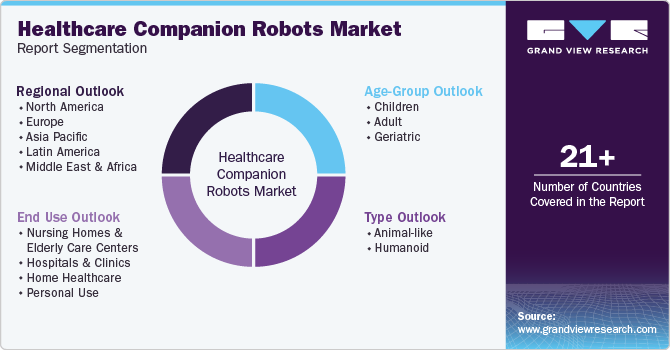

Healthcare Companion Robots Market Size, Share & Trends Analysis Report By Type (Humanoid, Animal-Like), By Age-Group (Children, Adult), By End Use(Hospitals And Clinics, Home healthcare), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-994-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

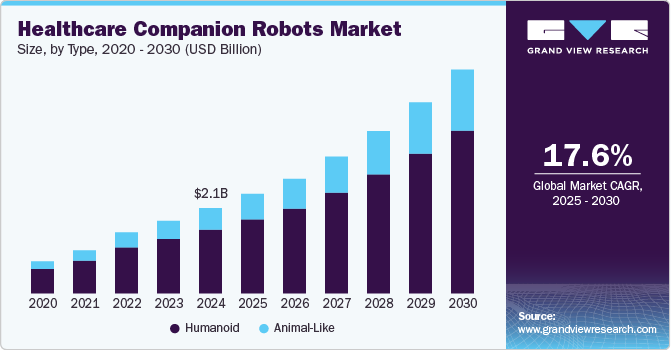

The global healthcare companion robots market size was estimated at USD 2.09 billion in 2024 and is projected to grow at a CAGR of 17.6% from 2025 to 2030. Rising investment in medical robots is one of the major factors driving the growth of the market. Other factors such as increasing disposable income and improving healthcare infrastructure is expected to impel the market growth over a forecast period. In August 2023, Intuition Robotics revealed that it has successfully completed the first round of funding, raising USD 25 million, which includes USD 20 million in venture capital and USD 5 million in venture debt. This funding will enable the company to address the increasing demand for its AI care companion, ElliQ, among government aging agencies and healthcare organizations.

Companion robots help enhance well-being and quality of life by assisting daily life. It mainly provides cognitive support, mobility supports and relaxation. Also, it helps in monitoring health and provides self-care support through interaction. The rising geriatric population across the globe and limited number of healthcare professionals to care for older population, particularly in countries such as Japan is likely to raise the demand for companion robot. Furthermore, various initiatives undertaken by government are supporting market growth. For instance, in May 2022, the New York state, which is a home to nearly 4.3 million older adults planned a partnership with Intuition Robotics, Israel to deliver companion robots to approximately 800 people in the state.

Technological advancement in the field of medical robotics is another factor driving industry growth. Various robotic products are developed to assist patients and improve the outcome. For instance, Service Robotics, a UK-based startup offers medical care robotics as a service (RaaS). The company developed a humanoid robot “GenieConnect”, an AI-based voice and video robot that provides engagement and stimuli to promote cognitive retention. Also, it helps in alleviating loneliness. In addition, it integrates with smart home devices and wearables to provide comprehensive and personalized care for users

In addition, development of innovative products by key players is impelling the healthcare companion robots industry growth. For instance, in June 2021, Hanson Robotics launched a robot “Grace”. It is designed to interact with the elderly people and isolated COVID-19 patients. Similarly, Kaspar robot developed by University of Hertfordshire is a humanoid robot which acts as a companion to improve the lives of children with autism and other communication difficulties. Such initiatives are expected to impel industry growth over a forecast period.

Moreover, increasing geriatric population across the globe is driving the demand for companion robots. According to the WHO report, by the year 2030, one out of every six individuals globally will be 60 years old or older. At that point, the number of people aged 60 and over will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of those aged 60 and older will have doubled to 2.1 billion.

