- Home

- »

- Next Generation Technologies

- »

-

Haptic Devices Market Size, Share And Growth Report, 2030GVR Report cover

![Haptic Devices Market Size, Share & Trends Report]()

Haptic Devices Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Usage (Graspable, Touchable, Wearable), By Type, By Feedback, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-466-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Haptic Devices Market Summary

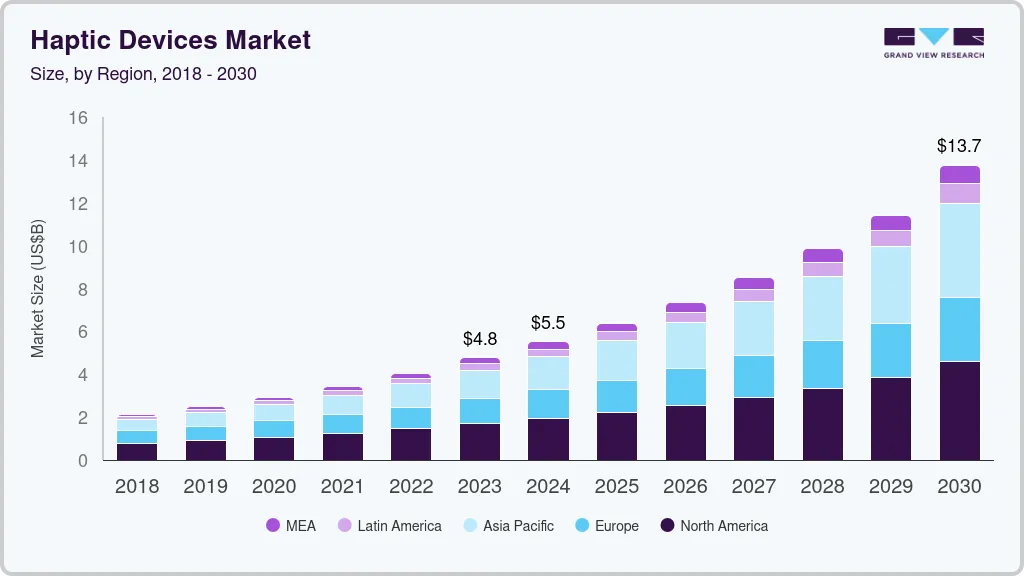

The global haptic devices market size was estimated at USD 4,781.0 million in 2023 and is projected to reach USD 13,741.0 million by 2030, growing at a CAGR of 16.3% from 2024 to 2030. The growth is attributed to the increasing adoption of haptic technology in the gaming and entertainment industries to enhance user experiences.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of component, hardware accounted for the largest revenue share of 71% in 2023.

- Hardware is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 4,781.0 Million

- 2030 Projected Market Size: USD 13,741.0 Million

- CAGR (2024-2030): 16.4%

- North America: Largest market in 2023

Haptic devices are now being integrated into gaming controllers, VR headsets, and other interactive entertainment systems. This technology provides tactile feedback, making virtual interactions feel more realistic and immersive. The demand for such devices is particularly strong in VR and AR gaming, where users seek a deeper level of engagement. As game developers continue to push the boundaries of immersive experiences, the role of haptic devices in creating a multisensory environment is becoming ever more critical.

The automotive industry is rapidly adopting haptic feedback technology to improve vehicle controls and enhance the user experience. Haptic devices are being integrated into touchscreens, steering wheels, and other in-car interfaces, allowing drivers to receive tactile feedback without taking their eyes off the road. This trend is driven by the need for safer and more intuitive interactions with vehicle systems, particularly as cars become more technologically advanced. Additionally, haptic feedback is being used in advanced driver assistance systems (ADAS) to alert drivers of potential hazards. As automotive technology evolves, the use of haptics in vehicles is expected to grow significantly.

The rise of wearable devices, such as smartwatches and fitness trackers, has spurred the integration of haptic feedback into these products. Haptic technology in wearables enhances user interaction by providing subtle, tactile notifications and alerts, such as vibrations for incoming calls or reminders to move. This trend is driven by consumer demand for more personalized and non-intrusive ways to stay connected and monitor health. Wearable devices are also incorporating haptics to simulate physical touch or provide guidance during exercises. As the wearable tech market continues to expand, the use of haptic feedback in these devices is expected to grow.

