Healthcare Blister Packaging Market Size, Share & Trends Analysis Report By Type (Carded, Clamshell), By Technology (Thermoforming, Cold Forming), By Material (Aluminum, Plastic Films), By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-169-5

- Number of Report Pages: 250

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Healthcare Blister Packaging Market Trends

The global healthcare blister packaging market size was estimated at USD 19.38 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030.The market is witnessing rapid growth owing to the growing consumption of solid oral pharmaceutical dosages. In addition, the growing demand for tamper-evident packaging in the pharmaceutical and healthcare industry is driving the industry growth. The Poison Prevention Packaging Act of 1970 was implemented in the U.S. to safeguard children from unintentional ingestion of hazardous substances found in various household items, such as food products, cosmetics, and pharmaceuticals. To comply with this regulation, pharmaceutical packaging companies must adhere to regulations that focus on child-resistant packaging designs.

Therefore, the use of single-dose blister packaging, such as peel-push blisters, is a common approach to meet these regulations and ensure child safety. This regulation is expected to drive the demand for healthcare blister packaging, thereby accelerating industry growth. In the U.S., an increase in the establishment of new chemical and biological companies has been observed in the past years. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the country saw the introduction of 65 new chemical and biological entities between 2008 and 2012. This positive trend continued with the launch of an additional 100 new chemical and biological entities from 2013 to 2017, followed by 159 more entities from 2018 to 2022.

These statistics indicate a promising future for pharmaceutical and healthcare industries, creating growth opportunities for healthcare packaging solutions, including blister packaging, within the country. According to the National Health Expenditure Account (NHEA), healthcare spending in the U.S. grew by 2.7% in 2021, reaching USD 4.3 trillion or USD 12,914 per person. In terms of the country's Gross Domestic Product (GDP), healthcare spending represented 18.3% of the total. This increasing healthcare expenditure is projected to positively influence the production of pharmaceuticals and medical devices, presenting growth potential for the market in this country. According to the National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP), currently, six in ten adults in the U.S. have a chronic disease such as cancer, heart disease, or diabetes.

Hence, the treatment for these chronic diseases requires a multitude of pharmaceutical products and medical devices including tablets, capsules, and syringes, which is anticipated to stimulate product demand in the region. Advanced medical technologies have also contributed to a rise in the geriatric population. According to The World Bank Group, the population in the age group of 65 years and above has grown from 687.01 million people in 2018 to 779.65 million people in 2022, with an annual growth rate of 9-10%. The high disposable income results in changes in the lifestyle as well as eating habits of consumers, which has contributed to increased health issues, such as diabetes, high blood pressure, and other cardiovascular ailments. This is driving the demand for oral solid dosage pharmaceuticals, which, in turn, is expected to positively influence industry growth.

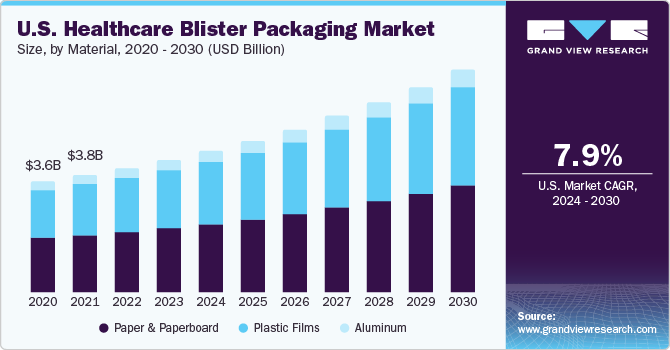

Material Insights

Based on materials, the market is segmented into paper & paperboard, plastic films, and aluminum. The aluminum segment accounted for the largest revenue share of more than 48.0 % in 2023 and is expected to grow at the fastest CAGR of 7.0% from 2024 to 2030. Aluminum plays a crucial role in blister packaging contributing significantly to the safety, efficiency, and shelf life of pharmaceutical products, such as tablets, capsules, pills, and medical devices. Moreover, aluminum foils are used in crafting blister pack covers for pharmaceutical products due to their recyclability, high UV resistance, and effective barrier against oxygen and moisture.

Plastic films protect pharmaceutical products by providing excellent barrier properties and protecting the contents from moisture, oxygen, and light. The major types of plastic films used in healthcare blister packaging are polyvinyl chloride (PVC), polyethylene (PE), and polyethylene terephthalate (PET). Paper & paperboard materials are commonly used in healthcare blister packaging for medical devices, such as single-use syringes and catheters. In addition, they are employed in the packaging of diagnostic medical devices, such as test strips, glucose meters, and mouth oxygen pumps. Paper & paperboard materials are considered more environmentally friendly compared to traditional plastic packaging.

