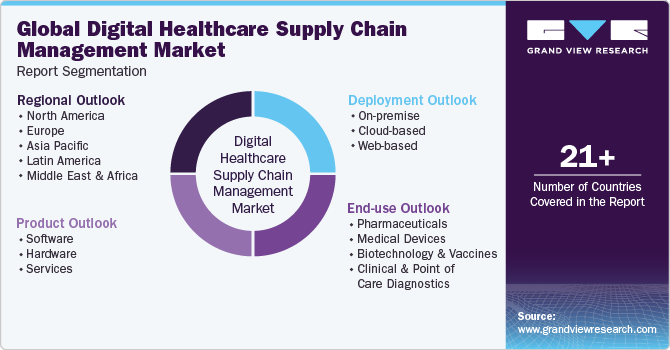

Digital Healthcare Supply Chain Management Market Size, Share & Trends Analysis Report By Product (Hardware, Software, Services), By Deployment (Web-based, Cloud-based, On-premise), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-989-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global digital healthcare supply chain management market size was estimated at USD 2.9 billion in 2023 and is projected to grow at a CAGR of 9.0% from 2024 to 2030. The market growth is attributed to the increasing investments in next-generation technologies such as control towers and digital twin technology, rising adoption of dashboards to enhance analytics, execution, and visibility, and government initiatives to enhance medical supply. Moreover, the emergence of cloud-based solutions and rising demand for limiting the large-scale counterfeiting of drugs in the pharmaceutical industry are anticipated to fuel the market growth over the forecast period.

The increasing adoption of cloud computing across the globe has transformed the healthcare industry. The SCM software industry has transformed the healthcare sector by adopting cloud-based supply chain software. The manufacturers and providers are focusing more on cloud-based software as it helps them achieve higher supplier quality and inventory optimization. For instance, Jump Technologies offers a cloud-based software solution called JumpStock, which integrates with ERP, EMR, or scheduling systems, thus allowing hospitals to lower costs related to variations in physician preferences, supply hoarding, & stockouts. Cloud-based traceability and tracking protect many manufacturers from variable expenses of a product recall by identifying product quality problems early.

Moreover, increasing transportation costs have resulted in higher operating costs incurred by healthcare facilities. Operating costs are mainly governed by inventory storage, production, and manufacturing. Poor inventory control is a major issue companies face, leading to substantial losses. According to a study published by NCBI in December 2022, hospitals in the U.S. waste 25.4 billion every year on unnecessary supply chain spending. In order to counter such challenges, companies have adopted various inventory management tools, such as inventory management software, Kanban, and industrialized barcode terminals.

The COVID-19 pandemic positively impacted the global market. The healthcare sector experienced significant shifts and challenges in response to the crisis. The pandemic accelerated the adoption of telehealth services, where the digital supply chain systems played a crucial role in supporting the distribution of virtual care resources, such as telemedicine equipment and remote monitoring devices. Moreover, data-driven decision-making became more critical. Prominent players in the market incorporated advanced analytics to forecast demand, optimize inventory, and streamline distribution.

Furthermore, the COVID-19 pandemic highlighted the importance of resilient supply chains, leading to increased investments in digital healthcare supply chain management solutions, including blockchain and supply chain twins, for enhanced transparency and traceability. For instance, in September 2021, Google Cloud introduced Supply Chain Twin, which allows market players to develop a digital twin of their physical supply chain, facilitating real-time dashboards, and collaboration in Google Workspace, alters on potential disruptions and advanced analytics.

GVR Survey Insights

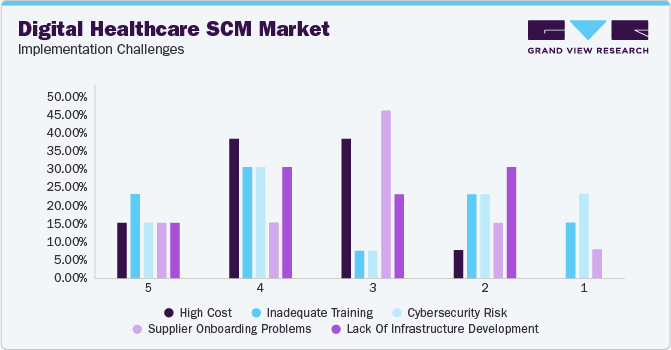

The challenges of data privacy and high costs are constraining the growth of the digital healthcare supply chain management (SCM) market.

