Heart Failure POC And LOC Devices Market Analysis Report By Type (Proteomic Testing, Metabolomic Testing), By Technology (Microfluidics), By End-use ( Clinics, Home), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-980-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

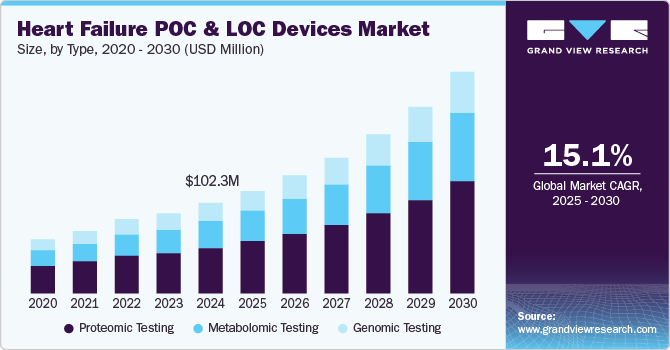

The global heart failure POC and LOC devices market size was estimated at USD 102.30 million in 2024 and is expected to grow at a CAGR of 15.09% from 2025 to 2030. Advancements in miniaturization, enabling cost-effective and efficient diagnostics. LOC technology facilitates rapid, high-throughput analyses, enhancing ease of use and reliability in disease diagnosis. Increasing R&D investments in LOC-based assays for cardiovascular diseases (CVD), especially heart failure, are fueling market growth. Rising prevalence of CVD globally and the need for early detection and management further amplify demand. Moreover, the shift towards decentralized healthcare and personalized medicine underpins the adoption of POC and LOC devices. Supportive government initiatives and technological breakthroughs also contribute significantly to market expansion.

Lab-on-a-chip (LOC) technology has emerged as a transformative tool in diagnostics, being implemented in both Point-of-Care (POC) diagnostics and central lab testing. However, in the current industry, POC tests are the only commercially available diagnostic option for heart failure. This limitation has created significant opportunities for emerging diagnostic developers striving to carve a substantial position in the industry. These companies are focusing on developing innovative POC solutions to bridge the existing gaps in heart failure diagnostics.

Heart failure presents a unique diagnostic challenge due to its wide range of clinical manifestations and symptoms that are often non-specific. Traditional diagnostic methods, while effective, are complex and time-consuming, making early detection difficult. This has spurred the development of POC tests that are designed to accelerate decision-making, particularly for individuals at risk of heart disorders. These tests detect critical cardiac markers and other parameters in real-time, enabling timely interventions. By addressing the challenges posed by health disparities and enhancing accessibility, POC diagnostics have become an integral part of modern cardiovascular care.

Government initiatives have also played a pivotal role in advancing LOC and POC diagnostic technologies. For example, the European Commission funded the KardiaTool project, aimed at developing low-cost LOC assays for detecting biomarkers from saliva samples. This innovative approach simplifies the diagnostic process and makes heart failure screening more accessible and cost-effective. Such initiatives not only reduce healthcare expenditure associated with hospital admissions but also promote early detection and preventive care.

Despite these advancements, challenges remain in the adoption and growth of POC diagnostics for heart failure. One significant barrier is the lack of a well-defined reimbursement framework for devices equipped with cassettes or cartridges capable of conducting multiple tests. This limitation hinders widespread market penetration and access to these technologies. To overcome this challenge, manufacturers are working to establish effective reimbursement strategies for multi-analyte POC tests. These efforts aim to ensure the economic viability and adoption of advanced diagnostic tools.

Roche Diagnostics India, in January 2024, made a significant breakthrough with the launch of its NT-proBNP test for POC diagnostics. This test, designed for the cobas h 232 system, is targeted at screening diabetes patients who are at an elevated risk of cardiovascular diseases (CVD), including heart failure. The introduction of this innovative test marks a milestone in bringing diagnostics closer to clinics and revolutionizing patient care. The NT-proBNP biomarker claim extension is specifically designed to enable faster and more efficient diagnosis and management of heart failure, particularly in patients with type 2 diabetes (T2D).

