- Home

- »

- Electronic Devices

- »

-

Headset Market Size, Share, Trends, Growth Report, 2030GVR Report cover

![Headset Market Size, Share & Trends Report]()

Headset Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (In-ear, Over-ear), By Price Band, By Connectivity (Wired, Wireless), By Application (Personal, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-170-2

- Number of Report Pages: 206

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Headset Market Summary

The global headset market size was estimated at USD 61.08 billion in 2022 and is anticipated to reach USD 558.89 billion by 2030, growing at a CAGR of 31.2% from 2023 to 2030. The rise in disposable income levels among developing countries such as India and China has increased consumer spending power, which is expected to drive market growth.

Key Market Trends & Insights

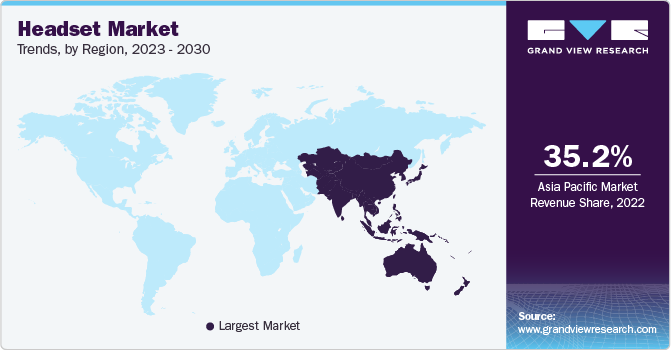

- Asia Pacific dominated the market and accounted for the largest revenue share of 35.2% in 2022 and is expected to grow at the fastest CAGR of 34.7% over the forecast period.

- North America is expected to witness significant growth during the forecast period.

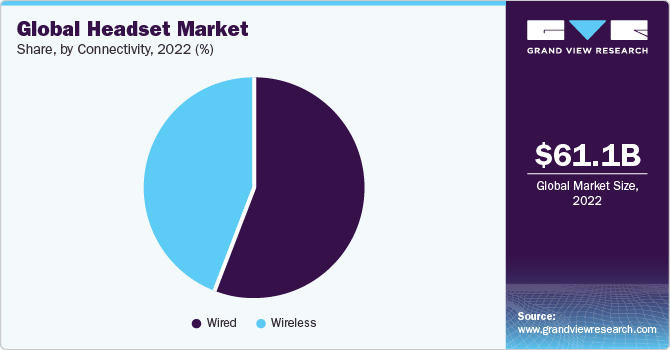

- By connectivity, the wired segment accounted for the largest revenue share of 51.7% in 2022.

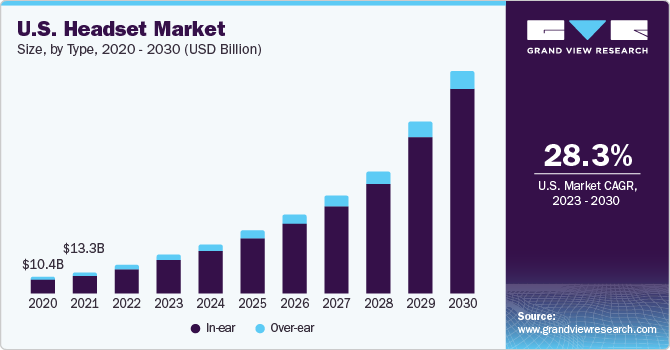

- By type, the in-ear segment accounted for the largest revenue share of 81.1% in 2022 and is expected to grow at the fastest CAGR of 32.1% over the forecast period.

- By application, the personal segment held the largest revenue share of 73.4% in 2022 and is expected to grow at the fastest CAGR of 33.0% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 61.08 Billion

- 2030 Projected Market Size: USD 558.89 Billion

- CAGR (2023-2030): 31.2%

- Asia Pacific: Largest market in 2022

Additionally, changing consumer preferences have led to the large-scale adoption of more advanced products equipped with sophisticated features such as voice command, noise cancellation, multiple pairing, and more. Similarly, the market has recently witnessed a growing demand for specially designed gaming products with advanced features such as in-game communication and virtual surround sound to provide immersive surround audio to aid and amplify the gaming experience. The development of active noise cancellation techniques, which provide consumers with a better listening experience, is expected to drive market growth. By delivering greater noise attenuation, noise-canceling headphones offer excellent hearing protection against constant noise levels. The technology protects against low-frequency droning sound and high levels of external noise.

For instance, Sony Group Corporation introduced Sony WH-1000XM4, a wireless headphone that offers an active noise cancellation feature using dual noise sensor technology. The dual noise sensor technology enables it to catch ambient noise and sends it to the dependable HD noise-canceling processor.