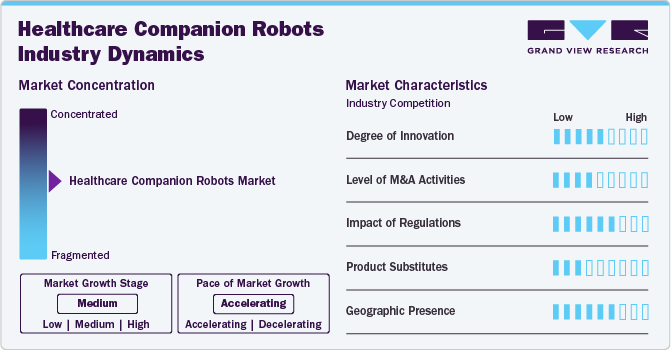

Market Concentration & Characteristics

Healthcare companion robots evolve from basic assistive devices to sophisticated systems capable of providing emotional support, monitoring vital signs, assisting with mobility, and even facilitating communication between patients and healthcare providers. Innovations such as AI-driven behavior learning, real-time data analytics, and autonomous navigation systems enable these robots to adapt to individual patient needs, enhancing personalized care. For instance, in July 2020, Milagrow, an Indian company specializing in consumer robots, launched four new humanoid robots: RoboJulia, RoboNano, RoboElf, and RoboDiCaprio. These robots specifically aim to serve the needs of hotels, hospitals, restaurants, and corporate offices. To meet this rising demand, particularly in the healthcare, hospitality, and office management sectors, Milagrow has introduced these four humanoid robots.

The healthcare companion robots industry is characterized by a medium level of merger and acquisition (M&A) activity. These M&A activities enable access to complementary expertise, technologies, and various distribution channels, enabling companies to enhance operational efficiency, accelerate product development, and capture a larger market share.

Healthcare companion robots evolve from basic assistive devices to sophisticated systems capable of providing emotional support, monitoring vital signs, assisting with mobility, and even facilitating communication between patients and healthcare providers. Innovations such as AI-driven behavior learning, real-time data analytics, and autonomous navigation systems enable these robots to adapt to individual patient needs, enhancing personalized care. For instance, in July 2020, Milagrow, an Indian company specializing in consumer robots, launched four new humanoid robots: RoboJulia, RoboNano, RoboElf, and RoboDiCaprio. These robots specifically aim to serve the needs of hotels, hospitals, restaurants, and corporate offices. To meet this rising demand, particularly in the healthcare, hospitality, and office management sectors, Milagrow has introduced these four humanoid robots.

The healthcare companion robots industry is characterized by a medium level of merger and acquisition (M&A) activity. These M&A activities enable access to complementary expertise, technologies, and various distribution channels, enabling companies to enhance operational efficiency, accelerate product development, and capture a larger market share.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are involved in evaluating and approving medical devices, including healthcare robots, to guarantee they comply with health and safety standards. These regulations are designed to address concerns related to data security, patient privacy, and the potential risks of robotic malfunctions.

Traditional healthcare aids, such as personal care attendants, physical therapy tools, and non-robotic assistive technologies like smart home devices, can serve as substitutes. Additionally, telemedicine platforms and video consultations with healthcare professionals have become popular alternatives, especially in managing chronic conditions and providing emotional support remotely.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Moreover, increasing investment in the development of healthcare companion robots will supplement its demand.

Type Insights

By type, the humanoid segment dominated the healthcare companion robots industry in 2024 and accounted for the largest revenue share due to the benefits offered by these robots, such as precision and minimal human errors. Furthermore, these robots are increasingly used to implement techno-psychological distractions for children during medical procedures. This approach helps reduce pain associated with anxiety and stress. In addition, the rising demand for robotics can be attributed to the growing population of individuals with disabilities. These robots help address the challenges faced by these populations by interacting effectively with their environment, contributing to the market growth of humanoid robots.

The animal-like segment in healthcare companion robots market is anticipated to witness the fastest CAGR of 19.1% over the forecast period. “Paro,” a robotic companion designed to resemble an animal, is increasingly used in dementia care due to the positive impact that interaction with these robots can have on the well-being of patients. These pet-like robots, with their animal-like aesthetics and behaviors, hold significant potential in aged care. In addition, they help alleviate loneliness among older adults, contributing to growth in this segment.

Age Group Insights

By age-group, the geriatric segment dominated the healthcare companion robots market in 2024 and accounted for the largest revenue share of 40.2%. A significant concern for older adults is social isolation and feelings of loneliness, which can result in both physical and mental health issues such as high blood pressure, heart disease, depression, and a decline in cognitive function. In March 2024, a South Korean company named Hyodol has introduced a robot doll that incorporates artificial intelligence (AI) to engage with elderly individuals experiencing dementia in an effort to combat loneliness. Moreover, there is often a greater need for caregivers in home care facilities than there are available providers, thereby fostering market growth.

The children segment in healthcare companion robots industry is anticipated to witness the fastest CAGR over the forecast periods due to rising demand of companion robots to support the emotional and cognitive development in children. Also, these robots are increasingly used to assist a therapy for children diagnosed with disabilities such as autism. “Buddy” the robot developed by Blue Frog Robotics, is one such robot which help to assist children with autism. In addition, various innovative product developed by key companies targeting children population is impelling the segment growth.