Diabetes, a global health crisis, poses a significant burden, especially in developing countries like India. Recognized as the diabetes capital of the world, India has over 101 million people living with the disease, according to the Indian Council of Medical Research-India Diabetes (ICMR-INDIAB) study. Diabetes is associated with significant morbidity and mortality, with up to 46% of diabetic patients developing CVD in their lifetime. Moreover, CVD accounts for nearly 50% of mortality in T2D patients. Alarmingly, approximately 30% of diabetic patients develop heart failure, and those with both T2D and heart failure face an eightfold increased risk of death compared to individuals without heart failure.

Despite these dire statistics, nearly 80% of heart failure cases in diabetic patients are diagnosed only after acute hospitalizations, even though symptoms may manifest up to five years prior. This diagnostic delay underscores the need for tools like Roche Diagnostics’ NT-proBNP test, which facilitates early detection and intervention. This test addresses a critical gap in heart failure management by enabling clinicians to identify high-risk T2D patients and initiate timely treatments. The accessibility and efficiency of such POC diagnostics are poised to transform patient outcomes, particularly in resource-constrained settings.

Type Insights

The market is segmented into proteomic, metabolomic, and genomic testing. The proteomic testing segment accounted for the largest revenue share of 50.85% in 2024. Technological advancements in omics studies have encouraged research on the role of genomics, proteomics, and metabolomics in cardiovascular events. This, in turn, helps identify novel biomarkers and assays to predict the risk of a heart attack before any symptom occurs. For instance, in April 2022, scientists at SomaLogic Inc. developed a blood test that can be used to predict an individual’s risk of heart attack, stroke, failure, and dying from these conditions in the upcoming four years.

The metabolomics testing segment is expected to grow at the fastest CAGR of 17.47% during the forecast period. N-terminal pro-b-type natriuretic peptide (NT-proBNP), troponin, and B-type natriuretic peptide (BNP) are widely used peptides for monitoring cardiovascular events. Among these, Troponin T (TnT) and Troponin I (TnI) are the most specific protein biomarkers associated with myocardial infarction.

As a result, many companies have focused on targeting these biomarkers, recognizing their potential as a key revenue-generating segment. The substantial number of commercial point-of-care (POC) devices leveraging protein marker testing has significantly contributed to the dominance of the proteomic testing segment in the market.

Technology Insights

The microfluidics method segment dominated the market with a revenue share of 48.36% in 2024. The rise of lab-on-a-chip (LOC) devices, driven by advancements in microfluidics, has transformed biomedical engineering over the past decade. Microfluidic devices, with their ability to manipulate fluids at the microscale, have shown immense promise in revolutionizing biomedical research and diagnostics, surpassing the capabilities of conventional methods. These innovations have fueled progress in diagnostics, single-cell analysis, micro- and nano-fabrication, organ-on-chip models, and med-tech applications, marking a significant shift in the healthcare technology.

Microfluidic technologies have proven particularly impactful for heart failure diagnostics. These devices enable the precise handling of small sample volumes to detect biomarkers such as N-terminal pro-b-type natriuretic peptide (NT-proBNP), troponin, and B-type natriuretic peptide (BNP). This level of precision allows for earlier and more accurate detection of cardiovascular conditions. By integrating nanomaterials with advanced microfluidic designs, LOC systems can analyze cardiac biomarkers rapidly and efficiently, improving the decision-making process in clinical settings.

Furthermore, developing LOC platforms for heart failure enables decentralized testing, bringing diagnostics closer to patients. This approach reduces reliance on central laboratories, accelerates diagnosis, and enhances accessibility in resource-limited settings. As the synergy between microfluidics and nanotechnology continues to advance, the potential for LOC applications in heart failure management is expected to expand significantly.

