Hardware Security Modules Market Size, Share & Trends Analysis Report By Type (LAN Based, PCIE Based, USB Based), By Deployment (Cloud, On-premises), By Application (Payment Processing, Authentication), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-354-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Hardware Security Modules Market Trends

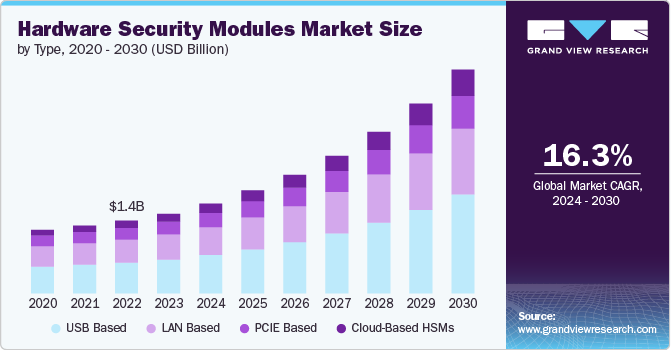

The global hardware security modules market size was estimated at USD 1.56 billion in 2023 and is anticipated to grow at a CAGR of 16.3% from 2024 to 2030. The hardware security modules (HSM) market is driven by several key factors, reflecting the increasing emphasis on robust cybersecurity measures across industries. The growing incidences of data breaches and cyber-attacks have heightened the need for advanced security solutions, prompting organizations to adopt HSMs for their superior encryption and key management capabilities. Additionally, the proliferation of digital transactions and the rise of cryptocurrencies necessitate secure cryptographic operations, bolstering the market. The expansion of cloud services also contributes significantly, as cloud providers integrate HSMs to enhance security and ensure trustworthiness.

The growing incidences of data breaches and cyber-attacks drive the hardware security modules (HSM) market by underscoring the critical need for enhanced security measures to protect sensitive information. According to the Identity Theft Resource Center’s 2023 Data Breach Report, in 2023, there were 2,365 cyberattacks, resulting in 343,338,964 victims. The year 2023 also witnessed a 72% increase in data breaches compared to 2021, which previously held the record. As cyber threats become more sophisticated and pervasive, organizations increasingly prioritize implementing robust encryption and key management solutions to safeguard their data assets. HSMs, with their capability to provide a high level of security through tamper-resistant hardware, are becoming essential in mitigating the risks associated with unauthorized data access and breaches. The heightened awareness of the potential financial and reputational damage from cyber-attacks further compels businesses to invest in HSMs as a proactive defense strategy. Consequently, the escalating frequency and severity of cyber threats catalyze the adoption of HSMs, fostering market growth by driving demand for these advanced security solutions.

The proliferation of digital transactions significantly drives the hardware security modules (HSM) market by amplifying the need for secure and reliable cryptographic operations. As the volume of online financial activities, including e-commerce, digital banking, and mobile payments, continues to surge, the importance of safeguarding these transactions against fraud and cyber threats becomes paramount. HSMs provide robust encryption and secure key management, ensuring the integrity and confidentiality of sensitive financial data during transmission and storage. This heightened security requirement is essential to maintaining consumer trust and compliance with stringent regulatory standards governing digital financial services. Consequently, the increasing reliance on digital transactions compels organizations to invest in advanced HSM solutions, thereby stimulating market growth by addressing the critical need for enhanced security in the digital financial ecosystem.

Type Insights

The USB based segment accounted for the largest market share of over 42% in 2023 in the hardware security modules market. The market segment is primarily driven by their portability, ease of deployment, and enhanced security features. Organizations and individuals favor USB-based HSMs for their convenience and flexibility, allowing secure cryptographic operations to be performed on the go. These devices are particularly advantageous for small to medium-sized enterprises and remote workers who require secure access to sensitive data and cryptographic keys outside traditional office environments.

The cloud-based HSMs segment is anticipated to grow at the highest CAGR over the forecast period. The market for cloud-based hardware security modules is propelled by the rapid adoption of cloud computing and the increasing need for scalable, on-demand security solutions. As businesses migrate their operations to the cloud to leverage benefits such as cost savings, flexibility, and improved collaboration, robust security measures become paramount. Cloud-based HSMs provide a secure environment for key management and cryptographic processing within the cloud infrastructure, ensuring compliance with regulatory standards and safeguarding against cyber threats. This approach allows organizations to seamlessly integrate advanced security functionalities without substantial upfront investment in physical hardware, facilitating widespread adoption and driving market growth.

