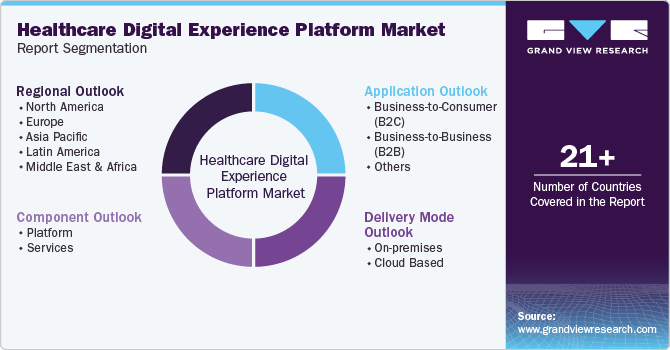

Healthcare Digital Experience Platform Market Size, Share & Trends Analysis Report By Component (Platform, Services), By Delivery Mode (On-premises, Cloud Based), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-821-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2020 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

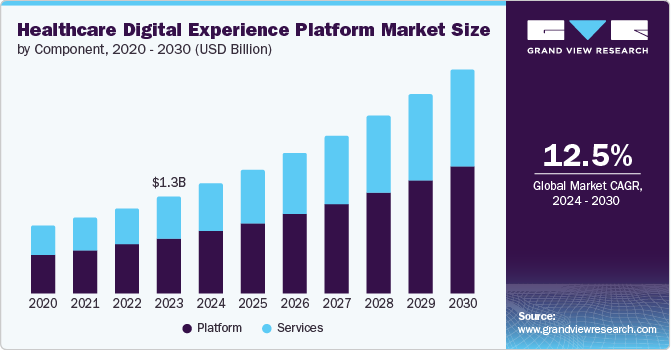

The global healthcare digital experience platform market size was valued at USD 1.26 billion in 2023 and is forecasted to grow at a CAGR of 12.5% from 2024 to 2030. The rising demand for digital experience platforms from healthcare providers and payer organizations to ensure process optimization is one of the key factors driving the market. The growing complexity of management tasks and ever-demanding consumers has led healthcare payers to deliver a seamless, end-to-end patient experience. Keeping in line with the holistic view of each patient, the healthcare digital experience platform acts as an integrated solution capable of delivering streamlined sales, service, and marketing. These platforms emphasize financial efficiency and patient engagement. These platforms can be customized or personalized to meet the demands of these organizations, wherein payers decide to implement these solutions at full scale.

The rising demand for digital experience platforms from healthcare providers and payer organizations to ensure process optimization is one of the key factors driving the market. For instance, in June 2024, Weave, a software company known for helping small and mid-sized healthcare businesses, has expanded its offerings with a new platform designed specifically for larger healthcare groups and enterprises. This new solution aimed to help multi-location practices, such as dental service organizations (DSOs), veterinary, vision, and medical groups, increase efficiency, standardize operations, and accelerate revenue cycle management.

The increasing complexity of management tasks and the rising demands of consumers have compelled healthcare payers to provide a seamless, end-to-end patient experience, ultimately driving the healthcare digital experience platform. For instance, in April 2024, Innovaccer Inc. launched the Healthcare Experience Platform (HXP), a comprehensive AI-powered solution to enhance patient engagement and drive revenue growth. This announcement followed Innovaccer's acquisition of Cured, to accelerate innovation to improve patient experiences and outcomes.

Aligned with a holistic view of each patient, the healthcare digital experience platform is an integrated solution that streamlines sales, service, and marketing, ultimately driving the overall healthcare digital experience. For instance, in July 2021, Cognizant and Koninklijke Philips N.V. announced a collaboration to develop end-to-end digital health solutions to improve patient care and accelerate clinical trials for healthcare organizations and life sciences companies. Philips and Cognizant teamed up to create powerful digital health tools. Philips brought their HealthSuite cloud platform, while Cognizant offered their digital engineering skills. This combined effort led to scalable solutions that better connect devices, use big data for valuable insights and ultimately deliver advanced healthcare options.

Component Insights

The platform segment dominated the revenue share with 57.6% in 2023, driven by the increasing digitalization trend. The growing demand for personalized patient experiences is a significant driver propelling the segment within the market. As healthcare organizations prioritize patient-centered care, these platforms enable tailored interactions, personalized content delivery, and customized healthcare services. This trend not only enhances patient satisfaction but also improves engagement and outcomes, driving the adoption and advancement of digital experience platforms in healthcare. For instance, in September 2023, Mercy and Microsoft established a long-term collaboration focused on leveraging generative AI and other digital technologies to enable healthcare providers such as physicians, advanced practice providers, and nurses to dedicate more time to patient care and enhance the overall patient experience. This initiative signified the future of healthcare, where advanced digital solutions were employed to improve care delivery for consumers.

