- Home

- »

- Healthcare IT

- »

-

Healthcare Application Lifecycle Management Solutions Market Report 2030GVR Report cover

![Healthcare Application Lifecycle Management Solutions Market Size, Share & Trends Report]()

Healthcare Application Lifecycle Management Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Offerings (Software, Services), By Deployment, By End-use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-344-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

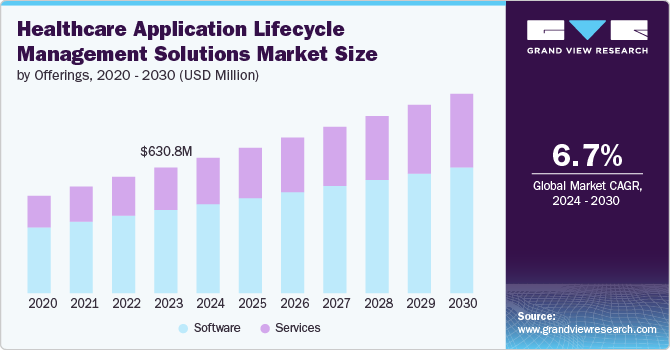

The global healthcare application lifecycle management solutions market size was estimated at USD 630.8 million in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. Market growth is driven by increasing adoption of Application Lifecycle Management (ALM) tools, which streamline the development and maintenance of essential software applications such as Electronic Health Records (EHRs), patient portals, and telemedicine platforms. The role of ALM in ensuring compliance with stringent regulations such as HIPAA enhances its importance in the market. In addition, rise in the number of cloud-based solutions and healthcare Software-as-a-Service (SaaS) offerings, as well as the growing demand for enhanced patient outcomes & operational efficiency, are expected to drive market expansion over the forecast period.

The healthcare industry has been significantly transformed by the increasing adoption of technologically advanced solutions such as cloud computing, DevOps practices, and CI/CD pipelines in ALM & SaaS globally. This transformation is further accelerated by the adoption of ALM across various portal software and information systems, driving market growth. The integration of artificial intelligence and machine learning is expected to become more prevalent, empowering healthcare providers to make data-driven decisions and enhance patient outcomes. The growing integration of existing healthcare systems is also a key market driver. For example, healthcare organizations are increasingly leveraging platforms such as Microsoft Power Platform to develop custom applications that improve patient care and streamline operations. Effective ALM is crucial for managing the development, testing, and deployment of these Power Platform apps within the regulated healthcare environment.

Such integration illustrates how healthcare providers utilize ALM solutions to create and manage patient engagement apps, enhancing communication & reducing administrative burden. Furthermore, the implementation of a robust ALM process with tools such as Azure DevOps enables organizations to swiftly deploy updates, maintain comprehensive traceability, and ensure governance across the application lifecycle. Moreover, the COVID-19 pandemic also had a positive impact on the market demand, resulting in significant changes and challenges in the sector. The pandemic accelerated the adoption of telehealth, increased demand for remote patient monitoring, and highlighted the critical need for efficient data management & interoperability, prompting healthcare organizations to invest in advanced ALM solutions. Notable market players integrated advanced analytics to predict demand, optimize inventory, and enhance distribution efficiency. Siemens utilized its Polarion ALM platform to ensure compliance with healthcare regulations and facilitate seamless integration, enabling organizations to swiftly adapt to the heightened digital demands caused by the pandemic.

Moreover, post-COVID-19, there has been increased collaboration between ALM vendors and healthcare IT firms & startups. This collaboration aims to deliver specialized and integrated solutions tailored to the unique requirements of the healthcare industry. Visure Solutions, a provider of ALM software, exemplified its ability to navigate the complexities of the post-pandemic business landscape by delivering innovative solutions to customers despite challenges. The company is focused on developing software tools that promote seamless collaboration among distributed teams, reflecting its commitment to advancing healthcare technology solutions.

