- Home

- »

- Consumer F&B

- »

-

Healthy Fruit And Vegetable Chips Market Size Report, 2033GVR Report cover

![Healthy Fruit And Vegetable Chips Market Size, Share & Trends Report]()

Healthy Fruit And Vegetable Chips Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Fruits, Vegetables), By Distribution Channel (Offline, Online), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-962-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthy Fruit And Vegetable Chips Market Summary

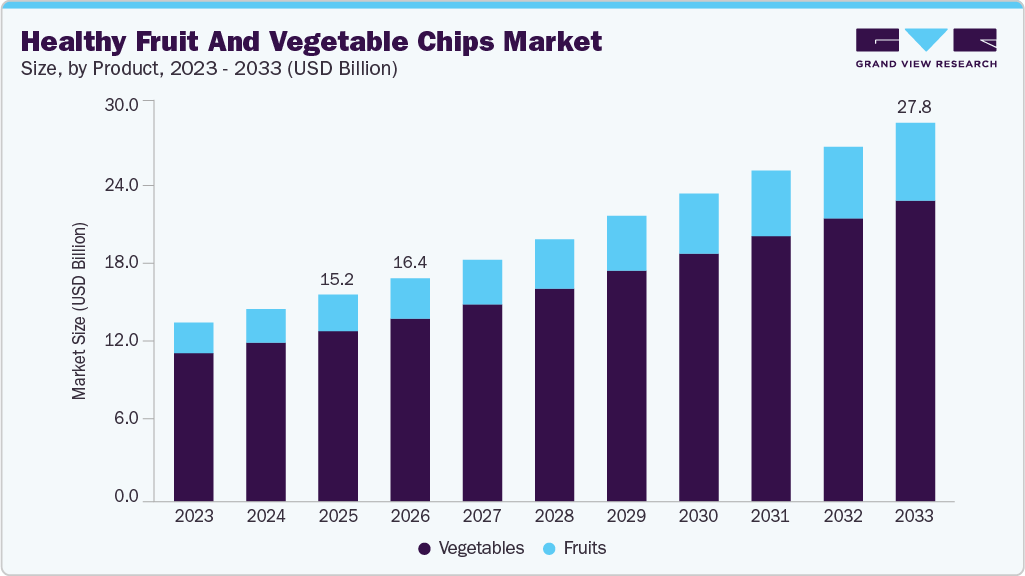

The global healthy fruit and vegetable chips market size was valued at USD 15.18 billion in 2025 and is expected to reach USD 27.79 billion by 2033, growing at a CAGR of 7.8% from 2026 to 2033. Rising awareness of obesity, diabetes, and other lifestyle-related conditions has made people reconsider their everyday snacking choices.

