- Home

- »

- Homecare & Decor

- »

-

Healthcare Real Estate Market Size And Share Report, 2030GVR Report cover

![Healthcare Real Estate Market Size, Share & Trends Report]()

Healthcare Real Estate Market Size, Share & Trends Analysis Report By Property (Hospitals, Medical Office Buildings (MOBs), Senior Living And Retirement Communities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-426-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Healthcare Real Estate Market Size & Trends

The global healthcare real estate market size was estimated at USD 1,336.94 billion in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030. The global healthcare real estate market has experienced significant growth over the past decade, driven by several key factors including demographic shifts, technological advancements, and changing healthcare delivery models.

The aging population, particularly in developed regions such as North America and Europe has emerged as one of the primary market growth drivers. As the population ages, the demand for healthcare services, including long-term care, assisted living, and specialized medical facilities has increased substantially. This demographic trend has spurred investment in healthcare real estate, with developers and investors focusing on creating state-of-the-art facilities to meet the rising demand for high-quality care.

Technological advancements have also played a crucial role in the growth of the healthcare real estate market. Innovations in medical technology and telemedicine have transformed how healthcare services are delivered, leading to the need for modern, adaptable facilities. For instance, the integration of telehealth services requires spaces equipped with advanced communication infrastructure. In addition, the rise of outpatient care and ambulatory surgical centers, which offer cost-effective alternatives to traditional hospital settings, has driven the development of specialized real estate assets. These advancements have encouraged investors to allocate capital towards healthcare properties that support new modes of healthcare delivery.

Moreover, the COVID-19 pandemic has underscored the importance of resilient and flexible healthcare infrastructure. The pandemic accelerated the adoption of telehealth and remote patient monitoring, necessitating the redesign and repurposing of existing healthcare spaces to accommodate these services. Healthcare real estate has had to adapt quickly to changing needs, such as creating isolation areas and enhancing infection control measures. This adaptability has highlighted the value of modern healthcare facilities and attracted increased investment from institutional investors seeking stable and recession-resistant assets.

The healthcare real estate market has also seen robust growth in emerging markets, driven by rising income levels and expanding access to healthcare services. Regions such as Asia Pacific and Latin America are experiencing rapid urbanization, leading to increased demand for healthcare infrastructure. Governments in these regions are investing heavily in healthcare to improve accessibility and quality of care, further boosting the market. Private investors are also capitalizing on these opportunities, developing hospitals, clinics, and senior living facilities to meet the growing needs of the population.

The trend towards specialized healthcare facilities, such as behavioral health centers, rehabilitation centers, and medical research facilities, has contributed to the diversification and expansion of the healthcare real estate market. Investors are increasingly recognizing the value of these niche sectors, which offer higher returns compared to traditional healthcare properties. The focus on specialized care is driven by the increasing prevalence of chronic diseases, mental health issues, and the need for advanced medical research. As a result, there is a growing pipeline of projects aimed at addressing these specific healthcare needs, further fueling the growth of the healthcare real estate market globally.

The healthcare real estate industry in India is poised for substantial growth, driven by increasing healthcare needs, rising investments, and the development of medical hubs beyond tier-1 cities. According to CBRE, rental rates in major cities are experiencing a robust annual growth of 5-7%, positioning healthcare real estate as an attractive investment opportunity.

According to a Knight Frank global healthcare report, India needs an additional 2 billion sq. feet of healthcare real estate to meet the demands of its current population, given the country's existing bed-to-population ratio of 1.3 beds per 1,000 people. This substantial demand for healthcare infrastructure is expected to significantly boost the growth of the Indian healthcare real estate industry, driving investment, development, and modernization across the sector. The government's unwavering commitment to fostering growth in the healthcare sector highlights its potential to significantly contribute to the nation's economic progress. As the landscape of healthcare properties evolves, the country expects advancements in investment strategies, technology integration, and sustainability practices, shaping the future of healthcare delivery in India. This evolution positions India as an emerging market as a secure and reliable investment opportunity for investors looking to diversify their portfolios.

