Health Check-up Market Size, Share & Trends Analysis Report By Type (General, Preventive, Specialized), By Test Type, By Application (Cardiovascular, Cancer), By Service Provider, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-081-2

- Number of Report Pages: 179

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Health Check-up Market Size & Trends

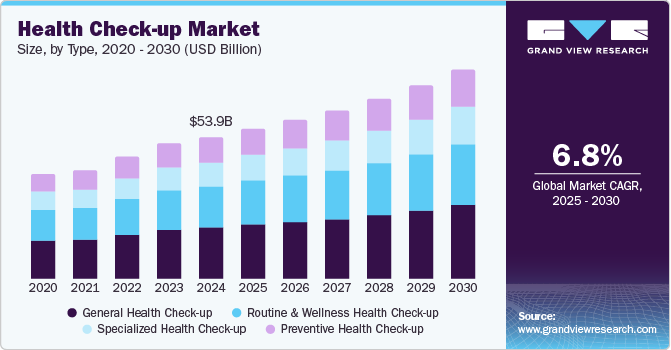

The global health check-up market size was estimated at USD 53.95 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. The market growth is attributable to the increasing prevalence of chronic diseases, rising investments from government bodies to establish population medical screening initiatives and adoption of telemedicine & home-based services in the healthcare ecosystem. For instance in May 2023, the Indian Health Ministry launched a medical screening initiative for people with hypertension and diabetes. This initiative will provide standard care to around 75 million people suffering from non-communicable diseases by 2025.

The increasing prevalence of life-threatening diseases is one of the key drivers for the global health check-up market. Additionally, non-communicable diseases such as diabetes, hypertension, cancer, and cardiovascular diseases are increasing, which often remain asymptomatic in the early stages. For instance, as per AMGA article, more than 30% of the U.S. population suffers from prehypertension, increasing the chances of developing high blood pressure. Regular health check-up allows individuals to manage the condition effectively, as only 1 in 4 U.S. adults have their hypertension under control.

Additionally, government bodies are undertaking initiatives to screen target population from different medical conditions. For instance, the U.S. Preventive Services Task Force (USPSTF) recommends yearly screening for adults aged 18 and older to manage blood pressure risks. Similarly, Middle Eastern economies have initiated medical screening programs to raise awareness of the increasing hypertension prevalence. For instance, in May 2023, the Ministry of Health and Prevention (MoHAP) UAE launched a national campaign for early detection of hypertension. By 2030, UAE plans to reduce the prevalence of high blood pressure by 30%. Hence, increasing recommendations from government bodies will be key drivers for the global market.

The global market is experiencing innovation driven by the adoption of digital technology in the healthcare ecosystem. In Europe region, countries are integrating medical services to improve the healthcare services across multiple countries, which is driving the need for digital technologies. For instance, in June 2022, Nordic countries launched Nordic Interoperability Project (NIP) aims to enable healthcare service providers in Sweden, Denmark, Norway, Finland, and Iceland to evaluate integrated digital medical ecosystem focused on self-management and preventive care. Additionally, a proposal from the European Commission in May 2022 plans to create European Health Data Space, which will harness medical data of nearly 450 million people, thereby establishing a cross-border digital healthcare connectivity. Increasing in health monitoring through digital platforms will increase the adoption of general & preventive tests over the forecast period.

The availability of health insurance coverage that includes preventive care benefits encourages individuals to undergo routine check-ups, thereby driving the market growth. For instance, as per the U.S. CDC, private health insurance in the U.S. covers around 66% of the insured population. In recent years, there has been a shift in insurance policies to prioritize preventive care. Most insurance providers now including preventive care services, such as health check-ups, vaccinations, and screenings, as part of their coverage at no additional cost. Furthermore, insurance companies require policyholders to undergo medical risk assessments as part of the underwriting process. These assessments typically involve health check-ups and help insurers assess the individual's wellness and determine appropriate coverage and premiums. Hence, underwriting processes and growing awareness of preventive care are anticipated to drive market growth.

