- Home

- »

- Consumer F&B

- »

-

Healthy Foods Market Size, Share, Industry Report, 2030GVR Report cover

![Healthy Foods Market Size, Share & Trends Report]()

Healthy Foods Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Functional Foods, Organic Foods), By Distribution (Supermarket & Hypermarket, Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-486-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthy Foods Market Summary

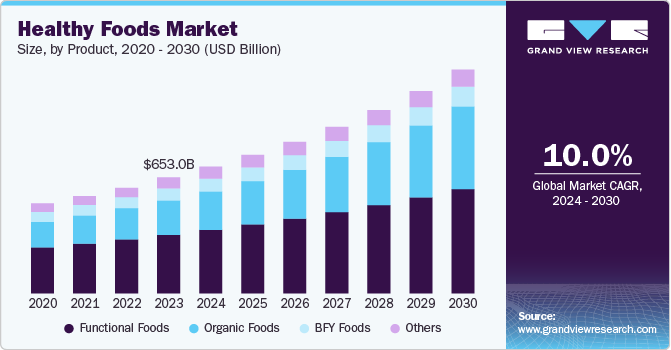

The global healthy foods market size was estimated at USD 653 billion in 2023 and is projected to reach USD 1258.5 billion by 2030, growing at a CAGR of 10% from 2024 to 2030. One of the most significant drivers of the market growth is the increasing awareness of health and nutrition among consumers.

Key Market Trends & Insights

- North America healthy foods market is expected to reach USD 417 billion by 2030

- The healthy foods market in the U.S. exceeded USD 190 billion in 2023.

- By product, functional foods were the most significant product category among healthy foods, generating a market revenue of usd 3.30 billion in 2023.

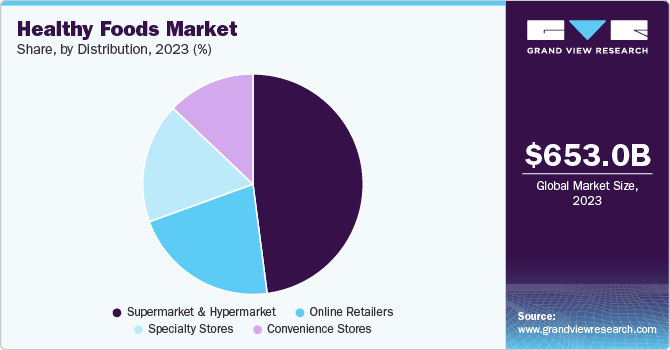

- By distribution, supermarkets and hypermarkets were the most extensive distribution channels.

Market Size & Forecast

- 2023 Market Size: USD 653 Billion

- 2030 Projected Market Size: USD 1258.5 Billion

- CAGR (2024-2030): 10%

- North America: Largest market in 2023

As more individuals recognize the importance of a balanced diet and its impact on overall well-being, there has been a marked shift towards healthier eating habits. This trend is fueled by rising incidences of lifestyle-related diseases such as obesity and diabetes, prompting consumers to seek out foods that offer nutritional benefits and support weight management. The demand for protein-rich products, organic foods, and those free from allergens is rising as people prioritize their health through dietary choices.

Adopting plant-based diets has emerged as a powerful trend influencing the market for healthy foods. With growing concerns about animal welfare, environmental sustainability, and personal health, many consumers are shifting from animal-based products to vegan and vegetarian options. This transition is supported by an increasing number of individuals who are lactose intolerant or have other dietary restrictions, further driving demand for plant-based alternatives. The popularity of dairy-free milk, gluten-free snacks, and plant-based proteins reflects this significant market shift.

The modern lifestyle has also played a crucial role in shaping the market. As more people work from home or lead busy lives, there is a growing preference for convenient food options that do not compromise health. Ready-to-eat meals and snacks that are nutritious and easy to prepare are gaining traction among consumers seeking quick yet healthy meal solutions. This trend aligns with the increasing focus on clean-label products emphasizing transparency in ingredients, catering to health-conscious consumers who prefer minimal processing in their food choices.

Technological advancements in food production and distribution are facilitating the growth of the market. Innovations such as fortified foods, functional beverages, and probiotic-rich products are becoming increasingly popular as consumers seek additional health benefits beyond basic nutrition. Moreover, e-commerce platforms have made it easier for consumers to access various health food products, further driving sales and expanding market reach.