End use Insights

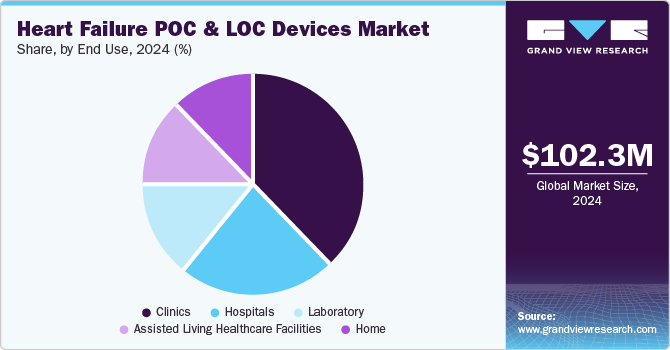

The clinics segment dominated the market with a revenue share of 37.80% in 2024. Point-of-care (POC) testing has proven highly effective in addressing critical healthcare needs across various settings. It is widely used in inpatient environments like operating rooms, emergency departments, and intensive care units, as well as outpatient settings, including physician’s offices, clinics, and home healthcare facilities.

In outpatient clinics, there is a growing focus on transitioning from curative treatments to predictive disease testing, particularly for conditions like heart failure. POC devices are increasingly adopted in these settings for timely and accurate diagnosis, enabling healthcare providers to make informed treatment decisions. This widespread adoption has positioned outpatient clinics as a dominant segment in the POC testing market.

Technological advancements, the integration of artificial intelligence (AI), and the development of novel diagnostic tools continue to enhance the effectiveness of POC devices. For example, in May 2023, research funded by the British Heart Foundation and the National Institute for Health Research (NIHR) led to the creation of the CoDe-ACS algorithm. This innovative tool utilizes patient data, including age, sex, heart metrics, and test results, to predict an individual's risk of a heart attack. Such advancements are expected to drive the efficiency and adoption of POC testing, further solidifying its critical role in modern healthcare.

The home segment is expected to grow at the fastest CAGR of 18.04% due to advancements in POC and LOC devices. High-tech innovations in healthcare have enabled the development of user-friendly devices that can be operated by individuals with minimal training. These portable and easy-to-use technologies allow users to perform tests at home or in other non-clinical settings, providing immediate results and enhancing accessibility.

For instance, products like Philips' Minicare I-20 are designed for simplicity, enabling non-laboratory personnel to easily perform diagnostic tests. Such advancements are driving the adoption of POC devices for home-based testing. This approach empowers individuals to monitor their health independently and facilitates timely clinic visits based on test outcomes. Self-testing at home significantly improves outpatient care by enabling early detection, supporting proactive health management, and reducing the burden on healthcare facilities. These benefits contribute to the growth of the home testing segment, making it a key driver in the broader adoption of portable diagnostic technologies.

Regional Insights

North America heart failure POC & LOC devices market dominated the global market and accounted for the revenue share of 47.97% in 2024. The heart failure point-of-care (POC) and lab-on-a-chip (LOC) devices market in the region has seen substantial organic revenue growth, largely driven by strategic partnerships and acquisitions. For instance, the business combination agreement between Quidel Corporation and Ortho Clinical Diagnostics Holdings plc, signed in December 2021, is a significant development. This partnership aims to provide enhanced diagnostic solutions, expanding access to various medical services, including immunohematology, immunoassay, molecular diagnostics, clinical chemistry, donor screening, and point-of-care diagnostics.

Such partnerships enable improved access to advanced diagnostic tools, which can play a crucial role in heart failure management, offering faster results and more efficient monitoring for patients. The global market for heart failure POC and LOC devices benefits from these innovations, making these diagnostic options more accessible and reliable for both healthcare providers and patients. Additionally, advancements in these technologies contribute to better patient outcomes by allowing quicker detection, real-time monitoring, and more personalized treatment plans.

U.S. Heart Failure POC And LOC Devices Market Trends

The heart failure point-of-care (POC) and lab-on-a-chip (LOC) devices market in the U.S. is experiencing significant growth due to technological advancements and increased demand for rapid diagnostics. Key trends include the development of more accurate, portable, and cost-effective devices for early detection and continuous monitoring of heart failure. Partnerships, like the one between Quidel Corporation and Ortho Clinical Diagnostics, are driving innovation, enhancing access to molecular diagnostics, and improving patient outcomes. Increased adoption of these devices in both clinical and home settings is fueling market expansion.

