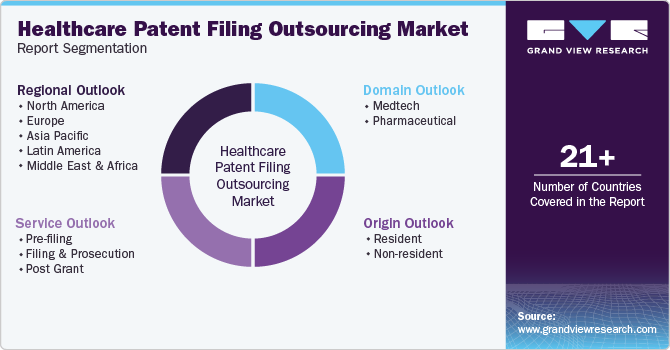

Healthcare Patent Filing Outsourcing Market Size, Share & Trends Analysis Report By Domain, By Service (Pre-filing, Filling & Prosecution, Post Grant), By Origin (Resident, Non-resident), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-333-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

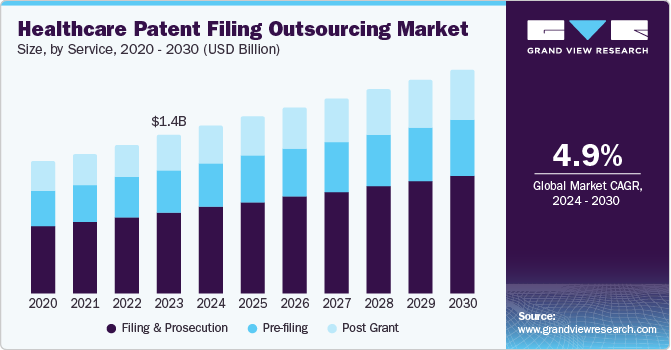

The global healthcare patent filing outsourcing market size was estimated at 1.38 billion in 2023 and is expected to expand at a CAGR of 4.9% from 2024 to 2030. Pharmaceutical and biotechnology companies invest significant funds in research & development for innovative medicines and medical devices that deliver positive results for patients. The growing innovation in medical devices and robust pharmaceutical and biopharmaceutical product pipelines propels the market growth.

The number of patent applications by these companies has increased in recent years. According to the information by the European Patent Office, it received a total of 15985 patent applications in the medical technology sector in 2023. To reduce costs and improve operational efficiency, many of these companies chose to outsource their patent application processes to third-party service providers, which has increased the demand for medical patent application outsourcing services.

Many pharmaceutical and biotechnology companies such as AbbVie, AGC Biologics, Amgen, Novartis, and Thermo Fisher Scientific are investing substantially in new manufacturing facilities worldwide and expanding their operations abroad to enter new markets and expand their customer base. As a result, there is an increased demand for medical patent application outsourcing services, as these companies need expert guidance to navigate the complex patent laws and regulations of different countries.

The market is witnessing significant growth due to increasing investment in healthcare research and development, leading to increased healthcare applications requiring patent protection. Medtronic inaugurated its newly expanded state-of-the-art MEIC in Hyderabad, India to expand its global R&D footprint and invest in the local innovation ecosystem.

Major trends shaping the market include increasing adoption of artificial intelligence and machine learning tools in patent research and analysis, growing demand for expertise in emerging healthcare sectors, emphasis on patent quality and strategic portfolio management, and expansion of patent services, commercialization, technology, and transmission support. The acceleration of healthcare innovations, the need for cost-effective patent services, and the globalization of healthcare companies indicate the growth factors.

Domain Insights

The pharmaceutical segment dominated the market and accounted for the largest revenue share of 50.4% in 2023 due to the increasing investments by the pharmaceutical industry in research and development to develop new drugs, treatments, and innovative health solutions. Pfizer, one of the pharmaceutical companies, invested USD 11.4 billion in research and development in 2022, with a significant portion for developing novel therapies and enhancing existing treatments across various therapeutic areas, including oncology, immunology, and rare diseases.

