- Home

- »

- Advanced Interior Materials

- »

-

Hand Protection Equipment Market, Industry Report, 2030GVR Report cover

![Hand Protection Equipment Market Size, Share & Trends Report]()

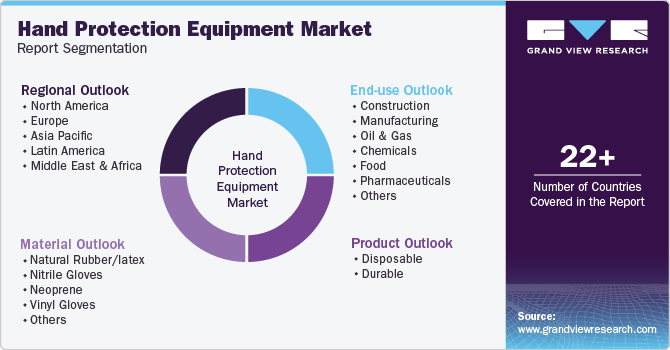

Hand Protection Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Disposable, Durable), By Material (Natural Rubber/Latex, Nitrile Gloves, Neoprene), By End-use (Construction, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-379-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hand Protection Equipment Market Summary

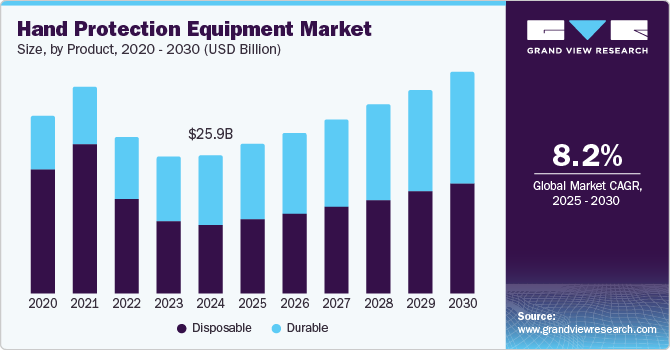

The global hand protection equipment market size was estimated at USD 25.91 billion in 2024 and is projected to reach USD 41.47 billion by 2030, growing at a CAGR of 8.2% from 2025 to 2030. The rising demand is attributed to the increasing concerns about hand hygiene and the product's efficiency during the COVID-19 pandemic in various end-use industries.

Key Market Trends & Insights

- The North America hand protection equipment market dominated the global market and accounted for the largest revenue share of 31.9% in 2024.

- The U.S. dominated the North America market, with the highest revenue share of 84.6% in 2024.

- Based on product, the durable hand protection equipment segment led the market and accounted for a revenue share of 51.0% in 2024.

- Based on material, the natural rubber/latex segment dominated the market and accounted for a revenue share of 36.5% in 2024.

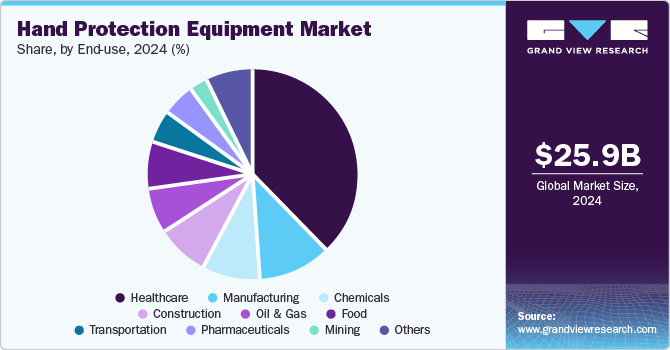

- Based on end-use, the healthcare sector led the market and accounted for a revenue share of 38.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.91 Billion

- 2030 Projected Market Size: USD 41.47 Billion

- CAGR (2025-2030): 8.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The second wave of COVID-19 caused a shortage of hand protection equipment in hospitals and industries, such as manufacturing and construction. In response, many manufacturers ramped up production to address the supply-demand gap.

Strict government regulations regarding the health and safety of doctors, nurses, and working professionals have prompted workers to use these products to protect against health hazards and healthcare-associated infections. These gloves have excellent chemical and tear resistance, tactility, & flexibility, which makes them ideal for use in areas with direct contact with chemicals, microbes, and physiological fluids. The industry is an amalgamation of global and regional players with a broad product portfolio, restricting new players from entering the market.

