Healthcare Asset Management Market Size, Share & Trends Analysis Report By Product (RFID, RTLS), By Application, By End Use (Hospitals, Laboratories, Others, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-368-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

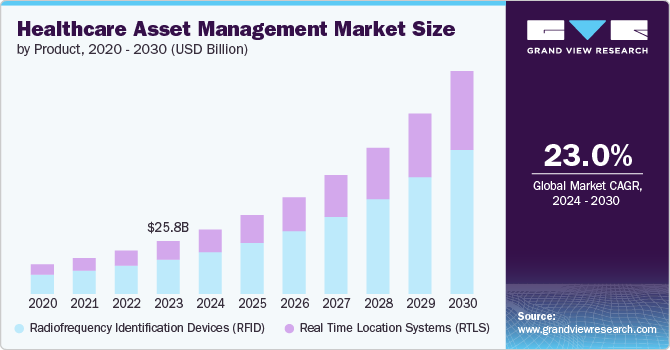

The global healthcare asset management market was estimated at USD 25.8 billion in 2023 and it is anticipated to grow at a CAGR of 23.0% from 2024 to 2030. The increasing need to enhance operational efficiency, rising drug counterfeiting activities, technological advancements, and growing healthcare expenditure are key drivers of market growth.

Moreover, the market players are developing advanced technologies and solutions to assist healthcare organizations in asset management, which is further expected to propel the market growth. For instance, in April 2024, TRIMEDX, a clinical asset management company, launched GeoSense for healthcare environments. This real-time location system (RTLS) is designed to offer precise tracking for medical devices, which can help medical facilities optimize their asset management.

Asset management solutions serve several purposes in the healthcare systems, such as reducing device search times, improving clinical efficiency, improving clinical engineering services such as maintenance and repairs, improving service delivery, enhancing inventory management, and improving device availability. These advantages offered by asset management solutions are increasing their popularity in the healthcare system, driving their demand globally.

Moreover, the adoption of this solution is wider than hospitals and clinics as pharmaceutical companies are increasingly adopting these solutions coupled with developing pharmaceutical industry targeted solutions. For instance, in January 2022, Aizon launched an asset monitoring application designed for pharmaceutical and biotech companies. The Aizon Asset Health offers intelligent historical maintenance analysis, critical assets condition monitoring, and identification of potential problems, which help the pharma and biotech companies to eliminate unplanned downtime and optimize maintenance costs.

Governments and private institutions globally have increased their focus on the healthcare sector, leading to an increase in investment in the development of healthcare infrastructure globally. For instance, Saudi Arabia intended to spend 50.4 billion USD in its healthcare sector in 2023. Moreover, the county aims to invest around 65 billion USD for the development of the healthcare infrastructure. This growing investment and developing healthcare infrastructure globally increases the need for technological solutions to increase the operational efficiencies of healthcare facilities, which is expected to drive the demand for healthcare asset management solutions.

Product Insights

Radiofrequency Identification Devices (RFID) segment led the market and accounted for a 65.0% share of the global revenue in 2023 owing to the improved tracking and visibility offered by these devices. Moreover, RFID is used for a wide range of applications beyond asset tracking in the healthcare setting, such as visitor tracking, medical staff tracking, patient tracking, and medication inventory management, which allows healthcare facilities to spot medication shortages and expiration, thereby improving patient care.

RFID tags are also being used on pharmaceutical products, which allows for tracking of the moment of those products throughout the supply chain. The development of advanced RFID is further anticipated to drive their demand in the market. For instance, in June 2021, SML RFID launched an ultra-small tag, GB32U9, to offer high-quality and rapid inventory counting to the pharmaceutical industry in dense tag populations.

Real Time Location Systems (RTLS) segment is anticipated to grow at the fastest CAGR of 23.2% over the forecast period. This growth can be attributed to the technological advancements in RTLS systems, high scalability, enhanced accuracy, and range offered by these systems. RTLS systems can be scaled to track thousands of assets across large hospitals, which increases their preference for healthcare organizations with better affordability. Moreover, the introduction of technologically advanced RTLS systems by the market players is further expected to fuel the segment's growth. For instance, in March 2024, CenTrak launched a unique and scalable Bluetooth Low Energy (BLE) Multi-Mode Platform. This RTLS solution offers a cost-effective deployment model with location data capabilities.