Europe Heart Failure POC And LOC Devices Market Trends

The Europe heart failure POC and LOC devices market held the second largest share in 2024 owing to increasing prevalence of chronic diseases and an increasing demand for rapid diagnostics in the region. The presence of favorable government initiatives and the development of independent diagnostic centers are further expected to boost market growth over the forecast period.

The heart failure POC and LOC devices market in the UK is expanding due to technological advancements in compact, accurate devices for early detection and monitoring. Trends include integration with digital health platforms for real-time tracking, increased adoption driven by the rising prevalence of heart failure, and regulatory support from the NHS. Cost-effective solutions for both hospital and homecare settings are further fueling market growth.

France heart failure POC and LOC devices market is experiencing growth driven by several key trends. Technological innovations in compact, high-accuracy devices are enabling quicker detection and continuous monitoring of heart failure. The integration of POC and LOC devices with digital health platforms is enhancing patient care through remote monitoring and data tracking. Additionally, the aging population and increasing prevalence of heart failure are boosting demand. France’s strong healthcare infrastructure and regulatory support for medical device adoption further support the expansion of these diagnostic technologies.

The heart failure POC and LOC devices market in Germany is growing due to advancements in diagnostic technologies and increased demand for efficient, rapid heart failure management. Key trends include the development of portable, high-precision devices for early detection and continuous monitoring, integrated with digital health solutions for real-time data tracking. The aging population and rising heart failure cases are driving market expansion, while strong healthcare infrastructure and favorable regulatory frameworks support the adoption of POC and LOC devices in both clinical and homecare settings.

Asia PacificHeart Failure POC And LOC Devices Market Trends

The Asia Pacific heart failure POC and LOC devices market is anticipated to grow at the fastest CAGR of 17.2% over the forecast period. The rise in the adoption of miniaturized models and measures for reducing hospital & clinic stays are expected to fuel the demand for POC products. Adoption of POC diagnostics in operating rooms, emergency rooms, intensive care units, path labs, and hospitals is expected to rise owing to the early and efficient results. Moreover, the presence of a strong product pipeline pertaining to the infectious and cardiac markers segment is estimated to enhance the market over the forecast period.

The heart failure POC and LOC devices market in China is growing rapidly, driven by rising healthcare demand and technological advancements. Key trends include the development of affordable, portable devices for early heart failure detection and continuous monitoring, which are critical in a large and aging population. Integration with digital health platforms allows real-time data tracking, improving patient management. Government initiatives to expand healthcare access and promote medical innovation, combined with increasing awareness of heart disease, are fueling the adoption of POC and LOC devices across China’s healthcare system.

Japan heart failure POC and LOC devices market is witnessing strong growth due to technological advancements and an aging population. Key trends include the development of highly accurate, compact devices for early detection and ongoing monitoring of heart failure. Integration with digital health systems enables remote monitoring and real-time data analysis, improving patient management. Japan's advanced healthcare infrastructure and regulatory support for innovative medical technologies are driving the adoption of POC and LOC devices. Additionally, the increasing prevalence of heart failure further accelerates market demand.

Latin America Heart Failure POC And LOC Devices Market Trends

The heart failure POC and LOC devices market in the Latin America is experiencing growth due to increasing demand for early detection and continuous monitoring solutions. Key trends include the rise of affordable, portable diagnostic devices that offer rapid results in both clinical and home settings. Technological innovations, including digital health integration, are improving patient management through real-time data tracking. The aging population and higher prevalence of heart disease are driving market expansion, while supportive government policies and efforts to improve healthcare access further contribute to the growth of POC and LOC devices in the region.

Brazil heart failure POC and LOC devices market is expanding due to rising demand for affordable, rapid diagnostic solutions. Key trends include the development of portable, high-accuracy devices for early detection and continuous monitoring of heart failure. Integration with digital health platforms allows real-time tracking and better management of patient data. Brazil’s aging population, increasing prevalence of heart disease, and efforts to improve healthcare access are driving market growth. Additionally, government support for healthcare innovation and cost-effective solutions is further accelerating the adoption of POC and LOC devices in the country.

