- Home

- »

- Consumer F&B

- »

-

Healthy Energy Drinks Market Size And Share Report 2030GVR Report cover

![Healthy Energy Drinks Market Size, Share & Trends Report]()

Healthy Energy Drinks Market Size, Share & Trends Analysis Report By Packaging (Cans, Bottles), By Type (Conventional, Organic), By Distribution Channel (Off-Trade, On-Trade), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-357-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Healthy Energy Drinks Market Size & Trends

The global healthy energy drinks market size was estimated at USD 4.17 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. The market is experiencing significant growth, driven by a confluence of factors that reflect changing consumer preferences and broader societal trends. One of the primary drivers is the increasing health consciousness among consumers. As people become more aware of the adverse effects of excessive sugar and artificial additives, they are gravitating towards healthier alternatives. This shift is particularly pronounced among younger demographics, who are more likely to scrutinize ingredient labels and choose products that align with their health and wellness goals. The demand for energy drinks that provide a natural energy boost without the downsides of traditional, sugary options is thus on the rise.

Another crucial driver is the expanding consumer base of fitness enthusiasts and athletes. This group requires energy drinks that not only boost energy levels but also support their overall fitness regimen. Products that contain natural ingredients, vitamins, and electrolytes are particularly appealing to this segment, as they promise enhanced performance and quicker recovery times without harmful side effects. The proliferation of fitness culture, fueled by the rise of social media influencers and fitness apps, has further propelled the demand for healthy energy drinks designed to meet the needs of active lifestyles.

Innovation and product diversification also play a significant role in driving the market. Manufacturers are continually developing new formulations and flavors to cater to diverse consumer preferences. The introduction of functional ingredients such as adaptogens, nootropics, and probiotics in energy drinks has created new sub-segments within the market, attracting consumers looking for specific health benefits beyond just an energy boost. This continuous innovation not only keeps the market dynamic but also helps companies differentiate their products in a crowded marketplace.

Sustainability and ethical considerations are increasingly influencing consumer choices, thereby driving the demand for healthy energy drinks. Many consumers today prefer products that are not only good for their health but also environmentally friendly. Brands that use organic ingredients, adopt eco-friendly packaging, and engage in sustainable sourcing practices are gaining traction. The alignment of a brand’s values with those of its consumers can significantly enhance brand loyalty and drive market growth.

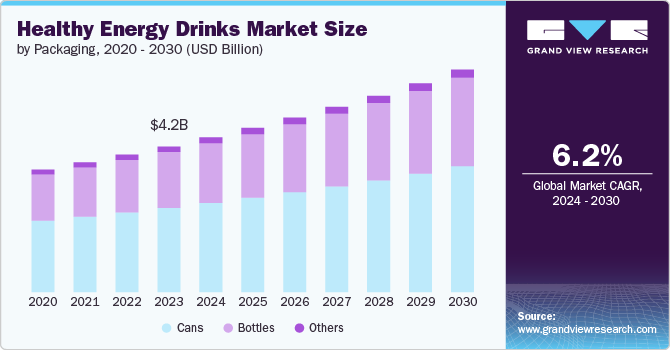

Packaging Insights

In 2023, the canned healthy energy drinks market segment captured a substantial revenue share of 57.9%, reflecting a significant preference among consumers for convenient, portable, and long-lasting beverage options. The popularity of canned drinks can be attributed to their durability and ease of storage and transport, making them an ideal choice for on-the-go consumption. Canned beverages often feature a longer shelf life compared to other packaging options, which appeals to both retailers and consumers looking for practicality.

Furthermore, advancements in canning technology have allowed manufacturers to preserve the natural ingredients and flavors of healthy energy drinks, ensuring that consumers do not have to compromise on quality. The eco-friendly aspect of cans, being more recyclable than plastic bottles, also resonates with the growing segment of environmentally conscious consumers. This blend of convenience, sustainability, and product integrity has driven the dominance of canned healthy energy drinks in the market.