Type Insights

The general health check-up segment held the largest share of 36.58% in 2024. General health check-up provides a comprehensive overview of the individual’s health, helping to identify risk factors and manage the health condition at early stages. Furthermore, healthcare professionals widely recommend general health check-ups as they contribute to reduce the disease burdens in the future. Moreover, individuals are focusing on proactively managing their well-being, which will drive the market during the forecast period. Furthermore, insurance companies are providing preventive medical services with no-cost sharing benefit, which will help the market growth. For instance, in May 2023, KFF’s article estimated that 151.6 million U.S. citizens were covered by private insurance with a preventive no-cost sharing policy.

The specialized health check-up segment is expected to showcase the fastest CAGR of 7.5% during the forecast period. Specialized health check-ups focus on cardiovascular health, cancer screenings, metabolic disorders, or genetic predispositions. Targeted screenings and tests provide individuals with a comprehensive assessment and early detection of condition-specific risks. For instance, as per Cancer Research U.K., an estimated 20.1 million people globally develop cancer each year with deaths exceeding 10 million annually. However, as per WHO report, 30%-50% of all cancer cases and deaths are preventable if targeted screening is diligently performed.

Test Type Insights

The blood glucose tests held the largest market share of 21.86% in 2024, which can be attributed to the increasing cases of diabetes across the globe. Blood glucose tests, such as fasting blood sugar (FBS) and oral glucose tolerance tests (OGTT), are important in diagnosing and monitoring diabetes. Additionally, early detection of diabetes allows for timely intervention and disease management, which can help to prevent or delay complications associated with the disease. For instance, the National Center for Chronic Disease Prevention and Health Promotion estimated that nearly 96 million U.S. adults have prediabetes, while the average prevalence rate of prediabetes has increased by 3% from 2013 to 2020. Hence, the growing prevalence of prediabetes and diabetes is anticipated to provide lucrative growth opportunities to the global health check-up market players.

The tumor biomarkers segment is expected to witness the fastest CAGR of 7.9% during the forecast period. Tumor biomarker tests identify individuals with a higher risk of developing cancer based on their biomarker profiles, family history, or other risk factors. In addition, tumor biomarkers provide valuable information on molecular characteristics, helping to create novel treatments. The inclusion of novel tumor biomarker test in preventive and specialized health check-up plans are expected to drive the segment growth during the forecast period.

Application Insights

The cardiovascular diseases segment held the largest market share of 28.62% in 2024, attributed to increasing disease prevalence, high mortality rates, and advancement in testing products. Cardiovascular diseases are the leading cause of death in the U.S., with conditions such as coronary heart disease (CHD) a major contributor to heart attacks. According to the American Heart Association, nearly 400,000 deaths in the U.S. were directly correlated with CHD. However, medical diagnostic companies are developing novel and highly sensitive CHD tests to reduce disease mortality with early stage diagnosis of disease. For instance, in April 2023, Cardio Diagnostic Holdings Inc., launched PrecionCHD blood test to detect coronary heart diseases. The platform is built by using company’s AI and biomarkers such as epigenetic and genetic, which helps in improving the clinical specificity of CHD test by 75%.

Cancer segment is expected to grow at the fastest CAGR of 7.5% during the forecast period. The growth is attributed to the increasing prevalence of cancer across the economies, with high mortality rates in significant countries. Additionally, early detection of cancer can result in significant healthcare savings. For instance, as per an article published on MJH Life Sciences in November 2020, early diagnosis and screening of cancer can save around USD 26 billion annually. Additionally, cancer-related deaths can be reduced by 24% if cancer diagnosis is done from stage 1 to stage 3. Thereby, healthcare professionals are guiding at-risk people to undergo medical check-ups throughout the year, which is anticipated to contribute to the segment's growth during the forecast period.

Service Provider Insights

Hospital-based laboratories dominated the market with a share of 57.69% in 2024. Hospital-based laboratories are equipped with advanced medical equipment and infrastructure for conducting a wide range of diagnostic tests and screenings, thereby providing demand for the segment. Additionally, they have access to state-of-the-art technologies and facilities, which helps in driving the revenue for health check-ups. For instance, in March 2023, White Plains Hospital launched a new in-house laboratory powered by innovative technologies, thereby, allowing to facilitate faster diagnosis and treatment for a larger patient pool. In addition, hospital-based laboratories are integrated with hospital services. The integration allows an effective follow-up on health check-ups, curating a strong demand for hospital-based labs.

