- Home

- »

- Healthcare IT

- »

-

Healthcare Satellite Connectivity Market Size Report, 2030GVR Report cover

![Healthcare Satellite Connectivity Market Size, Share & Trends Report]()

Healthcare Satellite Connectivity Market Size, Share & Trends Analysis Report By Component (Medical Devices, System & Software), By Application (Telemedicine), By Connectivity, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-844-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

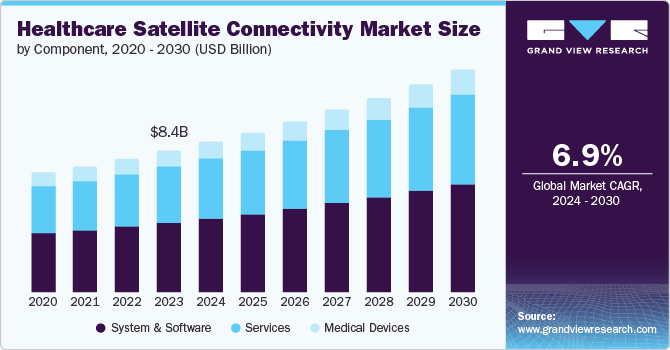

The global healthcare satellite connectivity market size was valued at USD 8.37 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. The shift towards healthcare satellite connectivity is brought by rise in chronic diseases, critical healthcare conditions such as COVID-19 pandemic, growing need for emergency virtual medical assistance, and the need to curb epidemics in remote areas.

The rise in chronic diseases demands emergency healthcare, leading to growth in the satellite connectivity market. According to the World Health Organization (WHO), chronic diseases or non-communicable diseases kill 41 million people globally, as per a report published in May 2023. The organization estimated that the deaths caused by chronic diseases would account for 86% each year by 2050. This causes the virtual healthcare and satellite connectivity market to grow exponentially.

The outbreak of the COVID-19 pandemic raised the potential for healthcare satellite connectivity to consult the doctors in case of emergencies. The rise in telehealth and telemedicine during the outbreak gave rise to healthcare satellite connectivity. Telehealth relies on satellite connectivity to offer virtual consultations to patients and remote access to healthcare facilities. Various companies are making innovations, such as Cigna Healthcare which launched virtual-first, a virtual care platform to expand telehealth services in October 2021. Such innovations are expected to drive market growth.

The surge in internet connectivity has paved the way for AI innovations and satellite connectivity in healthcare. Artificial Intelligence (AI) is used in healthcare to improve speed and accuracy and assist health professionals in making data-driven, real-time decisions to improve health outcomes, enabling better patient management. Various companies are involved in technological innovations to make healthcare connectivity a viable option. For instance, Wheel Health Inc., launched AI-powered Horizon, a virtual care platform in June 2024. Such innovations are attributed to the market growth.

Component Insights

System & software dominated the market and accounted for a share of 48.7% in 2023. The rise in medical devices to track and monitor health parameters leads to the growth of the system & software segment. The hardware requires compatible software to run the system smoothly, contributing to the market’s growth. In addition, the need to maintain patient databases and medical records, and the rising demand for data analytics are driving the segment growth. According to the National Library of Medicine report published in September 2023, the FDA is developing guidelines and a framework to guide the role of AI & ML in healthcare software.

The services segment is expected to register the fastest CAGR over the forecast period.The rising number of chronic cases, growing demand for emergency consultations, and increasing data analytics demand in healthcare are attributed to the segment’s growth. The emerging AI-driven technologies applied across healthcare platforms demand proper knowledge and adequate training in the respective domain to obtain the technology’s potential results. Various startups are merging and offering AI-based healthcare platforms; for instance, the Jivi startup was launched in April 2024, aiming to provide healthcare services by leveraging artificial intelligence, machine learning, and generative AI. The rising AI startups require professionals to have adequate training and education to enable proper patient management.

Application Insights

Telemedicine dominated the market and accounted for a share of 63.1% in 2023. The driving factors attributing to the segment growth include the outbreak of the COVID-19 pandemic, the need for emergency virtual medical assistance, better healthcare coverage in remote locations, and a boost in internet connections. According to the International Telecommunication Union (ITU), about 87 mobile broadband connections per 100 residents were available by 2023. The increase in internet connectivity gave rise to telemedicine, and several companies are launching new platforms and collaborating. For instance, Cigna International collaborated with Teladoc Health, Inc. in June 2021 to expand telehealth capabilities in India. Such partnership activities are expected to drive the segment growth.

