the Institute for Health Metrics and Evaluation study on the global burden of cardiovascular diseases and risks for 1990-2022 revealed significant insights.

-

Age-standardized cardiovascular disease (CVD) mortality rates varied regionally, ranging from 73.6 per 100,000 in High-income Asia Pacific to 432.3 per 100,000 in Eastern Europe in 2022.

-

Global CVD mortality significantly decreased by 34.9% from 1990 to 2022.

-

Leading Causes of Disability-Adjusted Life Years (DALYs): ischemic heart disease emerged as the leading global cause with age-standardized DALYs at 2,275.9 per 100,000. Intracerebral hemorrhage and ischemic stroke followed closely as prominent CVD causes for age-standardized DALYs.

-

Age-standardized CVD Prevalence: Varied globally, with rates ranging from 5,881.0 per 100,000 in South Asia to 11,342.6 per 100,000 in Central Asia.

-

Leading Risk Factor: High systolic blood pressure accounted for the largest number of attributable age-standardized CVD DALYs at 2,564.9 per 100,000 globally.

-

Significant Changes in Risk Factors (1990 to 2022): Household air pollution from solid fuels experienced the most substantial change, with a 65.1% decrease in attributable age-standardized DALYs.

Government initiatives aimed at improving organ donation rates, funding research in transplant medicine, and streamlining regulatory processes for organ transplantation have also played a role in driving the heart transplantation therapeutics market forward. These supportive measures create a conducive environment for advancements in this field.In January 2024, the International Society for Heart and Lung Transplantation (ISHLT) disclosed that it has allocated over USD 400,000 in funding to support research endeavors. It aims to enhance the care of patients with advanced heart and lung diseases. These grants were made possible through the financial backing of the ISHLT Foundation. Notably, these grants represent the second round of funding for the 2023 ISHLT grant cycles.

Drug Type Insights

The immunosuppressants segment held the largest market share of 54.58% in 2023. The growth is attributed to the drug’s ability to suppress the body's ability to attack the newly transplanted organ and aid in keeping it healthy and free from damage. Moreover, when a patient undergoes organ transplantation, the new organ appears as a foreign agent in the body's defense system, which triggers a natural immune response against the entry of the transplanted organ. In addition, the body's defense system prepares the body to attack the transplanted organ and try to damage or destroy it. Therefore, immunosuppressants are used to offset this impact, fueling this segment's growth, which drives the market growth during the forecast period.

The anti-infectives segment is expected to grow at the fastest CAGR of 5.8% during the forecast period. The rise of antimicrobial resistance poses a challenge in managing infections post-transplantation, necessitating developing and using novel anti-infective drugs with enhanced efficacy against resistant pathogens. In addition, advancements in medical technology and surgical techniques have increased the success rates of heart transplant procedures, leading to a growing population of transplant recipients who require long-term immunosuppression and infection management. Moreover, the increasing awareness among healthcare providers about the importance of infection prevention in transplant patients further drives the demand for anti-infective therapies tailored to this specific patient population.

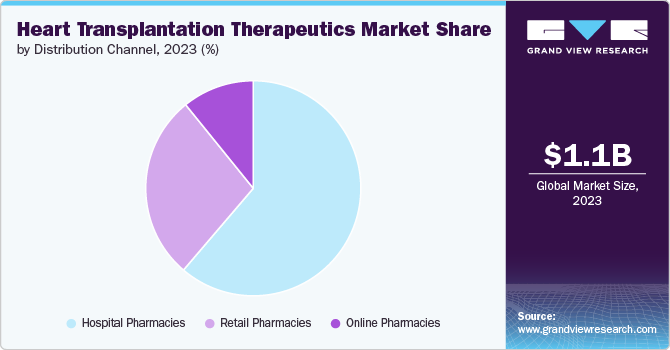

Distribution Channel Insights

The hospital pharmacies segment accounted for the largest market share of 61.25% in 2023. The growth is owed to their proximity to healthcare facilities and transplantation centers, which allows them to serve as vital distribution channels for specialized medications, contributing significantly to their growth. Moreover, hospital pharmacies play a crucial role in the healthcare system, especially in the context of heart transplantation. The operation of hospital pharmacies on the premises of medical facilities offers several advantages that contribute to the efficient coordination among healthcare professionals involved in heart transplantation procedures. This proximity allows for seamless communication and collaboration between pharmacists, physicians, surgeons, and other healthcare providers, ensuring timely access to critical therapeutics for successful heart transplant surgeries.

The online pharmacies segment is expected to grow at the fastest CAGR of 5.8% during the forecast period. The growth is owed to its convenient access to a wide range of prescription drugs and medications needed by heart transplant recipients, ensuring timely and continuous supply without frequent visits to physical pharmacies. Moreover, technological advancements in e-commerce and telemedicine have revolutionized the healthcare industry, including heart transplantation therapeutics. Online pharmacies leverage these innovations to personalized services such as automated refills and dosage reminders tailored to individual patient needs. By integrating digital solutions into pharmaceutical services, online pharmacies contribute to improved patient outcomes, medication adherence, and overall quality of care in heart transplantation.