Technology Insights

Based on technology, the market is bifurcated into thermoforming and cold forming. The thermoforming segment accounted for the largest revenue share of more than 84.4 % in 2023 and is expected to grow at the fastest CAGR of 7.9% from 2024 to 2030. The process involves heating a plastic film, forming cavities, loading the products, sealing with a lidding material, and trimming the edges. The lidding materials used in the thermoformed blister package are aluminum foil or laminate. Furthermore, thermoforming-based blister packaging is a cost-effective packaging solution.

It allows for faster production speeds and lower manufacturing costs compared to other technologies, including cold forming, making it an attractive option for healthcare companies. Cold forming technology involves using thin laminate film that contains aluminum to create blister packs through cold forming. A stamp is used to shape the film, allowing the aluminum-based material to stretch and retain the molded shape even after removing the stamp. One of the main advantages of cold forming is that the aluminum film provides excellent moisture barrier properties, preventing moisture from entering the packaging.

Type Insights

Based on type, the global industry has been further categorized into carded and clamshell. The carded type segment accounted for the largest revenue share of 56.5 % in 2023 and is expected to grow at the fastest CAGR of 8.2% from 2024 to 2030. This type of packaging offers added security as the product is pre-formed and sealed, making it easy for consumers to identify whether the product has been opened or damaged. There are two main types of carded blister packaging available in the market.

One type involves a clear thermoformed plastic cavity, while the other type incorporates foil as an essential component and creates the cavity through cold stretching. Clamshell blister packaging is commonly used for packaging medical devices, such as prefilled syringes, mouth oxygen pumps, vaccine vials, and others. This packaging solution is versatile and can be reused if unsealed, contributing to environmental sustainability.

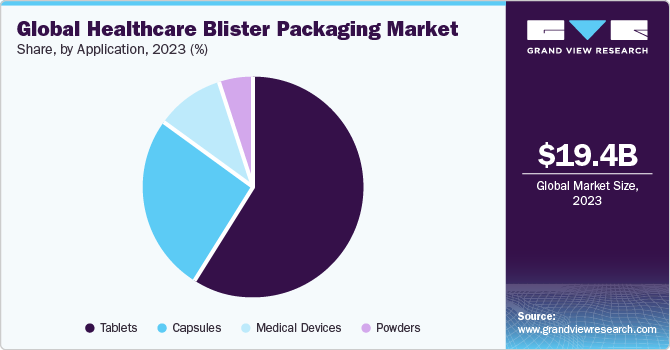

Application Insights

Based on applications, the global industry has been further segmented into tablets, capsules, powders, and medical devices. The tablet application segment accounted for the largest revenue share of more than 59.2% in 2023. The segment is projected to expand further at the fastest CAGR of 8.3% maintaining its leading position throughout the forecast years. Tablets packed in blister packaging are shielded from environmental factors, such as light, moisture, and oxygen.

This protection extends the shelf life of the tablets, maintaining their efficacy and reducing the chances of deterioration, which is crucial in the healthcare industry. Blister packaging products, such as medical trays and clamshells, are used for packaging several types of medical devices, such as prefilled syringes, auto-injectors, mouth oxygen inhalers, vials, ampoules, and catheters. This positive outlook is due to the ease of handling and identification of medical devices offered by blister packaging.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of more than 33.0% in 2023 and is expected to grow at the fastest CAGR of 8.4% from 2024 to 2030. The collaboration and partnership among major companies operating in the healthcare industry to launch new healthcare blister packaging products in Asia Pacific is anticipated to have a positive impact on the overall market growth. For instance, in August 2023, Aptar CSP Technologies, Inc. forged a strategic partnership with Porton PharmaTech to introduce Activ-Blister solutions in the Asia Pacific. This collaboration with Porton aims to enhance its ability to cater to both local production and exports in Asia Pacific.

In Europe, rising investment in pharmaceutical R&D is expected to lead to the emergence of new medications in the form of tablets and capsules, which is expected to create the need for moisture-resistant and tamper-evident packaging solutions, consequently driving market growth. Furthermore, the industry is expected to benefit from key countries, such as Switzerland, the Netherlands, Norway, Denmark, Belgium, the UK, Sweden, and Finland. According to the Pan American Health Organization (PAHO), in 2022, several countries in Central and Southern America experienced an increase in dengue, Zika, and chikungunya compared to the figures documented in 2021 and the initial months of 2023 witnessed significant outbreaks of chikungunya and dengue fever in South America.