A survey by Grand View Research revealed that respondents facing these challenges cited the high implementation costs (38.5% rated it the highest at “4”), inadequate training of specialized personnel (30.8% rated it the highest at “4”), and cybersecurity risks (30.8% rated it the highest at “4”) as their primary concerns.

Market Concentration & Characteristics

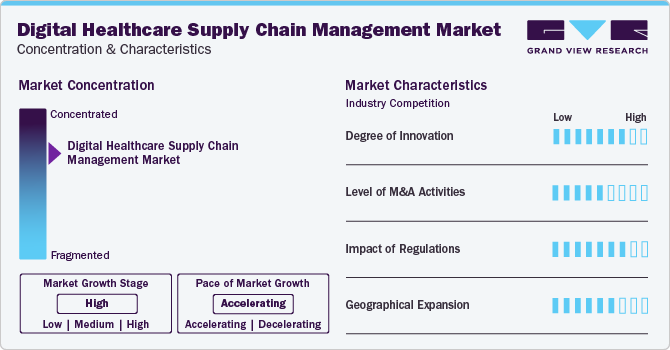

The market is experiencing rapid growth, driven by innovation. Cloud-based software adoption is particularly noteworthy, enabling manufacturers to enhance supplier quality and optimize inventory efficiently.

In the global market, significant M&A activity is observed among leading players. For instance, in March 2022, symplr acquired GreenLight Medical, a provider of healthcare SCM solutions. This acquisition is poised to strengthen the company's position within the healthcare industry.

Healthcare providers are obligated to adhere to stringent regulations governing the storage and transportation of medical supplies. Digital supply chain management (SCM) solutions offer a valuable means for ensuring compliance by effectively tracking the movement of these supplies and documenting their storage conditions.

Expanding geographically in digital healthcare supply chain management means using technology to streamline distribution, procurement, and inventory across various locations. Implementing cloud-based platforms, real-time tracking, and data analytics enables organizations to optimize logistics, ensure timely delivery of medical supplies, and enhance operational efficiency. This ultimately improves healthcare accessibility and outcomes worldwide

Product Insights

Based on product, the software segment led the market with the largest revenue share of 39.8% in 2023 and is expected to witness the fastest CAGR of 9.3% over the forecast period. The market is segmented into software, hardware, and services. The growth is driven by the increasing adoption of software as a service, which offers cloud computing applications for supply chain management and enterprise resource planning. In addition, the rising need for effective management of organizational workflows in healthcare companies and the increasing need for accurate & timely procurement of information are among key factors for segment growth.

Moreover, growing demand for reducing the rising medical costs and the shift toward value-based care in developed economies are boosting this segment. The increasing initiatives undertaken by public & private players for supporting healthcare IT infrastructure are also driving the segment in healthcare organizations. For instance, Premier, Inc. introduced an innovative cloud-based SaaS solution, called the PremierConnect Supply Chain, designed to streamline and optimize the procurement process for health systems across the continuum of care. This comprehensive solution provides flexible and real-time procure-to-pay & supply chain analytics capabilities.

Deployment Insights

Based on deployment, the cloud-based segment held market with the largest revenue share of 40.43% in 2023 and is anticipated to grow the fastest CAGR of 9.3% over the forecast period. The market is segmented into on-premises, cloud-based, and web-based. The growth is attributed to the increasing adoption of user-friendly technology and cost-effectiveness. In addition, the rising demand for maintaining inventory and procurement information among healthcare providers through cloud computing is expected to drive the segment further.

