Healthcare Testing, Inspection And Certification Outsourcing Market Size, Share, & Trends Analysis Report By Service (Testing, Inspection), By Type (Medical Devices, Pharmaceutical), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-963-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

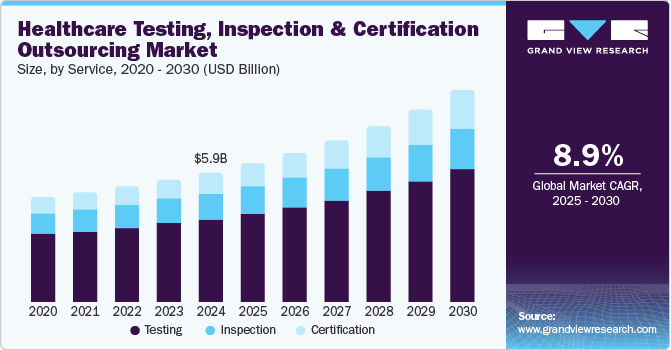

The global healthcare testing, inspection and certification outsourcing market size was estimated at USD 5.92 billion in 2024 and is anticipated to grow at a CAGR of 8.89% from 2025 to 2030. The market growth is primarily attributed to increasing demand for safe medical devices and pharmaceutical products, companies trying to maintain optimum standards and safety, and rising demand for biologics and small molecules to treat several diseases. This creates new opportunities for testing, inspection, and certification (TIC) services. Furthermore, rising regulatory demands across pharmaceuticals and medical devices are another factor propelling market demand.

Advancements in healthcare technology, such as biopharmaceutical innovations and personalized medicine, requiring robust TIC services to meet compliance and quality standards contribute significantly to market progression.

Ongoing reforms in the regulatory frameworks in medical devices and pharmaceuticals to ensure patient safety and product efficacy positively influence market growth. For instance, in April 2021, the FDA accredited UL as an ISO/IEC 17025 laboratory under the Accreditation Scheme for Conformity Assessment (ASCA) for medical device safety testing. Compliance with standards like the U.S. FDA’s or European CE certifications requires frequent testing, inspection, and certification. These standards mitigate risks, enhance product reliability, and build consumer trust, pushing more companies toward outsourcing TIC services to maintain competitive edge and compliance.

Continuous innovations in biopharmaceuticals, medical devices, and personalized medicine introduce complex regulatory and quality requirements. These advancements necessitate specialized TIC services to meet high safety and efficacy standards. For instance, digital health applications and AI-integrated medical devices require rigorous validation processes, which often exceed the in-house capacity of healthcare firms. By outsourcing to TIC providers with expertise in innovative technologies, healthcare companies streamline compliance, reduce costs, and focus on core research and development activities. This reliance on advanced TIC services positions healthcare firms to adapt rapidly to evolving regulatory landscapes and maintain a competitive advantage in the market.

Moreover, by outsourcing TIC functions, healthcare companies can significantly reduce overhead costs related to maintaining in-house compliance and quality assurance teams. This allows companies to redirect resources toward core activities like R&D, improving product development timelines without compromising safety standards. Outsourcing to specialized TIC providers also ensures efficient regulatory compliance through their expertise and established processes, reducing the risk of regulatory difficulties. Moreover, TIC services outsourcing allows several healthcare companies to control quality and compliance without high operational costs and gain a competitive edge in the market.

Geographic expansion by healthcare companies, particularly in regions like Asia-Pacific, Latin America, and parts of Africa, is another key factor driving overall market growth. Due to growing penetration by medium-scale healthcare companies and high demand for high-quality healthcare products and services, emerging markets have prompted regulatory authorities to impose stricter regulations on medical devices and pharmaceuticals to ensure safety and efficacy. For healthcare companies to expand in these markets, TIC outsourcing provides a solution for navigating complex regulatory environments without straining internal resources. By partnering with TIC providers experienced in global standards and regional regulations, companies can ensure compliance more efficiently, facilitating faster market entry and enhancing consumer trust in healthcare products.

