Healthcare API Market Size, Share & Trends Analysis Report By Services (EHR Access, Appointments, Remote Patient Monitoring), By Deployment Model (Cloud Based, On-Premise), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-928-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Healthcare API Market Size & Trends

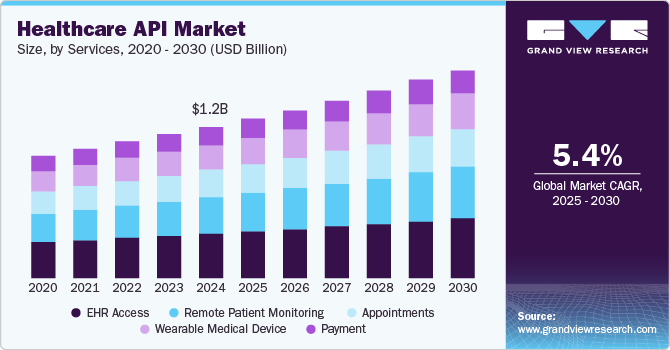

The global healthcare API market size was valued at USD 1.25 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2030. Healthcare APIs allow the integration of Electronic Health Records (EHRs), diagnostic tools, and patient management systems. This can help provide simplicity and accessibility to healthcare data, which is expected to drive market growth.

The growth of telemedicine and remote patient monitoring is another key driver of the healthcare API market. APIs facilitate virtual consultations, enable the integration of wearable health devices, and provide remote access to medical services. According to the National Center for Health Statistics (NCHS) data, approximately 27.4% of medical specialists utilized telemedicine for at least half of their patient visits, which is more than the usage rates among primary care physicians and surgical specialists. In addition, the adoption of telemedicine among physicians has surged significantly, rising from 15.4% in 2019 to 86.5% in 2021.

APIs allow telehealth platforms to securely exchange patient data with providers, enhancing care quality and reducing hospital readmissions. APIs are also central to integrating IoT-enabled devices, such as glucose monitors or smartwatches, with healthcare systems to provide real-time insights. Therefore, the rising use of telemedicine is likely to drive the market growth for healthcare APIs.

Moreover, the shift toward patient-centric healthcare and government initiatives such as the 21st Century Cures Act in the U.S., which requires open API access to patient data, are also adding to the key factors driving the market growth. APIs empower patients by enabling them to access and manage their health data through mobile apps and wearable devices. This increasing emphasis on using APIs is expected to drive the demand for APIs and market growth.

Services Insights

EHR access accounted for the largest share of 29.5% in 2024, owing to its ability to facilitate interoperability and streamlined clinical workflows. The increasing adoption of EHR systems by healthcare providers to enhance patient engagement, improve care coordination, and integrate advanced technologies such as AI and data analytics is a major driver for segment growth. As per the data from the Office of the National Coordinator for Health IT reveals that by 2021, approximately 88% of office-based physicians in the U.S. had adopted some form of EHR, while nearly 78% had implemented certified EHR systems, underscoring the widespread reliance on EHRs in modern healthcare.

The remote patient monitoring segment is expected to grow at the fastest CAGR of 5.9% over the forecast period. This growth can be attributed to the increasing demand for continuous health monitoring, especially chronic disease management, and the widespread adoption of wearable devices and IoT-enabled health technologies. According to the information by the World Health Organization in September 2023, noncommunicable diseases (NCDs) lead to the death of 41 million people annually, which is equivalent to 74% of all deaths globally. This increasing prevalence of chronic diseases is further likely to add to the growth of the segment.