Product Insights

On the basis of product, the market is segmented into software and services. The software segment dominated the market in 2023. This growth is fueled by life science companies' increasing adoption of SaaS for cloud-based applications in supply chain management and enterprise resource planning. Moreover, there is a growing need for enhanced collaboration and communication among development teams, driving the expansion of the software segment in the market. ALM software solutions integrate platforms that facilitate seamless collaboration and communication among stakeholders, accelerating development cycles and ensuring applications meet diverse healthcare provider & patient needs. As the healthcare industry undergoes digital transformation, software offerings for ALM solutions are increasingly critical.

The services segment is expected to grow at the fastest CAGR of 8.1% from 2024 to 2030. The segment growth can be attributed to the increasing complexity of regulatory compliance in healthcare. Regulations such as HIPAA and GDPR mandate rigorous standards for data security, privacy, and EHR management, boosting the demand for ALM services. These services, including audits, documentation, training, and ongoing compliance monitoring, ensure continuous compliance of healthcare applications across their lifecycle. This mitigates legal risks and enhances patient confidence. Expertise in compliance services is crucial for healthcare organizations navigating the intricate regulatory landscape.

Deployment Insights

On the basis of deployment, the market is segmented into on-premises and cloud-based. The cloud-based segment held the largest market share in 2023. This significant share can be attributed to the enhanced collaboration and productivity facilitated by cloud-based ALM solutions, which drive market growth. Cloud platforms enable healthcare teams to collaborate seamlessly, regardless of their physical location. Features such as real-time updates, shared workspaces, and integrated communication tools ensure that developers, clinicians, regulatory experts, and IT professionals can work together efficiently. This collaborative environment accelerates the development cycles of healthcare applications, ensures alignment across teams, and enhances the overall quality of the applications.

The accessibility of ALM tools from any internet-connected device enhances support for remote work and telehealth initiatives, which are increasingly vital in the healthcare sector. In December 2022, OpenBOM, a SaaS platform for digital product data management and collaboration, partnered with Orcanos, an integrated ALM provider. This collaboration aims to provide a unified SaaS solution for ALM and a Quality Management System (QMS) tailored to medical device manufacturers and healthcare providers. These cloud-native ALM systems enable manufacturers to accelerate product delivery while adhering to stringent regulatory standards.

Application Insights

On the basis of application, risk management held the largest market share of 23.9% in 2023. The shift toward value-based care models and population health management is influencing the adoption of ALM solutions in the risk management segment. Value-based care focuses on improving patient outcomes and reducing healthcare costs by emphasizing preventive care, care coordination, and population health management strategies. ALM solutions support value-based care initiatives by enabling healthcare organizations to develop and manage applications that facilitate data-driven decision-making, patient engagement, and personalized care delivery. These applications can include population health analytics platforms, chronic disease management tools, and patient portals that promote proactive management of health risks & enhance patient outcomes.

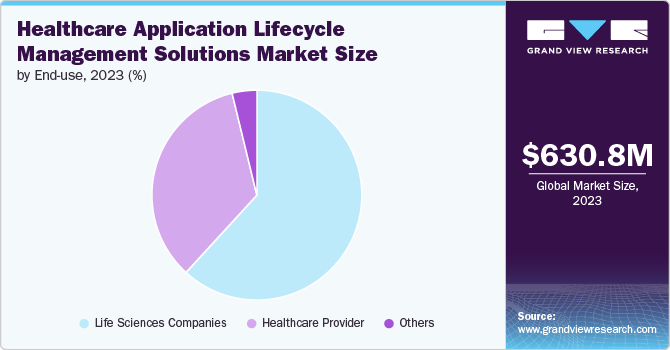

End-use Insights

On the basis of end-use, the market is segmented into life sciences companies, healthcare providers, and others. In 2023, life sciences companies held the largest market share of 61.8%, driven by the increasing complexity of product development in the industry, which necessitates the adoption of ALM solutions. ALM solutions provide integrated platforms that streamline these processes, enabling life sciences organizations to manage intricate development workflows, foster team collaboration, and ensure product quality & safety. New entrants are increasingly customizing ALM solutions to meet the specific needs of life sciences companies. For example, in December 2023, Ketryx, a provider of connected application lifecycle management software tailored for the life sciences sector, raised USD 14 million in Series A funding. This funding was aimed at accelerating product development efforts and expanding commercial operations. Ketryx also supports development teams in adopting modern DevTools and DevOps methodologies by integrating and converting development tools into an FDA-compliant centralized repository for the entire product lifecycle. This integration includes automated documentation, enabling teams to optimize their focus effectively. The development of pharmaceuticals, biologics, and medical devices involves multiple stages, including research, clinical trials, manufacturing, and postmarket surveillance. Each stage requires precise coordination, data management, and adherence to quality standards.