In 2022, a total of 3,125,367 cases of arbovirosis were reported, with 90% being dengue cases (2,811,433), 8.7% chikungunya cases (273,685), and 1.3% Zika cases (40,249). Therefore, a surge in the number of cases has led to an increased demand for pharmaceutical products, including medications for the treatment and management of these diseases. This uptick in demand is expected to drive the need for blister packaging as a secure and convenient way to package and dispense medications. According to the National Library of Medicine (NLM), the emergence of pharmaceutical nanomedicine products in Saudi Arabia is anticipated to have a substantial impact on the Middle East pharmaceutical market and healthcare system.

Since 2000, the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have granted marketing approvals to more than 80 nanomedicine products, with twice as many nanomedicines presently undergoing clinical trials. The nanomedicine market is projected to achieve a valuation of USD 350.8 billion by 2025, as reported by the NLM. Nanomedicine products require protection from environmental factors to maintain their stability. Blister packaging provides a barrier against moisture, light, and contaminants, ensuring the integrity of these products. Hence, the demand for blister packaging is expected to rise to meet these protection and stability requirements.

Key Companies & Market Share Insights

Major players are adopting merger & acquisition strategies to diversify their product or services portfolio and to gain synergies of cost and revenue among the companies. For instance, in September 2023, Sonoco Products Company, a diversified global packaging leader, announced the completion of its acquisition of the remaining equity interest in RTS Packaging for a value of USD 330 million. This acquisition will further strengthen and expand Sonoco’s 100% recycled fiber-based packaging solutions to serve growing consumer wine, spirits, food, beauty, and healthcare markets. With this acquisition, Sonoco added a network of 15 operations and 1,100 employees in the U.S., Mexico, and South America.

Key Healthcare Blister Packaging Companies:

- Amcor Plc

- Constantia Flexibles

- CCL Healthcare

- UFlex Limited

- Sonoco Products Company

- WestRock Company

- Honeywell International Inc.

- Klöckner Pentaplast

- Südpack

- TekniPlex

- Nelipak

- Acino International AG

- Lovell Industries

Healthcare Blister Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 20.6 billion |

|

Revenue forecast in 2030 |

USD 32.4 billion |

|

Growth rate |

CAGR of 7.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in Kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, technology, type, application, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Amcor Plc; Constantia Flexibles; UFlex Ltd.; CCL Healthcare; Sonoco Products Company; WINPAK Ltd.; WestRock Company; SteriPackGroup; Honeywell International Inc.; Klöckner Pentaplast; Südpack; TekniPlex; Blisterpak, Inc.; Abhinav Enterprises; YuanPeng Plastic Products Co., Ltd; Nelipak; Perlen packaging; Amber Packaging; Napco National; Salman Group; Acino International AG; Printopack; Lovell Industries; Takween Advanced Industries; ULMA Packaging; Uniworth Enterprises LLP |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Blister Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the healthcare blister packaging market report based on material, technology, type, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper & Paperboard

-

Solid Bleached Sulfate (SBS)

-

White-lined chipboard

- others

-

-

Plastic Films

-

Polyvinyl Chloride (PVC)

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Aluminum

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thermoforming

-

Cold Forming

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carded

-

Clamshell

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powders

-

Medical Devices

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Aluminum emerged as a dominating application with a value share of around 48.4% in the year 2023. Aluminum is lightweight in nature and highly durable, making it a suitable choice for healthcare blister packaging. This quality ensures that the pharmaceutical products are securely packaged for easy transportation and storage.

b. The key market player in the healthcare blister packaging market includes Amcor Plc; Constantia Flexibles; UFlex Limited; CCL Healthcare; Sonoco Products Company; WINPAK LTD.; WestRock Company; SteriPackGroup; Honeywell International Inc.; Klöckner Pentaplast; Südpack; TekniPlex; Blisterpak, Inc.; Abhinav Enterprises; YuanPeng Plastic Products Co., Ltd; Nelipak; Perlen packaging; Amber Packaging; Napco National; Salman Group; Acino International AG; Printopack; Lovell Industries; Takween Advanced Industries; ULMA Packaging; Uniworth Enterprises LLP.

b. The global healthcare blister packaging market was estimated at around USD 19.38 billion in the year 2023 and is expected to reach around USD 20.6 billion in 2024.

b. The global healthcare blister packaging market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach around USD 32.4 billion by 2030.

b. Rising consumption of solid oral pharmaceutical dosages and escalating demand for tamper-evident packaging in the pharmaceutical sector is anticipated to fuel the growth of healthcare blister packaging market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."