Middle East & Africa Heart Failure POC And LOC Devices Market Trends

The heart failure POC and LOC devices market in the Middle East and Africa is growing over the forecast period. Governments and private sectors in MEA are investing in healthcare infrastructure, including the expansion of clinics and hospitals. This development supports the integration of advanced technologies, such as POC diagnostic tools. Several countries in the Middle East, such as UAE, Kuwait, and Egypt, are experiencing economic growth, leading to increased healthcare spending by governments and individuals

Saudi Arabia heart failure POC and LOC devices market is growing due to technological advancements and increasing demand for early detection and continuous monitoring of heart failure. Key trends include the development of portable, accurate diagnostic devices integrated with digital health systems for real-time monitoring. Saudi Arabia’s aging population, rising prevalence of heart disease, and government efforts to improve healthcare access and innovation are driving market expansion. These factors are accelerating the adoption of POC and LOC devices across the country.

Key Heart Failure POC And LOC Devices Company Insights

Some key players include Abbott, Danahar, Siemens Healthineers, F. Hoffmann-La Roche Ltd, Quidel Corporation, bioMérieux S.A, Trinity Biotech, Abaxis, Inc. These players are undertaking various strategic initiatives to increase their share in the industry. New product development, collaborations, and partnerships are some such endeavors.

Key Heart Failure POC And LOC Devices Companies:

The following are the leading companies in the heart failure POC and LOC devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Danahar

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd.

- Quidel Corporation

- bioMérieux S.A

- Trinity Biotech

- Abaxis, Inc

Recent Developments

-

In April 2024, Roche Diagnostics India has launched the NT-proBNP test on the cobas h 232 system, aimed at improving early detection and intervention for diabetes patients at risk of cardiovascular disease (CVD). This test enables clinicians to identify high-risk Type 2 diabetes (T2D) patients by measuring levels of NT-proBNP, a biomarker associated with heart failure and cardiovascular stress. This move aligns with the growing focus on personalized care and early intervention in chronic disease management.

-

In December 2022, Ultromics' EchoGo obtained US Food and Drug Administration approval for their device EchoGo, an AI-based technology that delivers precise detection of heart failure with intact ejection fraction.

-

In May 2022, BioMérieux acquired Specific Diagnostic. This acquisition contributed to bioMérieux's global leadership in clinical microbiology by bringing significant innovation to the market and enhancing the company's fight against antimicrobial resistance.

Heart Failure POC And LOC Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 116.25 million |

|

Revenue forecast in 2030 |

USD 251.02 million |

|

Growth rate |

CAGR of 15.09% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technology, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Abbott; Danaher; Siemens Healthineers; F. Hoffmann-La Roche Ltd; Quidel Corporation; bioMérieux S.A; Trinity Biotech; Abaxis, Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Heart Failure POC And LOC Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global heart failure POC and LOC devices market report based on the type, technology, end use, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Proteomic Testing

-

Metabolomic Testing

-

Genomic Testing

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Microfluidics

-

Array-based Systems

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Hospitals

-

Home

-

Assisted Living Healthcare Facilities

-

Laboratory

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global heart failure POC and LOC devices market size was estimated at USD 102.30 million in 2024 and is expected to reach USD 116.25 million in 2025.

b. The global heart failure POC and LOC devices market is expected to grow at a compound annual growth rate of 15.09% from 2024 to 2030 to reach USD 251.02 million by 2030.

b. Microfluidics dominated the heart failure POC and LOC devices market with a share of 48.36% in 2024. This is attributable to the fact that it offers several benefits such as less consumption of reagent/sample and rapid turnaround time.

b. Some key players operating in the heart failure POC and LOC devices market include Abbott, Danahar, Siemens Healthineers, and F. Hoffmann-La Roche Ltd, Quidel Corporation, bioMérieux S.A, Trinity BiotechInstrumentation Laboratory, and Abaxis, Inc.

b. Key factors that are driving the market growth include growing popularity of home tests, rise in funding from government and private agencies, and an increase in the demand for outpatient services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."