Technological advancements in haptics are significantly enhancing the precision and responsiveness of these devices. New developments, such as ultrasonic haptics, allow for the creation of tactile sensations in mid-air, opening new possibilities for user interaction. Surface haptics, which can simulate textures and complex sensations on flat surfaces, are also gaining traction. These innovations are expanding the potential applications of haptic technology beyond traditional uses. As research and development in haptic technology continue, we can expect more sophisticated and varied haptic experiences in consumer electronics, automotive interfaces, and industrial applications.

Component Insights

The hardware segment dominated the market in 2023 with a market share of above 71%. The hardware segment of the haptic devices market is experiencing notable advancements in actuator technology, which is crucial for generating tactile feedback. Innovations in piezoelectric actuators, electroactive polymers, and ultrasonic actuators are enabling more precise, responsive, and varied haptic sensations. These developments are particularly impactful in enhancing user experiences in applications such as gaming controllers, automotive touchscreens, and consumer electronics like smartphones and wearables. As actuator technology continues to evolve, the market is seeing a shift towards more sophisticated haptic feedback systems that can simulate a broader range of textures and forces. This trend is expected to drive increased adoption of haptic technology across multiple industries.

The software segment is estimated to have a significant growth rate from 2024 to 2030. Another key trend in the haptic software segment is the push for greater cross-platform compatibility. As haptic technology is increasingly used across a variety of devices—ranging from smartphones and gaming consoles to automotive interfaces—there is a growing need for software solutions that can work seamlessly across different platforms. This trend is leading to the development of universal haptic APIs (Application Programming Interfaces) and middleware that enable consistent haptic experiences, regardless of the device or operating system. Such compatibility is crucial for the widespread adoption of haptic technology, as it ensures a consistent user experience across all devices.

Usage Insights

The touchable segment held the highest revenue share in 2023. The touchable segment of the market is experiencing significant growth due to its widespread adoption in consumer electronics. As touchscreens continue to dominate devices like smartphones, tablets, and laptops, there is an increasing demand for haptic feedback to enhance the tactile experience. Touchable haptic technology provides users with a more interactive and responsive interface, simulating physical buttons and textures on flat screens. This trend is driving manufacturers to integrate advanced touchable haptics into their products, making interactions more intuitive and satisfying for users.

The wearable segment is estimated to register the highest growth rate from 2024 to 2030. The wearable segment of the market is increasingly focusing on integrating haptic feedback with health and fitness monitoring functions. Wearable devices such as smartwatches and fitness bands are now equipped with haptic technology to provide real-time alerts and notifications related to health metrics like heart rate, activity levels, and sleep patterns. This trend enhances user engagement by offering a tactile way to receive important health information, making it more immediate and actionable. As consumers seek more personalized and interactive health monitoring solutions, the demand for haptic-enabled wearables is expected to grow.

Type Insights

The active haptic devices segment held the highest revenue share in 2023. The active haptic devices segment is experiencing significant advancements in precision and control, driven by the need for more realistic and responsive tactile feedback. Active haptic devices, which use actuators to generate forces, vibrations, or motions, are becoming increasingly sophisticated. These advancements are particularly important in applications like virtual reality (VR), gaming, and robotics, where precise control over haptic feedback enhances the user experience. The trend towards more refined and accurate haptic feedback is pushing manufacturers to innovate with new materials and technologies that can deliver a broader range of sensations.

The passive segment is estimated to have a significant growth rate from 2024 to 2030. One of the key trends in the passive haptic devices segment is the emphasis on cost-effective solutions. Passive haptic devices are generally less expensive to produce than their active counterparts because they do not require complex electronics or power sources. This cost advantage makes them attractive for a wide range of applications, particularly in education and consumer products, where affordability is a critical factor. As the demand for affordable haptic technology grows, the passive segment is expected to expand, offering practical and accessible solutions for a variety of users.

Feedback Insights

The force feedback segment held the highest revenue share in 2023. The demand for immersive gaming experiences is driving the adoption of force feedback technology in VR and gaming. Haptic devices, such as controllers and gloves, are increasingly used to simulate realistic tactile sensations, enhancing gameplay. Players can feel vibrations, impacts, and resistance, creating a more engaging experience in virtual environments. This trend is supported by advancements in VR hardware, which now allows for more precise and responsive force feedback. As the gaming industry continues to grow, force feedback haptic devices are becoming standard in high-end VR systems.