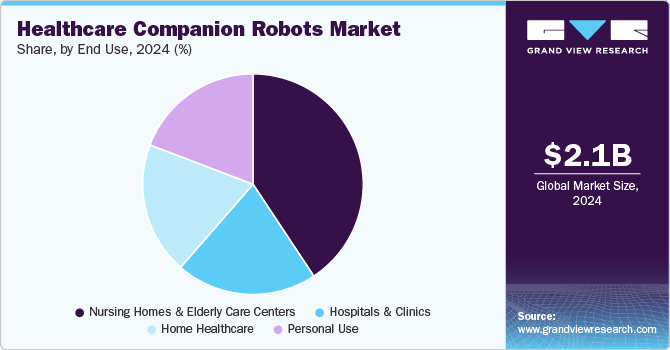

End Use Insights

By end use, the nursing homes and elderly care centers segment dominated the healthcare companion robots market in 2024 and accounted for the largest revenue share of 40.7%. Robots in nursing homes and elderly care centers are designed to assist with various tasks such as medication reminders, mobility assistance, and companionship, reducing the need for constant human supervision and improving the quality of life for residents. Moreover, the use of healthcare robots also helps to alleviate the labor shortage faced by the healthcare sector. In addition, these robots help with monitoring patients' health, providing real-time alerts to caregivers about any sudden changes in vital signs or behavior, thus improving overall patient safety.

The home healthcare segment in healthcare companion robots market is anticipated to witness the fastest CAGR over the forecast period. The shift towards home healthcare is facilitated by advancements in telemedicine, remote patient monitoring, and AI-powered robotics. Home healthcare robots can seamlessly integrate with telehealth platforms, allowing healthcare providers to monitor patients' health status remotely and intervene when necessary. In addition to the aging population, the rising healthcare costs and the strain on hospitals and care facilities are driving more people toward home-based care solutions, thereby supplementing market growth.

Regional Insights

North America healthcare companion robots market is anticipated to register the significant growth rate during the forecast period owing to the region's advanced healthcare infrastructure, high levels of technological innovation, and an aging population. Moreover, rising shortage of healthcare professionals and the growing prevalence of age-related health issues are driving market growth.

U.S. Healthcare Companion Robots Market Trends

U.S. healthcare companion robots market is anticipated to register a considerable growth rate during the forecast period. The rising healthcare costs and a shortage of caregivers is boosting healthcare companion robots industry growth. The Acorn report released in 2024 indicates that the shortage of caregivers in the U.S. is anticipated to reach 151,000 by 2030 and 355,000 by 2040.

Canada healthcare companion robots market is anticipated to register a considerable growth rate during the forecast period owing to rapidly aging population, increasing healthcare needs, and advancements in robotics and AI technology. Government initiatives and funding to support the development and deployment of AI-driven healthcare technologies are further driving growth.

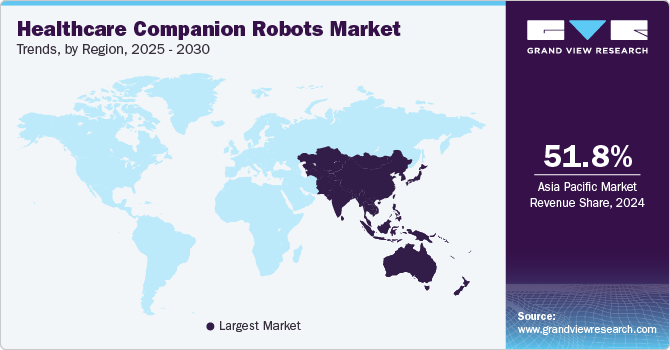

Asia Pacific Healthcare Companion Robots Market Trends

Asia Pacific dominated the healthcare companion robots market in 2024 and accounted for the largest revenue share of 51.8% owing to the rapidly aging population, particularly in countries such as Japan, China, and South Korea. In addition, government initiatives aimed at promoting healthcare technology adoption, along with growing investments in AI and robotics, are further fueling market growth.

The healthcare companion robots market in the Japan held the largest share in 2024. Increased research and development activities in Japan are advancing the healthcare companion robots industry. A total of 440 million USD has been designated for robotics projects within the “Moonshot Research and Development Program” over five years, from 2020 to 2025.

China healthcare companion robots market is anticipated to register the significant growth rate during the forecast period. Increasing product launches and approval in the region is fostering market growth. In March 2024, a China-based robotics company, Elephant Robotics, announced the global release of a robotic dog companion called metaDog.

Europe Healthcare Companion Robots Market Trends

The Europe healthcare companion robots is expected to witness the fastest growth over the forecast period due to the aging population, growing demand for home-based care, and a strong emphasis on technological innovation in healthcare. Furthermore, high levels of consumer acceptance of robotics, is expected to propel the market forward.