Key Market Trends & Insights

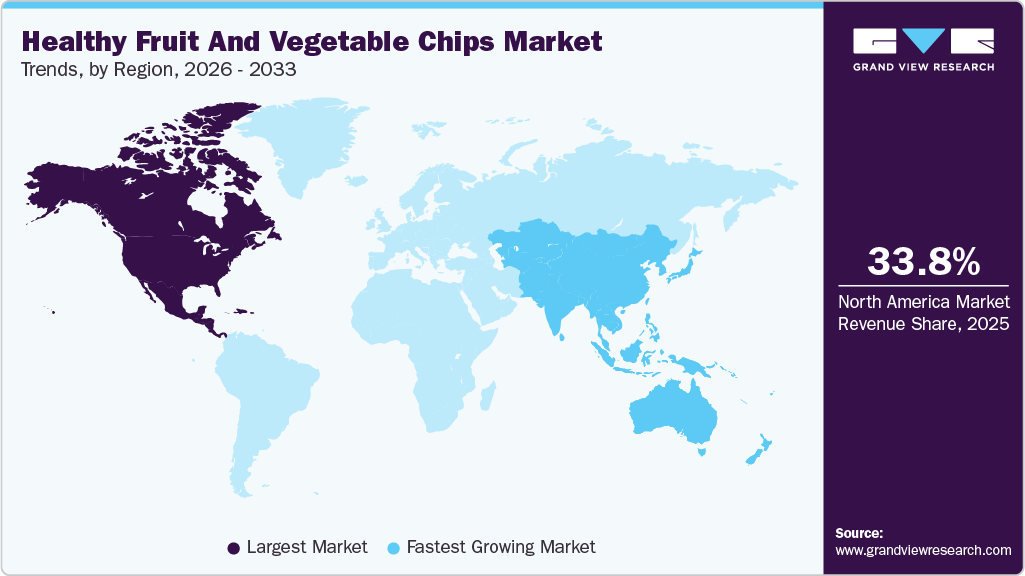

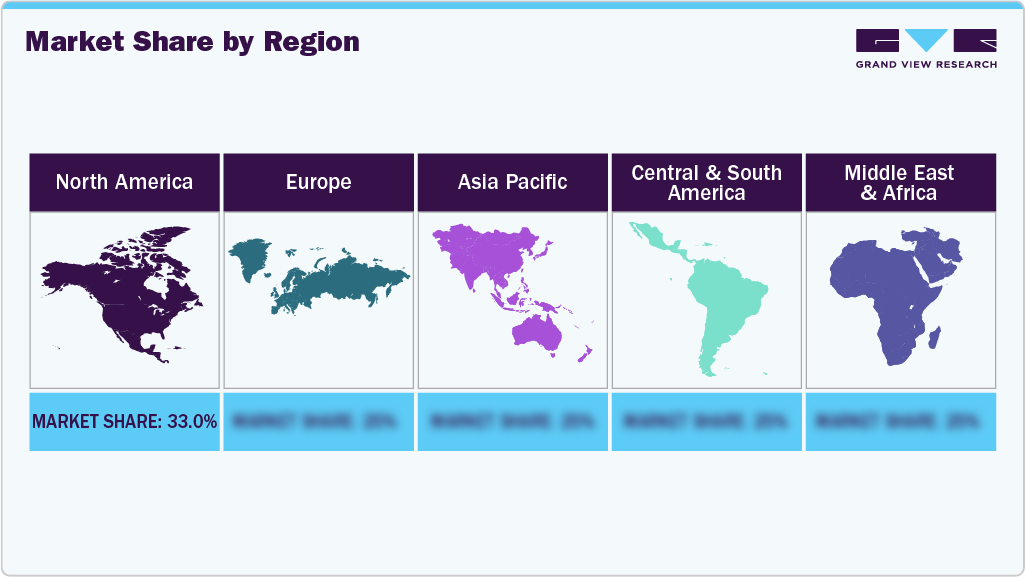

- North America healthy fruit & vegetable chips market led with a share of 33.8% in 2025.

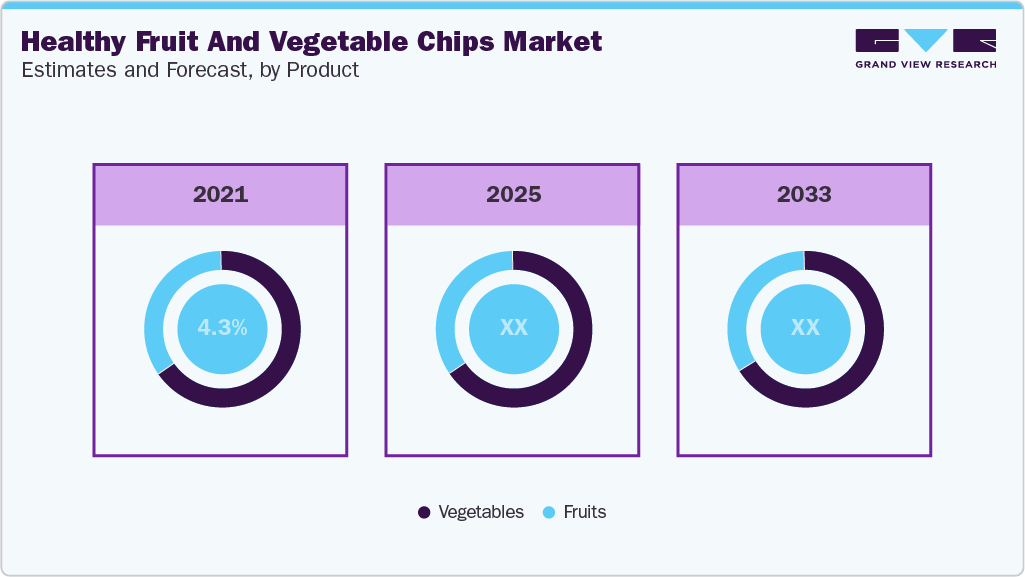

- By product, healthy vegetable chips led the market and accounted for a share of 95.3% in 2025.

