Healthcare Education Market Size, Share & Trends Analysis Report By Provider, By Application (Academic Education, Cardiology), By Delivery Mode, By End-use (Physicians, Non-physicians), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Healthcare Education Market Size & Trends

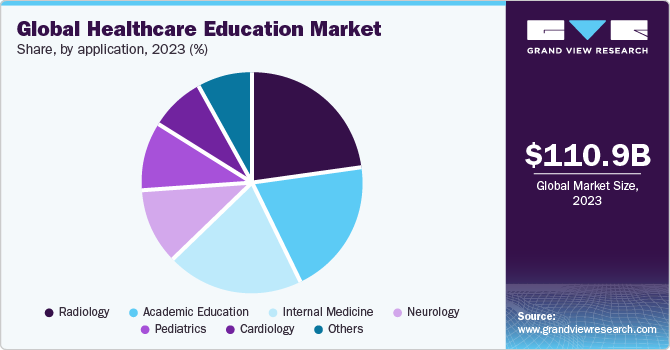

The global healthcare education market size was estimated at USD 110.95 billion in 2023 and is projected to grow at a CAGR of 13.3% from 2024 to 2030, driven by technological advancements such as e-learning, AI, and VR, which offer flexible and immersive learning experiences. The increasing demand for healthcare professionals due to an aging population and the need for pandemic preparedness, along with government and institutional support through policy initiatives and funding, is enhancing educational infrastructure and standardization.

Globalization, through international partnerships and cross-border education, is further expanding access to high-quality training. Additionally, the focus on continuous professional development and the emphasis on specialization and advanced degrees are fueling the market's growth. Increased awareness and emphasis on public health have led to the expansion of public health programs and initiatives to address global health challenges such as pandemics and non-communicable diseases.

The rise of interdisciplinary and integrated curricula, which adopt a holistic approach to healthcare education by integrating various fields such as medicine, nursing, pharmacy, and allied health sciences, has significantly contributed to the market growth. Regulatory requirements and the pursuit of professional growth have fueled the expansion of Continuing Medical Education (CME) and Continuing Professional Development (CPD) programs, ensuring that healthcare professionals maintain their licenses and stay updated with the latest advancements.

Additionally, the shift towards patient-centered care and personalized medicine requires training that emphasizes communication skills, and patient engagement. The growth of online and hybrid educational models has made healthcare education more accessible and flexible, catering to diverse learning needs. The emergence of new medical specialties and the focus on advanced certifications are driving the demand for specialized educational programs. Collaboration with the healthcare industry ensures that curricula are aligned with current standards and technological advancements, while improvements in educational technology, such as AI-powered tutoring systems and interactive e-books, have enhanced the quality and effectiveness of healthcare education. Simulation-based learning provides realistic, hands-on training, further preparing healthcare professionals for complex clinical scenarios.

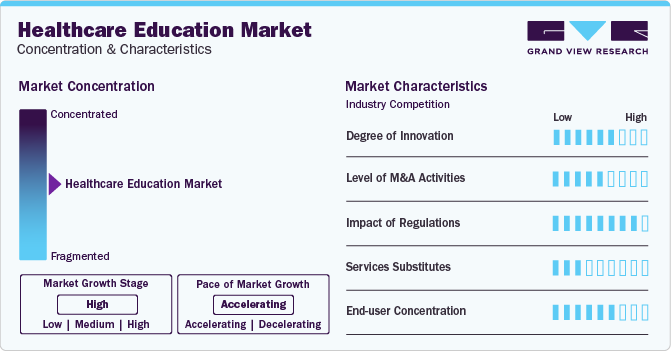

Market Characteristics & Concentration

The market growth stage is high, driven by technological integration, simulation-based learning, and interdisciplinary curricula. Advanced e-learning platforms, VR, AR, and AI tools provide flexible, immersive, and personalized learning experiences.The focus on continuous professional development (CPD) through online programs, microlearning, and modular courses ensures healthcare professionals stay updated with the latest advancements.

The healthcare education market experiences moderate M&A activity due to its diverse players, including universities, online providers, and specialized training companies, creating consolidation opportunities.

The market faces increasing regulatory scrutiny to ensure quality, safety, and compliance. Institutions have to adhere to stringent accreditation standards and obtain program approval from regulatory bodies. Graduates must meet professional licensing requirements, and continuing education providers are monitored for quality.

The market experiences a moderate threat of substitutes due to the availability of alternative education formats such as online platforms and simulation-based training. Competing models such as internships and self-paced learning also contribute to this threat.

End-user concentration significantly impacts the market, influencing demand and preferences. The population of students, healthcare professionals, and organizations in specific regions or sectors drive demand for tailored programs and services. Providers strategically target these segments for revenue potential, customizing offerings to meet their needs.