The healthcare provider segment is expected to grow at the fastest CAGR of 7.5% from 2024 to 2030. The segment growth is driven by the rising adoption of digital health technologies by healthcare providers, with ALM solutions playing a crucial role in developing, deploying, and maintaining different applications. These solutions offer structured frameworks that guide healthcare providers through the entire lifecycle of digital health technologies, from initial development and testing to deployment & ongoing updates. This structured approach enables healthcare providers to ensure the efficient operation of their digital health technologies, seamless integration with existing systems, and effective support for clinical workflows. These factors are anticipated to significantly propel market growth over the forecast period.

Regional Insights

The North America healthcare application lifecycle management solutions management market dominated the market with a share of 46.9% in 2023. Owing to the region's emphasis on technological innovation, regulatory compliance, and improving patient care, there is a need for enhanced digital supply chain efficiencies. Furthermore, the pandemic accelerated the adoption of digital technologies, requiring scalable and secure ALM tools to manage these applications effectively. Moreover, the presence of many pharmaceutical & medical device manufacturers and logistics companies is contributing to market growth. These players are investing in R&D of supply chain management solutions that are efficient and cost-effective. In addition, the market in countries like the U.S. and Canada is characterized by high investment in technology, a strong focus on regulatory adherence, and a commitment to enhancing patient care through innovative digital solutions.

U.S. Healthcare Application Lifecycle Management Solutions Market Trends

The healthcare application lifecycle management solutions market in the U.S. held the largest share in 2023. The growth can be attributed to factors such as the presence of top life sciences and pharmaceutical companies in the country, which account for a 45% share of the global pharmaceutical revenue. The region's leading healthcare organizations leverage these ALM tools to maintain a competitive edge, ensure data security, and improve operational efficiencies.

Europe Healthcare Application Lifecycle Management Solutions Market Trends

The healthcare application lifecycle management solutions market in Europe is the second-largest regional market. Europe is one of the most developed regions in the world, and the increasing digitization of healthcare systems across this region is creating a higher demand for robust ALM solutions to manage complex medical software applications. Healthcare organizations in the region are adopting comprehensive ALM tools to ensure compliance and maintain detailed documentation throughout the software lifecycle. The growing emphasis on patient safety and data security in healthcare applications is also fueling the adoption of ALM solutions that can help effectively manage and mitigate risks. In December 2021, CTG and Micro Focus extended their European Platinum Partnership to the French market. This expansion aimed to deliver comprehensive IT and business solutions, leveraging CTG's extensive market experience and Micro Focus's robust ALM software to help clients accelerate their software delivery. The partnership enhanced their ability to support digital transformation initiatives for clients in France, offering advanced technologies and services to meet evolving business needs.

Asia Pacific Healthcare Application Lifecycle Management Solutions Market Trends

The healthcare application lifecycle management solutions market in Asia Pacific is anticipated to grow at the fastest CAGR of 8.6% from 2024 to 2030, owing to the increasing adoption of technologically advanced solutions in Asian countries such as China, India, and Japan. Moreover, the rising focus on improving healthcare infrastructure, coupled with significant investments in IT and healthcare technologies, is propelling market growth. The integration of advanced technologies such as AI, machine learning, and cloud computing further enhances the capabilities of ALM solutions, making them indispensable for healthcare providers aiming to deliver high-quality, compliant, and efficient services.

Key Healthcare Application Lifecycle Management Solutions Company Insights

Competition in the market is driven by innovative product offerings from key players, stringent regulatory requirements, and supportive government initiatives to promote healthcare technologies. In addition, market players are implementing diverse strategies, including mergers & acquisitions, collaborations, and partnerships, to expand their geographic presence and broaden their customer base. These strategic moves highlight the dynamic competitive landscape in the industry.