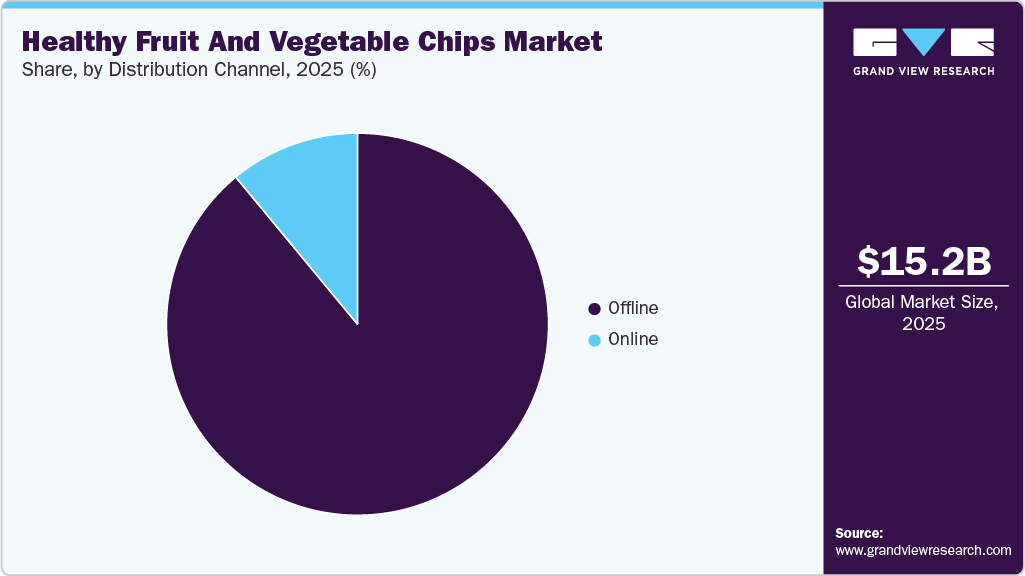

- By distribution channel, offline led the market and accounted for a share of 89.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 15.18 Billion