The decline in life expectancy reported by the Centers for Disease Control and Prevention underscores a growing demand for healthcare services, which will subsequently drive increased demand for healthcare real estate. In 2021, life expectancy for males fell to 73.2 years from 74.2 years in 2020, and for females, it decreased to 79.1 years from 79.9 years in 2020. This reduction indicates an increased need for healthcare services to address the health challenges contributing to these declines.

As life expectancy decreases, there is a heightened focus on managing chronic conditions and providing advanced medical care. This trend is likely to drive up the demand for various healthcare facilities, including hospitals, medical office buildings, and long-term care centers. The need for expanded medical infrastructure to cater to an aging population and those with complex health needs will consequently boost the demand for healthcare real estate. Investors and developers will likely increase their focus on acquiring and developing properties to meet this growing healthcare demand.

Property Type Insights

The hospital real estate held a market share of 33.56% in 2023. The increasing demand for healthcare services, driven by an aging population and the rising prevalence of chronic diseases, necessitates the expansion of hospital infrastructure to accommodate the growing patient base. In addition, advancements in medical technology and the need for specialized care facilities are prompting the development of new, state-of-the-art hospitals designed to meet these modern healthcare requirements. Moreover, government initiatives and policies aimed at improving healthcare access, particularly in underserved regions, are fueling investment in hospital construction. This growth is further supported by the attractiveness of hospitals as stable, long-term investments for real estate developers and institutional investors, who see the healthcare sector as a resilient and essential asset class with promising returns.

The construction of senior living and retirement communities within the healthcare real estate sector is projected to expand at a robust CAGR of 9.7% from 2024 to 2030. The aging global population is the primary catalyst, with an increasing number of individuals reaching retirement age and seeking specialized living arrangements that offer enhanced care and lifestyle amenities. In addition, evolving preferences for aging in place and the rising demand for high-quality, service-oriented senior living options are prompting significant investments in this sector. The sector's growth is further supported by favorable government policies and incentives aimed at improving senior care infrastructure, coupled with increased recognition of the need for integrated and supportive environments for elderly residents. These dynamics collectively underscore the growing attractiveness and necessity of expanding senior living and retirement community facilities.

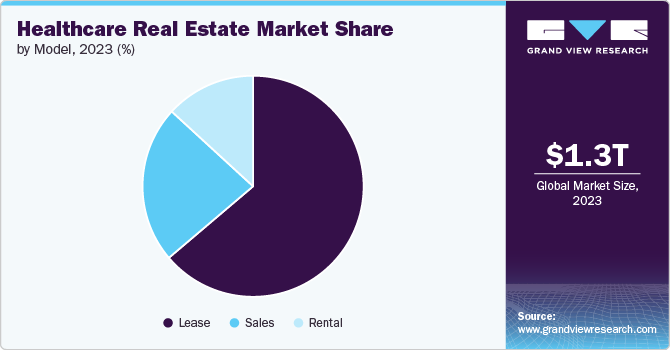

Model Insights

The lease model held a market share of 63.79% in 2023. The leasing model in healthcare real estate is experiencing significant growth due to several compelling factors. Leasing provides healthcare providers with the flexibility to adapt to evolving operational needs without the substantial capital expenditure associated with property acquisition. This model allows organizations to allocate financial resources more efficiently, focusing on core healthcare services rather than property ownership. In addition, leasing offers scalability, enabling providers to expand or contract their space in response to fluctuating patient volumes and changing healthcare delivery trends. The long-term stability of leasing agreements also appeals to investors, particularly real estate investment trusts (REITs), who seek steady income streams and lower risk profiles.

The healthcare real estate rental model is anticipated to grow at a CAGR of 7.9% from 2024 to 2030. Rental arrangements offer healthcare providers a cost-effective and flexible solution for securing space without the long-term financial commitment associated with ownership or leasing. This flexibility is particularly advantageous for temporary or specialized healthcare services, such as pop-up clinics or seasonal health initiatives, which require short-term space solutions. In addition, the rental model enables healthcare providers to quickly adapt to changing demands and operational needs without the burden of long-term property management or significant capital outlay. As the healthcare industry continues to innovate and expand, the ability to secure rental spaces for emerging services or temporary needs is becoming increasingly valuable.