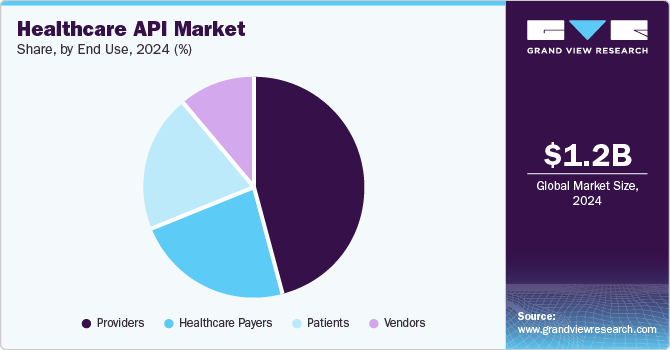

End Use Insights

Providers accounted for the largest market share of 46.0% in 2024, owing to the increasing prevalence of the disease. This significant share can be attributed to the rising reliance on digital solutions to streamline operations, enhance patient care, and ensure compliance with evolving healthcare regulations. Providers are increasingly adopting APIs to integrate electronic health records (EHRs), telemedicine platforms, and other digital health tools to improve clinical workflows and enhance patient engagement.

The healthcare payers segment is projected to grow at the fastest CAGR of 6.1% over the forecast period from 2025 to 2030. The increasing adoption of digital technologies to improve claims processing, enhance fraud detection, and streamline administrative functions is driving the demand for healthcare APIs in the market. Healthcare payers, such as insurance companies and government programs, are also leveraging APIs to integrate with healthcare providers, manage patient data, and offer more efficient services. This is further expected to add to the market demand.

Deployment Type Insights

The cloud-based segment accounted for the largest market share of 80.0% in 2024 and is expected to grow at the fastest CAGR of 5.7% over the forecast period. The growing preference for cloud solutions due to their scalability, cost-efficiency, and ease of deployment is likely to drive the demand for cloud-based APIs. In addition, cloud-based APIs enable seamless integration of healthcare systems and facilitate real-time data access for providers and patients, supporting interoperability and enhancing care delivery. For instance, Google Cloud APIs provides a scalable infrastructure solution managing essential healthcare data formats, such as HL7, FHIR, and DICOM.

The on-premise segment is expected to grow significantly from 2025 to 2030. Its ability to offer enhanced data security and greater control over healthcare data storage and management is likely to add to its market growth. In addition, healthcare organizations prefer on-premise solutions to comply with stringent data protection regulations and to mitigate risks associated with third-party data access, which is further likely to add to the segment growth.

Regional Insights

The North America healthcare API market had the largest revenue share of 33.6% in 2024. This growth can be attributed to the country's advanced healthcare infrastructure, the adoption of digital health technologies, and strong regulatory support. In addition, the growing demand for telemedicine and remote patient monitoring in North America is also accelerating the adoption of healthcare APIs.

U.S. Healthcare API Market Trends

The U.S. healthcare API market dominated North America with the largest revenue share in 2024. The presence of key global companies in the country and increasing investment in AI in healthcare are likely to drive market growth. According to the World Economic Forum in November 2024, venture-capital investments in health AI in the U.S. alone are estimated to reach USD 11 billion this year.

Europe Healthcare API Market Trends

Europe healthcare API market is expected to grow at the fastest CAGR of 6.0% over the forecast period from 2025 to 2030. The increasing adoption of digital health solutions and a strong focus on healthcare interoperability are major factors driving market growth in the region. The increasing emphasis on data privacy and initiatives, such as the General Data Protection Regulation (GDPR), has led to the development of secure API frameworks that enable seamless data exchange across healthcare systems. These factors are likely to drive the market growth in the region.

The Germany healthcare API market is expected to grow significantly over the forecast period owing to the development of healthcare infrastructure and increasing focus on digital health initiatives by government and private players. Initiatives and policies such as the Digital Healthcare Act (DVG) encourage the adoption of electronic health records (EHRs) and telemedicine services. Such initiatives are likely to drive the market growth in the country.

The healthcare API market in the UK accounted for a significant share in Europe. The presence of a well-established healthcare system in the country, including the National Health Service (NHS), and increasing emphasis on adopting digital solutions to improve patient care and operational efficiency are likely to drive market growth in the country.

Asia Pacific Healthcare API Market Trends

The Asia Pacific healthcare API market is anticipated to grow significantly over the forecast period. Rapid advancements in healthcare technology and increasing investment in healthcare infrastructure by countries such as India and China are driving the market growth in the region. In addition, government initiatives to promote digitization in healthcare and the increasing prevalence of chronic diseases in the region are expected to add to the market growth.