Standalone laboratories segment is expected to showcase the fastest CAGR of 7.8% during the forecast period. The high growth rate can be attributed to the ability of standalone labs to offer competitive pricing structures than hospital-based laboratories. The low-cost structure is due to lower overhead and administrative costs than hospital-based laboratories. Additionally, established healthcare providers are expanding into standalone laboratories to provide service specificity and patient loyalty. For instance, in December 2021, MD Medical Group launched its first standalone medical lab in Moscow to facilitate specific services of “mother and child” diagnostics in the region.

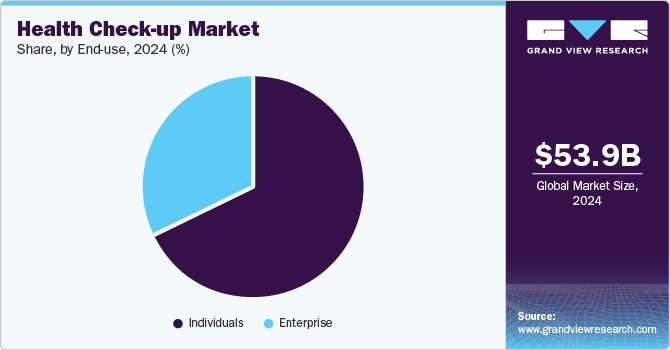

End-use Insights

The individuals segment held the largest market share of 67.98% in 2024. It can be attributed to the increasing awareness of general & preventive health benefits amongst the general population. Healthcare professionals also recommend health check-ups to understand disease prognosis and treatment methodologies. Individual end users often pay the fee out of pocket or through private insurance. The segment’s growth is attributed to the increasing health consciousness among individuals and the desire for early detection and intervention to maintain well-being.

Enterprise segment of the market is expected to grow at the fastest growth of 7.5% during the forecast period. Enterprises such as multinational corporations, educational institutions, and government bodies offer health check-ups as an employee wellness benefit to assess the medical status of their employees, identify potential medical risks, and offer appropriate interventions. Moreover, individuals often face difficulty undergoing health check-ups owing to time constraints; hence, enterprise-based users provide strong health feasibility to employees. For instance, according to the American Academy of Family Physicians article published in April 2023, nearly half of all American women skipped a preventive health check-up service in the last year due to high out-of-pocket costs and problems in scheduling appointments. Thereby, enterprise-provided health check-ups allow medical screening to the working population, augmenting segmental growth during the forecast period.

Regional Insights

North America Health Check-up Market Trends

North America health check-up market dominated with a share of 37.30% in 2024, it is due to the increasing healthcare coverage across the region. For example, within the U.S., public and private insurance offers distinct advantages while covering a specific population base, providing health check-ups across the country. For instance, as per Census Bureau’s report on insurance coverage in the U.S., nearly 35.7% of people held public health insurance coverage in 2021. In addition, the uninsured healthcare rate of U.S. children fell to 5.0% in 2021. Thereby, universal coverage across ages provides growth impetus to the regional market.

U.S. Health Check-up Market Trends

The U.S health check-up market is seeing growth driven by preventive healthcare awareness, technological advancements, and expanded access to telemedicine. A notable trend is the rise of at-home testing kits for routine health checks, like Everlywell’s diagnostic tests for cholesterol, thyroid, and vitamin levels. Employers are also investing in employee wellness programs offering regular screenings to manage workforce health proactively. Additionally, digital health apps and platforms such as Labcorp OnDemand allow individuals to order tests online, reflecting a shift toward consumer-driven health monitoring solutions.

Europe Health Check-up Market Trends

In Europe, the health check-up market is expanding with a focus on preventive care and early diagnosis. Countries like Germany and France are promoting routine screenings, supported by public health campaigns that encourage preventive tests for cardiovascular and metabolic conditions. The adoption of digital health platforms like Qured in the UK allows individuals to book at-home health checks, aligning with rising demand for accessible care. Moreover, employers are increasingly offering health check-ups as part of wellness initiatives, driving growth in workplace health services across Europe.