Deployment Insights

The on-premise deployment segment accounted for the largest market share in 2023 in the hardware security modules market. The need for stringent security controls, regulatory compliance, and data sovereignty primarily drives the adoption of hardware security modules (HSMs) in on-premise environments. Organizations with sensitive data prefer on-premise HSMs to maintain direct control over their cryptographic keys and security operations, ensuring compliance with industry-specific regulations and protecting against internal and external threats. Integrating HSMs seamlessly within existing IT infrastructure further enhances their appeal for businesses prioritizing data security and integrity.

The cloud segment is anticipated to expand at a compound annual growth rate of over 16% during the forecast period. The increasing shift towards cloud computing, scalability, and cost-efficiency drives the adoption of cloud-based HSMs. Cloud-based HSMs offer organizations the flexibility to manage cryptographic keys and security processes without significant upfront investments in hardware. This model supports dynamic scaling to meet varying demands, enabling businesses to leverage robust security measures in the cloud while maintaining compliance with regulatory requirements. The ease of integration with cloud services and the reduction in operational complexities further drive the adoption of cloud-based HSMs.

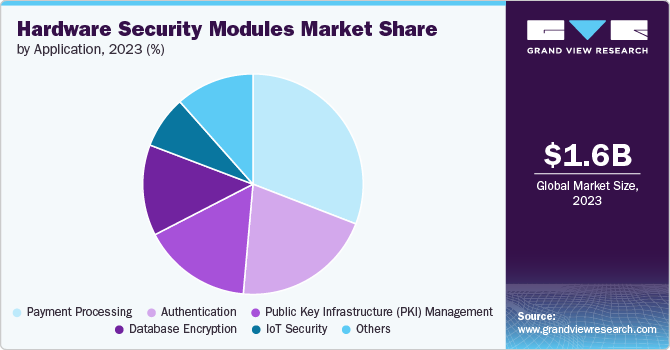

Application Insights

The payment processing segment accounted for the largest market share of over 30% in 2023 in the hardware security modules market. The critical need for secure transactions and compliance with stringent financial regulations drives the application of hardware security modules (HSMs) for payment processing. HSMs provide robust encryption and key management capabilities, ensuring the confidentiality and integrity of payment data during processing and storage. This level of security is essential for maintaining consumer trust and meeting standards such as the Payment Card Industry Data Security Standard (PCI DSS). Consequently, financial institutions and payment processors adopt HSMs to safeguard against fraud and cyber threats, thereby enhancing the overall security of the payment ecosystem.

The IoT security segment is anticipated to grow at the highest CAGR during the forecast period. In IoT security, the application of HSMs is driven by the necessity to protect vast networks of interconnected devices from cyber threats. IoT devices, often deployed in critical and sensitive environments, require strong security measures to ensure data integrity and secure communication. HSMs provide safe storage for cryptographic keys and enable secure boot processes, device authentication, and encrypted communication, mitigating unauthorized access and data breaches. The growing adoption of IoT technology across various industries underscores the importance of HSMs in maintaining robust security standards and protecting the integrity of IoT systems.

End Use Insights

The BFSI end use segment accounted for the largest market share in 2023. The use of HSM in the BFSI sector is primarily driven by the need for stringent security measures to protect sensitive financial data and ensure compliance with regulatory standards. HSMs provide robust encryption, secure key management, and authentication mechanisms essential for safeguarding transactions, customer information, and financial records. This level of security helps financial institutions mitigate risks associated with cyber threats and fraud, thereby maintaining trust and confidence among customers and stakeholders.

The retail and consumer products segment is anticipated to grow at a CAGR of over 20% during the forecast period. In the retail and consumer products industry, the adoption of HSMs is driven by the increasing need to secure payment processing systems and protect customer data. Retailers handle vast amounts of sensitive information, including payment card details and personal data, which makes them prime targets for cyber-attacks. HSMs offer advanced security solutions that encrypt transaction data and manage cryptographic keys, ensuring the integrity and confidentiality of customer information.

Regional Insights

North America hardware security modules market held the major share of over 35% in 2023. The hardware security modules (HSM) market in North America is experiencing robust growth, driven by the region's strong emphasis on cybersecurity and stringent regulatory requirements. The increasing adoption of advanced technologies such as cloud computing, IoT, and digital payments necessitates enhanced security measures, fostering the demand for HSMs. Additionally, the presence of key market players and substantial investments in research and development contribute to the market's expansion.

U.S. Hardware Security Modules Market Trends

The hardware security modules market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., HSM market is propelled by the rising incidences of cyber-attacks and data breaches, which underscore the need for robust encryption and critical management solutions. The U.S. government's stringent regulatory framework, including mandates like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), further drives the adoption of HSMs across various sectors, including financial services, healthcare, and government.