The connected imaging segment is expected to register the fastest CAGR during the forecast period. The rise in chronic diseases and technological advancements contribute to the segment growth. Connected imaging uses AI-driven technology to transform data into actionable insights and helps increase diagnostic accuracy and clinical outcomes, which helps to improve patient experience, achieve operational efficiency, and reduce the cost of care. Koninklijke Philips N.V. demonstrated the latest designed smart imaging systems at the European Congress of Radiology (ECR) in March 2023. Such technological advancements drive the segment growth.

Connectivity Insights

Fixed satellite services (FSS) dominated the market and accounted for a share of 78.9% in 2023. The rise in virtual consultations and real-time video conferencing is attributed to the segment growth. FSS is expected to grow rapidly in the healthcare sector due to increasing remote medical services and transmission of medicine data to reach patients in rural areas. The key players in the segment are EUTELSAT COMMUNICATIONS SA, SES S.A., and Intelsat which contribute to the segment growth.

The mobile satellite services (MSS) segment is expected to register the fastest CAGR during the forecast period. The factors responsible for the segment growth are increased internet access and virtual consultations, medical reports, records, and image transmission using mobile facilities. The key players contributing to the segment growth are Inmarsat Global Limited, Globalstar, Intelsat, and SES S.A.

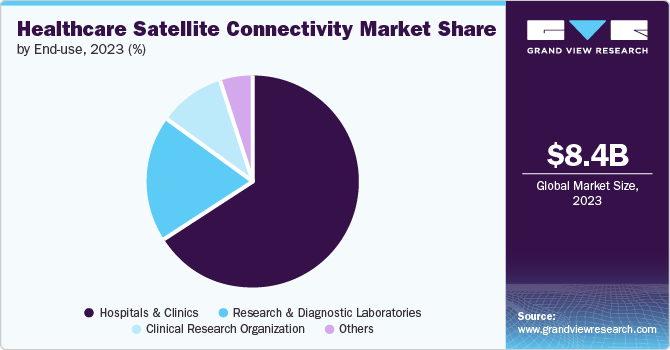

End Use Insights

The hospitals and clinics accounted for the largest market revenue share of 65.8% in 2023. The rising health conditions, increased demand to manage hospital operations, patient safety, and reduction in prescription errors are expected to drive the segment growth. Through satellite connectivity, communication between hospitals and clinics can be improved, reducing prescription and diagnostic errors. For instance, SpaceX launched a satellite internet service in May 2024 to improve hospital conditions in remote areas of Indonesia, giving millions access to the internet. Such instances are expected to drive the segment’s growth.

The clinical research organization segment is expected to register the fastest CAGR over the forecast period. The growing number of chronic disease cases, high mortality rates, and adoption of virtual consultations result in increased demand for advanced solutions, boosting the segment growth. The emergence of the COVID-19 pandemic encouraged clinical research organizations to seek alternative solutions to treat the disease. Such critical conditions are expected to drive market growth.

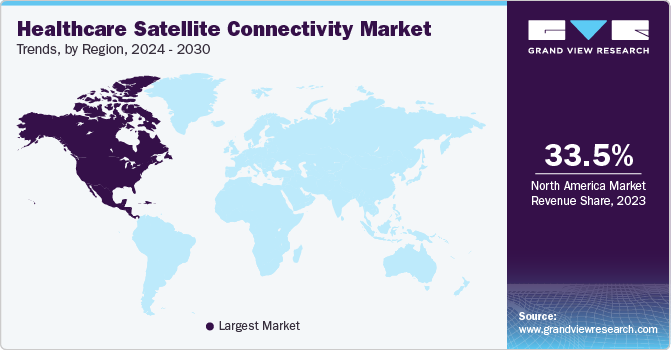

Regional Insights

North America satellite connectivity market dominated in 2023. The rise in internet infrastructure and the rising number of internet users are attributed to the growth of satellite connectivity in the region. The increasing involvement of companies, emerging startups, and technological advancements due to the rise in critical health conditions drives market growth. For instance, Terrestar Solutions Inc., based in Canada, is dedicated to offering operational satellite backed by satellite architecture to provide seamless and reliable connectivity. Such instances are expected to drive market growth.

U.S. Healthcare Satellite Connectivity Market Trends

The U.S. healthcare satellite connectivity market accounted for a 27.6% share of the global market in 2023. The growth is attributed to the rising number of internet users, technological advancements, and a growing number of companies and startups nationwide. In addition, the number of chronic disease cases are rising causing development of technologically advanced solutions. For instance, according to the Centers for Disease Control and Prevention (CDC) report published in February 2024, nearly 129 million people have at least one major chronic disease. Such conditions give rise to the satellite connectivity used in healthcare. For instance, SES S.A., the company’s satellite, provided connectivity services to hospitals in various countries such as Italy, Bangladesh, and Mexico. Such advancements are expected to drive market growth.