The growth of the UK health check-up market is driven by a focus on preventive health, with both private and NHS-funded initiatives encouraging regular screenings for conditions like diabetes and heart disease. Private healthcare providers, such as Bupa, offer comprehensive health assessments, while digital health services like Thriva provide convenient at-home blood testing kits. The rise of remote health monitoring is also evident, with wearable technology and online health assessments becoming popular. Additionally, corporate wellness programs increasingly include annual health check-ups, reflecting employer investment in employee well-being.

The health check-up market in France is growing with an emphasis on preventive care, supported by public and private sectors. The French healthcare system, through Assurance Maladie, encourages preventive check-ups for lifestyle diseases such as cardiovascular conditions and diabetes, which are available at primary care centers. Private clinics like Institut Pasteur offer specialized screenings, including comprehensive cancer and heart health assessments. Additionally, there is rising demand for digital health platforms, as seen with Doctolib, which enables users to book medical check-ups online, promoting easy access to preventive services.

The Germany health check-up market is expanding due to a focus on preventive care and early detection of chronic illnesses. Government initiatives like the "Check-up 35" program offer adults over 35 free biannual check-ups to screen for conditions such as heart disease, diabetes, and kidney disease. Private health providers, such as Helios and Mediclin, offer comprehensive packages for cancer screening and cardiovascular health, catering to an increasing number of health-conscious individuals. Additionally, digital health platforms, including TeleClinic, support remote health consultations, further enhancing access to preventive services across the country.

Asia Pacific Health Check-up Market Trends

Asia Pacific health check-up market is expected to grow the fastest during the forecast period. The market growth is due to the increasing government initiatives to improve the healthcare services owing to an increasing incidence of communicable and non-communicable diseases. For instance, in March 2023, the Indian Council of Medical Research (ICMR) informed the Indian government that cancer cases in the country are estimated to go up from 1.46 million in 2022 to 1.57 million in 2025. Moreover, the country has announced a population-based screening initiative for non-communicable diseases such as hypertension, common cancer, and diabetes. Due to the growing medical screening initiatives by governments across the economies, the region is anticipated to provide lucrative growth opportunities to the market players.

The China health check-up market has seen robust growth, driven by rising health awareness, urbanization, and increasing disposable incomes. Government programs, such as "Healthy China 2030," promote preventive healthcare and regular health screenings. Companies like iKang and Meinian Onehealth have capitalized on this trend, offering comprehensive check-up packages, including cancer and cardiovascular screenings, to meet the demand among both individuals and corporate clients. Furthermore, digital health platforms like Ping An Good Doctor make it easier to access health assessments and personalized health management services remotely, broadening accessibility across China.

The Japan health check-up market is expanding due to the aging population and a strong cultural focus on preventive healthcare. Annual health screenings, known as ningen dock, are popular and often encouraged by employers and the government to reduce long-term healthcare costs. Key providers like Riken and Nichii Gakkan offer specialized packages for early detection of lifestyle-related diseases such as diabetes and cardiovascular issues. Additionally, technological advancements, such as AI-based diagnostic tools and telemedicine, are being integrated to enhance efficiency and accessibility in regular health assessments.

Latin America Health Check-up Market Trends

In Latin America, the health check-up market is growing as public awareness of preventive healthcare increases, particularly in countries like Brazil, Mexico, and Argentina. Key drivers include a rising prevalence of chronic diseases, such as diabetes and hypertension, and the demand for affordable, accessible healthcare. Private providers like Clínica del Country in Colombia and Hospital Alemão Oswaldo Cruz in Brazil offer preventive check-up packages targeting lifestyle diseases. Additionally, governments are collaborating with private firms to expand screening initiatives, while telemedicine is making health assessments more accessible in remote areas.

The Brazil health check-up market is expanding due to a shift toward preventive care and rising chronic disease rates. The market is driven by both private clinics and government programs focusing on early detection and disease prevention. For instance, Fleury Group offers specialized check-up services tailored to specific risk profiles, while Rede D’Or São Luiz has seen growth in corporate health packages. Telemedicine has also become popular, enabling remote health evaluations and check-ups, especially in underserved areas, facilitating access to care across the country.