Europe Hardware Security Modules Trends

The hardware security modules market in Europe is growing significantly at a CAGR of over 14% from 2024 to 2030. The European HSM market is characterized by the region's stringent data protection regulations and high standards for security compliance. The GDPR significantly influences the adoption of HSMs as organizations strive to ensure data protection and regulatory compliance. The increasing focus on securing digital transactions and advancements in cloud computing and IoT further support the demand for HSMs in the European market.

Asia Pacific Hardware Security Modules Trends

The hardware security modules market in the Asia Pacific is growing significantly at a CAGR of over 18% from 2024 to 2030. The HSM market in the Asia Pacific region is proliferating, fueled by the increasing digitalization and expanding IT infrastructure in emerging economies such as China and India. The rise in online transactions and growing awareness of data security and privacy concerns drive the demand for HSMs. Additionally, government initiatives to bolster cybersecurity and the adoption of advanced technologies across industries contribute to the market's growth.

Key Hardware Security Modules Company Insights

The HMS market companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Hardware Security Modules Companies:

The following are the leading companies in the hardware security modules market. These companies collectively hold the largest market share and dictate industry trends.

- Alfresco Software, Inc.

- Box, Inc.

- DocuWare Corporation

- Hyland Software, Inc.

- International Business Machines Corporation

- Laserfiche

- M-Files Corporation

- Microsoft

- OpenText Corporation

- Oracle

Recent Developments

-

In October 2023, Microchip Technology introduced a new family of PIC32CZ CA 32-bit microcontrollers, featuring a 300 MHz Arm Cortex-M7 processor, integrated Hardware Security Module (HSM), and Flash memory options and a diverse array of connectivity for enhanced flexibility. This new family includes the PIC32CZ CA90, equipped with an HSM, and the PIC32CZ CA80, which does not include the integrated HSM. The HSM in the PIC32CZ CA90 offers a comprehensive security solution for consumer and industrial applications. Functioning as a secure subsystem, the HSM incorporates a separate MCU that operates the firmware and security features, such as key storage, hardware secure boot, a true random number generator, and cryptographic acceleration, among others.

-

In June 2023, Thales Trusted Cyber Technologies (TCT) announced the release of version 7.13.0 of the Luna Network and PCIe HSMs. This release marks the first Luna HSM version to incorporate post-quantum cryptographic (PQC) algorithms and stateful hash-based signature algorithms. In accordance with directives from multiple U.S. Federal policies, agencies are instructed to begin testing PQC implementations. This HSM release consists of pre-standard implementations of NIST-selected PQC algorithms to support agency and technology partner testing of PQC.

Hardware Security Modules Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.76 billion |

|

Revenue forecast in 2030 |

USD 4.35 billion |

|

Growth rate |

CAGR of 16.3% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

type, deployment, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa |

|

Key companies profiled |

Alfresco Software, Inc.; Box, Inc.; DocuWare Corporation; Hyland Software Inc.; International Business Machines Corporation; Laserfiche; M-Files Corporation; Microsoft; OpenText Corporation; Oracle |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hardware Security Modules Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the hardware security modules market report based on type, deployment, application, end use, and region.

-

Hardware Security Modules Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

LAN Based

-

PCIE Based

-

USB Based

-

Cloud-Based HSMs

-

-

Hardware Security Modules Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Hardware Security Modules Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Payment Processing

-

Authentication

-

Public Key Infrastructure (PKI) Management

-

Database Encryption

-

IoT Security

-

Others

-

-

Hardware Security Modules End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare and Life Sciences

-

Retail and Consumer Products

-

Technology and Communication

-

Industrial and Manufacturing

-

Automotive

-

Others

-

-

Hardware Security Modules Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hardware security modules market size was estimated at USD 1.56 billion in 2023 and is expected to reach USD 1.76 billion in 2024

b. The global hardware security modules market is expected to grow at a compound annual growth rate of 16.3% from 2024 to 2030 to reach USD 4.35 billion by 2030

b. North America dominated the hardware security modules market with a market share of 36.65% in 2023. The hardware security modules (HSM) market in North America is experiencing robust growth, driven by the region's strong emphasis on cybersecurity and stringent regulatory requirements. The increasing adoption of advanced technologies such as cloud computing, IoT, and digital payments necessitates enhanced security measures, fostering the demand for HSMs.

b. Some key players operating in the hardware security modules market include Alfresco Software, Inc., Box, Inc., DocuWare Corporation, Hyland Software, Inc. International Business Machines Corporation, Laserfiche, M-Files Corporation, Microsoft, OpenText Corporation, and Oracle.

b. The hardware security modules (HSM) market is driven by several key factors, reflecting the increasing emphasis on robust cybersecurity measures across industries. The growing incidences of data breaches and cyber-attacks have heightened the need for advanced security solutions, prompting organizations to adopt HSMs for their superior encryption and key management capabilities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."