Moreover, the rising awareness regarding the benefits of adopting the technology is anticipated to drive growth. Benefits associated with cloud technology include the use of external web servers, remote access & authorization, information sharing across different stages of the value chain, and immediate detection of security threats & lapses. Furthermore, it reduces the need for physical infrastructure & subsequently lowers the investment required, as cloud-based services are typically designed in a pay-as-you-go model.

Optimization of Supply Chains for Timely Delivery of Healthcare Products, Services, and Treatments:

AI-based solutions have revolutionized the pharmaceutical supply chain by providing actionable insights that lead to better visibility, service quality, and an improved customer experience. Logistics management platforms support pharmaceutical companies in facilitating immediate deliveries seamlessly, resulting in enhanced logistics efficiency through automation and digitization. This became increasingly important during the peak of COVID-19, as consumers depended heavily on e-commerce and online retailers for essential products.

|

Shipsy |

FarEye |

Tookan |

| Shipsy's AI-powered logistics management platform offers seamless scalability and automation of deliveries for top pharma companies. With faster order processing, intelligent auto-allocation, 3PL management, and real-time tracking, the platform delivers agility, speed, integrations, and visibility for same-day/one-hour deliveries. Shipsy has facilitated the delivery of COVID-critical goods for ACT Grants and Udhyam and enabled faster and contactless vaccine deliveries for DTDC across India. Its short deployment time makes it a preferred technology partner in the logistics industry. | FarEye's Intelligent Delivery Management Platform enables businesses to go live quickly, adapt to process changes, and maintain agility in their delivery ecosystem. With end-to-end visibility, consumers receive a great logistics experience throughout the delivery journey. FarEye's Intelligent Delivery Orchestration solutions allow retail enterprises to offer new and improved delivery experiences. FarEye achieves end-to-end visibility by optimizing routes, resulting in a positive customer experience. | Tookan is a SaaS-based delivery management solution that helps businesses manage their delivery processes and fleet. Its package includes a user-friendly Admin Panel and mobile application for drivers with integrated Google Maps API. The GPS system enables real-time tracking of drivers, recording their travel time, distance, and pickup & drop-off locations for better fleet management. |

Few notable AI-enabled SaaS logistics startups

End-use Insights

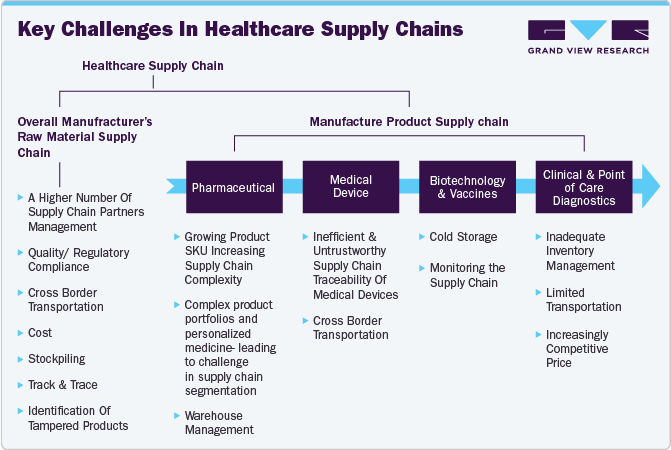

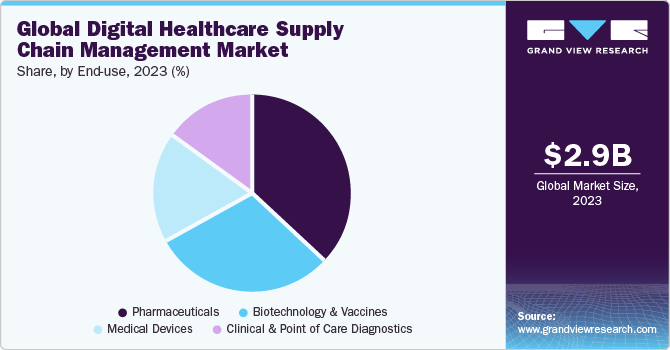

Based on end-use,the pharmaceutical segment held the market with the largest revenue share of 36.5% in 2023, driven by the need to comply with strict product tracking and tracing regulations throughout the supply chain. The market is segmented into pharmaceutical, medical devices, biotechnology, vaccines, and clinical and point-of-care diagnostics. The COVID-19 pandemic has also emphasized the importance of supply chain resilience, leading to increased adoption of digital supply chain management tools to mitigate disruptions and reduce inventory costs in the pharmaceutical industry.