Regional Insights

North America dominated the market with a revenue share of 37.67% in 2023. This growth is attributed to the increasing sales of immunosuppressants and the rising prevalence of several associated risk factors for heart transplantation in the region. In January 2024, the world’s first partial heart transplant was conducted by a team at Duke Health. The transplant successfully achieved functioning valves and arteries that grow along with the young patient. This groundbreaking procedure marks a significant advancement in cardiac surgery and offers hope for patients with complex heart conditions. The study also found that the procedure requires about a quarter of the amount of immunosuppressant medication compared to a full heart transplant, potentially saving patients from detrimental side effects that might compound over decades.

U.S. Heart Transplantation Therapeutics Market Trends

The heart transplantation therapeutics market in the U.S. held the largest share in 2023 in the North American region. This dominance is attributed to the rising number of organ transplantation procedures, including heart transplantation, in the country is a significant contributor to this trend. This is largely due to the advanced healthcare infrastructure in the region, which ensures a continuous supply of therapeutics to patients undergoing heart transplantation.The United Network for Organ Sharing (UNOS) Organ Procurement and Transplantation Network data reported that adult heart transplants nationwide increased by more than 11 percent in 2023 compared to the data from 2022. In 2023, a total of 4,039 adult heart transplants were performed across the United States, marking the first time the country surpassed the 4,000 marks in a calendar year for adult heart transplants.

Europe Heart Transplantation Therapeutics Market Trends

The heart transplantation therapeutics market in Europe is experiencing several notable trends in Europe due to the increasing adoption of advanced immunosuppressive therapies to prevent organ rejection post-transplant. In addition, there is a growing focus on personalized medicine in heart transplantation, where treatments are tailored to individual patients based on genetic factors and other specific characteristics. The rising prevalence of heart failure and cardiovascular diseases in Europe is also leading to an increased demand for heart transplantation therapeutics. According to the report published by the Lancet in October 2023, in Europe specifically, CVDs account for a substantial proportion of all deaths, with approximately 45% of mortality attributed to these conditions. The prevalence of CVDs underscores the importance of preventive measures, early detection, and effective management strategies to reduce the burden of these diseases.

Asia Pacific Heart Transplantation Therapeutics Market Trends

The increasing prevalence of cardiovascular diseases and heart failure in the region is a significant driver for the market. As the population ages and lifestyles become more sedentary, the incidence of heart-related conditions rises, leading to a higher demand for heart transplantation drugs. In addition, advancements in medical technology and surgical techniques have improved the success rates of heart transplant procedures, thereby boosting the need for associated pharmaceuticals. Moreover, growing investments in research and development activities focused on developing novel drugs for heart transplantation further propel market growth. The availability of favorable reimbursement policies and government initiatives to improve healthcare infrastructure also play a crucial role in driving the North America Heart Transplantation Drugs Market forward.

Key Heart Transplantation Therapeutics Company Insights

The heart transplantation therapeutics market is a dynamic and competitive industry with several key players vying for market share. The companies in this market are focusing on research and development, along with strategic partnerships and product launches. The commitment to advancing care through technological innovations has contributed to substantial market share in the heart transplantation therapeutics market.

Key Heart Transplantation Therapeutics Companies:

The following are the leading companies in the heart transplantation therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Astellas Pharma Inc.

- Biocon Ltd.

- Dr Reddys Laboratories Ltd.

- Endo International Plc

- GlaxoSmithKline Plc

- Glenmark Pharmaceuticals Ltd.

- Intas Pharmaceuticals Ltd.

- Jubilant Pharmova Ltd.

- LEO Pharma AS

- Lupin Ltd.

Recent Developments

-

In January 2022, BioVentrix acquired MateraCor Inc. and its lead product, an injectable hydrogel based on alginate that stops and reverses the progression of heart failure. This acquisition allows BioVentrix to enhance its product portfolio with innovative solutions targeting heart failure, a critical area in the heart transplantation therapeutics market.

Heart Transplantation Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.12 billion

Revenue forecast in 2030

USD 1.44 billion

Growth rate

CAGR of 4.25% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Astellas Pharma Inc.; Biocon Ltd.; Dr Reddys Laboratories Ltd.; Endo International Plc; GlaxoSmithKline Plc; Glenmark Pharmaceuticals Ltd.; Intas Pharmaceuticals Ltd.; Jubilant Pharmova Ltd.; LEO Pharma AS; Lupin Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heart Transplantation Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heart transplantation therapeutics market report based on drug type, distribution channel, and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunosuppressants

-

Anti-infectives

-

Analgesics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global heart transplantation therapeutics market size was estimated at USD 1.08 billion in 2023 and is expected to reach USD 1.12 billion in 2024.

b. The global heart transplantation therapeutics market is expected to grow at a compound annual growth rate of 4.25% from 2023 to 2030 to reach USD 1.44 billion by 2030.

b. The immunosuppressants segment accounted for the largest market share of 54.58% in 2023. The growth is attributed to the drugs ability to suppress the body's ability to attack the newly transplanted organ and aid in keeping it healthy and free from damage.

b. Some key players operating in the heart transplantation therapeutics market include Astellas Pharma Inc., Biocon Ltd.; Dr Reddys Laboratories Ltd.; Endo International Plc; GlaxoSmithKline Plc; Glenmark Pharmaceuticals Ltd.; Intas Pharmaceuticals Ltd.; Jubilant Pharmova Ltd.; LEO Pharma AS; and Lupin Ltd.

b. This growth is majorly driven by the rising incidence of cardiovascular diseases, such as heart failure, coronary artery disease, and cardiomyopathy, and is a significant driver for the heart transplantation therapeutics market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."