The increasing availability of counterfeit products may challenge the growth of the global market during the forecast period. The growing demand for reasonably priced and low-cost items and a need for more understanding have fueled the production of low-cost counterfeit products, likely to significantly hamper the market in emerging economies during the forecast period. Consumers who need more awareness about the brand and quality usually opt for products offering similar features at a considerably low price.

Due to their competitive product and price offerings in emerging markets like China, India, Indonesia, and Taiwan, the increased use of these counterfeit devices is expected to hamper market growth during the forecast period. According to OECD reports published in 2019, the global quantity of counterfeit products has expanded dramatically, accounting for approximately 3.3% of global trade.

Several manufacturers offer fitness tracking applications, influencing the growth favorably. The increasing adoption of headsets during the workout is expected to propel market demand in the coming years. Sports enthusiasts and gym-goers prefer hassle-free, wireless products to avoid tangling, which, in turn, leads to workout distractions. Manufacturers target fitness-conscious customers by offering innovative features such as fitness monitoring & tracking in devices. For example, the BioSport Audio in-ear headset powered by Intel provides health monitoring functions that require no special chargers or batteries. BioSport relies on built-in sensors and unique software to operate as a pedometer, heart monitor, and other biometrics.

Earphones & headphones are integral to day-to-day individual activities and have adoption across several verticals. One such area of adoption is the corporate world, which has witnessed a seismic shift in work culture during the pandemic. The lockdown situation has forced several corporate employees to adopt a work-from-home model. This shift has compelled office conferences, meetings, and training sessions to be attended from home and has boosted the sales of high-quality earphones.

End users such as small offices, home offices, enterprises, contact center employees, and remote workers are looking for features like long-distance wireless connectivity, Active Noise Cancellation (ANC), and good microphone performance.

Connectivity Insights

The wired segment accounted for the largest revenue share of 51.7% in 2022. The wired segment includes headsets connected through cables and classified into technologies such as active noise canceling (ANC), noise isolation designed for a gaming console, stereo audio, tangle-resistant cable, etc. The wired segment market will likely maintain its market share in the coming year because wired headsets are less expensive, have less latency, last longer, and offer superior audio quality.

The wireless segment is estimated to register the fastest CAGR of 32.7% over the forecast period, owing to the adoption of technological developments such as artificial intelligence, augmented reality, and SKAA technology. The adoption of bone conduction technology for developing earless, smart headsets is further propelling demand for the wireless segment in the market. The bone conduction technology enables people with deafness to hear and lets swimmers listen to music underwater. Improved accessibility and distinct product offerings drive demand for the wireless-headset market.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 35.2% in 2022 and is expected to grow at the fastest CAGR of 34.7% over the forecast period, owing to the increasing consumer disposable income, especially in developing countries such as India and China. As per the industry experts, the market in Asia Pacific is price sensitive, and therefore, major players face stiff competition from local brands in countries like India and China. For instance, brands like boAt, Shenzhen Dongxue Technology Co., Ltd., and others have introduced wireless headsets, offering multiple features at lower prices.

North America is expected to witness significant growth during the forecast period. The proliferation of smartphones is driving the market in North America. Due to the growing presence of well-known enterprises and rising acceptance of new technical products, the market is expected to grow in the forecasted period. Furthermore, the availability of wireless devices at affordable pricing is expected to expand the wireless segment across the region. In addition, the European region is likely to witness steady growth, owing to the continuous adoption of premium products in these regions.

Type Insights

The in-ear segment accounted for the largest revenue share of 81.1% in 2022 and is expected to grow at the fastest CAGR of 32.1% over the forecast period. Miniaturization of the in-ear segment and increased comfort drive demand for the segment. The rising demand for the smartphone market is expected to fuel the in-ear headset market segment. Technological improvements have led to the development of lighter and more compact items, making them more compatible with devices like tablets and smartphones. Furthermore, advantages like the great listening quality of in-ear devices have led customers to use in-ear earbuds to enhance their overall experience.

The over-ear segment is estimated to witness significant growth over the forecast period. This growth can be attributed to technological developments incorporating noise cancellation, voice assistant integration, TruNote audio technologies, and infrared wireless technology. There is a rise in demand for the over-ear segment in Asia Pacific countries. Growing demand for the mobile communications and high-end headset market is expected to incite regional growth. The availability of low-cost products from regional manufacturers is impacting the local market favorably.