Providers Insights

The universities and academic centers segment led the market and accounted for 31.0% in 2023.The segment's growth is attributed to its established reputation for academic excellence and credibility, drawing in students and professionals seeking top-tier educational programs. Offering a comprehensive curriculum, they uphold stringent accreditation standards, ensuring program quality and growing confidence among students and employers. Additionally, serving as hubs for research and innovation, these institutions foster collaboration with industry partners, driving advancements in medical science and enriching the educational experience.

The medical simulation segment is poised for significant growth over the forecast period due to continuous advancements in simulation technology. Innovations such as VR, AR, and haptic feedback systems are enhancing realism and effectiveness, leading to better learning outcomes. Simulations offer hands-on experience in a safe environment, bridging classroom learning with real-world practice and improving clinical competency. They also contribute to patient safety by allowing learners to practice procedures and teamwork without risk. Simulations promote collaboration among healthcare disciplines, aiding in CPD and competency assessment while facilitating interprofessional education. Despite initial investment costs, simulations offer long-term savings and scalability, making them a cost-effective training solution for healthcare education.

Application Insights

The radiology segment accounted for the largest market revenue share in 2023, emphasizing its essential role in modern healthcare for diagnostic imaging and treatment planning across various medical specialties. With increasing demand for radiology services, there is a need for well-trained professionals proficient in interpreting medical images and utilizing advanced imaging technologies. Technological advancements in imaging, such as AI-enhanced imaging and molecular imaging, drive the evolution of radiology education to ensure students are equipped with the latest techniques and tools. Radiology education directly impacts patient care by training professionals to accurately interpret images, diagnose diseases, and guide treatment decisions, making radiologists and radiologic technologists’ essential members of multidisciplinary care teams.

The cardiology segment is positioned for substantial growth due to the increasing prevalence of cardiovascular diseases globally. With advancements in cardiovascular medicine and technology, healthcare professionals require up-to-date skills to manage complex cases. Specialization in various cardiology subspecialties, emphasis on prevention, and a multidisciplinary approach emphasize the need for cardiovascular care. Integration of digital health and telemedicine further enhances accessibility and patient engagement. Thus, educational programs focus on evidence-based practices, research, and innovation to equip healthcare professionals with the necessary expertise to address the growing challenges in cardiovascular health effectively.

End-use Insights

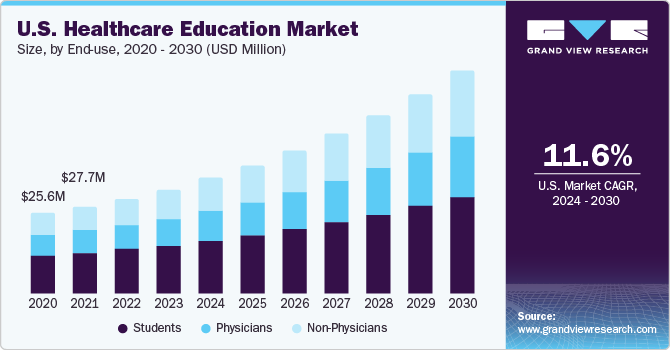

The students segment accounted for the largest market revenue share in 2023, owing to the high demand for healthcare education fueled by the industry's growth. Aspiring healthcare professionals seek quality education and training with diverse educational pathways available, including undergraduate, professional, and postgraduate programs; thus, institutions cater to students' interests and career aspirations. Admissions to healthcare programs are competitive, emphasizing the value placed on education for securing future opportunities. Additionally, lifelong learning and continuing education are essential for healthcare professionals to maintain license, certification, and competency throughout their careers, with institutions offering various programs to meet their ongoing educational needs.

The non-physician segment is poised for significant growth as non-physician healthcare professionals, including nurses, physician assistants, and pharmacists, take on increasingly vital roles in healthcare delivery. With expanding responsibilities and scope of practice, these practitioners are filling essential gaps in care delivery, particularly in areas facing workforce shortages. Emphasis on interprofessional education, advanced practice training, and specialization prepares non-physician practitioners to meet the evolving healthcare needs of diverse patient populations, with a focus on population health, preventive care, and specialized expertise in high-demand areas.

Delivery Mode Insights

The classroom-based courses segment dominated the market in 2023, due to its advantages in providing hands-on learning experiences, interpersonal interaction, and clinical simulation. These courses foster practical skills development, interpersonal communication, and teamwork essential for healthcare professionals. In classroom courses, simulation-based training and skills labs create a supportive learning environment. Instructors offer personalized instruction and real-time feedback. Peer-to-peer interaction promotes collaborative learning and community engagement, while contextual learning enhances awareness and patient-centered care delivery.

