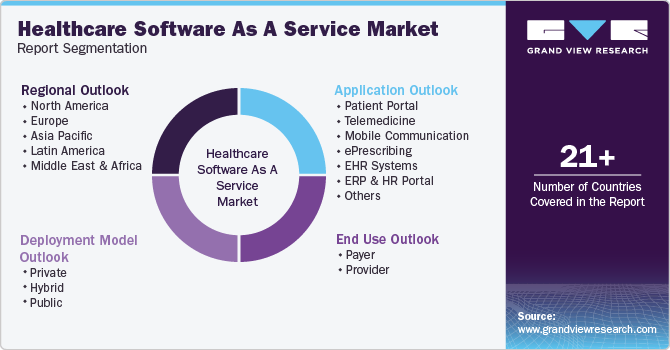

Healthcare Software As A Service Market Size, Share & Trends Analysis Report By Application (Patient Portal, Telemedicine, Mobile Communication, ePrescribing), By Deployment Model (Private, Hybrid, Public), By End Use (Payer), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-911-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Healthcare SaaS Market Size & Trends

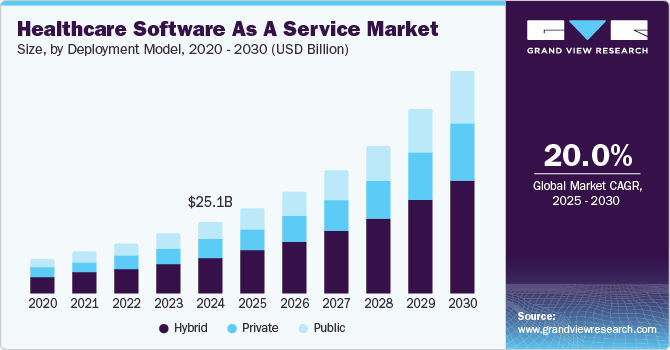

The global healthcare software as a service market size was valued at USD 25.13 billion in 2024 and is projected to grow at a CAGR of 20.0% from 2025 to 2030. This can be attributed to the increasing adoption of cloud computing, the need for cost-effective solutions, the growing demand for remote healthcare services, and regulatory compliance requirements. In addition, the shift toward digital transformation in healthcare, supported by government initiatives and technological advancements, is driving the growth of SaaS solutions. Moreover, the rise in patient engagement, data security concerns, and the need for streamlined healthcare management systems contribute to the market's expansion.

Telemedicine, powered by SaaS platforms, has transformed healthcare by enabling remote access to medical services through video consultations, secure messaging, and real-time patient data. These cloud-based solutions improve accessibility, reduce costs, and streamline operations, benefiting both providers and patients. SaaS tools such as patient portals, mobile health apps, and appointment scheduling systems enhance engagement, making healthcare more convenient and efficient. Leading institutions like Mayo Clinic and Cleveland Clinic have successfully implemented these technologies to improve patient experience and care delivery.

Healthcare providers leverage cloud-based solutions for electronic health records (EHR), patient management systems, and telemedicine platforms. The cloud enables healthcare organizations to reduce infrastructure costs, improve operational efficiency, and enhance collaboration across multiple locations. The HIMSS 2022 Cloud Adoption Survey found that 94% of healthcare organizations in the U.S. implemented cloud computing. SaaS solutions help healthcare organizations streamline operations and reduce the burden of maintaining physical infrastructure. In addition, these solutions enable healthcare providers to scale quickly as their needs grow, giving them the flexibility to adapt to changing demands. By outsourcing infrastructure management to cloud providers, organizations can focus more on improving patient care and less on IT maintenance.

Remote Patient Monitoring (RPM) has further revolutionized healthcare by enabling continuous tracking of patient health data, facilitating early detection of health risks, and reducing hospital remissions significantly drive the market growth. SaaS platforms streamline the management of Durable Medical Equipment (DME) through automated tracking, maintenance scheduling, and compliance monitoring, improving efficiency and reducing costs. Moreover, SaaS-driven solutions gaining traction in financial management systems enhance billing accuracy, accelerate reimbursements, and prevent fraud through AI-powered detection tools.