The medical devices segment is expected to grow at the fastest CAGR of 9.7% from 2024 to 2030. The segment growth is attributed to the increasing demand for technologically advanced supply chain for medical devices, as it encompasses various tasks and procedures that ensure the transportation of medical devices from the manufacturing site to the point of use. Moreover, a supply chain led by Master Data Management (MDM) helps companies make informed decisions and targeted actions in times of vulnerability. For instance, companies can address financial challenges, such as corporate liquidity, poor credit history, and changing industry value by implementing effective protocols & bolstering their cybersecurity measures against identified threats. The aforementioned factors are expected to boost the market growth in this segment over the forecast period.

Regional Insights

North America dominated the market with a revenue share of 32.9% in 2023, owing to the need for enhanced digital supply chain efficiencies, the adoption of technological advances facilitating overall cost reduction, and the integration of machine learning and AI to analyze and predict supply chain management outcomes. Moreover, the presence of many pharmaceutical & medical device manufacturers and logistics companies. These players are investing in R&D of supply chain management solutions that are efficient and cost effective. For instance, in January 2023, Palantir Technologies Inc. launched a Quality Management System for Foundry’s life science customers, enabling them to achieve GXP requirements.

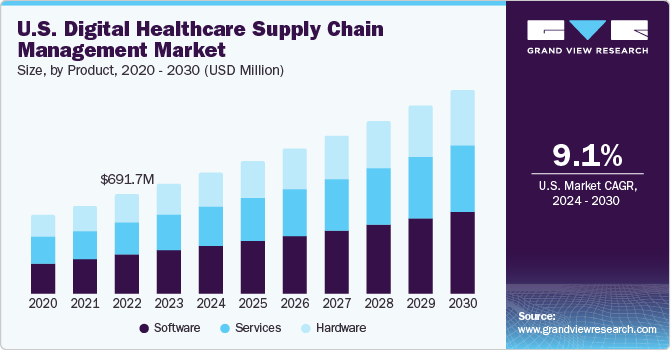

U.S. Digital Healthcare Supply Chain Management Market Trends

The digital healthcare supply chain management market in the U.S. held the largest share in 2023. The growth is attributed to factors such as the presence of top pharmaceutical companies in the country, which account for a 45% share of global pharmaceutical revenue. The growing focus of these pharmaceutical companies in the country on curbing large-scale counterfeiting of drugs has propelled the demand for supply chain management.

Europe Digital Healthcare Supply Chain Management Market Trends

Europe is the second largest dominating region in the market. Europe is one of the most developed regions in the world. The presence of a large number of healthcare providers and a high number of pharmaceutical & medical device companies enables the adoption of cloud-based solutions and mandatory implementation of the UDI system on medical devices by the European regulation has propelled the market growth in the region. Furthermore, the adoption of cloud computing has significantly transformed the healthcare systems in Europe.

The UK digital healthcare supply chain management market held the largest share in 2023. Growing adoption of supply chain management solutions across the UK healthcare sector can be attributed to the growing need for greater efficiency, enhanced patient safety, and lower costs.

Asia Pacific Digital Healthcare Supply Chain Management Market Trends

The Asia Pacific market is anticipated to grow the fastest CAGR of 10.4% from 2024 to 2030, owing to the increased adoption of technologically advanced solutions in Asian countries such as China, India, and Japan. Moreover, the rising number of government initiatives to encourage healthcare providers and other healthcare organizations to adopt cloud-based software solutions for improving inventory management system in hospitals, clinics, manufacturing hubs, & others is also expected to propel the market growth in the region over the forecast period.

