Healthcare Wipes Market Size, Share & Trends Analysis Report By Product (Dry Wipes, Wet Wipes), By Distribution Channel (Pharmacies & Drugstores, Supermarkets & Hypermarkets), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-707-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Healthcare Wipes Market Size & Trends

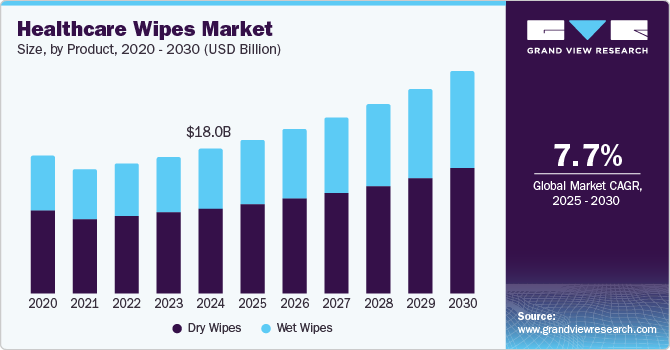

The global healthcare wipes market size was valued at USD 18.05 billion in 2024 and is expected to grow at a CAGR of 7.7% from 2025 to 2030. This expansion is attributed to increasing hygiene and infection control awareness, particularly since the COVID-19 pandemic. As healthcare facilities strive to maintain high standards of cleanliness, there has been a notable surge in the demand for effective cleaning solutions such as healthcare wipes. Wipes are essential for various applications, including patient care, surface disinfection, and sanitization of medical equipment, and they play a crucial role in infection prevention strategies.

The increasing prevalence of chronic diseases and the aging population that requires frequent healthcare services are also expected to drive the healthcare wipes industry. As older adults often have compromised immune systems, the need for stringent hygiene practices becomes paramount in healthcare settings. The elevated demand for healthcare wipes has encouraged manufacturers to innovate and improve product formulations to meet the specific needs of this population. For instance, manufacturers are designing a range of variants targeting specific requirements. Some of the options include wipes for sensitive skin, widely preferred by people with delicate skin, and wipes infused with antimicrobial agents, which are becoming increasingly popular in hospitals and nursing homes.

Technological advancements focused on enhancing the efficacy and safety of wipes are also expected to contribute to the expansion of the healthcare wipes industry. Innovations in materials and formulations allow for the development of environmentally friendly wipes and more effective at killing pathogens. Manufacturers are increasingly focusing on delivering sustainable solutions, creating biodegradable wipes that appeal to health-conscious consumers and institutions aiming to reduce their environmental impact. These factors are further expected to expand the healthcare wipes industry.

Healthcare wipes are of numerous types, including pre-injection wipes, non-invasive antiseptic wipes, skin cleaning wipes, macerator-friendly body wipes, and bath wipes. These products are available in a range of packaging styles, such as flow packs, sachets, buckets, or tubes. Furthermore, the increasing use of healthcare wipes owing to their ability to monitor and avoid infection is a prominent factor strengthening the growth of the market.

Product Insights

Dry wipes held the largest revenue share of 58.7% in the healthcare wipes industry in 2024 due to their versatility and cost-effectiveness. These wipes are widely utilized in hospitals, clinics, and nursing homes for various applications, including cleaning surfaces, disinfecting tools, and personal hygiene. Their effectiveness in infection control is a significant driver, especially as healthcare facilities prioritize sanitation to prevent hospital-acquired infections (HAIs). For instance, dry wipes are often employed in surgical settings to maintain sterile environments, making them indispensable in critical care. Dry wipes have a longer shelf life and lower environmental impact compared to wet wipes, appealing to healthcare providers looking for sustainable solutions.

The wet wipes segment is expected to grow at the fastest CAGR of 8.7% over the forecast period due to increasing consumer demand for convenience and enhanced hygiene practices. Urbanization, changing lifestyles, increasing working professionals, and busy schedules have surged the demand for quick and effective cleaning solutions that fit seamlessly into the daily routine. Wet wipes offer instant sanitation for hands and surfaces and are suitable for personal care. For instance, antibacterial wet wipes have gained popularity in public spaces, allowing users to quickly disinfect surfaces before use, thereby reducing the risk of infection. Innovations such as hypoallergenic formulations and eco-friendly materials are attracting health-conscious consumers and addressing environmental concerns.