The bottled healthy energy drinks market is expected to grow at a CAGR of 6.8% from 2024 to 2030. This anticipated growth is driven by several key factors. Firstly, the rising consumer demand for health-oriented beverages continues to fuel market expansion, as more individuals seek out nutritious and convenient drink options. Bottled drinks offer the added advantage of resealability, making them a preferred choice for consumers who value the ability to enjoy their beverage over an extended period without compromising freshness.

Additionally, innovative packaging designs and the use of sustainable materials in bottle production are attracting environmentally conscious consumers. The increasing presence of bottled healthy energy drinks in supermarkets, health food stores, and online platforms is enhancing accessibility and visibility, further propelling market growth. Moreover, strategic marketing efforts and endorsements by health influencers and athletes are amplifying the appeal of bottled options, contributing to their rising popularity. As manufacturers continue to innovate with new flavors and functional ingredients, the bottled healthy energy drinks segment is well-positioned for steady growth in the coming years.

Type Insights

The conventional healthy energy drinks market segment accounted for a revenue share of 66.8% in 2023. This significant share can be attributed to several factors. Traditional energy drink brands have successfully evolved to meet consumer demands for healthier alternatives, reformulating their products to include natural ingredients, reduced sugar content, and added vitamins and minerals. These brands often benefit from established distribution networks and strong brand recognition, making them readily accessible to a broad consumer base. Moreover, the extensive marketing campaigns and endorsements by athletes and fitness influencers have bolstered the appeal of these conventional brands, further driving their market penetration.

Organic healthy energy drinks market is expected to grow at a CAGR of 7.0% from 2024 to 2030. This projected expansion is driven by an increasing consumer shift towards organic and natural products, as health-conscious individuals become more aware of the benefits of avoiding synthetic additives and preservatives. Organic energy drinks, which use ingredients sourced from organic farming practices, appeal to consumers seeking cleaner and more environmentally friendly beverage options.

The rise in disposable income and the willingness to spend more on premium, health-focused products also contribute to this growth. Additionally, the ongoing trend of sustainability and ethical consumption drives demand for products that are not only good for personal health but also better for the planet. The expanding availability of organic energy drinks in various retail channels, including online stores, health food shops, and supermarkets, further enhances market accessibility.

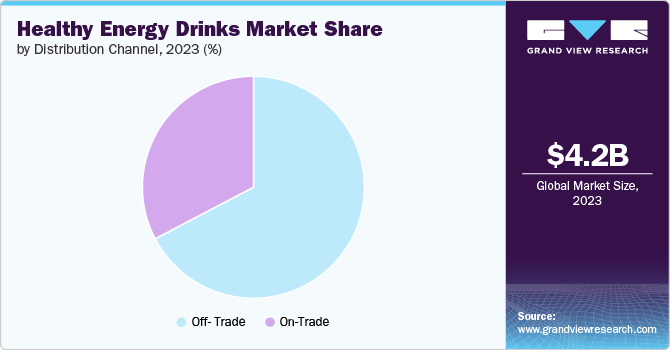

Distribution Channel Insights

Sales of healthy energy drinks through off-trade distribution accounted for a revenue share of 67.3% in 2023. This distribution channel includes sales through supermarkets, convenience stores, mass merchandisers, and online retailers, catering to the convenience-seeking consumer base. Off-trade channels offer significant advantages such as wide product availability, competitive pricing, and the ability for consumers to purchase beverages in bulk or as part of regular shopping trips.

The convenience and accessibility of purchasing healthy energy drinks through off-trade channels resonate well with busy consumers looking for quick and easy shopping experiences. Additionally, the growing trend of online shopping has further boosted off-trade sales, as consumers increasingly prefer the convenience of browsing and purchasing beverages from the comfort of their homes.

Sales of healthy energy drinks through on-trade distribution channels is expected to grow at a CAGR of 6.9% from 2024 to 2030. This anticipated growth is driven by several key factors. Firstly, the rising consumer preference for healthier beverage options is influencing establishments to offer a variety of healthy energy drinks on their menus. Health-conscious consumers who frequent these venues are increasingly seeking alternatives to traditional sugary drinks, driving demand within the on-trade sector. Moreover, the expansion of wellness-focused trends in the hospitality industry, including fitness centers, spas, and health-oriented cafes, is further fueling the adoption of healthy energy drinks in on-trade settings.