The electrotactile feedback segment is estimated to register the highest growth rate from 2024 to 2030. Electrotactile feedback is gaining traction in wearable devices, such as smartwatches, fitness trackers, and smart gloves. These devices use electrical stimulation to provide real-time alerts, notifications, and other sensory feedback without relying on traditional vibration motors. The technology is valued for its precision, as it can offer localized, low-power stimulation that is less obtrusive than mechanical alternatives. This trend is particularly strong in the fitness and health monitoring markets, where discreet feedback during exercise or medical monitoring is essential. As wearable tech advances, electrotactile feedback is expected to become a common feature in next-gen devices.

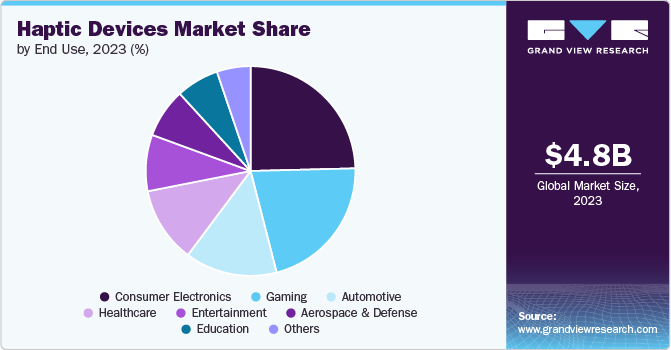

End Use Insights

The consumer electronics segment held the highest revenue share in 2023. Haptic feedback is becoming a key feature in wearable devices like smartwatches, fitness trackers, and AR/VR headsets. In smartwatches, haptics is used for alerts, notifications, and fitness goals, providing users with non-intrusive and immediate feedback. Fitness trackers use haptic signals to notify users of health-related metrics, such as heart rate and activity completion. The trend is being driven by the need for more discrete and personalized feedback mechanisms, particularly in health and fitness applications. As the wearable market continues to grow, haptic feedback will be essential for delivering real-time, subtle alerts and interactions without relying on visual or auditory cues.

The healthcare segment is estimated to register the highest growth rate from 2024 to 2030. Haptic devices are increasingly used in medical training, particularly in surgical simulations where they provide realistic force feedback, mimicking the resistance of tissues and organs. Medical students and professionals can practice complex procedures using haptic-enabled simulators, reducing the need for cadavers and live patients. This trend is being driven by the need for more immersive and risk-free training environments, helping to improve accuracy and confidence in surgeons. As robotic-assisted surgeries become more common, haptic feedback is critical for training surgeons to perform delicate procedures with precision. The trend toward virtual and remote training is also accelerating the adoption of haptic devices in medical education.

Regional Insights

The market for haptic devices in North America accounted for a revenue share of above 35% in 2023. North America, particularly the U.S., is a key market for haptic devices in gaming and entertainment. The demand for immersive gaming experiences is driving the integration of haptic feedback in consoles and VR headsets, making the region a leader in adopting advanced haptic technologies.

U.S. Haptic Devices Market Trends

The haptic devices market in the U.S. is anticipated to grow at a CAGR of above 14% from 2024 to 2030. The market in the U.S. is characterized by strong adoption in the gaming, entertainment, and automotive sectors. The U.S. is a key player in the development of advanced haptic technologies, with a focus on enhancing user experiences through immersive gaming and advanced vehicle interfaces. Additionally, the healthcare sector in the U.S. is increasingly utilizing haptic devices for medical training and simulations, contributing to the market's growth.

Europe Haptic Devices Market Trends

The haptic devices market in Europe is experiencing steady growth in 2023, driven by the region's strong automotive and healthcare industries. European automakers are increasingly integrating haptic feedback into vehicle interfaces to enhance safety and user experience, particularly in luxury and electric vehicles. Additionally, the region's advanced healthcare sector is adopting haptic devices for medical simulations and training, further fueling market demand.

Asia Pacific Haptic Devices Market Trends

The haptic devices market in Asia Pacific is anticipated to grow at the highest CAGR of over 18% from 2024 to 2030. The Asia-Pacific region is witnessing rapid growth in the Haptic Devices Market, largely due to the booming consumer electronics industry. Countries like Japan, China, and South Korea are leading in the production and adoption of haptic-enabled smartphones, gaming devices, and wearables. The region's focus on innovation and technological advancements, particularly in VR and AR, is also driving the demand for haptic devices in entertainment and education.