Key Healthcare Application Lifecycle Management Solutions Companies:

The following are the leading companies in the healthcare application lifecycle management solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Tata Elxsi

- Matrix Requirements

- Siemens

- IBM

- Oracle

- 2MG Healthcare (Services)

- Birlasoft

- Microsoft

- Kovair Software, LLC

- SQA Solution

- Arorian Technologies

- SAP

Recent Developments

-

In June 2024, Avionyx announced a partnership with Siemens Technology, enhancing its capabilities in software lifecycle management through the integration of Siemens’ Polarion ALM software. This collaboration would enable Avionyx to manage complex software development projects and customize solutions for client needs, especially in compliance with rigorous standards such as DO-178C and DO-254.

-

In December 2023, Inflectra partnered with Trustify to enhance its offerings in the software testing and lifecycle management markets. This collaboration helped integrate Inflectra's Spira platform with Trustify's cybersecurity and compliance expertise, delivering integrated solutions that ensure both software quality & security. The partnership aims to boost its market position and provide robust ALM solutions to clients.

-

In September 2023, SAP collaborated with Tricentis to integrate Tricentis Test Automation (TTA) with SAP Cloud ALM. This integration enhanced automated testing solutions for SAP applications such as FIORI, ARIBA, and SuccessFactors, aiming to improve efficiency and software update quality.

-

In March 2023, PTC conducted a webinar on implementing a fully digital ALM solution using Codebeamer for GAMP-compliant pharma lifecycle management. The focus was on enhancing collaboration and supporting various computer system validation aspects, including SCADA-PLC, MES, LIMS, and IT infrastructure for production process control systems.

-

In December 2022, OpenBOM partnered with Orcanos to offer an integrated SaaS ALM and QMS solution tailored for medical device manufacturers and healthcare providers.

Healthcare Application Lifecycle Management Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 679.4 million

Revenue forecast in 2030

USD 1,002 million

Growth rate

CAGR of 6.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offerings, deployment, end-use, application

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Tata Elxsi; Matrix Requirements; Siemens; IBM; Oracle; 2MG Healthcare (Services); Birlasoft; Microsoft; Kovair Software, LLC.; SQA Solution; Arorian Technologies; SAP.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Application Lifecycle Management Solutions Market Report Segmentation

This report forecasts revenue growth at the global, regional, & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the healthcare application lifecycle management solutions market report based on offerings, deployment, end-use, application, and region:

-

Offerings Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Sciences Companies

-

Pharma & Biotech Organizations

-

Medical Device Manufacturers

-

Others

-

-

Healthcare Provider

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Risk Management

-

Compliance Management

-

Supply Chain Traceability Test & Quality Management

-

Patient Monitoring

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare application lifecycle management solutions market size was estimated at USD USD 630.8 million in 2023 and is expected to reach USD 679.4 million in 2024.

b. The global healthcare application lifecycle management solutions market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 1,002 million by 2030.

b. North America dominated the healthcare application lifecycle management solutions market with a share of 46.9% in 2023. Owing to the region's emphasis on technological innovation, regulatory compliance, and improving patient care, there is a need for enhanced digital supply chain efficiencies. Further, the pandemic accelerated the adoption of telehealth and remote patient monitoring solutions, requiring scalable and secure ALM tools to manage these applications effectively.

b. Some key players operating in the healthcare application lifecycle management solutions market include Tata Elxsi, Matrix requirements, Siemens, IBM, Oracle, 2MG Healthcare (Services), Birlasoft, Microsoft, Kovair Software, LLC., SQA Solution, Arorian Technologies, and SAP.

b. Market growth is driven by the increasing adoption of application lifecycle management (ALM) tools, which streamline the development and maintenance of essential software applications like electronic health records (EHRs), patient portals, and telemedicine platforms. ALM's role in ensuring compliance with strict regulations such as HIPAA enhances its importance in the market. In addition, the rise of cloud-based solutions, Healthcare Software-as-a-Service (SaaS) offerings, and growing demand for enhanced patient outcomes and operational efficiency are expected to drive further market expansion in the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.