Moreover, managing Durable Medical Equipment (DME) has traditionally been a complex process due to regulatory compliance, inventory tracking, and maintenance requirements. SaaS solutions have streamlined this process by offering automated inventory tracking, maintenance scheduling, and compliance monitoring, ensuring that healthcare providers can efficiently manage and distribute medical equipment. Organizations that have implemented SaaS-based DME management systems have reported increased operational efficiency, reduced equipment downtime, and improved compliance. For instance, a regional hospital network reduced equipment downtime by 30% after automating its DME inventory and maintenance tracking.

Advancement of personalized medicine has been significantly supported by SaaS platforms, particularly in genomic medicine. These cloud-based solutions enable the analysis of genetic data to tailor treatments based on individual patient profiles. AI-driven analytics help identify genetic markers associated with diseases, allowing for early diagnosis and personalized therapeutic strategies. The scalability of SaaS platforms ensures that healthcare organizations can process vast amounts of genomic data efficiently, accelerating the development of targeted therapies.

Furthermore, digitalization is witnessing rapid growth in the healthcare sector. The COVID-19 pandemic has accelerated digitalization. Healthcare organizations faced multiple challenges such as the shortage of workforce and resources. Healthcare organizations started adopting digital platforms during the pandemic to overcome these challenges and to increasse return on investment. According to a survey published by Innovaccer Inc., a health cloud company, in 2021, 49% of healthcare organizations were actively working toward digital transformation.

Market Concentration & Characteristics

The industry growth is high and accelerating. This industry is characterized by rising prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD), asthma, increasing demand for home-based treatment and growing healthcare awareness.

The market is highly innovative, driven by advancements in AI, machine learning, and cloud computing. Companies evolve solutions to enhance patient care, streamline operations, and improve data analytics. For instance, in February 2024, Healthcare Triangle Inc. introduced a new SaaS solution to advance AI integration and digital transformation in healthcare and pharmaceuticals, addressing technology, data, care delivery, and business operation needs.

Merger and acquisition activity in the market is high. SaaS providers are significantly strategizing acquisition of EHR platform companies to create comprehensive, end-to-end healthcare solutions allow companies to capture a broader market share. For instance, in November 2022, Qualifacts, a U.S.-based SaaS provider of EHR platforms, acquired OnCall Health. The acquisition allows Qualifacts to leverage OnCall Health's technology to improve patient engagement and streamline healthcare delivery processes.

The impact of regulations on the market is classified as high. Strict regulations such as HIPAA in the U.S. and GDPR in Europe require software providers to implement strong data security measures. Companies update their platforms to stay compliant with these regulations, which impacts product development and adoption rates.

Regional expansion in the market is high due to the increasing adoption of digital health solutions, driven by rising healthcare costs and demand for efficient care delivery, which fuels this growth. For instance, in January 2025, Amazon Web Services (AWS) opened a data center region in Asia Pacific (Thailand), enabling businesses to store data locally and run applications efficiently. The area features three availability zones to enhance reliability and support business continuity.

“This investment by AWS solidifies Thailand’s position as a regional hub for digital innovation and will help us build a more inclusive digital society.”

- Paetongtarn Shinawatra, Prime Minister of Thailand

Application Insights

The telemedicine segment held the largest market share of 16.42% in 2024, driven by the rising demand for healthcare services in remote areas, especially post-pandemic. It enables healthcare providers to conduct virtual consultations, manage patient care remotely, and reduce in-person visits, improving accessibility and convenience for patients. Key drivers include advancements in video conferencing technologies, cost efficiency, and patient preference for convenient, at-home care. According to an article published by the Journal of Community Health Management in July 2024, telemedicine eliminates long-distance travel for medical care, crucial for patients in remote areas with limited healthcare access. It enables consultations with healthcare providers via video, phone, or online messaging, improving accessibility and convenience.

Patient portal segment is expected to register the fastest CAGR over the forecast period, due to its ability to improve patient engagement and streamline communication between patients and healthcare providers. These portals enable patients to access their medical records, schedule appointments, request prescriptions, and communicate directly with doctors. Drivers include the growing demand for remote healthcare services, increased patient involvement in their care, and the adoption of digital tools for better health management. For instance, Oracle's Health Patient Portal allows patients to interact with healthcare providers, access health data, schedule appointments, view lab results, pay bills, and more. Administrators customize features to meet both business and patient needs.