Distribution Channel Insights

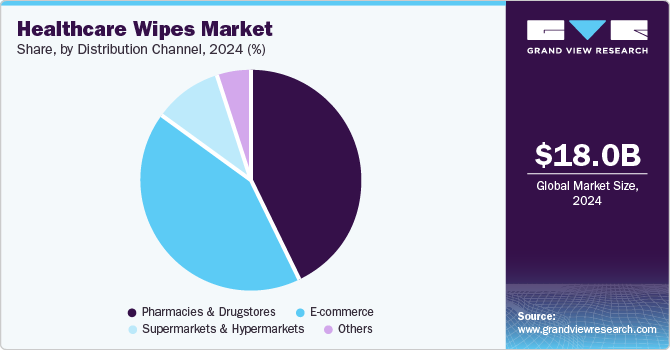

Pharmacies & drugstores held the largest revenue share of 43.6% in 2024, owing to their critical role as accessible points of sale for hygiene products. These retail outlets are often the first choice for consumers seeking immediate access to healthcare wipes, particularly during health crises when demand surges. The ease of purchasing wipes alongside other health-related products makes pharmacies a preferred shopping destination. For instance, consumers frequently buy antibacterial wipes while picking up prescriptions, reinforcing the association between pharmacies and personal hygiene products. Moreover, pharmacies typically offer a range of trusted brands and specialized products, catering to diverse consumer needs, including sensitive skin formulations and eco-friendly options.

The e-commerce segment is expected to grow at the fastest CAGR of 8.5% over the forecast period due to the convenience offered by online shopping websites. This segment allows consumers to purchase wipes from the comfort of their homes, which has become a particularly appealing option since the COVID-19 pandemic. For instance, many consumers have turned to e-commerce platforms to buy antibacterial wipes in bulk, ensuring they have adequate supplies for home use. E-commerce offers a wide range of products, including specialized wipes, that may not be available in local stores. It also caters to diverse consumer needs with variants for different skin types and eco-friendly options. The ability to compare prices and access discounts online further incentivizes purchases, making it a cost-effective choice for consumers.

Regional Insights

The North American healthcare wipes market held the largest revenue share of 35.5% in 2024, driven by its advanced healthcare infrastructure, including numerous hospitals and clinics prioritizing hygiene and infection control. This infrastructure supports a high demand for effective cleaning solutions, such as healthcare wipes, especially in settings where maintaining sterile environments is crucial. For instance, hospitals frequently use disinfectant wipes to clean surfaces and equipment to significantly reduce the risk of hospital-acquired infections. Moreover, substantial healthcare spending in North America facilitates continuous innovation and availability of diverse healthcare wipes, contributing to market growth.

U.S. Healthcare Wipes Market Trends

The U.S. healthcare wipes market dominated North America in 2024, driven by robust healthcare infrastructure, which includes a vast network of hospitals, clinics, and long-term care facilities that require high-quality cleaning solutions to maintain hygiene standards. The heightened focus on infection control has led to increased usage of healthcare wipes in various settings. For instance, hospitals have adopted strict sanitization protocols, using disinfectant wipes extensively to reduce the risk of hospital-acquired infections (HAIs). In addition, consumer awareness regarding personal hygiene and sanitation has surged, prompting individuals to seek effective cleaning products for home use.

Asia Pacific Healthcare Wipes Market Trends

The Asia Pacific healthcare wipes market is expected to grow at the fastest CAGR of 8.8% over the forecast period, driven primarily by heightened awareness of hygiene and infection control, and the increasing prevalence of healthcare-associated infections (HAIs) has led to a surge in demand for effective disinfectant wipes that can help mitigate cross-contamination risks in medical settings. Hospitals are increasingly adopting antibacterial wipes to sanitize surfaces and equipment, ensuring a safer environment for patients and staff. In addition, the growth of healthcare infrastructure in countries such as China and India further contribute to this market expansion as these nations invest in advanced medical facilities and technologies.

