- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Hard Coatings Market Size, Share & Growth Report, 2030GVR Report cover

![Hard Coatings Market Size, Share & Trends Report]()

Hard Coatings Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, (Nitrides, Oxides, Carbides), By Technology (PVD, CVD), By Application (Cutting Tool, Decorative Coatings, Optics, Gears, Bearings, Pistons), By End Use By Region, And Segment Forecasts

- Report ID: GVR-4-68040-340-3

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hard Coatings Market Summary

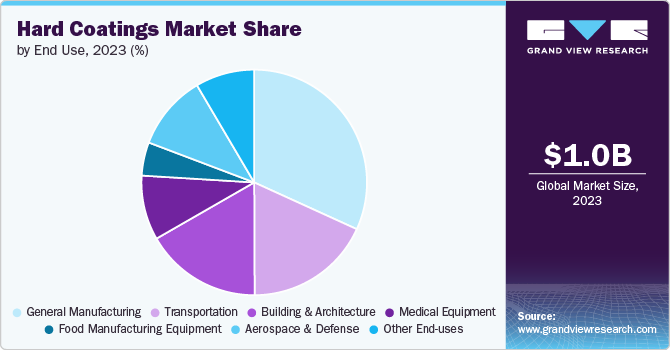

The global hard coatings market size was estimated at USD 1.0 billion in 2023 and is projected to reach USD 1.69 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The superior wear and abrasion resistance, essential for extending the lifespan of components in demanding applications such as automotive engines, aerospace turbines, and industrial machineries, driving the market growth.

Key Market Trends & Insights

- Asia Pacific hard coatings market dominated and accounted for a revenue share of 34.6% in 2023.

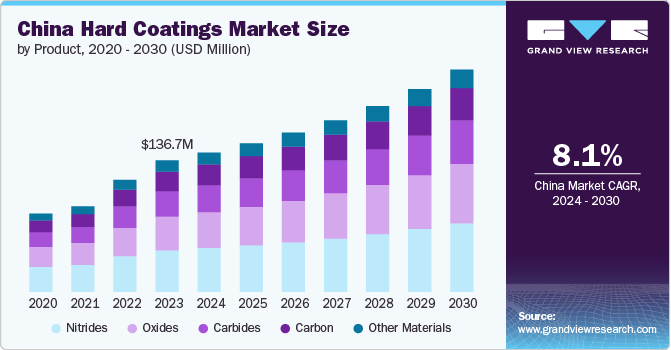

- The hard coating market in China is expected to be one of the promising markets in the region.

- By product, nitride hard coating segment dominated the market with a revenue share of 31.5% in 2023.

- By technology, CVD (chemical vapor deposition) technology segment dominated the market with a revenue share of 68.2% in 2023.

- By application, cutting tool applications segment dominated the market with a revenue share of 15.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.0 Billion

- 2030 Projected Market Size: USD 1.69 Billion

- CAGR (2024-2030): 7.1%

- Asia Pacific: Largest market in 2023

The optical industry is a significant consumer of the product owing to several benefits compared to soft coatings. The product maintains its properties for many years despite continuous use, whereas soft-coated lenses and optical components tend to degrade over time. The product is scratch-resistant, durable, anti-reflective, and anti-fog, thereby significantly enhancing the longevity and performance of optical products.

The product market faces a significant challenge due to the high costs associated with the coating process, which may hinder its growth. The availability of alternative solutions serves as a barrier to the market's expansion. These factors together limit the growth potential of the hard coating market over the forecast period.

Product Insights

Nitride hard coating dominated the market with a revenue share of 31.5% in 2023 owing to its wide usage in different industries including manufacturing, aerospace, and automotive, where equipment and components are subjected to extreme conditions and demanding performance required.

Nitride hard coatings such as titanium nitride, aluminum nitride, and chromium nitride are thin films applied to tools and components to enhance their hardness, wear resistance, and overall durability. These coatings are usually deposited using techniques like physical vapor deposition, or chemical vapor deposition

Technology Insights

CVD (chemical vapor deposition) technology dominated the market with a revenue share of 68.2% in 2023 as it offers superior hardness, water resistance, and thermal stability making it ideal for demanding applications. It is widely used in industries such as automotive, aerospace, electronics, and cutting tools where enhanced material properties are crucial.

In the CVD process, volatile precursor chemicals are vaporized and then reacted or decomposed on the substrate’s surface to form a solid tin film. This technique allows for the deposition of coatings with excellent uniformity, strong adhesion, and precise control over thickness and composition. Moreover, continuous improvements in the CVD technology such as low temperature CVD and plasma enhanced CVD expands its applicability and efficiency.

Application Insights

Cutting tool applications dominated the market with a revenue share of 15.0% in 2023. The product benefits the metal-cutting industry by reducing wear and significantly extending tool lifespan. The industry's requirements for dry machining, high-speed machining, and processing difficult materials like titanium and superalloys have driven advancements in coating technologies.

The quality of the machined surface is critical to the final product, with factors such as microstructure, hardness, surface roughness, and residual stress playing key roles. Hard coatings on cutting tools enhance surface finish consistency by maintaining the cutting-edge structure, reducing friction, and lowering operating temperatures.

Coated tools provide superior performance and safety against the mechanical and thermal stresses caused by excessive heat during cutting. They outperform uncoated tools by reducing tool-chip friction, improving cost-efficiency, and increasing machining productivity.