The e-learning solutions segment is poised for significant growth, as it offers healthcare professionals and students with accessibility, flexibility, and diverse learning resources. Learners benefit from self-paced education, interactive modules, and personalized learning pathways, fostering engagement and knowledge retention. With scalability and adaptability, e-learning reaches a wide audience globally, catering to individual needs and proficiency levels. Leveraging technological innovations such as AI, VR, and mobile apps, e-learning platforms provide immersive learning experiences and facilitate continuous professional development. Compliance with industry standards and accreditation criteria ensures the integrity and quality of educational content, enhancing learners' career prospects and credibility in the healthcare sector.

Regional Insights

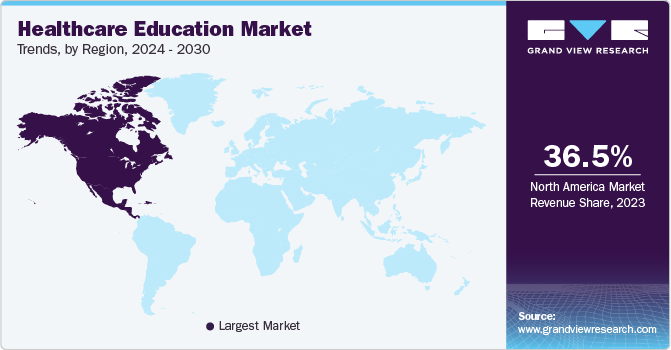

North America dominated the market and accounted for the largest share 36.5% in 2023, driven by its advanced healthcare infrastructure and high investment in education and training. The region's top-tier hospitals, medical schools, and research institutions create a clinical training environment with access to cutting-edge technology and diverse patient populations. Significant funding from both the public and private sectors supports a wide range of educational initiatives, making healthcare education more accessible. Additionally, the strong emphasis on continuing medical education (CME) ensures that healthcare professionals maintain licensure and stay updated with medical advancements, further driving the market growth.

U.S. Healthcare Education Market Trends

The market in the U.S. is expected to grow substantially over the forecast period. The country's growth is attributed to the presence of renowned institutions such as Harvard Medical School, Johns Hopkins University, and The University of Pennsylvania. These leading schools draw students from around the world, significantly boosting market revenue and reinforcing the country's reputation as a center for high-quality healthcare education.

Europe Healthcare Education Market Trends

Healthcare education is gaining traction in Europe as the region's aging population is driving the need for a larger, well-trained healthcare workforce to address age-related health issues and chronic diseases. European institutions are incorporating advanced technologies such as VR, AR, and simulation-based training to enhance learning and clinical preparedness. Significant government investment, through initiatives like the EU's Horizon 2020 and Horizon Europe programs, supports healthcare education and innovation.

The UK healthcare education market is expected to grow significantly over the forecast period. The NHS Workforce Development Initiatives, including the NHS Long Term Plan and NHS People Plan, aim to expand and train the healthcare workforce, which is driving the country's growth in healthcare education.

France's healthcare education market is expected to grow substantially over the forecast period. The country is establishing new medical schools, expanding existing ones, such as in Caen and Amiens, and increasing enrollment capacities. Interprofessional education is being emphasized, with institutions such as the University of Lyon promoting collaborative training. Additionally, the French National Health Strategy supports interprofessional education to improve teamwork and patient care.

The healthcare education market in Germany held the largest share of the Europe market driven by government support and funding. The federal and state governments invest heavily in healthcare education, with initiatives such as the Excellence Initiative and grants from the German Research Foundation (DFG) supporting top universities and research programs.

Asia Pacific Healthcare Education Market Trends

Asia Pacific market represented a significant market share in 2023. Governments across the region, including China, India, and Japan, are prioritizing healthcare education through initiatives like "Healthy China 2030" and the National Health Policy in India. With more than half of the world's population residing in the region, there's a significant demand for healthcare services, leading to the expansion of medical and nursing schools. Countries such as Singapore and Australia are renowned for their high-quality healthcare education programs.

China's healthcare education market is poised for significant growth. The country is rapidly expanding its medical education infrastructure, establishing new schools, and enlarging enrollment capacities to address workforce shortages. Moreover, China is embracing advanced educational technologies such as VR and simulation-based training, with institutions like Peking University and Shanghai Jiao Tong University.

The healthcare education market in India is expected to grow substantially over the forecast period. Programs such as the National Health Mission and Skill India Mission prioritize accessible and quality healthcare services, leading to enhancements in healthcare education and training. The country is witnessing an expansion in medical colleges and health institutions to address workforce shortages, mainly in rural areas. Moreover, technological integration and innovation, including digital learning platforms and innovative teaching methods, are transforming healthcare education, making it more accessible and interactive for students across the country.

Japan's healthcare education market is expected to grow significantly over the forecast period, driven by key factors such as interprofessional education (IPE) and public health initiatives. The emphasis on collaborative training programs in Japan's healthcare education system promotes teamwork among students from diverse healthcare specializations, preparing them for effective collaboration in team-based care models.