Deployment Model Insights

Hybrid segment held the largest revenue share in 2024, as it combines the benefits of both cloud-based and on-premise solutions. This model allows healthcare organizations to securely store sensitive data on-premise while leveraging the cloud's scalability, flexibility, and cost-effectiveness for non-sensitive operations. Factors include stringent data privacy regulations, secure patient data management, and growing cloud adoption.

Public segment is expected to register the fastest CAGR over the forecast period, driven by its cost-effectiveness, scalability, and ease of implementation. Public cloud solutions allow healthcare organizations to store and process data on third-party servers, reducing the need for extensive IT infrastructure. This model supports rapid scaling and access to advanced technologies without the burden of managing on-site systems. For instance, eSanjeevani is a cloud-based telemedicine platform developed, deployed, and maintained by The Centre for Development and Advanced Computing (C-DAC), Mohali, under India's Ministry of Health and Family Welfare.

End Use Insights

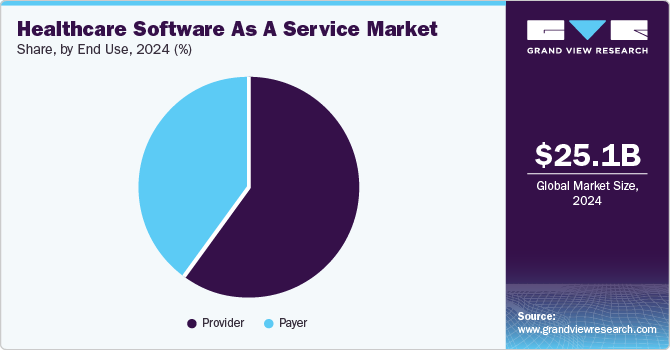

Provider segment held the largest revenue share in 2024 and is estimated to be the fastest-growing segment during the forecast period. This segment includes hospitals, clinics, and healthcare professionals utilizing SaaS solutions to enhance patient care, streamline operations, and improve data management. SaaS platforms support clinical decision-making, telemedicine, patient management, and billing. For instance, cloud-based EHR systems enable healthcare providers to access patient data remotely, improving collaboration and patient outcomes and reducing administrative costs.

The payer segment is estimated to witness lucrative growth during the forecast period. Health insurance companies are adopting SaaS technology for applications, including medical billing, ERP, and portal systems, due to its advantages, including faster deployment, cost reduction, scalability, and simplified upgrades. The growing digitalization in the insurance industry drives this segment's expansion. In addition, SaaS allows for enhanced data security and regulatory compliance, critical factors in the highly regulated insurance sector. As insurers seek to improve operational efficiency and customer experience, the demand for cloud-based solutions continues to rise.

Regional Insights

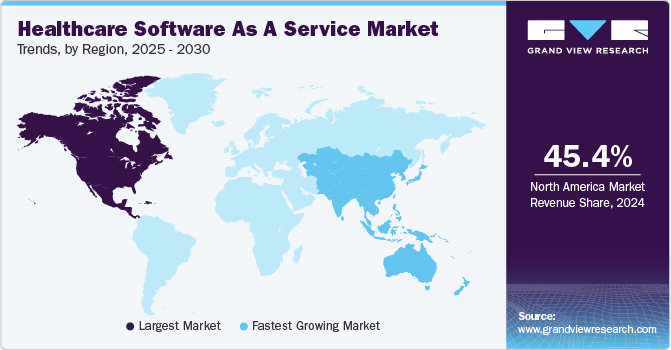

North America healthcare software as a service market accounted for the highest revenue share of 45.39% in 2024 due to the high market presence of major players such as IBM, Google, SAP, and Microsoft in the U.S. and Canada is a major contributor to the high revenue share. Moreover, high awareness about cloud technologies and rapid adoption of different cloud technologies including SaaS is further driving the growth. There is high demand for quality care and high regulatory pressure to reduce care costs. This is driving the demand for various digital healthcare technologies. For instance, in August 2021, the Health Resources and Services Administration (HRSA) invested USD 19 million for telehealth expansion.