Price Band Insights

The USD 151-350 segment accounted for the largest revenue share of around 42.8% in 2022. Highly sophisticated features such as sensitivity, frequency response, improved design, and demand for the value-added features provided by NFMI (near-field magnetic induction communication), such as noise reduction and 3D audio technology, are the factors anticipated to fuel demand for this product range.

Considering superior sound experience, quality, and brand recognition, high-priced headsets are chosen over low-priced headsets. For instance, customers prefer established brands such as Apple Inc. and Audeze LLC, which are well-known for providing premium quality products.

The USD 51-150 segment is estimated to register the fastest CAGR of 33.8% over the forecast period. A device within the pricing range of USD 51-150 is predicted to witness high demand as several small brands introduce new products with advanced features at affordable prices. Meanwhile, the COVID-19 effect is also expected to contribute to the growth of this segment as individual income has been affected, and they are anticipated to seek medium-priced products.

Application Insights

The personal segment held the largest revenue share of 73.4% in 2022 and is expected to grow at the fastest CAGR of 33.0% over the forecast period owing to the rise in technological innovation and advancements. The growing proliferation of headsets for gaming, fitness, sports, casual, and virtual reality is expected to fuel demand for the personal application segment. Furthermore, personal headset demand is increasing significantly due to the work-from-home mandates. The shift has compelled office conferences, meetings, and training sessions to be attended from home and has boosted the sales of the personal-headset market. The increased usage of OTT platforms and rising leisurely activities during the lockdown have also positively impacted the personal market.

The commercial segment is estimated to witness significant growth over the forecast period owing to the rising adoption of headsets in media and entertainment and BPO enterprises. Furthermore, demand for commercial headsets in the telecommunication and military sectors is being driven by the rise in the adoption of unified communication modes to conduct training sessions, meetings, video conferences, and webinars with the help of UC technology to reduce costs. Growing demand for improved communications in commercial applications, particularly in call centers and enterprises, is predicted to contribute to industry growth significantly.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in September 2022, Bose released the QuietComfort Earbuds II, an innovative wireless earbud with exciting features for an enhanced listening experience. One standout feature is CustomTune, which utilizes sound calibration to tailor audio and noise cancellation settings according to the unique acoustic response of the user's ear canal. This personalized approach ensures unparalleled sound quality and noise reduction.

Key Headset Companies:

- Alclair / Matrics Inc.

- Apple, Inc.

- Bose Corporation

- Grado Labs.

- HARMAN International.

- JVCKENWOOD Corporation

- Koninklijke Philips N.V.,

- Logitech.

- Panasonic Holdings Corporation

- Plantronics, Inc.; Pioneer Corporation.

- Sennheiser electronic GmbH & Co. KG

- SHENZHEN CANNICE TECHNOLOGY CO.,LTD.

- Shure Incorporated.

- Skullcandy.eu

- Sony Corporation

- ULTIMATE EARS.

- Zebronics India Pvt. Ltd.

Recent Developments

-

In October 2022, Logitech G, a division of Logitech International, introduced the G733 wireless headset, an exceptional wireless headset tailored specifically for gaming enthusiasts. This cutting-edge product boasts reversible suspension headbands, offering comfortable wear for extended gaming sessions. Including dual-layer memory foam ear pads ensures optimal sound isolation and plush comfort.

-

In September 2022, JBL unveiled the JBL Quantum 350 Wireless Headphones, a remarkable gaming headset designed to elevate the gaming experience. With a long-lasting 22-hour replenishable battery, gamers can enjoy extended gaming sessions without interruptions, ensuring uninterrupted playtime.

-

In September 2022, Logitech introduced the Brio 500 webcams and Zone Vibe headphones and headsets, catering to the evolving demands of hybrid work scenarios. Designed to facilitate seamless communication and productivity, these products are ideal for professionals such as teachers, architects, and designers.

-

In September 2022, Sony unveiled the WH-1000XM5 in India, an exquisite over-ear headset catering to audiophiles seeking top-notch quality. Boasting two sophisticated color options, black and silver, these premium headphones provide an impressive 30-hour battery life for extended listening pleasure. The WH-1000XM5 is 360 Reality Audio Certified, ensuring an immersive and lifelike audio experience for music enthusiasts. With the convenience of pairing two devices simultaneously and the Swift Pair technology, users can seamlessly switch between devices and enjoy a hassle-free connection.

-

In September 2022, Sennheiser introduced the Momentum 4, a cutting-edge wireless headphone that redefines audio performance. Users can enjoy extended listening sessions without interruption with an impressive 60 hours of battery backup. The Momentum 4 incorporates Adaptive Noise Cancellation (ANC) technology, ensuring a serene listening environment and enhanced audio clarity.