Key Haptic Devices Company Insights

The market is fiercely competitive, with prominent players like Cirrus Logic Inc., hap2U, Immersion Corporation, Synaptics Incorporated, and Texas Instruments Incorporated leading the industry as of 2023. These companies are aggressively growing their market presence through strategic moves, such as collaborations, mergers, acquisitions, and the introduction of cutting-edge products and technologies. For instance, In October 2023, AITO BV launched an innovative integrated touchpad that delivers superior haptic performance while achieving notable cost and space efficiencies compared to competing products. This advancement allows manufacturers to incorporate haptic touch technology into a broader array of laptops and devices, enhancing user interaction. The touchpad's design optimizes the integration of touch and haptic sensors, resulting in a solution that is approximately 40% thinner than previous models, thereby facilitating the production of lighter and more compact devices.

Key Haptic Devices Companies:

The following are the leading companies in the haptic devices market. These companies collectively hold the largest market share and dictate industry trends.

- AITO

- Boréas Technologies

- Cirrus Logic Inc.

- hap2U

- Immersion

- Johnson Electric Holdings Limited

- KEMET Corporation

- Microchip Technology Inc.

- Mouser Electronics, Inc.

- Synaptics Incorporated

- TDK Corporation

- Texas Instruments Incorporated

Recent Developments

-

In January 2023, TDK Corporation introduced the i3 Micro Module, a groundbreaking device that combines edge AI and wireless mesh connectivity in a single unit. Developed in partnership with Texas Instruments, this module incorporates a 32-bit microcontroller and a variety of sensors to enable real-time monitoring and anomaly detection in industrial settings. Its compact design and battery-powered operation make it ideal for condition-based monitoring and predictive maintenance, driving the adoption of smart factories.

-

In October 2023, Boréas Technologies introduced HapticStudio, a user-friendly software development kit (SDK) designed for creating customized haptic effects on its CapDrive semiconductors. This innovative SDK simplifies the development process, allowing designers to easily adjust parameters such as vibration intensity and response speed without extensive coding. Accompanying this launch is the BOS1921, an ultra-low-power piezo driver that enhances the capabilities of HapticStudio, facilitating the rapid creation of immersive tactile experiences across various consumer electronics.

Haptic Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.51 billion

Revenue forecast in 2030

USD 13.74 billion

Growth Rate

CAGR of 16.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, usage, type, feedback, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AITO BV; Boréas Technologies; Cirrus Logic Inc.; hap2U; Immersion Corporation; Johnson Electric Holdings Limited; KEMET Corporation; Microchip Technology Inc.; onsemi; Renesas Electronics Corporation; Synaptics Incorporated; TDK Corporation; Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Haptic Devices Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global haptic devices market report into component, usage, type, feedback, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Graspable

-

Touchable

-

Wearable

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Active Haptic Devices

-

Passive Haptic Devices

-

-

Feedback Outlook (Revenue, USD Million, 2018 - 2030)

-

Force Feedback

-

Vibrotactile Feedback

-

Electrotactile Feedback

-

Thermal Feedback

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Entertainment

-

Gaming

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global haptic devices market size was estimated at USD 4.78 billion in 2023 and is expected to reach USD 5.51 billion in 2024

b. The global haptic devices market is expected to grow at a compound annual growth rate of 16.4% from 2024 to 2030, reaching USD 13.74 billion by 2030.

b. North America dominated the Haptic Devices market with a share of 35.4% in 2023. The demand for immersive gaming experiences is driving the integration of haptic feedback in consoles and VR headsets, making the region a leader in adopting advanced haptic technologies.

b. Some key players operating in the Haptic Devices market include ADP, Inc., Ceridian HCM, Inc., Cezanne HR Ltd., Cornerstone OnDemand, Inc., IBM Corporation, Infor, Oracle, SAP SE, Talentsoft, The Access Group, Ultimate Software, Workday, Inc.

b. Key factors that are driving the market growth include utilization in healthcare, demand in the automotive industry, and integration into consumer devices and increasing demand for haptic devices in gaming industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.