Healthcare Mobile Application Market Size, Share & Trends Analysis Report By Type, By Platform (Android, iOS), By Technology (AI-enabled, Non-AI-enabled), By End-use (Consumer, Hospitals/Healthcare Providers), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-109-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Healthcare Mobile Application Market Trends

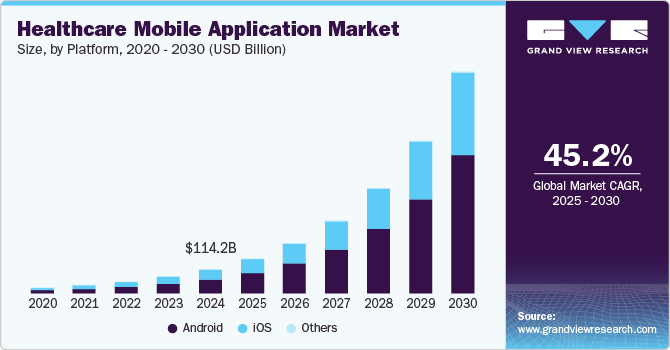

The global healthcare mobile application market size was valued at USD 114.18 billion in 2024 and is projected to grow at a CAGR of 45.2% from 2025 to 2030. The rise in smartphone penetration and the increasing demand for digital health solutions have made healthcare more accessible to a broader audience. This shift has been further accelerated by the COVID-19 pandemic, which prompted many healthcare providers to adopt telemedicine and other digital services to minimize in-person visits. In addition, the growing prevalence of chronic diseases has led to an increasing focus on preventive care and self-management, driving the adoption of mobile health applications among patients and healthcare professionals alike.

The continuous advancement of technology, particularly in artificial intelligence and machine learning, enhances the functionality of these applications, allowing for more personalized patient experiences. Furthermore, the integration of wearable devices with mobile applications is anticipated to improve health monitoring and data collection, enabling users to manage their health more effectively. As healthcare systems increasingly prioritize patient-centered care models, the demand for mobile applications that facilitate communication between patients and providers is likely to grow.

As awareness around mental health issues rises, there is a growing market for applications focused on mental well-being, offering services such as therapy sessions and mindfulness exercises. In addition, government initiatives aimed at expanding digital health services contribute to market growth by promoting the adoption of mobile health technologies across various demographics. This combination of technological innovation and societal shifts towards holistic health management is expected to sustain robust growth in the healthcare mobile application industry over the coming years.

Type Insights

The fitness products and training segment dominated the market with a share of 34.3% in 2024. This can be attributed to the increasing consumer focus on health and wellness, alongside a growing trend towards fitness tracking and personalized training programs. Mobile applications that offer tailored workout plans, nutrition tracking, and community support have gained popularity among fitness enthusiasts. For instance, the Fitbit mobile application provides real-time health insights, syncing effortlessly with Fitbit devices via Bluetooth. It consolidates key health metrics, such as step counts and sleep patterns, into a user-friendly interface. In addition, the rise of social media platforms has further fueled interest in fitness, as users share their progress and motivate each other through these applications.

The online pharmacy segment is projected to grow at the highest CAGR during the forecast period, driven by the convenience of accessing medications online, especially as consumers seek efficient ways to manage their health. The COVID-19 pandemic accelerated the shift towards digital healthcare solutions, making online pharmacies more appealing for individuals looking to avoid in-person visits. Furthermore, features such as home delivery services and automatic prescription refills enhance user experience, contributing to the anticipated expansion of this segment within the healthcare mobile application industry.

Platform Insights

The android segment dominated the market with the largest revenue share in 2024 due to the widespread use of Android devices globally, which provide users with diverse application options and functionalities. The platform's flexibility allows developers to create various healthcare solutions tailored to different user needs, including fitness tracking, telemedicine, and medication management applications. Furthermore, Android's open-source nature encourages innovation among developers, leading to a rich ecosystem of apps that cater to various demographics.

The iOS segment is projected to grow at a significant CAGR during the forecast period, driven by a loyal customer base that values quality and security in mobile applications. iOS users are often willing to invest in premium applications that offer advanced features and superior user experiences. The stringent app review process on the Apple App Store ensures that only high-quality applications are available, which enhances consumer trust in iOS healthcare solutions. In addition, as developers increasingly focus on creating innovative health applications that leverage Apple's HealthKit framework and other integrated technologies, the appeal of iOS for health-conscious consumers is likely to rise.