-

In September 2022, Bose announced a strategic partnership with Qualcomm, a renowned US-based multinational company specializing in software development and semiconductor manufacturing. The collaboration aims to enhance the future of Bose devices by integrating Qualcomm's advanced music and voice platforms.

-

In August 2022, Grado launched its Statement X series headsets, featuring the GS1000x and GS3000x models. The GS3000x headphones showcase a stunning cocobolo wood border and are equipped with Grado's most powerful driver, delivering exceptional audio performance. On the other hand, the GS1000x boasts a unique combination of mahogany and ipê wood, further enhancing its aesthetics and sonic characteristics.

-

In July 2022, JBL introduced the JBL LIVE Pro 2 headphones, an impressive addition to their wireless product lineup. These headphones have remarkable features, including 40 hours of listening time, ensuring an uninterrupted audio experience. With an IPX5 rating, the LIVE Pro 2 headphones offer water and sweat resistance, making them suitable for active use.

-

In June 2022, Sony unveiled INZONE, a brand-new product line dedicated to PC gaming gear. This exciting lineup comprises three headsets, with two of them being wireless and one wired, along with two monitors.

-

In March 2022, JBL, a subsidiary of Harman International, joined forces with 100 Thieves, a renowned American gaming organization and fashion lifestyle brand, for an exclusive partnership on the Quantum ONE Headset. This limited edition, game-focused headset marks a significant milestone in JBL's efforts to establish itself as a leading brand in the gaming industry.

-

In February 2022, Sony and Niantic, a leading US-based augmented reality platform developer, joined forces for a groundbreaking collaboration. The partnership focuses on integrating Niantic's cutting-edge AR technology with Sony's advanced audio technology to create innovative headphones featuring auditory AR capabilities.

-

In June 2021, Poly unveiled the Poly Voyager Focus 2, a cutting-edge wireless headset with advanced features. Among its highlights are the Acoustic Fence technology and active noise cancellation (ANC), ensuring crystal-clear audio and enhanced focus during calls and meetings. The headset is offered in two variants, the Voyager Focus 2 UC and Voyager Focus 2 Office, both Microsoft Teams-certified, guaranteeing seamless integration with the popular communication platform.

-

In September 2020, Panasonic unveiled an exciting lineup of five new headsets as part of their Athleisure and Retro series. The HTX90N, NJ310B, HTX20B, TCM130, and TCM55 models all boast voice assistance and noise cancellation technology, ensuring a seamless audio experience.

Headset Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 83.66 billion

Revenue forecast in 2030

USD 558.89 billion

Growth rate

CAGR of 31.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, volume in million units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Price Band, Connectivity, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, South Africa, UAE

Key companies profiled

Alclair / Matrics Inc.; Apple, Inc.; Bose Corporation; Grado Labs.; HARMAN International.; JVCKENWOOD Corporation; Koninklijke Philips N.V., Logitech.; Panasonic Holdings Corporation; Plantronics, Inc.; Pioneer Corporation.; Sennheiser electronic GmbH & Co. KG; SHENZHEN CANNICE TECHNOLOGY CO.,LTD.; Shure Incorporated.; Skullcandy.eu; Sony Corporation; ULTIMATE EARS.; Zebronics India Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Headset Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global headset market report on the basis of type, price band, connectivity, application, and region:

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

In-ear

-

Over-ear

-

-

Price Band Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Below USD 50

-

USD 51-150

-

USD 151-350

-

Over USD 351

-

-

Connectivity Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global headset market size was estimated at USD 61.08 billion in 2022 and is expected to reach USD 83.66 billion in 2023.

b. The global headset market is expected to grow at a compound annual growth rate of 31.2% from 2023 to 2030 to reach USD 558.89 billion by 2030.

b. In-ear segment dominated the headset market with a share of 81.1% in 2022. The rising demand for the smartphone market is expected to fuel the in-ear headset market segment.

b. Some key players operating in the headset market include Alclair / Matrics Inc.; Apple, Inc.; Bose Corporation; Grado Labs.; HARMAN International.; JVCKENWOOD Corporation; Koninklijke Philips N.V., Logitech.; Panasonic Holdings Corporation; Plantronics, Inc.; Pioneer Corporation.; Sennheiser electronic GmbH & Co. KG; SHENZHEN CANNICE TECHNOLOGY CO.,LTD.; Shure Incorporated.; Skullcandy.eu; Sony Corporation; ULTIMATE EARS.; and Zebronics India Pvt. Ltd. among others

b. The development of active noise cancellation techniques, which provide consumers with a better listening experience is expected to drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.