Middle East & Africa (MEA) Healthcare Education Market Trends

The Middle East and Africa region is experiencing a surge in healthcare education. The region's growing healthcare infrastructure, fueled by significant investments, is creating a demand for skilled professionals, necessitating healthcare education and training programs. Government initiatives and policies, including national health strategies and public-private partnerships, are also contributing to the expansion of healthcare education.

The Kingdom of Saudi Arabia's healthcare education market is poised for modest growth, driven by the government's Vision 2030 initiative. With a focus on diversifying the economy and investing in sectors such as healthcare and education, Vision 2030 presents opportunities for the expansion of healthcare education. The Saudi government's Healthcare Transformation Program (HTP) aims to enhance healthcare services and infrastructure, thereby stimulating the demand for skilled professionals trained through education programs.

The healthcare education market in South Africa is expected to grow significantly over the forecast period due to rising demand for healthcare professionals, driven by a shortage of workers and a growing population. The expanding private healthcare sector is also fueling demand for well-trained staff, with many private institutions investing in education and training programs. Additionally, economic growth and increased investment in the healthcare sector are enhancing infrastructure, educational institutions, and resources for healthcare education.

Key Healthcare Education Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in January 2024, the Maharashtra University of Health Sciences (MUHS), in collaboration with the Koita Foundation, launched India's first foundation course on digital health designed for medical students. The course will cover hospital management information systems, health data collection using wearables and sensors, electronic medical records, and the application of artificial intelligence and machine learning in healthcare.

Key Healthcare Education Companies:

The following are the leading companies in the healthcare education market. These companies collectively hold the largest market share and dictate industry trends.

- Articulate Global Inc.

- Coursera Inc.

- Elsevier

- GE HealthCare.

- HealthStream

- Infor

- Koninklijke Philips N.V.

- Siemens Healthcare Private Limited

- Stryker

- symplr

Recent Developments

-

In March 2024, UNICEF, in collaboration with the IIT Bombay and the International Institute of Health Management Research, New Delhi, launched a 10-week 'Digital Health Enterprise Planning Course'. This course aims to empower healthcare professionals, including doctors, nurses, pharmacists, policymakers, and IT professionals, to lead the digital transformation of India's healthcare sector. The curriculum covers telemedicine, digital health interventions, health informatics, and cybersecurity, addressing the growing demand for digital health education.

-

In January 2024, Wolters Kluwer partnered with Kortext to launch the AI-powered Lippincott Medical Education eBook library. This AI-driven digital platform aims to transform access to medical educational resources for universities and students across India.

-

In October 2023, Northwestern University launched a new master’s degree program in Health Professions Education. This program aims to equip healthcare professionals with leadership skills in healthcare education and practice. It features in-person residencies covering topics such as mastery learning and simulation-based curriculum design.

Healthcare Education Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 124.71 billion |

|

Revenue forecast in 2030 |

USD 264.26 billion |

|

Growth rate |

CAGR of 13.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Providers, application, delivery mode, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, U.K., Germany, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, UAE, KSA, South Africa |

|

Key companies profiled |

Articulate Global Inc.; Coursera Inc.; Elsevier; GE HealthCare; HealthStream; Infor; Koninklijke Philips N.V.; Siemens Healthcare Private Limited; Stryker; symplr |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Education Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global healthcare education market report based on provider, application, delivery mode, end-use, and region.

-

Provider Outlook (Revenue, USD Billion, 2017 - 2030)

-

Continuing Medical Education Providers

-

Educational Platforms

-

Learning Management Systems

-

Universities and Academic Centers

-

OEMs/Pharmaceutical Companies

-

Medical Simulation

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Academic Education

-

Cardiology

-

Radiology

-

Neurology

-

Pediatrics

-

Internal Medicine

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Classroom-based Courses

-

E-learning Solutions

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Students

-

Physicians

-

Non-Physicians

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

U.A.E

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthcare education market size was estimated at USD 110.95 billion in 2023 and is expected to reach USD 124.71 billion in 2024.

b. The global healthcare education market is expected to grow at a compound annual growth rate of 13.3% from 2024 to 2030 to reach USD 264.26 billion by 2030.

b. North America dominated the market in 2023, accounting for over 35.0% share of the global revenue, driven by its advanced healthcare infrastructure and high investment in education and training.

b. Some key players operating in the healthcare education market include Articulate Global Inc.; Coursera Inc.; Elsevier; GE HealthCare; HealthStream; Infor; Koninklijke Philips N.V.; Siemens Healthcare Private Limited; Stryker; symplr.

b. Key factors driving the growth of the healthcare education market include the increasing adoption of digital learning and the growing demand for training due to continuous advancements in medical technology.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."