Service Insights

The testing service segment dominated the market in 2024 with the largest revenue share of 63.80%. With the increasing complexity of medical devices and pharmaceuticals, stringent testing is essential to meet regulatory standards across various global markets. Healthcare companies increasingly outsource testing services to specialized TIC providers to access advanced equipment, technology, and expertise while managing costs and minimizing time-to-market. For instance, in June 2023, DEKRA introduced AI testing and certification services to address the growing demand for safe, secure AI-powered products. This positioned the company as a prominent player in AI safety certification and gained a significant share in the expanding market segment focused on AI assurance. This offered the company a competitive edge in emerging technologies.

On the other hand, the certification service segment is anticipated to register the fastest CAGR over the analysis period. The stringent regulatory landscape across healthcare sectors requires consistent product quality, safety, and efficacy validation, especially for pharmaceuticals and medical devices. Certification guarantees compliance with global and regional standards, building credibility and trust in highly regulated markets like Europe and North America. In addition, the rising complexity of healthcare products, including biopharmaceuticals and personalized medical devices, has intensified the need for specialized certifications that guarantee adherence to advanced technical and safety specifications. As healthcare companies seek quicker market entry with reduced compliance risks, outsourcing certification services allows them to meet these standards cost-effectively, further boosting demand in this segment.

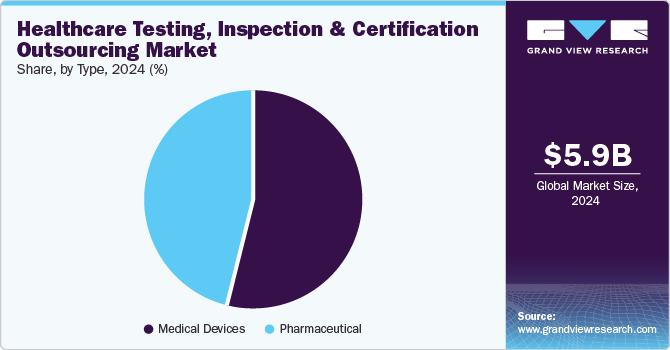

Type Insights

Medical devices held the larger revenue share in the global market in 2024. This is due to the healthcare sector's stringent regulatory demands and growing technological complexity. Increased adoption of advanced devices like wearables, diagnostics, and implantable medical devices led to rigorous quality and compliance requirements, especially in developed and regulated markets. TIC services are critical for ensuring these devices meet international standards, such as FDA and ISO certifications, which are essential for patient safety and market access. In addition, the rapid pace of innovation in medical devices, including biocompatibility testing and cybersecurity assessments, augmented the need for specialized TIC providers that offer expertise in these areas, allowing manufacturers to reduce time-to-market and focus on innovation.

The pharmaceuticals segmentis expected to witness the fastest CAGR of 9.35% over the forecast period. Increasing regulatory scrutiny around drug safety and efficacy necessitates robust testing and compliance measures, propelling demand for TIC services. In addition, the rapid development of biologics and personalized medicine requires specialized testing protocols to meet unique regulatory standards. As pharmaceutical companies increasingly outsource these functions to focus on core competencies, these companies seek TIC providers to navigate complex regulatory landscapes efficiently, ensuring compliance while reducing time-to-market, thereby accelerating segment growth potential in the near future.

Regional Insights

The North America healthcare testing, inspection and certification (TIC) outsourcing marketheld the second-largest revenue share in the global market in 2024. This is attributed to substantial industry players in the region, combination of advanced regulatory frameworks, and a strong focus on innovation. The region's stringent compliance requirements for pharmaceuticals and medical devices necessitate high-quality TIC services, accelerating market demand. In addition, the presence of leading pharmaceutical and biotechnology firms accelerates the demand for specialized testing, making North America a pivotal market for TIC outsourcing.