Regional Insights

The healthcare real estate market in North America held a share of 50.41% of the global revenue in 2023. In North America, the healthcare real estate market is undergoing substantial growth driven by robust investments in cutting-edge medical facilities and a significant increase in healthcare service demand. The U.S., in particular, is seeing an expansion in medical office buildings (MOBs), integrated health campuses, and specialty care centers to accommodate a growing aging population and rising prevalence of chronic conditions. The market is also benefiting from heightened investment from real estate investment trusts (REITs) and private equity firms, aimed at modernizing healthcare infrastructure and improving patient care delivery across various regions.

U.S. Healthcare Real Estate Market Trends

The healthcare real estate market in the U.S. is expected to grow at a CAGR of 8.3% from 2024 to 2030. The U.S. healthcare real estate sector is rapidly evolving, characterized by a surge in demand for diversified healthcare facilities such as outpatient centers, specialty hospitals, and senior living communities. This growth is fueled by an increasing focus on value-based care, technological advancements in medical treatments, and a demographic shift towards an older population. The expansion of integrated health systems and the rise of telehealth services are further driving the need for sophisticated and accessible healthcare properties, positioning the U.S. as a leading market in healthcare real estate development.

Asia Pacific Healthcare Real Estate Market Trends

The Asia Pacific market is projected to grow at a CAGR of 9.3% from 2024 to 2030. In the Asia Pacific region, the healthcare real estate market is expanding significantly due to rapid urbanization, a growing middle class, and improving healthcare infrastructure. Countries such as China and India are investing heavily in new hospitals, medical research facilities, and senior living communities to meet the increasing healthcare needs of their large populations. The region is also witnessing a rise in demand for advanced life sciences and biotech facilities, driven by burgeoning research and development activities and a focus on enhancing healthcare accessibility and quality.

The Indian government is actively fostering the development of healthcare real estate through targeted initiatives. The Pradhan Mantri Jan Arogya Yojana (PMJAY) enhances healthcare affordability, driving demand for medical services in these regions. In addition, the expansion of All India Institutes of Medical Sciences (AIIMS) into tier-2 cities significantly bolsters medical infrastructure. Furthermore, the "Heal in India" initiative is poised to boost medical tourism, creating additional opportunities for infrastructure growth and advancing the healthcare sector.

Europe Healthcare Real Estate Market Trends

Europe accounted for a revenue share of around 13.94% in the year 2023. Europe's healthcare real estate market is experiencing growth driven by increasing healthcare expenditures, an aging population, and strategic government initiatives aimed at improving medical infrastructure. Investment is focused on upgrading existing facilities and developing new medical centers, senior living communities, and specialty care centers to address the diverse healthcare needs across the continent. The expansion is particularly pronounced in tier-2 and tier-3 cities, where there is a concerted effort to enhance regional healthcare access and support the evolving demands of an older demographic.

Key Healthcare Real Estate Company Insights

The competitive landscape of the healthcare real estate sector is characterized by a dynamic interplay of key players, emerging trends, and strategic positioning. Major institutional investors, including Real Estate Investment Trusts (REITs) and private equity firms, dominate the market, leveraging their substantial capital reserves to acquire and develop high-value healthcare properties. These investors are increasingly focusing on acquiring medical office buildings (MOBs), senior living facilities, and specialized care centers, driven by the sector's stability and long-term growth prospects.

In addition, healthcare providers and developers are intensifying their efforts to differentiate themselves through the development of cutting-edge, patient-centric facilities. This includes integrating advanced medical technologies, creating adaptable spaces for evolving healthcare delivery models, and incorporating sustainable design principles to attract tenants and enhance operational efficiencies.

Key Healthcare Real Estate Companies:

The following are the leading companies in the healthcare real estate market. These companies collectively hold the largest market share and dictate industry trends.