China Healthcare Wipes Market Trends

The China healthcare wipes market dominated Asia Pacific in 2024 with the largest revenue share, driven by the increasing awareness of hygiene and infection control. Hospitals and clinics are increasingly adopting healthcare wipes for their convenience and effectiveness in maintaining cleanliness. Many medical facilities in China now utilize disinfectant wipes to sanitize surfaces and equipment quickly, ensuring compliance with stringent health regulations. In addition, substantial investments in healthcare infrastructure are further fueling market growth as more facilities seek efficient cleaning solutions. The demand for eco-friendly and biodegradable wipes is also rising, reflecting a growing commitment to sustainability within the healthcare sector.

Europe Healthcare Wipes Market Trends

Europe healthcare wipes market is expected to grow significantly over the forecast period, due to increased awareness about hygiene and infection control, which has become a priority for both consumers and healthcare facilities. Moreover, hospitals across Europe have adopted stringent sanitization protocols that rely heavily on wipes for surface disinfection. Europe's aging population is expected to further contribute to the market growth, as older individuals require more frequent medical care and specific hygiene products. The growing healthcare infrastructure and investment in advanced medical facilities further support this demand. Regulatory standards promoting the use of antibacterial and disinfectant wipes in healthcare settings are expected to drive manufacturers to innovate and improve product offerings and positively impact the sales.

Key Healthcare Wipes Company Insights

Some key players in the healthcare wipes market include Procter and Gamble, 3M, Johnson & Johnson Services, Inc., Diamond Wipes International, Inc, The Clorox Company, KIMBERLY-CLARK CORPORATION, Costco Wholesale Corporation, Reckitt Benckiser Group PLC, Procotech Ltd, Beiersdorf AG, Ecolab, and Berry Global Inc.. These companies in the healthcare wipes market employ various strategies to maintain a competitive edge, including the development of innovative products that enhance clean efficiency and effectiveness. They focus on sustainability by incorporating eco-friendly materials and packaging to meet the rising demand for environmentally responsible options.

-

Johnson & Johnson Services, Inc. specializes in providing high-quality baby skincare wipes designed to meet delicate skin needs. Their advanced fiber technology allows these wipes to effectively cleanse while holding triple the weight of moisturizing lotion, creating a protective barrier that helps prevent diaper rash.

-

The Clorox Company is renowned for its commitment to health and hygiene through its extensive range of disinfecting and sanitizing products, including healthcare wipes. Their wipes are formulated to kill germs and bacteria, making them essential for maintaining cleanliness in home and healthcare settings.

Key Healthcare Wipes Companies:

The following are the leading companies in the healthcare wipes market. These companies collectively hold the largest market share and dictate industry trends.

- Procter and Gamble

- 3M

- Johnson & Johnson Services, Inc.

- Diamond Wipes International, Inc

- The Clorox Company

- KIMBERLY-CLARK CORPORATION

- Costco Wholesale Corporation

- Reckitt Benckiser Group PLC

- Procotech Ltd

- Beiersdorf AG

- Ecolab

- Berry Global Inc.

Recent Developments

-

In February 2024, Ecolab launched the Disinfectant 1 Wipe, which is the first EPA-registered disinfectant wipe made entirely from 100% plastic-free, readily degradable wood pulp fibers. This innovative wipe addresses the urgent need for sustainable solutions in healthcare settings, where traditional plastic-based disinfectant wipes have raised environmental concerns.

-

In June 2023, Berry Global launched a new range of sustainable wipe substrate materials to enhance options for the healthcare, hygiene, and food production markets. This initiative provides customers with diverse technologies, including spunbond, spunlace, and SMS, all designed to meet rigorous hygiene standards required in professional wiping applications.

Healthcare Wipes Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 19.15 billion |

|

Revenue forecast in 2030 |

USD 27.70 billion |

|

Growth Rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

Procter and Gamble, 3M, Johnson & Johnson Services, Inc., Diamond Wipes International, Inc, The Clorox Company, KIMBERLY-CLARK CORPORATION, Costco Wholesale Corporation, Reckitt Benckiser Group PLC, Procotech Ltd, Beiersdorf AG, Ecolab, Berry Global Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Wipes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare wipes market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Wipes

-

Wet Wipes

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies & Drugstores

-

Supermarkets & Hypermarkets

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."