Technology Insights

The non-AI-enabled segment dominated the market with the largest revenue share in 2024. Many existing applications focus on traditional functionalities without incorporating artificial intelligence, appealing to users who prefer straightforward solutions for their health management needs. These applications often provide essential features such as appointment scheduling, basic health tracking, and educational resources without overwhelming users with complex technology.

The AI-enabled segment is expected to grow at the highest CAGR over the forecast period. Integrating artificial intelligence into healthcare mobile applications enhances personalization through tailored recommendations based on user behavior and preferences. AI technologies also facilitate predictive analytics that can identify potential health issues before they arise, empowering users to take proactive measures in managing their health. Moreover, natural language processing capabilities enable more intuitive interactions within these applications, making it easier for users to access information and support.

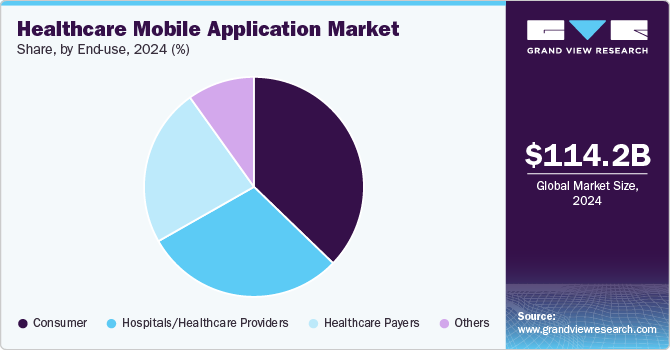

End-use Insights

The consumer segment dominated the market with the largest revenue share in 2024.The emphasis on consumer empowerment in healthcare drives demand for user-friendly applications that cater directly to individual needs. For instance, Walgreens Boots Alliance (WBA), in collaboration with Microsoft and Adobe, has created a digital healthcare and customer insights platform that provides users with a comprehensive view of their health. This initiative aims to unlock personalized healthcare and shopping experiences, focusing on daily health management and chronic care. Features such as personalized dashboards, goal-setting tools, and community support foster engagement among users while promoting healthier lifestyles.

The hospitals/healthcare providers segment is expected to grow at the fastest CAGR over the forecast period. Mobile applications facilitate real-time access to patient data, streamline administrative tasks, and enhance collaboration among medical teams. For instance, Cerner offers a range of health applications tailored to meet the specific needs of healthcare organizations, such as Cerner Millennium. These solutions are designed to enhance patient care and streamline workflows, ensuring that healthcare providers can deliver effective services efficiently. Furthermore, telehealth services integrated into these applications enable providers to reach patients remotely, improving access to care while reducing operational costs.

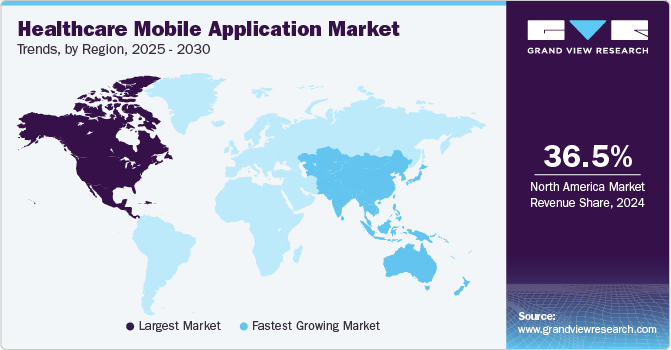

Regional Insights

North America healthcare mobile application market dominated the global market with a revenue share of 36.5% in 2024. The region's well-established healthcare infrastructure supports a robust ecosystem for digital health innovations, combined with high smartphone penetration rates that facilitate widespread adoption of mobile health solutions among consumers. In addition, favorable regulatory environments encourage investment in technology-driven healthcare initiatives while promoting interoperability among various systems.

U.S. Healthcare Mobile Application Market Trends

The U.S. healthcare mobile application market dominated the regional market in 2024. The country's advanced digital health ecosystem fosters innovation and investment in mobile health technologies across various sectors, including fitness tracking apps, chronic disease management tools, and telemedicine platforms. High levels of consumer awareness regarding health issues, coupled with increasing insurance coverage for telehealth services, contribute significantly to market growth.

Europe Healthcare Mobile Application Market Trends

Europe healthcare mobile application market is expected to grow at a significant CAGR from 2025 to 2030 due to increasing investments in digital health initiatives across various European countries aiming at improving patient care quality through technology integration into existing systems. Rising consumer demand for innovative health solutions such as remote monitoring tools or mental wellness apps drives developers toward creating versatile applications tailored specifically for European markets characterized by diverse regulatory requirements and cultural preferences regarding healthcare delivery methods.