- 2033 Projected Market Size: USD 27.79 Billion

- CAGR (2026-2033): 7.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

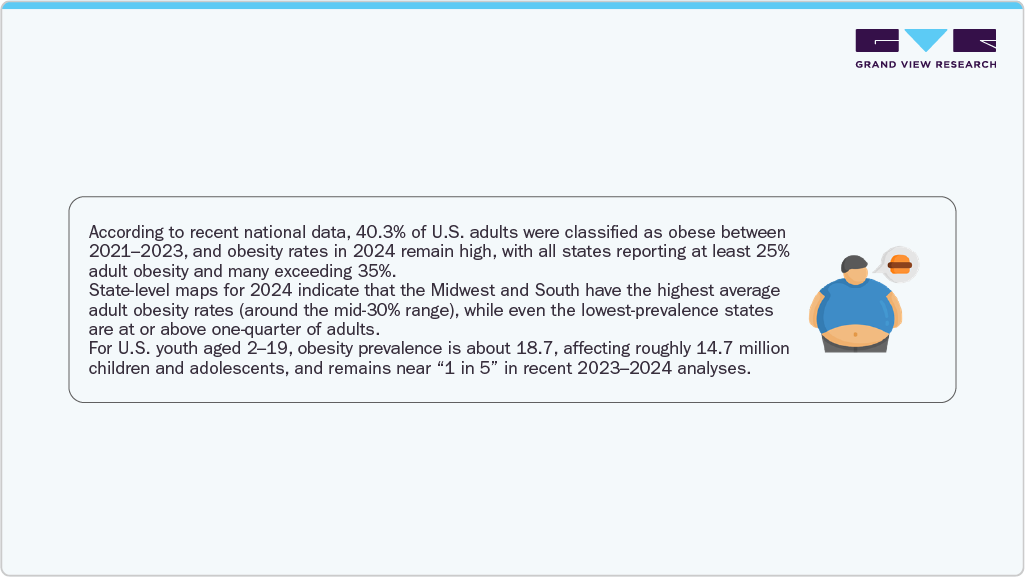

As snacking has become a daily behavior rather than an occasional indulgence, consumers increasingly prefer options that feel lighter, more nutritious, and aligned with their wellness goals. Fruit- and vegetable-based snacks, especially those that are baked, dehydrated, or air-fried, offer a way to enjoy familiar textures and flavors without the guilt associated with conventional chips.A major driver behind this trend is the strong preference for clean-label and simple-ingredient products. Consumers are carefully evaluating packaging for calorie counts, added sugars, salt levels, preservatives, and oil types. Products with short, natural ingredient lists and transparent claims such as “no added sugar,” “no artificial flavors,” “no preservatives,” or “made from whole fruits/vegetables” are increasingly favored. The growing avoidance of palm oil and highly processed ingredients further strengthens the appeal of healthier alternatives. Many fruit and vegetable snacks are marketed as palm-oil free or made with healthier oils, which resonates strongly with health-conscious buyers.

The expansion is driven by shifting taste preferences of the consumer and the adoption of healthy products instead of deep-fried ones. Inclination towards functional and sustainable ready-to-eat snacks, in consort with health awareness among customers, is augmenting the industry outlook. Survey data from Mondelēz’s 2024 State of Snacking report show that about 60% of global consumers now prefer to eat snacks or smaller meals more frequently instead of traditional large meals, and around 88-94% report snacking at least once a day, with Gen Z and Millennials leading this behavior. Consumers are also becoming more mindful: roughly two‑thirds say they actively seek portion‑controlled snacks, indicating that while snacking frequency is high, people are trying to manage portions and nutrition rather than cut back on snacks themselves. Furthermore, the market is expected to witness significant growth owing to factors such as the availability of a wider range of products, tortilla chips, bean chips, corn chips, and others through various sales channels.

Younger consumers, particularly Gen Z and Millennials, are reinforcing this shift. These groups are more inclined toward plant-based eating, sustainability, and functional foods that contribute to overall well-being. Their reliance on social media for nutrition inspiration accelerates trends toward healthier snacking, as wellness influencers and diet-focused content highlight the benefits of natural, plant-derived snacks. Convenience also plays a key role in single-serve fruit and vegetable snacks that fit well into busy, on-the-go lifestyles and provide a portion-controlled option for school, work, and travel.