The Japan healthcare API market accounted for a significant market share in 2024 owing to increasing efforts to integrate technologies into healthcare, such as electronic health records (EHRs), telemedicine, and AI-powered health solutions. Government initiatives in the country, such as the Health and Medical Strategy, also aim to enhance the efficiency and quality of healthcare services, further driving the adoption of healthcare APIs in the country.

The India healthcare API market is expected to grow significantly owing to the rapid digitalization of healthcare services and the increasing demand for efficient, data-driven healthcare solutions. Government initiatives such as the National Digital Health Mission (NDHM) are also expected to add to the growing demand for healthcare APIs in the country.

Key Healthcare API Company Insights

Some of the key companies operating in the Healthcare API market are Merck & Co., Inc., AbbVie, Inc., Bristol-Myers Squibb Company, and Albemarle Corporation. These companies are engaged in various strategies, such as mergers and acquisitions and expansion activities, to gain a competitive edge in the market.

-

Microsoft Corporation is a global technology company that operates in various industries, including healthcare, through its cloud, AI, and software solutions. The company offers Azure Healthcare APIs, which enables secure and interoperable data exchange using standards such as FHIR (Fast Healthcare Interoperability Resources).

-

Apple Inc. is a global company that designs, manufactures, and markets technological products, including smartphones, tablets, personal computers (PCs), and wearable and portable devices. In addition to hardware, Apple provides software, accessories, related services, and third-party digital content and applications. The company’s HealthKit API allows developers to build applications that securely manage and share health-related data.

Key Healthcare API Companies:

The following are the leading companies in the healthcare API market. These companies collectively hold the largest market share and dictate industry trends.

- Practo

- Apple, Inc.

- General Electric Company

- Athenahealth

- Oracle

- Microsoft Corporation

- eClinicalWorks

- Greenway Health, LLC

- Practice Fusion, Inc.

- Salesforce, Inc.

Recent Developments

-

In September 2023, Metriport announced the launch of an open-source API designed to streamline the process of accessing medical records from any Electronic Health Record (EHR) system.

-

In December 2023, Nvidia announced the introduction of a new suite of cloud-based APIs aimed at accelerating the development and deployment of specialized AI models for medical imaging.

-

In November 2023, Oneview Healthcare launched its new Virtual Care API that enables seamless integration of virtual care solutions into healthcare workflows, allowing providers to deliver remote consultations and monitor patients more effectively.

Healthcare API Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 1.32 billion |

|

Revenue forecast in 2030 |

USD 1.72 billion |

|

Growth rate |

CAGR of 5.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Services, deployment type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Practo, Apple, Inc., General Electric Company, Athenahealth, Cerner Corporation, Microsoft Corporation, Epic Systems Corporation, eClinicalWorks, Greenway Health, LLC, Practice Fusion, Inc., Salesforce, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Healthcare API Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare API market report based on services, deployment type, end use, and region:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

EHR access

-

Appointments

-

remote patient monitoring

-

Payment

-

Wearable medical device

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud Based

-

On-Premise

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare payers

-

Providers

-

Patients

-

Vendors

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare API market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 1.72 billion by 2030.

b. The global healthcare API market size was estimated at USD 1.25 billion in 2024 and is expected to reach USD 1.32 billion in 2025.

b. Some key players operating in the healthcare API market include Practo Technologies Pvt. Ltd., Apple, Inc, Epic Systems Corporation, General Electric Company, Microsoft Corporation, eClinical Works LLC, Greenway Health, LLC, Allscripts Healthcare Solutions Inc., Practice Fusion, Inc., and MuleSoft, Inc.

b. Key factors driving the healthcare API market growth include increasing healthcare investments & adoption of technologically advanced healthcare solutions, the adoption of API integrated electronic health records (EHRs) that provide simplicity and ease of healthcare data accessibility, improved patient outcomes, increased patient satisfaction & development in care quality.

b. North America dominated the healthcare API market with a share of 33.6% in 2024. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance, favorable policies, and high digital literacy rates.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."