Finally, there is a growing emphasis on preventive health measures among consumers. Many individuals are now more proactive about their health, seeking foods that enhance their immune systems and overall vitality. This shift towards preventive nutrition encourages manufacturers to develop products that cater to these needs, including supplements, functional foods, and snacks designed to boost energy levels and support long-term health. As awareness about the connection between diet and disease prevention grows, the demand for health-oriented food products is expected to rise correspondingly.

One of the primary challenges in the healthy foods industry is the shorter shelf life of fresh products. While fresh foods are often preferred for their superior nutritional content and flavor, their perishable nature necessitates quick consumption or refrigeration. This limitation can lead to increased production costs and higher waste rates due to unsold inventory, ultimately affecting profitability and sustainability efforts within the market. Retailers may struggle to keep fresh, healthy food items in stock, which can deter consumers who prioritize convenience and availability.

Another significant barrier is the high prices associated with health foods. Many consumers find that organic and wellness-focused products come at a premium compared to conventional options, which can limit accessibility for a broader audience. The perception that healthy eating is expensive can discourage individuals from adopting more nutritious diets, particularly in regions with prevalent economic constraints. This challenge is particularly acute in markets like India, where a substantial portion of the population cannot afford a nutritious diet.

The market also faces regulatory challenges, particularly concerning fortified foods and beverages. Stricter regulations aimed at ensuring product safety and transparency can create hurdles for manufacturers who may struggle to comply with these standards. Failure to meet regulatory requirements can limit the availability of certain products in the market, stifling innovation and reducing consumer choices. Manufacturers must navigate these complex regulations while maintaining product quality and meeting consumer expectations.

Product Insights

Functional foods were the most significant product category among healthy foods, generating a market revenue of USD 3.30 billion in 2023. One of the primary drivers is the increased consumer interest in health and wellness. As individuals become more aware of the impact of nutrition on overall well-being, there is a growing demand for foods that offer health benefits beyond essential nutrition. Functional foods, which include products fortified with vitamins, minerals, probiotics, and other bioactive compounds, are increasingly sought for their potential to prevent chronic diseases such as obesity, diabetes, and cardiovascular issues. This shift towards health-conscious eating habits encourages consumers to seek functional foods to enhance their quality of life and support long-term health goals.

Another significant factor contributing to the growth of the functional food market is the rise in chronic diseases. With conditions like heart disease and diabetes becoming more prevalent, consumers are actively looking for dietary solutions to manage these health challenges. Functional foods are positioned as practical tools for promoting health and preventing disease, which resonates with a population increasingly focused on preventive healthcare. The aging demographic also plays a crucial role; older adults are particularly interested in foods that support cognitive function, joint health, and overall vitality. This demographic shift further drives demand for products specifically addressing age-related health concerns.

Technological food processing and formulation advancements also propel the functional food market forward. Innovations have led to the developing of more effective and palatable functional food products, making them more appealing to consumers. In addition, the rise of e-commerce platforms has enhanced accessibility, allowing consumers to find and purchase these specialized products easily. As manufacturers continue exploring new ingredients and formulations that cater to specific health needs-such as gut health or immune support-the market will likely see continued expansion. Overall, the combination of heightened health awareness, the need for disease management solutions, and technological progress creates a robust environment for growth in the functional food sector.

Organic food is expected to be the fastest-growing product category, growing at a CAGR of 13.6% from 2024 to 2030. As consumers become more educated about the benefits of organic foods-such as reduced exposure to harmful pesticides and chemicals-they are increasingly inclined to choose organic options over conventional products. This shift in consumer behavior is supported by a growing body of research highlighting the health advantages of organic diets, including improved nutritional profiles and potential long-term health benefits. Furthermore, the rise of social media and digital platforms has facilitated information sharing, allowing consumers to access knowledge about organic farming practices and their positive impacts on health and the environment.

Another critical driver for the organic food market is the heightened concern for environmental sustainability. As awareness of climate change and ecological degradation grows, consumers seek food products that align with their sustainability and ethical consumption values. Organic farming practices are often perceived as more environmentally friendly due to their emphasis on biodiversity, soil health, and reduced reliance on synthetic fertilizers and pesticides. This alignment with ecological values encourages consumers to support organic agriculture to promote sustainable food systems. Consequently, many individuals view purchasing organic products as a dietary choice and a commitment to environmental stewardship.