The medtech segment market is highly competitive and is projected to witness a steady CAGR in the forecast period. The medtech segment is further sub-segmented into assistive care devices, consumables and disposables, diagnosis and imaging devices, drug delivery devices, surgical devices, and wearable medical devices. The wearable medical devices segment is expected to expand rapidly over the forecast period due to the mounting demand for such devices in telehealth services and improving health consciousness among people.

Service Insights

The filing and prosecution segment dominated the healthcare patent filing outsourcing market and accounted for the largest revenue share of 51.9% in 2023 attributed to the company complexity associated with filing and prosecution coupled with cost-efficiency by outsourcing such tasks. In-house filing and prosecution can also consume more than the required time for internal resources. Therefore, the time savings in filing and processing activities offered by medical outsourcing companies will boost the segment growth during the forecast period.

The pre-filing segment is likely to witness a significant CAGR over the forecast period. Pre-filing is a crucial step in patent filing, as it requires due diligence before filing a patent. If the filing steps are done unprofessionally and without being competent in the patent processes, the procedures can be reapplied, which is mostly a time-consuming process for business organizations. Therefore, the demand for competency and professional service highlights the need for pre-filing services.

Origin Insights

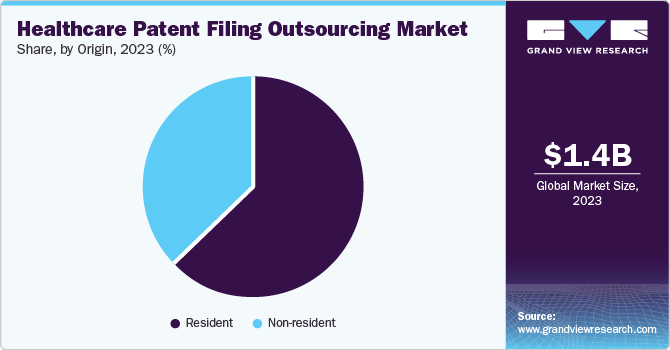

The resident segment dominated the market and accounted for the largest revenue share of 63.2% in 2023. Approximately 70% of the overall patents registered in the WIPO repository are resident patents. The resident segment is a crucial component of the market. This segment refers to the outsourcing of patent filing and prosecution activities to service providers located within the client’s location, region, and country. Many healthcare companies prefer to work with resident outsourcing partners due to their familiarity with local patent laws, regulations, and language requirements.

The non-resident segment is projected to expand with a steady CAGR over the forecast period. The popularity of this segment has grown as a result of the healthcare industry's expanding global reach and the demand for extensive patent safeguarding in multiple markets. Also, with the help of local patent outsourcing firms and the know-how of local regulations is beneficial for applicants to get a patent in another country. Such factors contribute to the growth of non-resident segment over the forecast period.

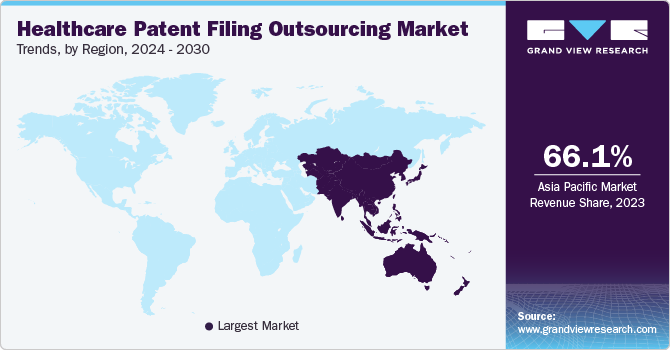

Regional Insights

North America accounted for a significant revenue share in 2023. Healthcare companies possess cutting-edge technologies, research facilities, and financial resources, which empower them to conduct extensive research and development endeavors. Companies frequently opt to delegate their patent filing procedures to specialized service providers in order to streamline operations, cut down on expenses, and capitalize on the expertise in patent prosecution.

U.S. Healthcare Patent Filing Outsourcing Market Trends

The healthcare patent filing outsourcing market in the U.S. dominated North America in terms of revenue share in 2023. Due to the strong presence of pharmaceutical, biotechnology, and medical device industries in the country, the need for outsourcing patent filing and prosecution services is steadily increasing.