Expansion is apparent as more healthcare providers adopt SaaS solutions for EHR, telemedicine, and patient management. For instance, in January 2024, HEALWELL agreed to acquire Intrahealth, a SaaS-based multinational EHR provider serving around 15,000 clinicians and millions of patients in small clinics and large healthcare organizations across Canada and globally.

U.S. Healthcare Software As A Service Market Trends

Healthcare SaaS market in the U.S. is growing and is driven by the increasing adoption of cloud-based solutions across hospitals, clinics, and insurance companies. Factors include the widespread use of SaaS for telemedicine, health data analytics, and billing management, which improves operational efficiency and patient engagement. The rise of telemedicine platforms, especially post-pandemic, is another significant trend, with virtual care becoming a permanent part of healthcare delivery. M&A activities are high as companies seek to integrate specialized solutions, including health data analytics. For instance, in November 2023, Thoma Bravo, a software investment firm, completed its USD 1.8 billion acquisition of NextGen Healthcare, Inc., a cloud-based healthcare technology solutions provider.

Asia Pacific Healthcare Software As A Service Market Trends

Healthcare SaaS market in the Asia Pacific is experiencing significant innovation in telemedicine, health data analytics, and AI-powered healthcare tools. Regulatory frameworks are evolving, and data protection laws are being implemented to ensure patient privacy. For instance, in March 2023, Fujitsu introduced a new cloud-based platform in Japan’s healthcare sector to advance personalized healthcare and support drug development. The new platform allows the automatic conversion of medical data from EHR at medical institutions to align with the next-generation HL7 FHIR (Health Level Seven) Fast Healthcare Interoperability Resource standards. It ensures the secure aggregation of health-related information.

Healthcare SaaS market in China is driven by government initiatives to improve healthcare access and efficiency. Expansion is being driven by investments in innovative healthcare and telemedicine, supported by the government's focus on improving healthcare in rural areas. Strategic partnerships between tech giants and healthcare providers are encouraging growth. For instance, in June 2023, Tencent Healthcare and Eisai China formed a strategic partnership, integrating Tencent's digital technology with Eisai's customer management, marketing, and event management, aiming to enhance academic communication and drive innovation and market growth in China.

Healthcare SaaS market in India includes the rapid adoption of telemedicine and cloud-based health management systems, driven by increasing internet penetration and smartphone usage. The government’s push for digital health through initiatives such as the National Digital Health Mission (NDHM) accelerates SaaS adoption. Innovation is evident in the rise of AI-driven healthcare tools for diagnostics, predictive analytics, and patient engagement. For instance, in December 2024, ISB DLabs, in partnership with CitiusTech, launched 'I-HEAL ISB 3.0' to accelerate digital healthcare innovation in India.

Europe Healthcare Software As A Service Market Trends

Healthcare SaaS market in Europe is driven by the increasing adoption of digital health solutions, driven by rising healthcare costs and demand for efficient care delivery, fuels this growth. For instance, in December 2024, CORDET Capital Partners offered senior secured debt facilities to assist MTIP in acquiring a majority stake in Dossier Solutions and management reinvesting alongside MTIP and Peakstone.

Latin America Healthcare Software As A Service Market Trends

Healthcare SaaS market in Latin America is expanding due to the increasing adoption of cloud-based solutions, which addresses the region's need for cost-effective and scalable healthcare management systems. Strategic partnerships between technology providers and healthcare organizations are accelerating, with collaborations between local startups and global players increasing. For instance, in July 2023, Chubb and HealthAtom teamed up to offer comprehensive dental healthcare coverage and services to patients across Latin America. This collaboration utilizes HealthAtom's SaaS technology expertise to improve the region's dental health management and insurance services.

Middle East & Africa Healthcare Software As A Service Market Trends

Healthcare SaaS market in Middle East & Africa is driven by substantial investments in healthcare infrastructure, digital health technologies, and government initiatives to modernize healthcare systems. The regulatory landscape is evolving, focusing on patient data privacy and security, particularly in nations such as the UAE, where regulatory bodies such as the Dubai Health Authority ensure compliance with international standards. Collaborations between global technology firms and regional healthcare providers are becoming more frequent, driving the adoption of cloud-based solutions faster. For instance, in April 2023, Emircom partnered with SymphonyAI to deliver SymphonyAI's IT and manufacturing solutions to Emircom's customers across the Middle East.