Lastly, the organic food market is also propelled by demographic shifts and changing lifestyles. Younger consumers, particularly millennials and Generation Z, are leading the charge in prioritizing health-conscious and sustainable food choices. These demographics tend to be more informed about the implications of their food choices on personal health and the planet, driving demand for organic products. In addition, urbanization has resulted in greater access to organic foods through specialized grocery stores and online platforms, making it easier for consumers to incorporate these products into their diets. As a result, increased awareness, environmental concerns, and demographic changes create a robust foundation for continued growth in the organic food market.

The growth of the Better-for-You (BFY) foods segment is driven by the rising health consciousness among consumers, who are increasingly concerned about obesity and chronic health conditions. As awareness of the importance of nutrition in maintaining health escalates, consumers are actively seeking snacks and food options that provide taste and enhanced nutritional value. This shift is evident in the demand for products made with natural ingredients, reduced unhealthy additives, and functional benefits such as probiotics and antioxidants. In addition, the influence of younger demographics, particularly millennials and Generation Z, who prioritize health and wellness in their purchasing decisions, further propels the BFY segment's expansion.

Distribution Insights

Supermarkets and hypermarkets were the most extensive distribution channels for healthy foods, accounting for market revenue exceeding USD 300 billion in 2023. The growth of supermarkets and hypermarkets in the market is significantly driven by the increasing consumer demand for health-conscious products. As nutrition awareness and its impact on overall health rise, consumers actively seek more nutritious food options that align with their dietary preferences. Supermarkets are responding to this trend by expanding their organic, natural, and functional food offerings, catering to the growing segment of health-conscious shoppers. This shift is supported by initiatives that promote healthy eating habits, as evidenced by reports indicating that a substantial percentage of consumers are trying to eat healthier. By prioritizing the availability of wholesome foods, supermarkets position themselves as key players in the health and wellness movement.

Another crucial driver is the integration of e-commerce and omnichannel retailing within supermarkets and hypermarkets. The convenience of online shopping has transformed consumer purchasing behaviors, allowing customers to easily access a wide variety of healthy food options from the comfort of their homes. Many retailers are enhancing their digital platforms to offer personalized shopping experiences, which include tailored recommendations for healthy products based on individual preferences and dietary needs. This integration not only increases accessibility to nutritious foods but also encourages consumers to explore new products that they might not have considered in a traditional shopping environment.

In addition, supermarkets increasingly adopt sustainability practices and ethical consumerism as part of their business strategies. Consumers are now more inclined to support brands that prioritize environmental responsibility and ethical sourcing of ingredients. Supermarkets are responding by offering locally sourced organic produce, reducing packaging waste, and implementing sustainable practices throughout their supply chains. This commitment to sustainability resonates with health-conscious consumers who view their food choices as a reflection of their values. By aligning their product offerings with these principles, supermarkets attract a loyal customer base and contribute positively to public health and environmental sustainability initiatives.

Online distribution is expected to grow at a CAGR of 11.8% from 2024 to 2030. Online distribution channels are significantly driving market growth by enhancing accessibility and convenience for consumers. The rise of e-commerce platforms allows consumers to browse various healthy food options from their homes, eliminating the need to visit physical stores. This convenience particularly appeals to health-conscious individuals who may have busy lifestyles and prefer quick access to nutritious products. Furthermore, online channels often provide detailed product information, including nutritional content and ingredient sourcing, empowering consumers to make informed choices about food purchases. The ability to compare prices and read reviews also fosters a more competitive marketplace, encouraging brands to maintain high quality and transparency.

Online distribution channels facilitate a broader reach for local and international brands within the healthy foods industry. E-commerce platforms break down geographical barriers, allowing consumers in remote areas to access specialty healthy foods that may not be available in nearby supermarkets. This democratization of access is particularly beneficial for niche products, such as organic or gluten-free items, which might have limited shelf space in traditional retail settings. Moreover, the integration of social media marketing and influencer partnerships within e-commerce strategies further enhances brand visibility and consumer engagement. As health trends evolve, online channels enable brands to quickly adapt their offerings based on consumer feedback and emerging dietary preferences, driving innovation and growth in the healthy foods sector.