Asia Pacific Healthcare Patent Filing Outsourcing Market Trends

Asia Pacific dominated the global market and accounted for the largest revenue share of 66.1% in 2023. The region is home to several emerging economies with rapidly growing healthcare industries. The number of patents filed in the medical device technology sector by countries across the globe has witnessed exponential growth for certain nations. China, India, and Japan are the top three countries to account for the maximum number of patents filed in the recent years.

Europe Healthcare Patent Filing Outsourcing Market Trends

The Europe healthcare patent filing outsourcing market is expected to witness a steady CAGR driven by the well-established pharmaceutical and biotech industries. The Europe healthcare patent filing outsourcing market is growing significantly due to the region’s strong focus on innovating new patent technologies. The demand for outsourcing services is increasing due to the presence of pharmaceutical manufacturers. This is expected to drive market growth in the forecast period.

Key Healthcare Patent Filing Outsourcing Company Insights

This market is highly fragmented in nature with a significant number of patent outsourcing firms. Most market participants are privately owned. Some of the major players in the market include Clarivate, ipMetrix, Synoptic IP Pvt Ltd, and others.

-

Clarivate is a global information and analytics company. The company offers a wide range of products and services including scientific and academic research, patent intelligence, trademark protection, and domain management. Some of its key offerings include Web of Science, a platform for scientific and scholarly research; Derwent Innovation, a patent intelligence solution; CompuMark, for trademark searching and protection; and MarkMonitor, for online brand protection.

-

Synoptic IP PVT LTD is a technology company specializing in innovative solutions for intellectual property management and protection. The company offers a wide range of products and services to support businesses in protecting their intellectual assets. Their offerings include IP management software, patent and trademark monitoring services, and strategic advisory for IP portfolio development.

Key Healthcare Patent Filing Outsourcing Companies:

The following are the leading companies in the healthcare patent filing outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Clarivate

- ipMetrix

- CRJ IPR SERVICES LLP

- Patent Outsourcing Limited Trading as Patent Outsourcing.

- Synoptic IP PVT LTD

- Dennemeyer Group

- POWELL GILBERT

- Bristows LLP

- HOYNG ROKH MONEGIER

- CARPMAELS & RANSFORD LLP

Recent Developments

- In July 2024, Clarivate Plc a global provider of transformative intelligence, acquired Rowan TELS Corp. Under this acquisition, Clarivate will expand its workflow automation solutions, intelligence capabilities, IP management resulting in all-inclusive and integrated solutions to facilitate, filing, prosecution, and patent preparation.

Healthcare Patent Filing Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.46 billion |

|

Revenue forecast in 2030 |

USD 1.94 billion |

|

Growth Rate |

CAGR of 4.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Domain, service, origin, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy ; Spain; Norway; Sweden; Denmark; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; UAE; Saudi Arabia; South Africa; Kuwait |

|

Key companies profiled |

Clarivate; ipMetrix CRJ IPR Services LLP; Patent Outsourcing Limited; Synoptic IP PVT LTD; Dennemeyer Group; POWELL GILBERT; Bristows LLP; HOYNG ROKH MONEGEIER; CARPMAELS & RANSFORD LLP |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Patent Filing Outsourcing Market Report Segmentation

This report forecasts revenue growth on a global, regional and country level and analyzes the latest trends in each sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare patent filing outsourcing market on the basis of domain, service, origin, and region

-

Domain Outlook (Revenue, USD Million, 2018 - 2030)

-

Medtech

-

Assistive Care Devices

-

Consumables and Disposables

-

Diagnosis and Imaging Devices

-

Drug Delivery Devices

-

Surgical Devices

-

Wearable Medical Devices

-

-

Pharmaceutical

-

-

Service Outlook (Revenue, USD Million, 2018- 2030)

-

Pre-filing

-

Filing & Prosecution

-

Post Grant

-

-

Origin Outlook (Revenue, USD Million, 2018 - 2030)

-

Resident

-

Non-resident

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."