- Home

- »

- Healthcare IT

- »

-

Healthcare Predictive Analytics Market Size Report, 2030GVR Report cover

![Healthcare Predictive Analytics Market Size, Share & Trends Report]()

Healthcare Predictive Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Clinical, Financial, Operations Management), By End-use (Payers, Providers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-297-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Predictive Analytics Market Summary

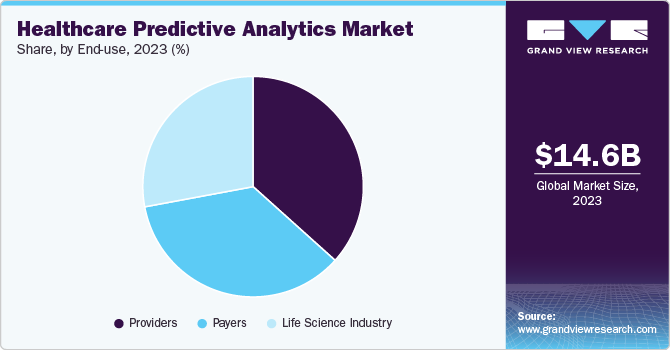

The global healthcare predictive analytics market size was estimated at USD 14,579.7 million in 2023 and is projected to reach USD 67,255.6 million by 2030, growing at a CAGR of 24% from 2024 to 2030. The growing demand for advanced analytics systems to improve patient outcomes and reduce cost, coupled with advancements in artificial intelligence (AI) and machine learning technologies to improve the analysis of complex, large-scale datasets, enhancing drug discovery, personalized medicine, and patient care, are some of the factors driving market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, UK is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, financial accounted for a revenue of USD 5,172.0 million in 2023.

- Population Health is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 14,579.7 Million

- 2030 Projected Market Size: USD 67,255.6 Million

- CAGR (2024-2030): 24.4%

- North America: Largest market in 2023

Moreover, the rising prevalence of chronic diseases and the need for cost-effective treatment solutions increase the demand for AI-powered predictive analytics in healthcare.

Moreover, the increasing adoption of evidence-based medicine to deliver effective care to the right patient is another critical factor driving market growth. For instance, in April 2023, Children's Mercy inaugurated the Patient Progression Command Center in collaboration with GE Healthcare. This 6,000 sq. ft. hospital operations center at Children's Mercy Kansas City employs AI, predictive analytics, and real-time information to enhance care coordination from the moment of a patient's admission until discharge.

Furthermore, the increasing volume of healthcare data generated from various sources, such as wearable devices, mobile health applications, and electronic health records (EHRs), creates opportunities for advanced analytics solutions. For instance, according to the World Economic Forum, hospitals generate 50 petabytes of data annually. In addition, according to the statistics published on HealthIT.gov, as of 2021, 96% of acute care hospitals and 4 in 5 (78%) office-based physicians had adopted certified EHRs. The rising demand for value-based care also emphasizes the need for tools to measure outcomes effectively and reduce costs. In addition, advancements in artificial intelligence (AI) and machine learning (ML) are enhancing the capabilities of predictive analytics tools, making them more accessible and effective for healthcare organizations.

The COVID-19 pandemic positively impacted the health and life science industries. The outbreak forced the industry to manage supply chain disruption and clinical development during the pandemic, encouraging the industry to accelerate innovation to respond to the crisis. This resulted in a significant increase in the adoption of AI for life science analytics. Increasing clinical trials, drug discoveries, and technological advancements in deep learning fuel the market growth.

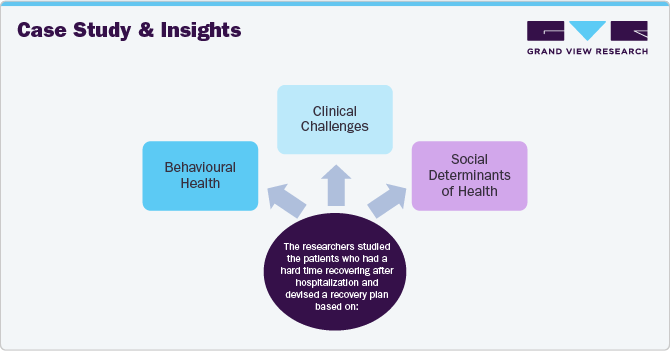

Case Study & Insights

A research team at Corewell Health utilized AI and predictive analytics to identify patients at high risk of readmission. The study focused on patients facing challenges in post-hospitalization recovery, leading to the development of a targeted recovery plan.