Application Insights

The hospital asset management segment held the largest market share in 2023. This can be attributed to the increasing emphasis on improving patient outcome and the availability of advanced solutions. The application of these solutions in hospitals has increased from just tracking medical equipment and devices to tracking staff, visitors, and patients, which can play a significant role in large-capacity hospitals. Moreover, the development of advanced systems and software is further increasing the adoption of these systems in hospitals. For instance, in September 2022, Medikabazaar launched MBARC, a medical equipment service platform that allows hospitals to monitor, manage, and measure their biomedical assets in an effective and efficient manner.

Pharmaceutical asset management segment is expected to witness the fastest growth over the forecast period. This growth can be attributed to the increasing demand for drug counterfeiting, stringent regulatory requirements, improving supply chain efficiency, and growing focus on inventory optimization. Moreover, the regulatory bodies are taking various initiatives to enhance the supply chain of various pharmaceutical drugs, which is further anticipated to drive the segment growth. For instance, the Drug Supply Chain Security Act (DSCSA) Pilot Project Platform was established by the FDA to assist the stakeholders involved in the drug supply chain with developing technologies for drug tracking and increasing awareness about product tracking and verification.

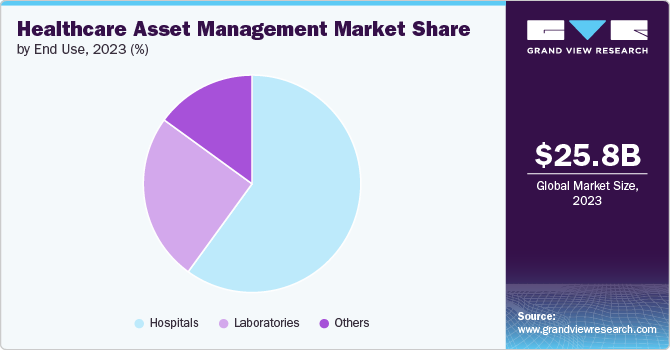

End Use Insights

The hospitals segment held the largest market share in 2023. Hospitals are increasing their efforts to enhance operational efficiency and manage their existing assets and workforce, as a lack of asset management practices can lead to asset loss and compromised patient care. Such factors increase the importance of these systems in hospitals. Moreover, hospitals are increasingly adopting Radio Frequency Identification (RFID) and Real-Time Location Systems (RTLS) to track and manage their assets. These technologies allow real-time tracking of equipment and supplies, improving visibility and reducing losses in the hospital setting, which increases their adoption and contributes to the high segment share.

Laboratories segment is expected to witness the fastest CAGR from 2024 to 2030. This growth can be attributed to the increasing focus on laboratory efficiency and productivity, increasing research activities and growing emphasis on sample management. Laboratories deal with a large number of samples that require careful tracking and storage. Asset management solutions with sample tracking capabilities can ensure proper sample handling and minimize the risk of errors, thereby maintaining the sample quality and ensuring better operations for the laboratories.

Regional Insights

North America dominated the healthcare asset management market and accounted for a 42.0% share in 2023. This growth can be attributed to the region’s developed healthcare infrastructure, investments in advanced technologies, and stringent regulatory framework.

U.S. Healthcare Asset Management Market Trends

The healthcare asset management market in the U.S. is expected to witness significant growth from 2024 to 2030. This can be attributed to the presence of leading market players, focus on patient safety, acceptability towards technologically advanced digital solutions, and the introduction of advanced solutions in the country.

The U.S. has a developed healthcare infrastructure with an increasing focus on patient safety. Newly developed advanced solutions are enabling healthcare organizations in the country to optimize workflows and enhance asset management. For instance, in January 2023, EZ Web Enterprises (EZO) announced the consolidation of its product offerings to provide a Software as a Service (SaaS) solution. This solution helps customers control and maintain operational equipment and assets, optimizing utilization and quality, reducing operational costs, and increasing productive uptime.

Europe Healthcare Asset Management Market Trends

Europe healthcare asset management market is expected to witness significant growth over the forecast period. This can be attributed to the increasing focus on cost-containment, stringent regulations on medical devices, and increasing adoption of RFID and RTLS technologies.

Asia Pacific Healthcare Asset Management Market Trends

The healthcare asset management market in Asia Pacific region is anticipated to witness the fastest growth at a CAGR of 23.9% during the forecast period. This can be attributed to the developing healthcare infrastructure, increasing integration of digital technologies in the region's healthcare sector, and growth potential in the developing economies.