The China digital healthcare supply chain management market held the second largest share in 2023. The growing adoption of GS1 standards in the region to track visibility of pharmaceutical products is expected to further boost the market growth in the region.

The digital healthcare supply chain management market in japan held the third largest share in 2023. Japan is an emerging market for pharmaceutical and medical device industries. The presence of a large number of medical device industries is boosting the adoption of cloud-based software solutions to maintain the supply chain with ease to promote the establishment of regional health information exchange networks and ameliorate the quality of medical services in Japan.

Key Digital Healthcare Supply Chain Management Company Insights

Rising competition in the market owing to innovative product offerings by key players, the presence of various regulatory norms, and favorable initiatives by governments for boosting digital health are impacting the competitive landscape. Moreover, key players in the market are adopting various strategies such as mergers & acquisitions, collaborations, partnerships, and collaborations to strengthen their geographical presence and expand their customer base.

Key Digital Healthcare Supply Chain Management Companies:

The following are the leading companies in the digital healthcare supply chain management market. These companies collectively hold the largest market share and dictate industry trends.

- Palantir Technologies, Inc.

- InterSystems Corporation

- ump Technologies, Inc.

- Tecsys

- LogiTag Systems

- Mckesson Corporation

- Oracle

- SAP

- Infor

- Terso Solutions

- CenTrak (HALMA plc)

- Biolog-ID

- Mediceo Corporation

Recent Developments

-

In January 2023, Palantir Technologies Inc. partnered with Cardinal Health. Under this collaboration, Cardinal Health’s solution would be integrated into Palantir’s Foundry platform, which would further amalgamate real-time clinical data, diagnosis, customer purchasing, and consumption data for pharmaceutical & life sciences products. This collaboration was anticipated to enhance the company's purchasing decisions using predictive inventory needs

-

In February 2022, Global Healthcare Exchange (GHX) announced acquiring Syft AI-enabled inventory management and SCM solutions. The acquisition is expected to help GHX expand and digitalize its supply chain segment

-

In September 2021, McKesson Corporation launched McKesson’s Rapid Returns Solutions for Health Systems. This solution focuses on increasing the accuracy and amount of credit received by hospitals & healthcare systems for returned pharmaceuticals & other healthcare products

Digital Healthcare Supply Chain Management Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.2 billion |

|

Revenue forecast in 2030 |

USD 5.4 billion |

|

Growth rate |

CAGR of 9.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors and trends |

|

Segments covered |

Product, deployment, end-use, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Palantir Technologies, Inc.; InterSystems Corporation; ump Technologies, Inc.; Tecsys; LogiTag Systems; Mckesson Corporation; Oracle; SAP; Infor; Terso Solutions; CenTrak (HALMA plc); Biolog-ID; Mediceo Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Digital Healthcare Supply Chain Management Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital healthcare supply chain management market report based on product, deployment, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud-based

-

Web-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Medical devices

-

Biotechnology and Vaccines

-

Clinical and Point of Care Diagnostics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital healthcare supply chain management market size was estimated at USD 2.9 billion in 2023 and is expected to reach USD 3.2 billion in 2024.

b. The global digital healthcare supply chain management market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 5.4 billion by 2030.

b. The cloud-based segment held the largest market share in 2023 and is anticipated to show the fastest growth at a CAGR of 9.3% over the forecast period. The growth is attributed to the increasing adoption of user-friendly technology and cost-effectiveness. Additionally, the rising demand for maintaining inventory and procurement information among healthcare providers through cloud computing is expected to drive the segment further.

b. Some key players operating in the digital healthcare supply chain management market include Palantir Technologies, Inc.; InterSystems Corporation; ump Technologies, Inc.; Tecsys; LogiTag Systems; Mckesson Corporation; Oracle; SAP; Infor; Terso Solutions; CenTrak (HALMA plc); Biolog-ID; Mediceo Corporation.

b. Key factors driving the market growth include increasing investments in next-generation technologies such as control towers and digital twin technology, rising adoption of dashboards to enhance analytics, execution, and visibility, and government initiatives to enhance medical supply.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."