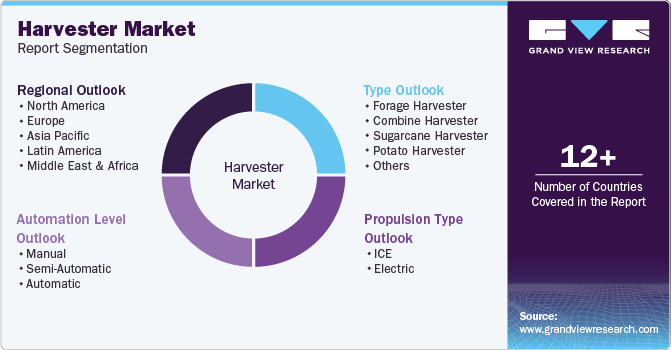

Harvester Market Size, Share & Trends Analysis Report By Type (Forage, Combine, Sugarcane, Potato), By Automation Level (Automatic, Manual, Semi-Automatic), By Propulsion Type (ICE, Electric), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-439-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Harvester Market Size & Trends

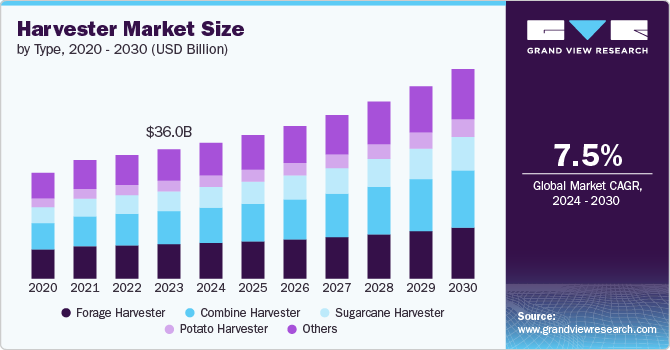

The global harvester market size was estimated at USD 36.00 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. Increasing mechanization in agriculture, the rising demand for food, and technological advancements in harvesting equipment are driving the demand for harvesters across the globe. Furthermore, governments across the globe are recognizing the importance of modernizing agriculture and offering financial incentives, subsidies, and low-interest loans to farmers for purchasing advanced harvesting equipment. These initiatives are encouraging the adoption of harvesters, particularly in emerging economies.

The rapid advancements in technology are making harvesters more efficient, reliable, and cost-effective. Innovations such as AI, machine learning, robotics, and IoT are being integrated into harvesting equipment, enhancing their capabilities and driving market growth. Precision agriculture has become a dominant trend in modern farming, and harvesters are equipped with GPS. Sensors and IoT technology are capable of mapping fields, monitoring crop health, and optimizing the harvesting process. These innovations not only improve efficiency but also reduce waste and environmental impact.

As concerns about climate change and environmental sustainability grow, there is a rising demand for eco-friendly harvesting solutions. Manufacturers are focusing on reducing the carbon footprint of harvesters by developing energy-efficient machines and exploring alternative power sources such as electric and hybrid engines. For instance, in January 2024, Caterpillar Inc. announced the prototype demonstration project for a 600V battery-powered electric field elevator for nut harvesting equipment. The company is developing prototypes in collaboration with Flory Industries, a nut-harvesting equipment manufacturer, and Holt of California, a dealer of Caterpillar.

Technology plays a crucial role in the evolution of the agriculture harvester market. AI is revolutionizing the agriculture harvester market by enabling machines to learn from data, make decisions, and optimize harvesting processes. AI-powered harvesters can analyze field conditions, predict the best time to harvest, and adjust their operations in real-time to maximize yield and minimize losses. Furthermore, robotic technology is increasingly being integrated into harvesters, allowing for more precise and efficient harvesting.

There is a growing awareness of the need for sustainable farming practices to protect the environment and ensure long-term food security. Harvesters that support sustainable farming by reducing waste, conserving energy, and minimizing soil degradation are in high demand. The expansion of large-scale farming operations, particularly in regions like North America, Europe, and Part of Asia, is driving the demand for high-capacity harvesters. Large farms require efficient and powerful harvesting equipment to manage vast areas of crops, propelling the demand for advanced harvesters in the market.

Type Insights

The forage harvester segment dominated the market and accounted for more than 26.0% share of global revenue in 2023. The adoption of self-propelled forage harvesters is increasing, driven by their high efficiency and ability to operate in various field conditions. The trend towards sustainable farming practices is also influencing the forage harvester market, with manufacturers focusing on developing equipment that minimizes environmental impact.