U.S. Healthcare Testing, Inspection And Certification Outsourcing Market Trends

The U.S. healthcare testing, inspection and certification outsourcing market accounted for a significant share of the North America region in 2024 owing to increasing regulatory requirements, a growing emphasis on patient safety, and the need for cost-effective solutions. The rise in chronic diseases and expanding advanced medical technologies further propel demand.

Europe Healthcare Testing, Inspection And Certification Outsourcing Market Trends

The Europe healthcare testing, inspection and certification (TIC) outsourcing market dominated the global market and accounted for 43.50% revenue share in 2024. This large share of the region is due to stringent regulatory frameworks and an increasing focus on quality assurance in healthcare services. The European Medicines Agency's rigorous medical device and pharmaceutical standards mandate comprehensive testing and certification processes, fostering market demand for specialized outsourcing services. Technological advancements, such as automation and data analytics, enable more efficient testing processes. Moreover, collaboration among key stakeholders, including healthcare providers and regulatory bodies, promotes a robust outsourcing ecosystem that enhances service delivery and compliance across the region.

The Germany healthcare testing, inspection and certification (TIC) outsourcing market held the largest revenue share in the European region in 2024. The country's stringent regulatory requirements necessitate thorough testing and certification processes, driving demand for specialized outsourcing services. Furthermore, technological advancements and an increasing focus on patient safety foster collaboration between healthcare providers and outsourcing firms, enhancing efficiency while ensuring compliance with national and EU health standards.

The healthcare testing, inspection, and certification (TIC) outsourcing market in the UK plays a significant role, driven by a growing emphasis on compliance with the UK Conformity Assessed (UKCA) marking requirements and the need for high-quality healthcare services. The rise of personalized medicine and digital health technologies also fuels demand for specialized testing and certification. In addition, increasing investment in healthcare infrastructure and research initiatives fosters collaboration between the public and private sectors, enhancing service delivery and operational efficiency.

The France healthcare testing, inspection, and certification (TIC) outsourcing market is a growing market driven by the implementation of the European Union’s Medical Device Regulation (MDR), which compels manufacturers to seek reliable outsourcing partners for compliance and quality assurance. In addition, a focus on innovation in biopharmaceuticals and medical technology enhances the demand for specialized testing services.

Asia Pacific Healthcare Testing, Inspection, And Certification Outsourcing Market Trends

Asia Pacific healthcare testing, inspection and certification (TIC) outsourcing market is anticipated to witness the fastest CAGR over the forecast period. The region's growth is due to rapid economic growth and increasing healthcare expenditure. The rise in chronic diseases and a growing aging population increase the demand for efficient testing services. In addition, evolving regulatory frameworks and a push for international quality standards induce manufacturers to outsource TIC processes. Advancements in technology and expanding healthcare infrastructure further facilitate the adoption of specialized outsourcing solutions across the region.

China Healthcare Testing, Inspection, and Certification (TIC) Outsourcing Market held the largest revenue share in the Asia Pacific region in 2024. The implementation of stricter regulations and standards, such as the National Medical Products Administration (NMPA) requirements, drives demand for reliable testing services. Rapid advancements in biotechnology and medical devices also create a need for thorough certification processes. Increased foreign investment and collaboration with global firms further bolster the growth of outsourcing capabilities in the sector.

The healthcare testing, inspection, and certification (TIC) outsourcing market in India is emerging. It is driven by the mushrooming pharmaceutical and medical device sector, supported by government initiatives like the Production Linked Incentive (PLI) scheme. The increasing demand for quality healthcare services and compliance with international standards push manufacturers to seek specialized outsourcing solutions. Furthermore, a skilled workforce in science and technology, coupled with advancements in digital health, enhances operational efficiency and drives the growth of testing and certification services in the country.

Japan healthcare testing, inspection, and certification (TIC) outsourcing market is driven by its aging population and a growing emphasis on advanced medical technologies. The stringent regulatory environment, including the Pharmaceuticals and Medical Devices Agency (PMDA) standards, requires thorough testing and certification processes, increasing demand for healthcare TIC outsourcing services.