Result

Corewell Health's interdisciplinary team leveraged a predictive analytics tool to identify potential readmission candidates. By addressing key factors for each patient, they successfully prevented 200 readmissions, resulting in a cost savings of USD 5 million.

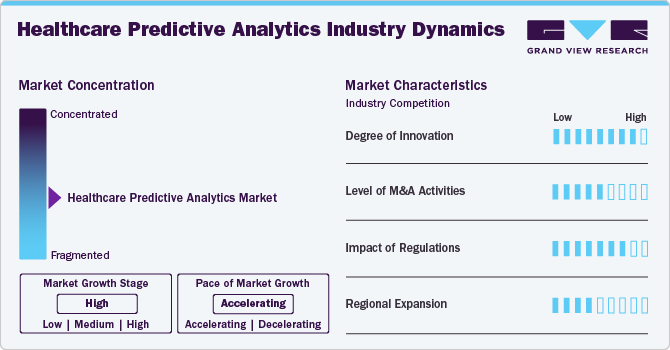

Market Concentration & Characteristics

The healthcare predictive analytics market experiences a high degree of innovation driven by technological advancements. Innovations in predictive analytics are pushing the boundaries of what is possible in diagnostics, drug discovery, personalized medicine, and healthcare delivery. For instance, in May 2024, mPulse launched an integrated predictive analytics product for consumer assessment of healthcare providers and systems and health outcomes surveys.

“The healthcare ecosystem continues to seek ways to better personalize the consumer experience while lowering costs and improving health outcomes. We’re excited to be bringing new capabilities to market that enable just that—an industry-first combination of predictive analytics with health engagement to transform the consumer health experience. With this combined offering, mPulse is establishing a new category in the digital health market.”

- CEO of mPulse.

“We work extensively with leading healthcare organizations and have been able to translate fragmented healthcare data sets into actionable insights using our AI-powered predictive models. This launch adds a new layer of performance by enabling efficient deployment of personalized digital interventions aligned with our predictive models’ recommendations. I’m excited to bring this tool to market for the health plans we work with to help them unlock operational efficiencies and improve program outcomes for their members.”

The industry is experiencing a high level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in April 2024, ABOUT Healthcare acquired AI analytics company Edgility to offer patient progression solutions with predictive and prescriptive analysis.

Predictive analytics operates within a complex regulatory landscape to protect patient privacy and promote ethical practices. The use of personal health data necessitates strict adherence to privacy regulations such as HIPAA in the U.S. and GDPR in Europe. Regulatory bodies such as the FDA in the U.S. and the EMA in Europe are actively developing guidelines and frameworks to ensure the safety, efficacy, and ethical use of AI technologies in healthcare. In addition to legal compliance, ethical considerations play a significant role in implementing predictive analytics in healthcare.

The industry is witnessing moderate regional expansion, driven by an increasing customer base for predictive analytics tools. The expansion of biotechnology sectors and increased healthcare expenditure in emerging markets create new opportunities for healthcare predictive analytics platforms. Countries with developing healthcare infrastructures are increasingly investing in digitalization and technological advancements. Furthermore, as scientific awareness of artificial intelligence and machine learning continues to grow globally and access to these technologies improves in emerging markets, major market players are expected to enhance their regional expansion efforts.

Application Insights

Financial application segment dominated the market in 2023 and accounted for the largest revenue share of 35.5%. Financial applications include revenue cycle management, assessing the risk of fraud, and reducing fraudulent claims. For instance, the U.S. Department of Justice states that healthcare frauds worth USD 100 billion occur yearly. Predictive models for fraud detection can be constructed using artificial intelligence based on access to big data from patient records and provider payments. This application type benefits private and public organizations, fueling market growth.

Population health management segment is expected to grow at the fastest CAGR of 24.4% from 2024 to 2030. Predictive analytics is likely to aid in identifying possible disease outbreaks. In addition, by accessing large amounts of patient data generated through telehealth and other online platforms and connected devices, healthcare professionals can identify at-risk patients and start looking at treatments immediately, thus improving patient survival chances.

End-use Insights

The healthcare providers segment held the largest market share in 2023. Predictive analytics can automate hospital administrative processes, predict staffing needs, and control hospital drug and supply costs, leveraging the performance of hospitals and other healthcare providers. The integration of predictive analytics also facilitates better resource allocation and care management, further enhancing patient engagement. Care providers use predictive tools to identify high-need patients and coordinate care more effectively. For instance, in July 2024, in collaboration with Masimo, Cleveland Clinic launched a remote patient monitoring program and tele-ICU initiative to develop new artificial intelligence (AI)-enabled predictive analytics, focusing on cardiology.