The combine harvester segment is projected to witness the highest CAGR of 8.5% from 2024 to 2030. This segment is primarily driven by the increasing global population and the corresponding demand for food. Furthermore, government initiatives promoting mechanization in agriculture, particularly in developing countries, are expected to drive the adoption of combine harvesters. For instance, the Indian government’s Sub-Mission on Agricultural Mechanization (SMAM) provides subsidies to farmers for purchasing modern agricultural machinery, including combine harvesters.

Automation Level Insights

The semi-automatic segment dominated the market and accounted for more than 54.0% share of global revenue in 2023. The rising labor costs and the scarcity of skilled farm labor are significant drivers for the adoption of semi-automatic harvesters. These machines offer a balance between cost and efficiency, making them attractive for mid-sized farms. Countries like China, India, and Brazil are seeing increased adoption of semi-automatic harvesters as part of their agricultural modernization programs. These machines are becoming increasingly sophisticated, with enhancements such as GPS tracking, yield mapping, and real-time data analytics, which were once reserved for fully automated systems.

The automatic segment is projected to register a significant CAGR from 2024 to 2030. The primary driving factor for automatic harvesters is the need for increased efficiency and productivity in large-scale farming. These machines reduce the reliance on manual labor, which is becoming increasingly expensive. Moreover, the integration of AI and machine learning allows farmers to optimize their harvesting processes, reduce waste, and improve yield quality.

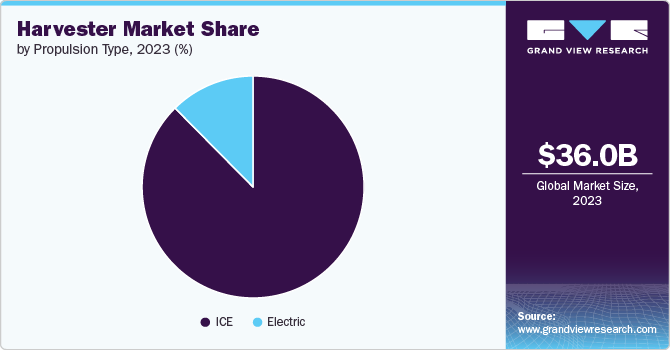

Propulsion Type Insights

The ICE segment dominated the market and accounted for more than 87.0% share of global revenue in 2023. The infrastructure for diesel fuel is well-established, especially in rural areas where farming is prevalent, making ICE harvesters a convenient choice for farmers. Furthermore, manufacturers are investing in advanced engine technologies to reduce fuel consumption and emissions. For instance, Tier 4 engines, which adhere to strict emissions standards set by the U.S. Environmental Protection Agency (EPA), have become increasingly common. These engines utilize advanced after-treatment systems, such as selective catalytic reduction (SCR) and exhaust gas recirculation (EGR), to minimize nitrogen oxide (NOx) emissions.

The electric segment is projected to register the highest CAGR from 2024 to 2030. This segment is characterized by rapid innovation and growing interest from both manufacturers and farmers. One of the most significant trends is the development of high-capacity batteries that can provide longer operational times. Lithium-ion batteries are being widely adopted due to their energy density and relatively quick charging times. Furthermore, some manufacturers are even exploring solid-state batteries, which offer even greater energy storage and safety.

Regional Insights

The North America harvester market is expected to grow at a notable CAGR of 8.0% from 2024 to 2030. The market in the region is influenced by advancements in technology and the growing emphasis on large-scale farming operations. The region has seen a significant rise in the adoption of high-capacity harvesters designed for extensive farmlands, particularly in the U.S. and Canada.

U.S. Harvester Market Trends

The harvester market in the U.S. is expected to grow at a CAGR of 8.0% from 2024 to 2030. The market in the U.S. is witnessing an increasing adoption of autonomous and AI-driven harvesters, particularly in the Midwest, where large-scale grain farming dominates. Additionally, the growing trend towards the use of electric and hybrid harvesters as part of broader shift towards sustainable farming practices.

Asia Pacific Harvester Market Trends

Asia Pacific harvester market dominated the global market and accounted for a revenue share of over 39.0% in 2023. The regional market growth is driven by the increasing mechanization of agriculture in emerging economies such as India and China. With the rapid adoption of advanced harvesting equipment, the region is transitioning from traditional manual labor to mechanized farming practices. The demand for multi-crop harvesters has surged, particularly in countries like India, where diverse cropping patterns require versatile machinery.