The services segment is expected to grow at the fastest CAGR over the forecast period. The demand for integrated and streamlined healthcare solutions is a significant driver fueling growth in the services segment of the healthcare digital experience platform market. These solutions enable healthcare providers to consolidate various aspects of patient care, such as electronic health records (EHR), patient management, and telemedicine, into cohesive platforms. By enhancing efficiency, interoperability, and the overall patient experience, integrated healthcare solutions supported by digital experience platforms are increasingly becoming essential for healthcare organizations aiming to optimize operations and improve clinical outcomes. For instance, in March 2024, Doceree launched its technology to empower healthcare providers to enhance care quality and improve patient outcomes. Spark utilized advanced patented technology, clinical data, and AI-driven triggers to seamlessly integrate clinically relevant communications into existing clinical workflows in real-time. Leveraging Doceree's patented trigger technology, Spark's innovative suite addressed key healthcare challenges such as patient affordability, drug adherence, patient recruitment for clinical trials, and effective clinical messaging on pharmaceutical innovations.

Delivery Mode Insights

The cloud-based segment dominated the market in terms of revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period, the cloud-based delivery mode emerged as the leading choice, driven by the increasing demand for cloud technology in various healthcare organizations. This trend is primarily due to the need for secure information sharing, cost streamlining, operational efficiency improvement, and enhanced patient services. For instance, in January 2024, Benenden Health, a non-profit healthcare provider, partnered with Sabio Group to upgrade their member experience. They implemented Genesys Cloud, a cloud-based system, allowing them to connect with members through various digital channels. This improved service offers personalization and greater efficiency.

The demand for customized solutions that cater to specific organizational requirements drives the on-premises segment. This necessity arises from healthcare providers seeking tailored digital solutions that can be closely integrated with existing infrastructure and workflows, ensuring seamless operations and compliance with regulatory standards. Customization enables organizations to effectively address unique clinical and administrative needs, enhancing efficiency and optimizing patient care delivery within controlled IT environments.

Application Insights

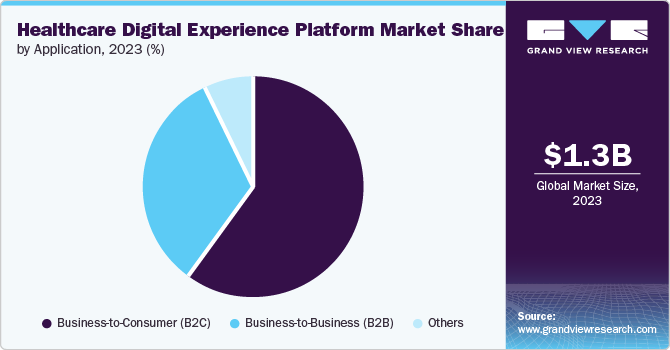

In 2023, the Business-to-Consumer (B2C) segment dominated the market in terms of revenue share. The rising adoption of integrated healthcare solutions among providers and payers is a significant driver propelling the business-to-business (B2B) segment within the healthcare digital experience platform market. This trend is driven by the need for seamless interoperability and data exchange across healthcare networks, enabling efficient collaboration and communication. Integrated platforms support providers and payers in optimizing workflows, improving care coordination, and enhancing operational efficiency, thereby driving the demand for B2B solutions that facilitate comprehensive healthcare management and delivery. For instance, in April 2023, Virgin Pulse, a well-being engagement and digital health company, entered a partnership with Cigna Healthcare, the health benefits division of The Cigna Group. This collaboration aimed to deliver a more connected and personalized health experience, benefiting approximately 11 million customers. The platform, accessible via myCigna, underscored Cigna Healthcare's dedication to empowering individuals and entire workforces to improve health decisions and foster healthier habits throughout their wellness journeys.

The business to consumer (B2C) segment is expected to grow at the significant rate over the forecast period due to the healthcare consumers seeking tailored, user-centric interactions and services that cater to their specific health needs and preferences. Digital experience platforms are increasingly designed to offer personalized content, treatment plans, and communication channels, enhancing patient engagement, satisfaction, and overall health outcomes. As patients prioritize individualized care experiences, healthcare providers are leveraging digital platforms to deliver personalized healthcare solutions that meet these expectations, thereby driving the expansion of the B2C segment in the market.

Regional Insights

North America healthcare digital experience platform market dominated the market 38.11% in 2023. It is attributed to the factors such as the region's advanced healthcare infrastructure and high internet penetration, which facilitate the adoption of digital platforms for patient engagement, telehealth, and remote monitoring. These factors enable healthcare providers to enhance access to care, improve communication between patients and providers, and offer remote healthcare services efficiently. In addition, the robust technological ecosystem in North America supports innovation in digital health solutions, driving the development and adoption of digital experience platforms that cater to the evolving needs of healthcare delivery and patient care in the region.