Middle East & Africa Health Check-up Market Trends

The Middle East health check-up market is experiencing significant growth as awareness of preventive healthcare increases across the region. Governments and private sectors are both investing heavily in preventive health measures to address the rising burden of chronic diseases like diabetes and heart conditions. In the UAE, providers such as Mubadala Health offer comprehensive health assessments targeting early disease detection. Additionally, Saudi Arabia’s Vision 2030 promotes wellness and preventive care, fostering partnerships with global healthcare providers like Cleveland Clinic for specialized check-up packages.

The health check-up market in Saudi Arabia is experiencing significant growth, driven by increasing awareness of preventive healthcare and lifestyle-related diseases. Key trends include the rise of health screening packages offered by hospitals and clinics, a focus on digital health services for easy access, and government initiatives promoting regular health check-ups. For example, the Saudi Ministry of Health launched campaigns encouraging citizens to undergo annual health screenings, while private clinics are offering comprehensive packages that cater to various age groups and health concerns.

Key Health Check-up Company Insights

The key players operating in the global health check-up market are enhancing healthcare services and increasing strategic initiatives such as collaboration between government and private companies to enhance the efficiency and effectiveness of medical screening services. Moreover, increasing introduction of direct-to-customer tests are further anticipated to fuel the market growth over the forecast period. For instance, in February 2023, Hurdel launched a Vitamin D test in the U.S., which will be sold on the company’s online store. Furthermore, the preventive test will allow the physicians to discuss concerns over chronic conditions and wellness.

Key Health Check-up Companies:

The following are the leading companies in the health check-up market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- SYNLAB International GmbH

- OPKO Health, Inc. (BioReference Health, LLC.)

- Eurofins Scientific

- UNILABS

- Sonic Healthcare Limited

- ARUP Laboratories

- Q2 Solutions

- LalPathLabs.com

View a comprehensive list of companies in the Health Check-up Market

Health Check-up Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 56.88 billion |

|

Revenue Forecast in 2030 |

USD 79.18 billion |

|

Growth rate |

CAGR of 6.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, test type, application, service provider, end-use, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; SYNLAB International GmbH; OPKO Health, Inc. (BioReference Health, LLC.); Eurofins Scientific; UNILABS; Sonic Healthcare Limited; ARUP Laboratories; Q2 Solutions; Laboratory Corporation of America Holdings; LalPathLabs.com |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Health Check-up Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented global health check-up market report based on type, test type, application, service provider, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

General Health Check-up

-

Preventive Health Check-up

-

Specialized Health Check-up

-

Routine And Wellness Health Check-up

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Glucose Test

-

Kidney Function Test

-

Bone Profile Test

-

Electrolyte Test

-

Liver Function Test

-

Lipid Profile Test

-

Special Biochemistry

-

Cardiac Biomarkers

-

Hormones & Vitamins

-

Tumor Markers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Diseases

-

Metabolic Disorders

-

Cancer

-

Inflammatory Conditions

-

Musculoskeletal Disorders

-

Neurological Conditions

-

Others

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based Laboratories

-

Central Laboratories

-

Standalone Laboratories

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise

-

Individuals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global global health check-up market size was estimated at USD 53.95 billion in 2024 and is expected to reach USD 79.18 billion in 2025.

b. The global global health check-up market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach USD 79.18 billion by 2030.

b. Hospital-based laboratories dominated the global health check-up market with a share of 57.69% in 2024. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the global health check-up market include Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, SYNLAB International GmbH, OPKO Health, Inc. (BioReference Health, LLC.), Eurofins Scientific, UNILABS, Sonic Healthcare Limited, ARUP Laboratories, Q2 Solutions, Laboratory Corporation of America Holdings, LalPathLabs.com

b. Key factors that are driving the health check-up market growth include the increasing prevalence of chronic diseases, rising investments from government bodies to establish population medical screening initiatives, and adoption of telemedicine & home-based services

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."