"By harnessing Masimo's AI-powered decision support tools, automation solutions and monitoring devices, alongside Cleveland Clinic's vast clinical expertise and dedication to providing the highest quality, most innovative care, our partnership has the potential to significantly ease staff shortages, better standardize care, and promote intensivist- and specialist-led care,"

- Masimo Founder and CEO Joe Kiani.

Payers segment is expected to grow significantly over the forecast period. Rising medical costs have heightened the pressure on health plans to manage financial risk while maintaining quality care. Conventionally, health plans have relied on historical claims data to forecast medical utilization, but this approach often delays responses to emerging trends. Advances in predictive analytics are addressing these challenges within the payer segment. For instance, in May 2024, Cohere Health introduced early trend signal intelligence to predict medical utilization. This solution enables health plans to anticipate shifts in medical loss ratios and prepare for potential increases in utilization and costs. The technology identifies the providers driving these trend shifts by analyzing proprietary prior authorization data, which is available months before related claims are processed. This allows health plans to implement faster, more targeted utilization management and network adjustments.

Regional Insights

North America healthcare predictive analytics market dominated with the largest revenue share of 48.4% in 2023. Increasing demand for personalized medicine, rising focus on improving patient care, and robust healthcare infrastructure are some of the factors driving market growth. In addition, substantial investments in drug discovery and therapy development further aid the adoption of predictive analytics tools in the pharmaceutical and biotechnology industry.

U.S. Healthcare Predictive Analytics Market Trends

U.S. Healthcare predictive analytics market held the largest revenue share in 2023 due to the rising prevalence of chronic diseases and the increasing demand for efficient and personalized healthcare solutions and established healthcare infrastructure. Moreover, the presence of institutes and organizations such as the CDC’s Center for Forecasting and Outbreak Analytics, which predicts disease forecasting using analytics and disease models, helps drive market growth.

Europe Healthcare Predictive Analytics Market Trends

Europe Healthcare predictive analytics market observed a lucrative growth in 2023. Increasing adoption of precision and personalized medicine and robust infrastructure on disease research, coupled with established healthcare settings, are some of the factors driving market growth. Moreover, adopting artificial intelligence and machine learning in healthcare is projected to propel the Europe healthcare predictive analytics market from 2024 to 2030.

Healthcare predictive analytics market in UK is expected to grow over the forecast period. High healthcare expenditures, availability of advanced technological solutions, and the rising prevalence of chronic disorders have led to an increase in the adoption of predictive analytics services in the UK.

Germany healthcare predictive analytics market held the largest market share in 2023 in the European market. The growing geriatric population, the rising prevalence of chronic diseases such as cancer, CVDs, etc, and the significant presence of healthcare facilities across the country are factors fueling market growth. In addition, Germany’s healthcare market is rapidly adopting digitalization and creating significant new opportunities for established companies & emerging startups, thereby creating lucrative opportunities for predictive analytics solutions.

Asia Pacific Healthcare Predictive Analytics Market Trends

Healthcare predictive analytics market in Asia Pacific is anticipated to grow at the fastest CAGR of 26.9% from 2024 to 2030 due to increasing disposable income, rising healthcare expenditure, and technological advancements such as the integration of artificial intelligence in healthcare. Moreover, the rising prevalence of chronic diseases and improving healthcare infrastructure have led to the rapid adoption of healthcare predictive analytics to reduce the rising health-related costs and achieve better treatments for patients.

Healthcare predictive analytics market in Japan is expected to grow significantly over the forecast period, owing to the advancing digital infrastructure and the growing geriatric population. Additionally, the growing government support and initiatives for promoting digital health technologies encourage innovation in the sector.

China healthcare predictive analytics market held the largest revenue share in 2023 due to the increasing preference for precision medicine and technological advancements. Furthermore, the growing geriatric population coupled with the rising incidences of chronic disease is creating an opportunity for predictive disease analytics to grow as it assists in clinical decision-making, treatment, and resource allocation as per future needs.

Latin America Healthcare Predictive Analytics Market Trends

Latin America healthcare predictive analytics market is anticipated to grow at a significant CAGR over the forecast period. This can be attributed to the increasing adoption of technology in maintaining patient health records, growing awareness about AI technologies, increasing government spending, and collaboration activities.

Middle East And Africa Healthcare Predictive Analytics Market Trends

Middle East and Africa healthcare predictive analytics market is expected to grow at a significant CAGR over the forecast period. This can be attributed to technological advancements, rising healthcare expenditures, and favorable government policies. For instance, in October 2023, the UAE Ministry of Health and Prevention (MoHAP) launched the Centre of Excellence for AI in healthcare, aiming at health data digitalization, integrating smart technologies to develop health capacities, and using big data for predictive analysis.