Asia Pacific region is witnessing significant growth in its healthcare infrastructure, propelled by increasing investments from government and private entities. For instance, in March 2022, Australia’s Department of Health and Aged Care announced a four-year health development plan with an investment of 372.39 billion USD for the development of a stronger health system in the country. Such increasing investments in the healthcare sector of the region are expected to drive the demand for advanced solutions such as asset management solutions in the region.

Key Healthcare Asset Management Company Insights

Some key players are using various strategies, such as product launches, partnerships, expansion, acquisitions, and collaborations, to increase their presence and gain a competitive edge over other market players.

Key Healthcare Asset Management Companies:

The following are the leading companies in the healthcare asset management market. These companies collectively hold the largest market share and dictate industry trends.

- AiRISTA Flow, Inc.

- CenTrak Inc.

- Novanta Inc.

- Sonitor Technologies

- VERSUS TECHNOLOGIES

- STANLEY Healthcare

- Zebra Technologies Corporation

- GE Healthcare

- IBM

- Siemens Healthcare GmbH

- Motorola Solutions, Inc.

- Infor, Inc.

- Accenture PLC

- Sonitor Technologies Inc.

- Tyco International Ltd

Recent Developments:

-

In April 2023, GE Healthcare launched ReadySee, an asset management and network supervision solution. ReadySee is developed to transform device and infrastructure data into actionable insights, which can help healthcare professionals locate such devices, eliminate manual efforts, and manage cybersecurity protocols by identifying vulnerabilities.

-

In November 2022, Vizient, Inc. and HANDLE Global entered into a strategic partnership to launch a capital asset management system for Vizient member healthcare organizations to assist them in tracking capital equipment and expenses, thereby enhancing equipment lifecycle planning and asset utilization.

Healthcare Asset Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 31.5 billion |

|

Revenue forecast in 2030 |

USD 109.3 billion |

|

Growth Rate |

CAGR of 23.0% from 2024 to 2030 |

|

Actual Data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, Application, End Use and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, Spain, France, Italy, Norway, Seden, Denmark, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

AiRISTA Flow, Inc.; CenTrak Inc.; Novanta Inc.; Sonitor Technologies; VERSUS TECHNOLOGIES; STANLEY Healthcare; Zebra Technologies Corporation; GE Healthcare; IBM; Siemens Healthcare GmbH; Motorola Solutions, Inc.; Infor, Inc.; Accenture PLC; Sonitor Technologies Inc.; Tyco International Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare Asset Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare asset management market report based on product, application and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Radiofrequency Identification Devices (RFID)

-

Tags

-

Passive Tags

-

Low Frequency

-

High Frequency

-

-

Ultra-high frequency

-

Readers/Interrogators

-

Antennas

-

-

Accessories Hardware

-

Software

-

Services

-

-

Real Time Location Systems (RTLS)

-

Hardware

-

Tags/Badges

-

Readers/Interrogators

-

-

Software

-

Services

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Asset Management

-

Equipment Tracking and Management

-

Patient Management

-

Temperature and Humidity Control

-

Staff Control

-

Infection Control and Hand Hygiene Compliance

-

-

Pharmaceutical Asset Management

-

Drug Anti-counterfeiting

-

Supply Chain Management

-

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare asset management market size was estimated at USD 25.8 billion in 2023 and is expected to reach USD 31.5 billion in 2024.

b. The global healthcare asset management market is expected to grow at a compound annual growth rate of 23.0% from 2023 to 2030 to reach USD 109.3 billion by 2030.

b. North America dominated the healthcare asset management market, with a share of 42.0% in 2023. This is attributable to the region’s developed healthcare infrastructure, investments in advanced technologies, and stringent regulatory framework, which led to the increasing adoption of healthcare asset management solutions.

b. Some key players operating in the healthcare asset management market include AiRISTA Flow, Inc.; CenTrak Inc.; Novanta Inc.; Sonitor Technologies; VERSUS TECHNOLOGIES; STANLEY Healthcare; Zebra Technologies Corporation; GE Healthcare; IBM; Siemens Healthcare GmbH; Motorola Solutions, Inc.; Infor, Inc.; Accenture PLC; Sonitor Technologies Inc.; Tyco International Ltd

b. Key factors that are driving the market growth include the increasing need to enhance operational efficiency, rising drug counterfeiting activities, technological advancements, and growing healthcare expenditure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."