In addition, collaborations between energy drink brands and on-trade establishments to develop specialized menu offerings and promotional campaigns are enhancing product visibility and consumer awareness. As more consumers integrate health and wellness considerations into their dining and social experiences, the on-trade distribution channel for healthy energy drinks is poised for continued growth in the coming years.

Regional Insights

North America Healthy Energy Drinks Market Trends

The healthy energy drinks market in North America captured a revenue share of over 41.1% in 2023. This dominance can be attributed to several factors contributing to market growth and consumer preference within the region. Firstly, North America has a large and diverse consumer base that is increasingly health-conscious and actively seeks out healthier beverage alternatives. The region's robust economy and high disposable income levels enable consumers to prioritize premium products, including healthy energy drinks that offer functional benefits without compromising on taste or health considerations.

Moreover, the strong presence of established brands and ongoing innovation in product formulations, such as reduced sugar content and natural ingredients, resonate well with North American consumers' preferences for transparent and nutritious choices. The region's well-developed retail infrastructure, encompassing supermarkets, specialty health food stores, and online platforms, facilitates widespread accessibility and distribution of healthy energy drinks.

In addition, proactive marketing campaigns, endorsements by athletes and health influencers, and growing consumer awareness of the benefits of maintaining an active lifestyle further bolster market growth. As these trends continue to shape consumer behavior and preferences, North America is expected to maintain its prominent position in the global market in the foreseeable future.

U.S. Healthy Energy Drinks Market Trends

The U.S. healthy energy drinks market is a dynamic segment within the broader beverage industry, characterized by strong consumer demand for products that combine energy-boosting benefits with health-conscious ingredients. In recent years, this market has seen significant growth driven by several key factors. Firstly, heightened consumer awareness of health and wellness has fueled a shift towards beverages that offer functional benefits like increased energy without the high sugar content typically found in traditional energy drinks. This trend is particularly pronounced among younger demographics and health-conscious individuals who prioritize ingredients such as natural stimulants, vitamins, and electrolytes.

Europe Healthy Energy Drinks Market Trends

The European healthy energy drinks market is a rapidly growing segment within the beverage industry, driven by evolving consumer preferences towards healthier and more functional drink options. Several factors contribute to the market's expansion across the region. There is rising awareness and adoption of healthier lifestyles among European consumers, leading to increased demand for beverages that provide energy without the drawbacks of excessive sugars and artificial ingredients. This shift is supported by a growing emphasis on fitness, wellness, and sustainable living, influencing purchasing decisions towards products with natural ingredients, lower calorie counts, and added vitamins or minerals.

Asia Pacific Healthy Energy Drinks Market Trends

The healthy energy drinks market in Asia Pacific is expected to witness a CAGR of 7.2% from 2024 to 2030. This growth trajectory is driven by several key factors influencing consumer behavior and market dynamics in the region. Firstly, increasing urbanization and rising disposable incomes are contributing to changing lifestyles and dietary preferences among consumers. As more individuals adopt busy lifestyles and seek convenient yet nutritious beverage options, the demand for healthy energy drinks is expected to rise.

Moreover, a heightened awareness of health and wellness, influenced by global health trends and local initiatives promoting healthier living, is driving the shift towards beverages that offer functional benefits such as energy boosts without compromising on health considerations. This trend is particularly strong among younger demographics and urban professionals who prioritize products with natural ingredients, reduced sugar content, and additional health-enhancing additives like vitamins and antioxidants.

Key Healthy Energy Drinks Company Insights

Key companies span globally recognized brands and regional players, each contributing uniquely to market dynamics and consumer preferences. These companies play a pivotal role in shaping the competitive landscape through innovation, product differentiation, and strategic market expansions.