Europe Healthcare Satellite Connectivity Market Trends

Europe accounted for a significant market share in 2023 in the healthcare satellite connectivity market. The rising internet connectivity allows emerging telemedicine platforms to do so. For instance, according to Eurostat, the number of internet users increased to 91% in 2023. The rising number of chronic disease cases and the geriatric population encourage advanced solutions. Various telemedicine companies are involved in using satellite connectivity. For instance, Colibri is an operational telemedicine solution providing services using satellite broadband communication to offer efficient support and fix telemedicine stations in remote areas.

The rise in internet users, increasing chronic diseases, and technological advancements are attributed to the market growth in the UK. In the 3rd quarter of 2022, 27.3 million broadband connections were fixed, according to a Uswitch Limited report published in September 2023. Companies are involved in the market, offering advanced solutions in the healthcare space using satellite connectivity. For instance, OneWeb, a Eutelsat Group, offers satellite connectivity and ensures that the healthcare facilities stay connected to the patients. Such companies are expected to drive market growth.

Asia Pacific Healthcare Satellite Connectivity Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The rising number of chronic cases and increasing internet connectivity in the region is expected to drive the market growth. Various companies and communities are joining the market to offer advanced solutions. For instance, a new satellite solution is being used to provide medical assistance in rural areas at Dargo Bush Nursing Centre in Australia, according to data published in October 2022. Such technological adoptions by various facilities are expected to drive market growth.

The rising number of health concerns and boost of internet connectivity is attributed to market growth. The startups are collaborating with the government to provide better health solutions in rural areas; for instance, Astrome developed a network solution called GigaMesh and signed a contract with the Department of Telecommunication to provide next-generation network solution, making affordable internet connectivity to 15 villages in different parts of the country according to the report published in July 2022.

Key Healthcare Satellite Connectivity Company Insights

Some key companies in the healthcare satellite connectivity market include X2nSat, Inmarsat Global Limited, Hughes Network Systems, LLC, Expedition Communications, and Nigado Network, among others. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Inmarsat Global Limited is a satellite service provider dedicated to offering mobile satellite communication services to various industries, such as aviation, enterprise, government, and maritime. The company collaborates in various countries to provide mobile health solutions and improves disease monitoring and health system management in rural areas.

-

Hughes Network Systems, LLC provides broadband satellite services and manages network solutions for government and businesses. The company offers technological solutions supporting innovative and responsive healthcare services and digital and virtual healthcare services with better connectivity, transforming digital healthcare.

Key Healthcare Satellite Connectivity Companies:

The following are the leading companies in the healthcare satellite connectivity market. These companies collectively hold the largest market share and dictate industry trends.

- X2nSat

- Inmarsat Global Limited

- Hughes Network Systems, LLC

- SES S.A.

- Expedition Communications

- Globalstar

- EUTELSAT COMMUNICATIONS SA

- DISH Network L.L.C.

- Nigado Network

Recent Developments

-

In June 2022, Johnson & Johnson launched a satellite center dedicated to global health discovery at Singapore’s medical school, a joint venture by Duke University and the National University of Singapore.

-

In March 2021, Evitalz signed an agreement with Inmarsat’s Fleet Connect to provide a telehealth solution for people on ships.

Healthcare Satellite Connectivity Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.91 billion

Revenue forecast in 2030

USD 13.31 billion

Growth Rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, connectivity, end use

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

X2nSat, Inmarsat Global Limited, Hughes Network Systems, LLC, SES S.A. Expedition Communications, Globalstar, EUTELSAT COMMUNICATIONS SA, DISH Network L.L.C., Nigado Network

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Satellite Connectivity Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare satellite connectivity market report based on component, application, connectivity, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Devices

-

Wearable External Device

-

Implantable Medical Device

-

Stationary Medical Device

-

-

System & Software

-

Remote Device Management

-

Network Bandwidth Management

-

Data Analytics

-

Application Security

-

Network Security

-

-

Services

-

System Integration Services

-

Consulting, Training & Education

-

Support & Maintenance Services

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Telemedicine

-

Clinical Operations

-

Connected Imaging

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Satellite Services (MSS)

-

Fixed Satellite Services (FSS)

-

Specialty markers

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Research Organization

-

Hospitals & Clinics

-

Research & Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."