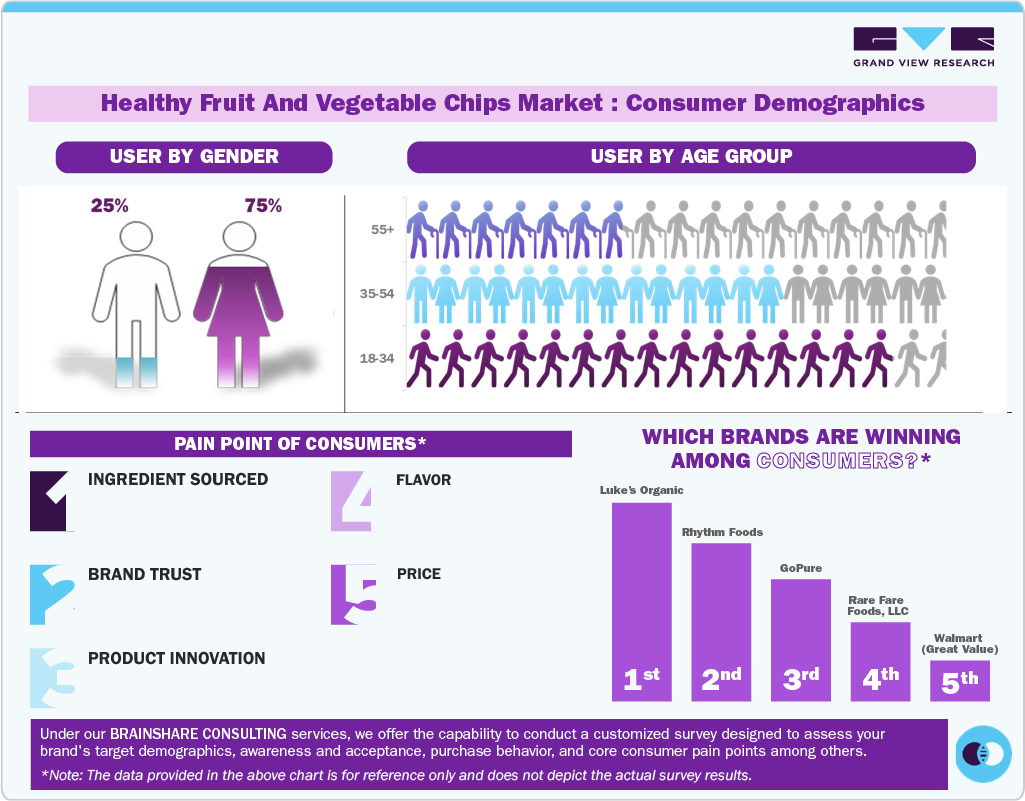

Consumer Insights

Consumers are increasingly shifting toward Healthy Fruit and Vegetable Chips as part of a broader move toward responsible snacking and health-aligned purchasing behavior. Rising awareness of obesity, lifestyle diseases, and daily calorie intake has encouraged individuals to view snacks not as indulgences but as extensions of their wellness goals. As a result, products that offer a lighter nutritional profile, cleaner ingredient lists, and plant-based positioning are gaining preference over conventional fried potato chips. Healthy chips made from apples, bananas, beets, carrots, kale, or mixed vegetables align with these expectations by offering perceived nutritional value, lower guilt, and compatibility with weight-management routines.

A parallel trend is the growing emphasis on label literacy and ingredient transparency. Consumers are now examining nutrition labels in far greater detail, comparing calories, saturated fats, added sugars, sodium content, and oil types before making a purchase. Most adults now consider labels an important decision factor and feel more confident choosing products with simple, recognizable ingredients. This shift is also driving the rejection of palm oil, which many associate with higher saturated fat content and environmental concerns. Brands highlighting “no palm oil,” “baked or air-fried preparation,” and “no artificial additives” therefore benefit from higher trust, stronger shelf appeal, and repeat purchases.

This public health challenge has increased pressure on consumers to make incremental dietary improvements, particularly in categories such as snacking, which is often a daily habit. Healthy fruit and vegetable chips fit neatly into this behavioral shift by offering a convenient, portion-controlled alternative that feels more aligned with long-term health goals. Consequently, the combination of rising obesity, stricter ingredient scrutiny, and preference for “clean” snacking options is contributing to strong and sustained growth in the healthy chips segment.

Product Insights

Healthy vegetable chips dominated the market with a share of 95.3% in 2025. The market for healthy vegetable chips is rising as more and more consumers are seeking snacks that combine convenience and nutrition. Vegetable chips offer a ready-to-eat, crunchy alternative to traditional fried snacks while delivering fiber, vitamins, and other nutrients.

Growing health awareness and wellness trends, including interest in plant-based diets, lower fat intake, and clean-label foods, encourage people to choose vegetable chips made from root vegetables (like sweet potato, beetroot, carrot) or leafy greens (like kale, spinach) over calorie-dense potato chips.

Healthy fruit chips are expected to grow at a CAGR of 9.8% from 2026 to 2033. The market for healthy fruit chips is growing as many consumers now prefer snacks that are nutritious yet convenient, as a healthier alternative to traditional fried potato chips. As people become more aware of diet-related health risks like obesity, diabetes, and cardiovascular disease, they are shifting toward snacks with lower fat and calories, and higher fiber, vitamins, and natural ingredients features often associated with fruit- and vegetable-based chips. Moreover, changing lifestyles, especially among urban dwellers and working professionals, make ready-to-eat, portable, on-the-go snacks more attractive, and fruit chips fit well into this demand for quick, healthy, convenient snacks.

Distribution Channel Insights

Sales of healthy fruit & vegetable chips through the offline channel accounted for a share of 89.0% in 2025. As many consumers prefer to physically see and inspect snack products before buying, offline retail channels remain key for healthy fruit & vegetable chips. Brick-and-mortar stores (hypermarkets, supermarkets, convenience stores) offer easy availability, immediate purchase, and the chance to check packaging, freshness, and quantity factors that give shoppers confidence when buying health-oriented snacks.

Additionally, the broad presence of such stores makes them accessible even in smaller towns or neighborhoods, enabling wider distribution and reaching consumers who may not shop online. Many buyers still prefer traditional retail for food items, especially snacks, which supports steady sales through offline channels.