Europe Harvester Market Trends

The harvester market in Europe is expected to grow at a notable growth rate from 2024 to 2030. Stringent environmental regulations in Europe are pushing farmers to adopt harvesters that meet low-emission standards. The EU’s Common Agriculture Policy (CAP) includes provisions that encourage the use of sustainable farming equipment.

Key Harvester Company Insights

Some key market companies include AGCO Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Dasmesh Group, Deere & Company, KUBOTA Corporation, Linttas Electric Company, Mahindra&Mahindra Ltd., SDF, and Caterpillar Inc.

-

AGCO Corporation is engaged in designing, manufacturing, and distributing agricultural tractors and replacement parts worldwide. The company offered products under North America's Gleaner and AGCO Allis brands. It currently offers its agricultural tractors under the following brand names: Challenger, Fendt, Massey Ferguson, and Valtra. The company focuses on product innovation and invests in the research & development of High Horsepower (HHP) tractors and advanced harvesting technology platforms. AGCO Corporation offers its products through a network of approximately 3,275 independent distributors and dealers across 140 countries.

Erisha Agritech Private Limited and Linttas Electric Company are some emerging companies in the target market.

-

Linttas Electric Company is a South Australia-based company focused on developing electric-powered combine harvesters. By offering electric harvesters the company aligns with the global trend towards more sustainable farming practices, which is gaining traction among environmentally conscious farmers and large agricultural enterprises.

Key Harvester Companies:

The following are the leading companies in the harvester market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Dasmesh Group

- Deere & Company

- KUBOTA Corporation

- Linttas Electric Company.

- Mahindra&Mahindra Ltd.

- SDF

- Caterpillar Inc.

Recent Developments

-

In January 2024, CNH Industrial N.V. announced investment of around USD 167 million (EUR 150 million) for expanding its production facility and R&D capabilities at the New Holland Harvesting Center of Excellence located in Belgium. Through the investment, the company redesigned the assembly line and logistics area to streamline the manufacturing of CR11.

-

In August 2023, Swaraj Tractors, a brand of Mahindra&Mahindra Ltd. launched the Swaraj 8200 Wheel Harvester. The harvester featured an intelligent system including live location tracking, fuel consumption, distance traveled, and acres harvested.

Harvester Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 37.88 billion |

|

Revenue forecast in 2030 |

USD 58.41 billion |

|

Growth rate |

CAGR of 7.5% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, automation level, propulsion type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

AGCO Corporation; CLAAS KGaA mbH; CNH Industrial N.V.; Dasmesh Group; Deere & Company; KUBOTA Corporation; Linttas Electric Company; Mahindra&Mahindra Ltd.; SDF; Caterpillar Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Harvester Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global harvester market report based on type, automation level, propulsion type, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Forage Harvester

-

Combine Harvester

-

Sugarcane Harvester

-

Potato Harvester

-

Others

-

-

Automation Level Outlook (Revenue, USD Million, 2017 - 2030)

-

Manual

-

Semi-Automatic

-

Automatic

-

-

Propulsion Type Outlook (Revenue, USD Million, 2017 - 2030)

-

ICE

-

Electric

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global harvester market size was estimated at USD 36.00 billion in 2023 and is expected to reach USD 37.88 billion in 2024.

b. The global harvester market is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030 to reach USD 58.41 billion by 2030.

b. The forage harvester segment dominated the market in 2023 and accounted for more than 26.0% share of global revenue. The adoption of self-propelled forage harvesters is increasing, driven by their high efficiency and ability to operate in various field conditions.

b. Some of the companies operating in the harvester market include AGCO Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Dasmesh Group, Deere & Company, KUBOTA Corporation, Linttas Electric Company, Mahindra&Mahindra Ltd., SDF, and Caterpillar Inc.

b. Increasing mechanization in agriculture, the rising demand for food, and technological advancements in harvesting equipment are driving the demand for the harvesters across the globe. Furthermore, governments across the globe are recognizing the importance of modernizing agriculture and offering financial incentives, subsidies, and low-interest loans to farmers for purchasing advanced harvesting equipment. These initiatives are encouraging the adoption of harvesters, particularly in emerging economies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."