Hand protection gloves ensure worker safety and are crucial in manufacturing, construction, healthcare, and chemical industries. These gloves are made from different materials, each designed to protect against specific risks. They are available in various styles, such as disposable gloves for single-use and reusable gloves intended for prolonged use. The choice of gloves depends on the particular hazards found in the workplace. Leading companies are innovating advanced hand protection equipment with flash protection to safeguard against electrical hazards and expand market reach.

Product Insights

The durable hand protection equipment segment led the market and accounted for a revenue share of 51.0% in 2024. Durable gloves are mainly used in the construction and manufacturing industries to avoid injuries from burns, cuts, and hazardous chemicals. Previously restricted to the industrial, construction, and healthcare sectors, durable gloves are now accessible to the general population, propelling their demand. Reduced need for frequent replacements helps decrease waste, making them a more eco-friendly option and saving money in the long run due to fewer replacements.

The disposable hand protection equipment segment is expected to grow at the fastest CAGR of 8.5% over the forecast period. These gloves are mainly used in the food and healthcare industries to protect against the transmission of infection. The COVID-19 pandemic caused a rise in demand and a shortage in the supply of disposable gloves. The rising awareness of healthcare-associated infections and increasing demand for disease control drive the product demand. The lower costs of disposable gloves are anticipated to offer them a competitive advantage in short-duration industrial projects. The COVID-19 pandemic had surged the demand for gloves by almost three times. Furthermore, the demand for gloves has increased due to easier access to e-commerce platforms and high pharmacy stocks.

Material Insights

The natural rubber/latex segment dominated the market and accounted for a revenue share of 36.5% in 2024. The demand for these products was relatively high as they are flexible, comfortable to wear, and ideal for handling sensitive applications, such as medical procedures and surgeries. These gloves are essential in light manufacturing for precise tasks, protecting workers in assembly lines, and cleaning services as they safeguard against chemicals, and the beauty industry uses them for hair dyeing, nail care, and skincare procedures.

The neoprene segment is expected to grow at the fastest CAGR of 9.1% over the forecast period, fueled by their excellent resistance to chemicals, oils, and solvents, making them ideal for hazardous environments. Their durability ensures long-lasting protection against abrasion, tearing, and punctures. Furthermore, flexible and comfortable, they maintain dexterity while offering water and thermal protection. Neoprene is used in industries such as chemical and pharmaceutical for handling hazardous substances, oil and gas for exposure to oils, automotive for repairs, and construction for heavy machinery tasks, combining protection and flexibility.

End-use Insights

The healthcare sector led the market and accounted for a revenue share of 38.2% in 2024. Hand protection is essential in preventing infections in healthcare settings such as hospitals and clinics. Specialized gloves, such as nitrile or chemo-rated types, protect workers handling hazardous drugs and chemotherapy agents. Strict safety regulations require protective gear for both worker and patient safety. With an aging population and advances in medical procedures, the demand for hand protection in healthcare is increasing, ensuring sterility and safety during surgeries, treatments, and daily caregiving tasks.

The pharmaceutical sector is estimated to grow at the fastest CAGR of 9.0% over the forecast period, as employees in the pharmaceutical industry face various on-the-job hazards as they come in contact with hazardous chemicals, solvents, and drugs. As the pharmaceutical industry evolves with new drug formulations, including biologics, the need for hand protection increases to handle potent compounds safely. Maintaining sterility and preventing cross-contamination during manufacturing processes is crucial. With the growing global demand for pharmaceutical products, the handling of active ingredients has risen, further driving the need for protective gloves and PPE to ensure safety and product purity.

Regional Insights

North America hand protection equipment market dominated the global market and accounted for the largest revenue share of 31.9% in 2024, owing to increasing healthcare expenditures and rising awareness of healthcare-acquired infections. The rising prevalence of chronic conditions in individuals aged 65-74 is boosting the demand for hand protection equipment. As the aging population faces higher rates of illnesses such as diabetes and arthritis, stricter safety regulations and greater healthcare demand further drive growth in the North American PPE market.