In terms of revenue, the online distribution channel is expected to grow at a CAGR of 10.0% from 2026 to 2033. The market for healthy fruit and vegetable chips is rising through online channels as more consumers are shopping digitally and online platforms make it easy to discover, compare, and order healthier snacks. Online retailers offer a wide selection of dietary-friendly and “better-for-you” chips that may not be available in typical grocery stores, and home delivery adds convenience. Additionally, social media, influencer reviews, and targeted digital marketing help raise awareness and drive demand for healthy snack alternatives, making online buying of fruit and vegetable chips increasingly attractive.

Regional Insights

The North America healthy fruit & vegetable chips market accounted for a share of 33.8% in 2025. Consumers in North America are increasingly opting for healthy, clean-label, ready-to-eat snacks as part of a broader shift toward wellness, convenience, and plant-based diets. With rising awareness about obesity, diabetes, and other lifestyle-related diseases, many people seek lower-calorie, nutrient-rich alternatives to traditional fried snacks, making fruit and vegetable chips a preferred choice over potato chips. The increasing demand for portability and convenience, especially among working adults and busy households, further fuels this trend.

U.S. Healthy Fruit And Vegetable Chips Market Trends

The healthy fruit & vegetable chips market in the U.S. is growing as there is growing health consciousness among many U.S. consumers, as rising rates of obesity and diabetes motivate people to seek out healthier snack alternatives. At the same time, busy lifestyles and demand for convenience make on-the-go snacks (like fruit and vegetable chips) attractive they offer a crunchy, satisfying, ready-to-eat option without the heavy calories or processed ingredients of traditional chips.

Europe Healthy Fruit And Vegetable Chips Market Trends

The healthy fruit & vegetable chips market in Europe is expected to grow at a CAGR of 7.2% from 2026 to 2033. The market for healthy fruit and vegetable chips is rising among European consumers as more people are seeking convenient snacks that don’t compromise on health or nutrition.

As lifestyles get busier, many consumers want portable, ready-to-eat options that are easier to carry than fresh produce, yet more wholesome than traditional potato chips or processed snacks. At the same time, a growing awareness of wellness, including concerns about weight management, blood sugar, and heart health, is shifting preferences toward snacks made from vegetables and fruits (rich in fiber, vitamins, and minerals) rather than fried or highly processed foods.

Asia Pacific Healthy Fruit And Vegetable Chips Market Trends

The healthy fruit & vegetable chips market in Asia Pacific is expected to register the highest CAGR of 9.0% from 2026 to 2033, as more consumers are becoming health-conscious and seeking nutritious, clean-label snacks instead of traditional fried snacks. As busy urban lifestyles increase demand for convenient, ready-to-eat foods, on-the-go snack options like veggie or fruit chips are becoming popular for their perceived better nutrition (fiber, vitamins, lower fat) combined with convenience. Additionally, rising interest in plant-based diets, non-GMO and natural food products among younger and middle-class consumers in the region has driven demand for snacks made from legumes, vegetables, or fruits that promise cleaner, healthier eating.