The Germany healthcare companion robots market is anticipated to register the fastest growth rate during the forecast period. Increasing demand for automation in elderly care, rehabilitation, and healthcare delivery are fostering market growth. The growing trend of home care services and the increasing focus on patient-centered care are also contributing to market growth.

Latin America Healthcare Companion Robots Market Trends

The Latin America healthcare companion robots market is anticipated to register a considerable growth rate during the forecast period. Increasing prevalence of chronic diseases, and the growing recognition of robotics as a tool to address healthcare challenges are escalating healthcare companion robots industry expansion.

Brazil healthcare companion robots market is anticipated to register a considerable growth rate during the forecast period. Shortages of healthcare resources and high demand for services are supplementing market growth.

Middle East & Africa Healthcare Companion Robots Market Trends

The Middle East and Africa region is experiencing lucrative growth in the healthcare companion robots market. Rising disposable incomes and increasing life expectancy are fostering regional growth. In the Middle East, countries such as the UAE, Saudi Arabia, and Qatar are making substantial investments in healthcare infrastructure and technological advancements, including robotics, to improve healthcare delivery and patient care.

South Africa healthcare companion robots market is anticipated to register a considerable growth rate during the forecast period. Factors such as growing prevalence of chronic diseases and increasing government investment in healthcare are likely to contribute to market growth over the forecast period.

Key Healthcare Companion Robots Company Insights

Key participants in the healthcare companion robots market focus on developing innovative business growth strategies through mergers and acquisitions, partnerships and collaborations, product portfolio expansions, and business footprint expansions.

Key Healthcare Companion Robots Companies:

The following are the leading companies in the healthcare companion robots market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Frog Robotics & Buddy

- ASUS

- Intuition Robotics

- inGen Dynamics

- PARO Robots U.S., Inc.

- No Isolation

- Luvozo

- Honda Robotics

- Hanson Robotics

- Ubtech

- Emotix

View a comprehensive list of companies in the Healthcare Companion Robots Market

Recent Developments

-

In March 2024, Franka Robotics, a company developing robotics technologies featuring human-like tactile abilities, launched the Franka AI Companion. This innovative tool, with its advanced hardware and software capabilities, is created to support robotics researchers and represents a breakthrough in research productivity and creative potential in robotics.

-

In January 2024, Intuition Robotics, a leader in AI technology for seniors, announced significant updates and improvements to its AI companion, ElliQ. This latest version, ElliQ 3, marks a substantial advancement in incorporating generative AI into daily living, transforming the dynamics of human-AI interactions. Backed by a USD 25M funding boost, the upgrades include enhanced hardware and software features, enabling Intuition Robotics to increase the reach and accessibility of ElliQ. These enhancements aim to increase the autonomy and well-being of older people while also reducing experiences of isolation.

-

In December 2023, the Office for the Aging in New York state collaborated with Intuition Robotics to address the issue of isolation among seniors. Officials noted that hundreds of free AI companions have been given to seniors, with 150 devices remaining available.

-

In March 2022, Intuition Robotics Ltd. Announced the official market release of its ElliQ digital care companion. The social robot aims to assist older adults in becoming more physically active and socially involved, allowing them to enjoy happier and more independent lives.

Healthcare Companion Robots Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.44 billion |

|

Revenue forecast in 2030 |

USD 5.48 billion |

|

Growth rate |

CAGR of 17.62% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, age group, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Blue Frog Robotics & Buddy; ASUS; Intuition Robotics; inGen Dynamics; PARO Robots U.S., Inc.; No Isolation; Luvozo; Honda Robotics; Hanson Robotics; Ubtech; Emotix |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Companion Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the healthcare companion robots market report on the basis of type, age group, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal-like

-

Humanoid

-

-

Age-Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Children

-

Adult

-

Geriatric

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Nursing homes and elderly care centers

-

Hospitals and clinics

-

Home healthcare

-

Personal use

-

-

Regional Outlook Revenue (USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare companion robots market size was estimated at USD 2.09 billion in 2024 and is expected to reach USD 2.44 billion in 2025.

b. The global healthcare companion robots market is expected to grow at a compound annual growth rate of 17.62% from 2025 to 2030 to reach USD 5.48 billion by 2030.

b. Asia Pacific dominated the global healthcare companion robots market with a share of 51.8% in 2024. This is attributable to the increasing geriatric population in the region and various initiatives undertaken by the government for the development of companion robots to support the elderly population.

b. Some key players operating in the global healthcare companion robots market include Blue Frog Robotics & Buddy; ASUS; Intuition Robotics; inGen Dynamics; PARO Robots U.S., Inc.; No Isolation; Luvozo; Honda Robotics; Hanson Robotics; Ubtech; Emotix; Jibo.

b. Key factors that are driving the market growth include rising geriatric population; increasing disposable income, improving healthcare infrastructure and technological advancement in the field of medical robotics.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."