For instance, the Digital Healthcare Act (DVG) aims to expedite patient access to innovative care by extending an approximately USD 206 million annual investment in an innovation fund. This legislation enables health insurance funds to support the development of patient-oriented digital innovations through targeted funding and participation in venture capital funds focused on health innovation.

Asia Pacific Healthcare Mobile Application Market Trends

Asia Pacific healthcare mobile application market is expected to grow at the highest CAGR from 2025 to 2030. Factors such as increasing smartphone adoption rates across developing nations, including India and Indonesia, drive this growth alongside improved internet connectivity, enabling broader access to digital health services. Governments are also investing heavily in digital health initiatives aimed at enhancing public health outcomes through technology integration.

China healthcare mobile application market dominated the Asia Pacific region in 2024, driven by rapid urbanization and technological advancements that have led to a surge in mobile app usage for health-related services. With a vast population increasingly reliant on smartphones for daily activities, including managing their health, Chinese consumers are turning towards digital platforms that offer convenience and accessibility.

Key Healthcare Mobile Application Company Insights

The healthcare mobile application market features several key players that shape its landscape. 8FIT offers personalized workout and nutrition plans, integrating fitness and dietary guidance. Epocrates, Inc. provides clinical decision support tools for healthcare professionals, giving access to drug information and medical guidelines. At the same time, MyFitnessPal, Inc. specializes in nutrition tracking, allowing users to log food intake and monitor dietary habits. Lifesum AB promotes healthier choices by offering customized meal plans and health insights based on individual preferences. These companies play a significant role in shaping the healthcare mobile application industry.

-

8FIT is a health and fitness application that provides users with personalized workout routines and meal plans, aiming to promote a holistic approach to wellness. The app features a variety of workouts, including HIIT, yoga, and Pilates, along with self-care guidance and progress-tracking tools. Available in multiple languages, 8FIT has gained significant traction globally, boasting millions of downloads and a focus on helping users build sustainable, healthy habits.

-

Epocrates, Inc. is a mobile application designed for healthcare professionals, offering essential clinical decision support tools. It provides access to comprehensive drug information, medical guidelines, and patient safety features such as drug interaction checks. Epocrates aims to enhance the quality of care by equipping clinicians with timely information at the point of care, thereby facilitating informed decision-making in clinical settings.

Key Healthcare Mobile Application Companies:

The following are the leading companies in the healthcare mobile application market. These companies collectively hold the largest market share and dictate industry trends.

- 8FIT

- Fitbit

- Nike, Inc.

- Johnson & Johnson Services, Inc.

- epocrates, Inc.

- Wolters Kluwer N.V.

- MyFitnessPal, Inc.

- Tata 1mg.

- Lifesum AB

- Cigna

Recent Development

-

In January 2025, Cipla Limited launched CipAir, an AI-powered mobile application designed to simplify asthma management. The app aims to help patients track their condition, adhere to treatment plans, and improve their overall quality of life. Cipairr offers personalized insights and support to empower individuals in effectively managing their asthma.

-

In December 2024, Intetics partnered with a leading manufacturer of ultrasound systems to revolutionize cardiac healthcare by launching an innovative mobile application. This solution offers real-time visualization alongside advanced parameter calculations, significantly improving efficiency and mobility for clinicians worldwide. The collaboration stemmed from the ultrasound company’s need for specialized expertise in developing medical mobile applications. Intetics employed its Remote In-Sourcing model to collaborate closely with the client’s clinical team, ensuring the application integrates seamlessly with healthcare workflows.

Healthcare Mobile Application Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 165.61 billion |

|

Revenue forecast in 2030 |

USD 1,070.58 billion |

|

Growth rate |

CAGR of 45.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion/trillion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, platform, technology, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa |

|

Key companies profiled |

8FIT; Fitbit; Nike, Inc.; Johnson & Johnson Services, Inc.; epocrates, Inc.; Wolters Kluwer N.V.; MyFitnessPal, Inc.; Tata 1mg.; Lifesum AB; Cigna |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Mobile Application Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare mobile application market report based on type, platform, technology, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Appointment Booking and Consultation

-

Online Pharmacy

-

Diagnosis and Testing

-

Fitness Products and Training

-

Nutrition & Diet

-

Healthcare Insurance

-

Remote Patient Monitoring

-

Others

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

AI-enabled

-

Non-AI-enabled

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer

-

Hospitals/Healthcare Providers

-

Healthcare Payers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."