Key Healthcare Predictive Analytics Company Insights

Key players operating in the healthcare predictive analytics market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships play a key role in propelling the market growth.

Key Healthcare Predictive Analytics Companies:

The following are the leading companies in the healthcare predictive analytics market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Verisk Analytics, Inc.

- McKesson Corp.

- SAS

- Oracle

- Allscripts (now Veradigm)

- Optum, Inc.

- MedeAnalytics, Inc.

- INFRAGISTICS

- Cloudera

- Health Catalyst

- IQVIA Inc

- Inovalon

- OSP

- ClosedLoop

Recent Developments

-

In August 2024, Innovacer launched a Government Health AI Data and Analytics Platform (GHAAP) focusing on Public Health and Medicaid Modernization. This platform improves the unifying clinical and non-clinical data while leveraging built-in AI to drive progressive health IT outcomes and transformation.

“With the launch of GHAAP, Innovaccer is addressing the long-standing challenges of data fragmentation in the public healthcare sector. Our platform’s ability to unify diverse data sources and support AI-driven insights marks a significant step forward. This integration facilitates a more cohesive approach to healthcare, allowing for better management of Medicaid operations and public health initiatives. The future of public sector healthcare lies in the ability to harness and operationalize data effectively, and GHAAP is designed to do just that.”

- Former Medicaid Director in Texas and Arizona.

-

In May 2024, Cohere Health introduced early trend signal intelligence for predicting medical utilization. This enables health plans to anticipate shifts in their medical loss ratio and prepare for potential increases in utilization and associated costs.

-

In December 2023, Guidehealth acquired Arcadia’s managed service organization and value-based care service division to expand its tools and services for providers, focusing on developing predictive analytics tools.

"It's a cloud-based solution that allows our 'healthguides' to use generative AI risk predictive models in engaging patients and coordinating their care. And, where the coordination opportunity that we have recognized and pushed forward on with this acquisition is to harness the capabilities of an MSO to help with the referrals, scheduling, prior auths and utilization management, and then add a number of AI solutions and a lot of data infusion to create the right connections between the community access and the centralized resources of the MSO.”

- chief technology officer at Guidehealth

-

In October 2023, ClinIntell launched CDI 2.0, focusing on improving hospital documentation with predictive analytics.

-

In March 2020, the Health Data Analytics Institute (HDAI) raised USD 16 million to launch an AI API, expanding its clinical prediction service access.

Healthcare Predictive Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.49 billion

Revenue forecast in 2030

USD 67.26 billion

Growth rate

CAGR of 24.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

IBM; Verisk Analytics, Inc.; McKesson Corp.; SAS; Oracle;

Allscripts (now Veradigm); Optum, Inc.; MedeAnalytics, Inc.; INFRAGISTICS; Cloudera; Health Catalyst; IQVIA Inc; Inovalon; OSP; ClosedLoop

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Healthcare Predictive Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare predictive analytics market report based on application, end-use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Operations Management

-

Demand Forecasting

-

Workforce Planning and Scheduling

-

Inpatient Scheduling

-

Outpatient Scheduling

-

-

Financial

-

Revenue Cycle Management

-

Fraud Detection

-

Other Financial Applications

-

-

Population Health

-

Population Risk Management

-

Patient Engagement

-

Population Therapy Management

-

Other Applications

-

-

Clinical

-

Quality Benchmarking

-

Patient Care Enhancement

-

Clinical Outcome Analysis and Management

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Payers

-

Providers

-

Life Science Industry

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare predictive analytics market size was estimated at USD 14.58 billion in 2023 and is expected to reach USD 18.49 billion in 2024.

b. The global healthcare predictive analytics market is expected to grow at a compound annual growth rate of 24.02% from 2023 to 2030 to reach USD 67.26 billion by 2030.

b. The financial segment dominated the healthcare predictive analytics market with a share of 35.5% in 2023. This is attributable to the fact that this system saves costs for private and public medical organizations through fraud prevention and proper payment management of claims.

b. Some key players operating in the healthcare predictive analytics market include IBM, Cerner Corporation; Verisk Analytics, Inc.; McKesson Corporation; SAS; Oracle; Allscripts; Optum, Inc.; and MedeAnalytics, Inc.

b. Key factors that are driving the healthcare predictive analytics market growth include pressure to contain soaring health-care costs, introduction of advanced analytics, and increasing demand for personalized medication.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.