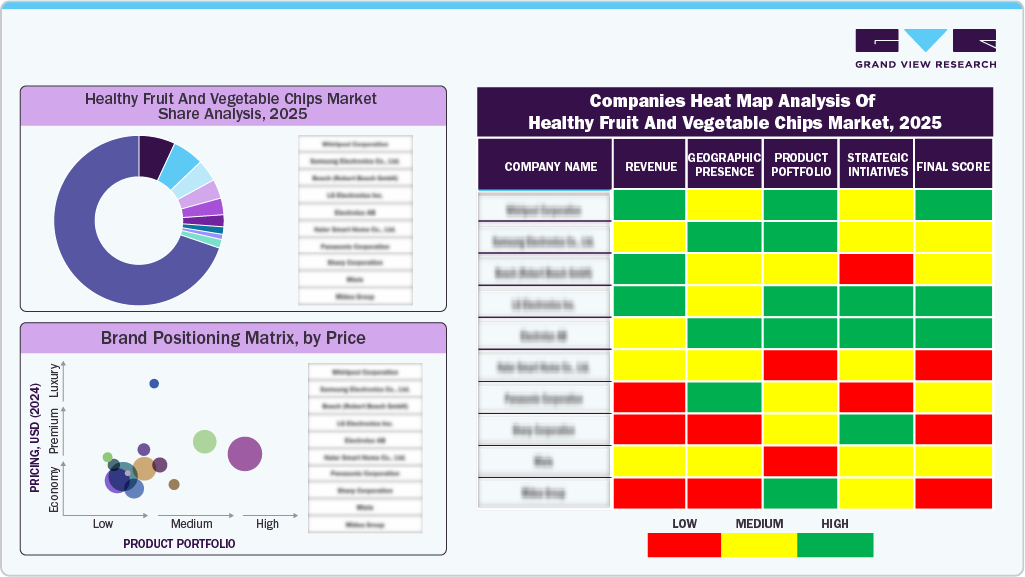

Key Healthy Fruit And Vegetable Chips Company Insights

The presence of a few established players and new entrants characterizes the market. Many big players are increasing their focus on the growing trend of the healthy fruit & vegetable chips market. Players in the market are diversifying their service offerings in order to maintain market share.

Key Healthy Fruit And Vegetable Chips Companies:

The following key companies have been profiled for this study on the healthy fruit and vegetable chips market.

- Luke's Organic

- Rhythm Foods

- GoPure

- Rare Fare Foods, LLC

- Walmart (Great Value)

- Lantev

- Plant Snacks

- Rivera Foods

- SENECA FOODS CORP.

- SPARE SNACKS LIMITED

Recent Developments

-

In November 2025, To Be Honest (TBH), the D2C snack brand of Ghodawat Consumer Limited, launched Mix Veggie Chips in India, made from vacuum-cooked golden and purple sweet potato, jackfruit, beetroot, and okra, seasoned with rock salt and marketed as a low-fat, nutrient-retaining, palm‑oil-free healthy snack.

-

In August 2024, Kibo Foods launched new Veggie Crunch chips made from green peas, offering 7 grams of plant-based protein per 110‑calorie serving in three flavors: Sea Salt, Sour Cream & Onion, and Hot Chipotle. The baked, 3D bite‑size chips are vegan, gluten‑free, non‑GMO, and free from preservatives, added sugar, dairy, and high saturated fat, and are sold in 12‑packs for $21.99 via KiboFoods.us and Amazon, extending Kibo’s sustainable, legume‑based snacking line.

-

In March 2024, Brothers All Natural launched new Infused Freeze-Dried Fruit Crisps at Natural Products Expo West 2024, featuring Fuji apple slices soaked in raspberry, blueberry, and strawberry juice, then freeze‑dried into crispy 100% fruit snacks with no additives. Sold in resealable bags (about 2 cups of fruit and 90 calories), the crisps are peanut‑, tree‑nut‑, soy‑, dairy‑ and gluten‑free, non‑GMO, Kosher, and available online as a convenient, allergy‑friendly, better‑for‑you snack.

Healthy Fruit And Vegetable Chips Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 16.38 billion

Revenue forecast in 2033

USD 27.79 billion

Growth rate

CAGR of 7.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Luke's Organic; Rhythm Foods; GoPure; Rare Fare Foods, LLC; Walmart (Great Value), Lantev; Plant Snacks; Rivera Foods; SENECA FOODS CORP.; SPARE SNACKS LIMITED

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthy Fruit And Vegetable Chips Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthy fruit & vegetable chips market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Fruits

-

Apple

-

Banana

-

Mango

-

Pineapple

-

Coconut

-

Strawberry

-

Others

-

-

Vegetables

-

Sweet potato

-

Beetroot

-

Carrot

-

Tomato

-

Spinach

-

Kale

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthy fruit & vegetable chips market size was estimated at USD 15.18 billion in 2025 and is expected to reach USD 16.38 billion in 2026

b. The global healthy fruit & vegetable chips market is expected to grow at a compound annual growth rate of 7.8% from 2026 to 2033 to reach USD 27.79 billion by 2033

b. Healthy vegetable chips dominated market with a share of 95.3% in 2025. The market for healthy vegetable chips is rising as more and more consumers are seeking snacks that combine convenience and nutrition. Vegetable chips offer a ready-to-eat, crunchy alternative to traditional fried snacks while delivering fibre, vitamins, and other nutrients.

b. Some of the key players are Luke's Organic; Rhythm Foods; GoPure; Rare Fare Foods, LLC; Walmart (Great Value), Lantev; Plant Snacks; Rivera Foods; SENECA FOODS CORP.; SPARE SNACKS LIMITED.

b. Key factors that are driving the healthy fruit & vegetable chips market growth include the growing shift in consumers’ preference toward functional, convenient, and flavored ready-to-eat snacks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.