Regional Insights

The North America healthy foods market is expected to reach USD 417 billion by 2030, growing at a CAGR of 9.8% over the forecast period. The growth of the market in North America is primarily driven by an increasing consumer commitment to health and wellness, significantly accelerated by the COVID-19 pandemic. As many individuals reassess their dietary choices, around 50% of consumers report prioritizing healthy eating, with a strong focus on fresh produce and foods free from artificial ingredients. This trend reflects a broader shift towards conscious eating, where consumers actively seek products that promote personal health and align with sustainability goals. The pandemic has further intensified this movement, leading to a notable increase in the consumption of plant-based foods and reduced processed food intake as people become more aware of the links between diet and overall well-being.

U.S. Healthy Foods Market Trends

The healthy foods market in the U.S. exceeded USD 190 billion in 2023. The changing consumer attitudes and the expansion of online distribution channels have played a crucial role in driving market growth. E-commerce platforms have made it easier for consumers to access a diverse range of nutritious food options, including organic and specialty products that may not be available in traditional grocery stores. This increased accessibility caters to the growing demand for convenience among health-conscious shoppers who prefer the ease of online shopping. Moreover, enhanced product information and customer reviews on these platforms empower consumers to make informed choices, further fueling interest in healthier food options. As supermarkets and hypermarkets adapt to these trends by expanding their healthy food offerings and improving their online presence, they are well-positioned to meet the evolving needs of U.S. consumers.

Asia Pacific Healthy Foods Market Trends

The Asia Pacific healthy foods market is expected to grow at a CAGR of 10.4% from 2024 to 2030. The growth of the market in the Asia Pacific region is being propelled by several interrelated factors, with rising health consciousness among consumers taking center stage. In countries like China and India, there is a notable shift towards preventive health measures, with nearly 39% of consumers actively seeking products to help prevent health issues before they arise. This proactive approach has led to increased demand for foods rich in nutrients, such as protein and fiber, which are sought after for their health benefits. For instance, the popularity of protein-rich snacks is particularly pronounced among younger demographics, including Gen Z and Millennials, who prioritize nutrition as part of their lifestyle choices. The focus on health has also encouraged brands to innovate by incorporating functional ingredients that cater to specific health needs, such as immunity boosting and weight management.

Another significant growth driver in the market is the increasing disposable income across Asia, enabling consumers to make healthier food choices. As the middle class expands-projected to rise from 2 billion in 2020 to 3.5 billion by 2030-countries like Indonesia and Vietnam are witnessing a surge in demand for premium healthy food products. Consumers are more willing to spend on organic and sustainably sourced foods, reflecting a broader trend towards ethical consumption. This economic shift not only enhances access to a variety of healthy options but also supports local producers who prioritize sustainable agricultural practices. The willingness to invest in health-promoting foods is further amplified by growing awareness of the link between diet and long-term well-being.

Technological advancements and innovations in food processing are also playing a crucial role in driving the market in Asia Pacific. Countries such as Japan are at the forefront of developing functional foods that meet evolving consumer preferences for taste and health benefits. The introduction of products fortified with vitamins and minerals, as well as plant-based alternatives, caters to a growing interest in dietary diversity and nutritional enhancement. For example, Japan's focus on food labeling has led to increased transparency regarding caloric values and nutritional content, allowing consumers to make informed choices about their diets. This trend is mirrored in South Korea, where technological innovations have resulted in the creation of convenient, ready-to-eat healthy meals that appeal to busy urban lifestyles.

Finally, the COVID-19 pandemic has acted as a catalyst for change in consumer behavior across the Asia Pacific region, heightening awareness of health and wellness. The pandemic prompted many individuals to reassess their dietary habits and prioritize immune-boosting foods, leading to a surge in demand for functional products that support overall health. In countries like Australia, consumers are increasingly looking for foods that not only satisfy hunger but also contribute positively to their physical and mental well-being. This shift has resulted in a greater emphasis on clean-label products that contain natural ingredients without additives or preservatives. As consumers become more mindful of their food choices, brands that emphasize transparency and health-promoting attributes are likely to thrive in this evolving market landscape.