- Healthpeak Properties, Inc.

- Ventas, Inc.

- Welltower Inc.

- Brookdale Senior Living Inc.

- Medical Properties Trust, Inc.

- CBRE Group, Inc.

- Carter Validus Mission Critical REIT

- JLL (Jones Lang LaSalle)

- Mediclinic Group

- Hammerson plc

Recent Developments

-

In March 2024, Healthpeak Properties, Inc. closed on the previously announced merger with Physicians Realty Trust valued at $21 billion, marking a major consolidation in the healthcare real estate investment trust (REIT) sector. This strategic merger combines Healthpeak's extensive portfolio and operational expertise with Physicians Realty Trust's significant holdings in medical office buildings, creating a formidable entity in the healthcare real estate market. The merged entity manages a substantial portfolio encompassing 52 million square feet, with 40 million square feet dedicated to outpatient medical office properties. These assets are strategically located in high-growth markets, including Dallas, Houston, Nashville, Phoenix, and Denver.

-

In August 2024, National Dental Healthcare REIT announced the successful completion of its latest real estate acquisition. This strategic move bolstered NDH REIT's leadership position in the industry and underscored its commitment to broadening its diverse portfolio. The acquisition, which was finalized on June 28, 2024, encompassed 13 properties situated across New York, Florida, Texas, Oklahoma, Ohio, Georgia, Indiana, and Virginia.

Healthcare Real Estate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,434.88 billion

Revenue forecast in 2030

USD 2,270.40 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Property type, model, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Healthpeak Properties, Inc.; Ventas, Inc.; Welltower Inc.; Brookdale Senior Living Inc.; Medical Properties Trust, Inc.; CBRE Group, Inc.; Carter Validus Mission Critical REIT; JLL (Jones Lang LaSalle); Mediclinic Group; Hammerson plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Healthcare Real Estate Market Report Segmentation

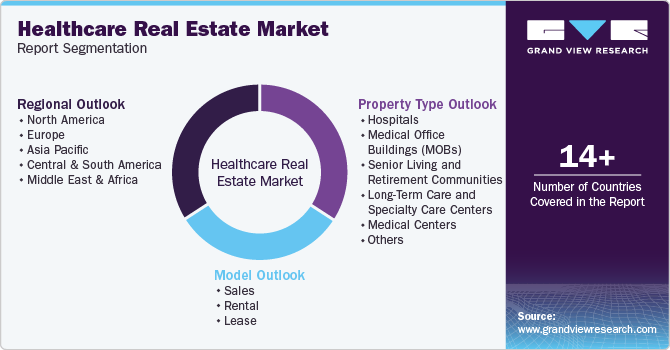

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the healthcare real estate market on the basis of property type, model, and region:

-

Property Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Medical Office Buildings (MOBs)

-

Senior Living and Retirement Communities

-

Long-Term Care and Specialty Care Centers

-

Medical Centers

-

Others

-

-

Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sales

-

Rental

-

Lease

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthcare real estate market was estimated at USD 1,336.94 billion in 2023 and is expected to reach USD 1,434.88 billion in 2024.

b. The global healthcare real estate market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 2,270.40 billion by 2030.

b. North America dominated the healthcare real estate market with a share of over 50.41% in 2023. The healthcare real estate market in North America is undergoing substantial growth driven by robust investments in cutting-edge medical facilities and a significant increase in healthcare service demand.

b. Some of the key players operating in the healthcare real estate market include Healthpeak Properties, Inc., Ventas, Inc., Welltower Inc., Brookdale Senior Living Inc., Medical Properties Trust, Inc., CBRE Group, Inc., Carter Validus Mission Critical REIT, JLL (Jones Lang LaSalle), Mediclinic Group, and Hammerson plc.

b. Demographic shifts, technological advancements, and changing healthcare delivery models are key factors driving the healthcare real estate market growth. The aging population, particularly in developed regions such as North America and Europe has emerged as one of the primary market growth drivers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."