Key Healthcare Testing, Inspection And Certification Outsourcing Company Insights

Key companies in the healthcare testing, inspection, and certification (TIC) outsourcing market collectively hold a significant market share. These companies leverage their extensive expertise and advanced technologies to provide comprehensive services that ensure compliance with regulatory standards. In addition, the increasing focus on quality assurance and patient safety drives competition among these firms, prompting ongoing investments in innovation and expanding service offerings to meet diverse client needs across the healthcare sector. Collaborations and strategic partnerships enhance their capabilities, facilitating entry into emerging markets. For instance, in July 2024, SGS North America introduced the SGS Lincolnshire Center of Excellence to expand its biologics testing capabilities in North America. This expansion broadened the company's bioanalytical testing service offerings in the market.

Key Healthcare Testing, Inspection And Certification Outsourcing Companies:

The following are the leading companies in the healthcare testing, inspection and certification outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- SGS SA

- Intertek Group plc

- Eurofins Scientific SE

- DEKRA CERTIFICATION B.V.

- UL Solutions Inc.

- TÜV SÜD

- ALS Limited

- CSA Group Testing & Certification Inc.

- Applus+ Technologies, Inc.

- Element Materials Technology

Recent Developments

-

In July 2024, SGS SA announced the acquisition of Gossamer Security Solutions in the U.S. and Analisis Quimico y Microbiologico SAS (AQM) and Cromanal SAS in Colombia. These acquisitions aimed to enhance SGS's cybersecurity capabilities by acquiring Gossamer, particularly in IT security certification. Meanwhile, AQM and Cromanal strengthen SGS's footprint in the Colombian pharmaceutical testing market.

-

In June 2023, Applus+ Technologies, Inc. acquired Rescoll, a prominent materials testing and R&D technological partner in France. Through this acquisition, the company broadened its service offerings in Europe.

Healthcare Testing, Inspection And Certification Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.34 billion |

|

Revenue forecast in 2030 |

USD 9.71 billion |

|

Growth Rate |

CAGR of 8.89% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, type, region |

|

Regional scope |

North America, Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; India; China; Japan; Australia; South Korea; Thailand; Indonesia; Singapore; Malaysia; Taiwan; Brazil; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Kuwait; Israel |

|

Key companies profiled |

SGS SA; Intertek Group plc; Eurofins Scientific SE; DEKRA CERTIFICATION B.V.; UL Solutions Inc.; TÜV SÜD; ALS Limited; CSA Group Testing & Certification Inc.; Applus+ Technologies, Inc.; Element Materials Technology |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Testing, Inspection And Certification Outsourcing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare testing, inspection and certification outsourcing market report based on service, type, and region:

-

Service Outlook (Revenue, USD Million, 2018- 2030)

-

Testing

-

Inspection

-

Certification

-

-

Type Outlook (Revenue, USD Million, 2018- 2030)

-

Medical Devices

-

Pharmaceutical

-

-

Regional Outlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

Singapore

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global healthcare testing, inspection and certification outsourcing market size was estimated at USD 5.92 billion in 2024 and is expected to reach USD 6.34 billion in 2025.

b. The global healthcare testing, inspection and certification outsourcing market is expected to grow at a compound annual growth rate of 8.89% from 2025 to 2030 to reach USD 9.71 billion by 2030.

b. Europe dominated the healthcare testing, inspection and certification outsourcing market with a share of 43.50% in 2024. This is attributable to the fact that it is one of the top manufacturing hubs of highly reliable, complex, and high-end pharmaceuticals.

b. Some key players operating in the healthcare testing, inspection and certification outsourcing market include SGS SA, Intertek Group plc, Eurofins Scientific SE, DEKRA CERTIFICATION B.V., UL Solutions Inc., TÜV SÜD, ALS Limited, CSA Group Testing & Certification Inc., Applus+ Technologies, Inc., Element Materials Technology

b. Key factors that are driving the healthcare testing, inspection and certification outsourcing market growth include the increasing frequency of outsourcing R&D activities by the major pharmaceutical companies to focus on their core competencies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."