Key Healthy Foods Company Insights

The market for healthy foods is characterized by a diverse and competitive landscape, with several key players actively shaping the industry. Major companies such as Nestlé, Danone, PepsiCo, Coca-Cola, and General Mills are prominent in this space, each focusing on expanding their portfolios to include healthier food and beverage options. For instance, Nestlé has been enhancing its offerings in the health and wellness segment, while Danone is well-known for its dairy and plant-based products. These companies leverage research and development to innovate and differentiate their products, addressing the increasing consumer demand for natural, organic, and functional foods. In addition, strategic partnerships and acquisitions are common strategies these firms employ to enhance their market presence and product variety.

Emerging players and local brands are also making significant inroads in the healthy foods market, contributing to its fragmentation. These smaller companies often focus on niche segments such as gluten-free, vegan, or functional foods tailored to specific health needs, which resonates with consumers seeking specialized options. The competition from these local players encourages established brands to innovate continuously and adapt their offerings to meet evolving consumer demands. As a result, the market is becoming increasingly dynamic, with companies needing to stay agile in response to trends like plant-based diets, functional foods, and personalized nutrition solutions.

Key Healthy Foods Companies:

The following are the leading companies in the healthy foods market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé S.A.

- Danone S.A.

- PepsiCo Inc.

- General Mills Inc.

- Kraft Heinz Company

- Mondelez International Inc.

- GlaxoSmithKline PLC

- Abbott Laboratories

- Herbalife Nutrition Ltd.

- Archer Daniels Midland Company

- Chobani Global Holdings LLC

- Clif Bar & Company

- Dairy Farmers of America Inc.

- Glanbia PLC

- Yakult Honsha Co., Ltd

Healthy Foods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 712.2 billion

Revenue forecast in 2030

USD 1258.5 billion

Growth rate (Revenue)

CAGR of 10% from 2024 to 2030

Actuals

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Nestlé S.A.; Danone S.A.; PepsiCo Inc.; General Mills Inc.; Kraft Heinz Company; Mondelez International Inc.; GlaxoSmithKline PLC; Abbott Laboratories; Herbalife Nutrition Ltd.; Archer Daniels Midland Company; Chobani Global Holdings LLC; Clif Bar & Company; Dairy Farmers of America Inc.; Glanbia PLC; Yakult Honsha Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthy Foods Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthy foods market report based on product, distribution, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Functional Foods

-

Organic Foods

-

BFY Foods

-

Others

-

-

Distribution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarket & Hypermarket

-

Convenience Stores

-

Specialty Stores

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthy foods market was valued at USD 653 billion in 2023 and is expected to reach USD 712.2 billion in 2024.

b. The global healthy foods market is expected to expand at a compound annual growth rate (CAGR) of 10.0% from 2024 to 2030 to reach USD 1258.5 billion by 2030.

b. Functional foods were the most significant product category among healthy foods, generating a market revenue of USD 3.30 billion in 2023. One of the primary drivers is the increased consumer interest in health and wellness. As individuals become more aware of the impact of nutrition on overall well-being, there is a growing demand for foods that offer health benefits beyond essential nutrition. Functional foods, which include products fortified with vitamins, minerals, probiotics, and other bioactive compounds, are increasingly sought for their potential to prevent chronic diseases such as obesity, diabetes, and cardiovascular issues.

b. Some key players operating in the healthy foods market include Nestlé S.A.; Danone S.A.; PepsiCo Inc.; General Mills Inc.; Kraft Heinz Company; Mondelez International Inc.; GlaxoSmithKline PLC; Abbott Laboratories; Herbalife Nutrition Ltd.; Archer Daniels Midland Company; Chobani Global Holdings LLC; Clif Bar & Company; Dairy Farmers of America Inc.; Glanbia PLC; Yakult Honsha Co., Ltd

b. One of the most significant drivers of the health foods market is the increasing awareness of health and nutrition among consumers. As more individuals recognize the importance of a balanced diet and its impact on overall well-being, there has been a marked shift towards healthier eating habits. This trend is fueled by rising incidences of lifestyle-related diseases such as obesity and diabetes, prompting consumers to seek out foods that offer nutritional benefits and support weight management. The demand for protein-rich products, organic foods, and those free from allergens is rising as people prioritize their health through dietary choices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.