U.S Healthcare Digital Experience Platform Market Trends

Technological advancements, such as Artificial Intelligence, machine learning, and IoT, are pivotal in shaping the healthcare digital experience platform (DXP) market in the U.S. These innovations enable DXPs to analyze vast amounts of data, forecast patient outcomes, and customize interactions, thereby enhancing care quality and operational efficiencies across the healthcare ecosystem. For instance, in June 2024, Wheel Health, Inc., a prominent telehealth and virtual care solutions provider, introduces its advanced Horizon platform, which leverages AI to revolutionize care delivery. This platform offers health plans, digital health solution providers, and life sciences companies a simplified means to rapidly expand their virtual care initiatives nationwide. Horizon sets a new benchmark in scalable and intelligent healthcare solutions by enhancing patient experiences, optimizing outcomes, and generating actionable insights from each program.

Asia Pacific Healthcare Digital Experience Platform Market Trends

Asia Pacific Healthcare Digital Experience Platform is expected to grow at the fastest CAGR of 13.8% over the forecast period, this growth is attributed to the increasing digitalization and adopting technologies such as AI, IoT, and telehealth are transforming healthcare delivery and enhancing patient engagement. Rising healthcare demands driven by aging populations and chronic diseases are prompting investments in DXPs to improve operational efficiency and patient outcomes. Supportive government policies and regulatory frameworks are further accelerating DXP adoption, while the expansion of telemedicine is bridging healthcare access gaps, underscoring the region's focus on patient-centric care and driving overall market growth. For instance, in April 2024, Toku, a cloud communication leader in Asia Pacific, acquired AiChat, a Singaporean AI customer service platform. This move strengthens Toku's position as a one-stop shop for customer experience (CX) solutions. By incorporating AiChat's AI technology, Toku aims to deliver personalized and seamless customer service across various channels.

China Healthcare Digital Experience Platform Market Trends

The healthcare digital experience platform (DXP) market in China is shaped by significant factors. Rapid advancements in AI, IoT, and big data analytics are pivotal, enabling DXPs to enhance healthcare delivery and improve patient outcomes through sophisticated solutions. Concurrently, increasing healthcare demands driven by an aging population, higher incidence of chronic diseases, and urbanization compel healthcare providers to invest in DXPs. These platforms are crucial for enhancing operational efficiency and ensuring high-quality care amidst growing healthcare challenges in China.

Key Healthcare Digital Experience Company Insights

The key companies in the healthcare digital experience platform are Accenture, Sitecore, Optimizely, Liferay Inc., Wipro, Cognizant, SoftServe Inc., Oracle, Microsoft, Salesforce, Inc., and Open Text Corporation. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Accenture specializes in healthcare digital experience platforms, focusing on enhancing patient engagement and operational efficiency through innovative digital solutions. Their approach integrates advanced technologies such as AI, data analytics, and cloud services to streamline healthcare delivery, improve care coordination, and empower patients with personalized digital tools.

-

Sitecore offers a digital experience platform (DXP) tailored for healthcare organizations. This platform helps them create engaging and personalized patient experiences across all digital touchpoints, such as websites and patient portals. This can improve patient satisfaction, loyalty, and potentially lead to better health outcomes.

Key Healthcare Digital Experience Companies:

The following are the leading companies in the healthcare digital experience platform market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Sitecore

- Optimizely

- Liferay Inc.

- Wipro

- Cognizant

- SoftServe Inc.

- Oracle

- Microsoft

- Salesforce, Inc.

- Open Text Corporation

Recent Developments

-

In March 2023, Fujitsu launched a new cloud-based platform to facilitate digital transformation in healthcare by securely collecting and utilizing health-related data. The platform automatically converts data from electronic medical records into HL7 FHIR standards and aggregates them securely. Patients could consent to store personal health information such as vital signs and activity data in a non-personally identifiable format, enabling medical institutions and pharmaceutical companies to conduct data analysis and research more effectively.

-

In September 2023, Accenture acquired Nautilus Consulting, a respected UK-based consultancy specializing in electronic patient records (EPR). This strategic buy strengthens Accenture's ability to drive digital transformation in healthcare, allowing it to deliver more impactful solutions across the UK and internationally.

Healthcare Digital Experience Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.43 billion |

|

Revenue forecast in 2030 |

USD 2.9 billion |

|

Growth rate |

CAGR of 12.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2020 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, delivery mode, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE ; Kuwait |

|

Key companies profiled |

Accenture; Sitecore; Optimizely; Liferay Inc.; Wipro; Cognizant; SoftServe Inc.; Oracle; Microsoft; Salesforce, Inc.; Open Text Corporation. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. |

Global Healthcare Digital Experience Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the segments from 2020 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare digital experience platform market report on the basis of component, delivery mode, application, and region:

-

Component Outlook (Revenue, USD Million, 2020 - 2030)

-

Platform

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2020 - 2030)

-

On-premises

-

Cloud Based

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Business-to-Consumer (B2C)

-

Business-to-Business (B2B)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."