The market continues to evolve with changing consumer preferences towards healthier lifestyles and functional beverages. Key companies play a crucial role in driving innovation, market growth, and shaping industry trends as they compete to capture a larger share of the expanding global market.

Key Healthy Energy Drinks Companies:

The following are the leading companies in the healthy energy drinks market. These companies collectively hold the largest market share and dictate industry trends.

- Red Bull GmbH

- Monster Beverage Corporation

- PepsiCo, Inc.

- Celsius Holdings, Inc.

- BANG Beverage Company LLC

- Fitt Ventures, Inc.

- Aspire Drinks

- KING KONGIN

- Guru Energy

- NOS Energy

Recent Developments

-

In May 2024, ZOA Energy introduced Green Apple as a new flavor in its Zero Sugar beverages line-up. This addition enhanced the brand's existing portfolio, which included core flavors such as Tropical Punch, Strawberry Watermelon, Frosted Grape, Wild Orange, Cherry Limeade, White Peach, Super Berry, and Pineapple Coconut. Green Apple was infused with ZOA Energy's signature blend of B & C vitamins, electrolytes, and zero sugar, aligning with the brand's commitment to providing refreshing and nutritious energy drinks tailored for health-conscious consumers.

-

In April 2024, KEY, an all-natural energy drink harnessing the power of ketones to modernize the energy drink market. Co-founded by two executives with extensive experience at rival beverage companies Coca-Cola and PepsiCo, Karishma Thawani and Tekla Back, KEY introduced a clean alternative devoid of the sugar shock or caffeine jitters often associated with conventional energy drinks.

-

In March 2024, ASPIRE Healthy Energy Drinks redefined the energy drink category with its innovative approach. The company targeted 70% of U.S. women who had not previously used energy drinks, introducing them to a new experience. Featuring a natural formula with 80 mg of caffeine and zero sugar, ASPIRE is growing with 65% of its customer base being women. This demographic focus enabled ASPIRE to resonate strongly with health-conscious women seeking healthier energy alternatives.

-

In December 2023, KING KONGIN, renowned as a powerhouse in the energy drinks market, unveiled a significant development in its product line. The company was excited to announce a new range of energy drinks aimed at inspiring individuals to conquer life's challenges and achieve peak performance. This expansion reflected KING KONGIN's commitment to promoting a healthier lifestyle by introducing beverages crafted with premium quality and 100% natural ingredients.

Healthy Energy Drinks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.43 billion

Revenue forecast in 2030

USD 6.37 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Packaging, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; UK; Italy; Spain; China; Japan; India; South Korea; Brazil; South Africa

Key companies profiled

Red Bull GmbH; Monster Beverage Corporation; PepsiCo; Inc.; Celsius Holdings; Inc.; BANG Beverage Company LLC; Fitt Ventures; Inc.; Aspire Drinks; KING KONGIN; Guru Energy; and NOS Energy

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Healthy Energy Drinks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Healthy energy drinks market report based on packaging, type, distribution channel, and region:

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Cans

-

Bottles

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-trade

-

On-trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthy energy drinks market was estimated at USD 4.17 billion in 2023 and is expected to reach USD 4.43 billion in 2024.

b. The global healthy energy drinks market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030, reaching USD 6.37 billion by 2030.

b. The healthy energy drinks market in North America captured a revenue share of over 41.1% in 2023. This dominance can be attributed to several factors contributing to market growth and consumer preference within the region.

b. Some key players operating in the market include Red Bull GmbH, Monster Beverage Corporation, PepsiCo, Inc., Celsius Holdings, Inc., BANG Beverage Company LLC, Fitt Ventures, Inc., Aspire Drinks, KING KONGIN, Guru Energy, and NOS Energy.

b. One of the primary drivers is the increasing health consciousness among consumers. As people become more aware of the adverse effects of excessive sugar and artificial additives, they are gravitating towards healthier alternatives. This shift is particularly pronounced among younger demographics, who are more likely to scrutinize ingredient labels and choose products that align with their health and wellness goals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."