Key Healthcare Software As A Service Company Insights

Key players operating in the market are Microsoft, Salesforce, Adobe, SAP, Oracle, CISCO, Google, IBM, ServiceNow, and Workday. Players operating in the market are adopting various strategies such as partnerships, collaborations, mergers and acquisitions, and product developments to expand product portfolio and global presence. For instance, in November 2021, EverCommerce, a SaaS company, announced its plans to acquire DrChrono, an EHR, practice management, and billing software company, to expand its product offerings.

Key Healthcare Software As A Service Companies:

The following are the leading companies in the healthcare software as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Salesforce, Inc.

- Adobe

- SAP

- Oracle

- Cisco Systems, Inc.

- IBM

- ServiceNow

- Workday, Inc.

- CareCloud, Inc.

- Suki AI, Inc.

Recent Developments

-

In November 2024, Hyland introduced an advanced healthcare cloud imaging SaaS solution and NilShare to enhance image collaboration.

“Hyland is unwavering in its dedication to revolutionizing healthcare processes and workflows through cutting-edge modernization and advanced intelligence. The Hyland Cloud Imaging solution signifies a transformative leap in how organizations manage and utilize their unstructured data, complementing the strategic investments we are making in our Content Innovation Cloud. By leveraging the strength of AI and cloud technology, we empower our healthcare customers to unlock unprecedented insights and efficiencies, enabling them to drive better patient outcomes and innovations within their organizations.”

- Jitesh Ghai, CEO of Hyland.

-

In November 2024, Simplify Healthcare introduced SimplifyX, a new subsidiary that delivers innovative software products to multiple industries.

"We are thrilled to build upon our success in the health insurance market by launching SimplifyX™, focused on delivering AI-native SaaS solutions to businesses of all kinds. As we look to the future, we recognize the immense potential that exists beyond our core industry, and we are confident that this new venture will allow us to capitalize on those opportunities while maintaining our position as a leader in health insurance technology. Now, the significant cost advantages we enjoy when we build solutions will be available to our customers - and they can build and deploy faster and better - the way it was always meant to be - 50% faster and 10X better!”

- Mohammed Vaid, CEO and Chief Solution Architect, Simplify Healthcare.

Healthcare Software As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 30.04 billion |

|

Revenue forecast in 2030 |

USD 74.74 billion |

|

Growth Rate |

CAGR of 20.0% from 2025 to 2030 |

|

Actual Data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, deployment model, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Latin America; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Microsoft, Salesforce, Inc.; Adobe; SAP; Oracle; Cisco Systems, Inc.; Google; IBM; ServiceNow; Workday, Inc.; CareCloud, Inc.; Suki AI, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Software As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare software as a service market report based on application, deployment model, end use, and region:

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Patient Portal

-

Telemedicine

-

Mobile Communication

-

ePrescribing

-

EHR Systems

-

ERP & HR Portal

-

Medical Billing

-

Others

-

-

Deployment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Hybrid

-

Public

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Payer

-

Provider

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare software as a service market size was estimated at USD 25.13 billion in 2024 and is expected to reach USD 30.04 billion in 2025.

b. The global healthcare software as a service market is expected to grow at a compound annual growth rate of 20.0% from 2025 to 2030 to reach USD 74.74 billion by 2030.

b. North America dominated the healthcare software as a service market and accounted for the largest revenue share of 45.39% in 2024. This is attributed to its advanced healthcare infrastructure, high adoption of digital health solutions, and strong regulatory frameworks (HIPAA) that ensure data security and privacy.

b. Some key players operating in the healthcare software as a service market include Microsoft, Salesforce, Inc., Adobe, SAP, Oracle, Cisco Systems, Inc., Google, IBM, ServiceNow, Workday, Inc., CareCloud, Inc., Suki AI, Inc.

b. Key factors that are driving the healthcare software as a service market growth include the increasing adoption of cloud computing, the need for cost-effective solutions, the growing demand for remote healthcare services, and regulatory compliance requirements. In addition, the shift toward digital transformation in healthcare, supported by government initiatives and technological advancements, is driving the growth of SaaS solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."