End Use Insights

General manufacturing end use dominated the market with a revenue share of 31.9% in 2023. The product is extensively used in general manufacturing to enhance the performance and longevity of various components and tools. Their application spans multiple industries, leading to improved product quality, reduced maintenance costs, and increased operational efficiency.

Hard coatings also find applications in automotive parts like engine components, pistons, gears, and bearings to reduce friction, wear, and corrosion thereby improving durability and efficiency. In addition, they are applied to turbine blades, landing gear components, and other critical parts to enhance resistance to erosion and corrosion under extreme conditions.

Regional Insights

In North America, the demand for hard coatings is primarily driven by several key industries in the region including automotive manufacturing, aerospace, and defense sector. In addition, the region’s emphasis on technological innovations and stringent quality standards further boost the adoption of hard coatings in various industrial applications.

Asia Pacific Hard Coatings Market Trends

Asia Pacific hard coatings market dominated and accounted for a revenue share of 34.6% in 2023. Owing to rising construction activities and growing demand from the automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.

Furthermore, the easy availability of raw materials, coupled with less stringent laws regarding VOC emissions as compared to North America and Europe, has provided huge opportunities for the use of products in various end-use sectors such as construction, automotive, marine, and manufacturing.

The hard coating market in China is expected to be one of the promising markets in the region on account of the government’s support to promote investments in the manufacturing sector. Several companies are expanding or setting up new manufacturing facilities owing to low labor costs and ease of raw material procurement in the country. The growing manufacturing sector is expected to propel the demand for the product in automotive, aerospace, construction, electrical & electronics, and other industries.

Europe Hard Coatings Market Trends

Europe hard coatings market witnessed a significant revenue share in 2023 due to the growing automotive sector of the region. According to the data from the European Automotive Manufacturers Association, there was an almost 14% increase in new car registrations in 2023, with sales exceeding 10.5 million new vehicles. This surge in new vehicle sales has had a positive effect on the demand for the product in the region.

Key Hard Coatings Company Insights

Some key players operating in the market include OC Orelikon Management AG, Momentive, Cemecon AG, Carl Zeiss, SDC Technologies Inc., ASB Industries, Cemecon, Duralar Technologies,

-

Duralar Technologies is a prominent player in the product coating market, the company has developed innovative families of ultra-hard metal coatings. These advanced coatings often combine metal and diamond-based elements, resulting in superior toughness, strength, and performance. Among their offerings is ArmorLube, a unique ultra-hard coating that also delivers permanent, clean, and dry lubrication, effectively eliminating the need for oils or greases that can attract dust, dirt, and cause operational issues.

-

SDC Technology is one of the prominent players in manufacturing premium abrasions, scratch, and chemical resistance coatings for various substrates including plastic glass, and metal. The company offers a wide range of coatings used in diverse applications like eyeglasses, sunglasses, safety glasses, automotive and aerospace components, and electronic devices.

Key Hard Coatings Companies:

The following are the leading companies in the hard coatings market. These companies collectively hold the largest market share and dictate industry trends.

- OC Orelikon Management AG

- Momentive

- Cemecon AG

- Carl Zeiss

- SDC Technologies Inc.,

- ASB Industries

- Cemecon

- Duralar Technologies

- Gencoa Ltd

- Hardcoatings Inc.,

- IHI Hauzer, Inc

- Sulzer Ltd

- Ultra Optics

- Ultra Optics

Recent Developments

-

In March 2023, Oerlikon Balzers announced the launch of its new DiamondShield PVD coating, which is said to offer superior wear resistance and corrosion protection.

-

EMAG and HPL Technologies are collaborating to develop a hard coating system for disc brake in response to European commissions’s “Euro7” standard, which will set particulate matter emission limit for braking system starting in 2025 for cars and 2027 for commercial vehicles. They aim to meet these stringent regulations by integrating HPL technologies WECODUR laser cladding assemblies into EMAG’s machine platform.

Hard Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.11 billion

Revenue forecast in 2030

USD 1.69 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

OC Orelikon Management AG; Momentive; Cemecon AG; Carl Zeiss; SDC Technologies, Inc.; ASB Industries; Cemecon; Duralar Technologies; Gencoa Ltd; Hardcoatings Inc.; IHI Hauzer, Inc; Sulzer Ltd; Ultra Optics; Voestalpine

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hard Coating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hard coatings market report based on product, technology, application, end use & region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nitrides

-

Oxides

-

Carbides

-

Carbon

-

Other Products

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PVD

-

CVD

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cutting Tool

-

Decorative Coatings

-

Optics

-

Gears

-

Bearings

-

Pistons

-

Cams

-

Cylinders

-

Hydraulic/Pneumatic Components

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

General Manufacturing

-

Transportation

-

Building & Architecture

-

Medical Equipment

-

Food Manufacturing Equipments

-

Automotive

-

Other End uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hard coatings market was valued at USD 1,062.9 million in 2023 and is expected to reach USD 1.11 billion in 2024.

b. The global hard coatings market is expected to witness CAGR of 7.1% from 2024 to reach USD 1.69 billion by 2030.

b. Asia Pacific dominated the market segment with a revenue share of 34.6% in 2023. Owing to rising construction activities and growing demand from the automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.

b. Some of the key players operating in the market include OC Orelikon Management AG, Momentive , Cemecon AG, Carl Zeiss, SDC Technologies Inc., ASB Industries, Cemecon, Duralar Technologies, among others.

b. The global hard coatings market is expected to witness huge positive growth over the forecasted period owing to their superior wear and abrasion resistance, which is essential for extending the lifespan of components in demanding application such as automotive engines, aerospace turbines and industrial machineries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.