U.S. Hand Protection Equipment Market Trends

The hand equipment market in the U.S. dominated the North America market, with the highest revenue share of 84.6% in 2024. As healthcare systems evolve, there is a stronger focus on improving safety standards and providing quality protective gear for healthcare workers. Hospitals and clinics are upgrading hand protection to meet stricter regulations. Meanwhile, industrialization in the U.S. is increasing workplace exposure to chemical, mechanical, and thermal hazards, driving the demand for advanced hand protection solutions to ensure worker safety.

Asia Pacific Hand Protection Equipment Market Trends

The Asia Pacific hand protection equipment market is expected to grow at the fastest CAGR of 9.2% over the forecast period due to increasing concerns regarding hygiene across the healthcare industry, which is expected to positively impact the market growth. The increasing workforce, strict government regulations, and strict labor laws, coupled with expansion in healthcare institutions, are expected to drive the industry. Stringent restrictions on medical drug research and workplace conditions in the healthcare and pharmaceutical industries are anticipated to grow the industry.

The hand protection equipment market in China led the Asia Pacific market with the highest revenue share in 2024. China's rapid industrialization, particularly in manufacturing, construction, and mining sectors, has heightened workplace hazards, creating a greater need for enhanced safety measures, including hand protection equipment. The country's economic growth has also fueled increased investments in infrastructure and industrial projects, further driving the demand for protective gear. The impact of COVID-19 has also amplified the need for hand protection across various sectors as hygiene and safety standards become more critical.

Europe Hand Protection Equipment Market Trends

Europe hand protection equipment market held a substantial market share in 2024. European public health campaigns emphasize hygiene and boost hand protection demand in industries and among the general public. Strict occupational safety regulations require personal protective equipment (PPE), pushing industries to adopt hand protection solutions. These factors collectively drive the growth of the hand protection equipment market in Europe.

Germany hand protection equipment market dominated the European market with the highest revenue share in 2024. Germany's economic growth, driven by the automotive, chemicals, and manufacturing sectors, has increased workplace hazards, requiring enhanced safety measures, including hand protection. Infrastructure and industrial investments have further boosted demand for protective equipment, contributing to the expansion of industries that rely on such gear for worker safety.

Key Hand Protection Equipment Company Insights

Key companies in the global hand protection equipment market include Top Glove Corporation Bhd, Hartalega Holdings Berhad, Superior Glove, and Adenna LLC, among others. Top companies prioritize developing advanced gloves with enhanced materials and protection features, such as cut or chemical resistance. Strategic partnerships with other PPE manufacturers and industries help expand product offerings, improve distribution channels, and access new markets.

-

Top Glove Corporation Bhd is headquartered in Malaysia. The company specializes in producing a wide range of gloves, including latex, nitrile, vinyl, and surgical gloves. It serves various healthcare, food, automotive, and industrial sectors.

-

Hartalega Holdings Berhad is headquartered in Kuala Lumpur, Malaysia. It produces nitrile gloves used in healthcare, industrial, and food sectors. The company operates state-of-the-art facilities and has a significant presence in international markets, exporting to over 50 countries.

Key Hand Protection Equipment Companies:

The following are the leading companies in the hand protection equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Superior Glove

- Adenna LLC

- MCR Safety

- Atlantic Safety Products

- Ammex Corp.

- KCWW

- Sempermed

- Halyard

Recent Developments

-

In December 2024,Superior Glove, a global leader in safety gloves and sleeves, chose High Point, North Carolina, for its first U.S. manufacturing facility. The company plans to invest significantly, creating over 100 jobs over the next five years and boosting local economic growth.

-

In May 2024, KARAM Safety, a global leader in PPE and fall protection, acquired Midas Safety India, enhancing its product range. This acquisition strengthens KARAM's market position by combining fall protection expertise with Midas Safety India's hand protection offerings.

Hand Protection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.96 billion

Revenue forecast in 2030

USD 41.47 billion

Growth Rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; Russia; Spain; UK; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Top Glove Corporation Bhd, Hartalega Holdings Berhad, Superior Glove, Adenna LLC, MCR Safety, Atlantic Safety Products, Ammex Corp., KCWW, Sempermed, and Halyard

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hand Protection Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global hand protection equipment market report based on product, material, end-use, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Disposable

-

Durable

-

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Natural rubber/latex

-

Nitrile gloves

-

Neoprene

-

Vinyl gloves

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.