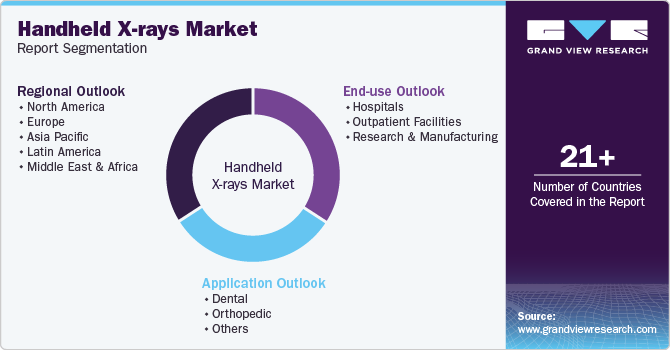

Handheld X-rays Market Size, Share & Trends Analysis Report By Application (Dental, Orthopedic), By End-use (Hospitals, Outpatient Facilities, Research & Manufacturing), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-042-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Handheld X-rays Market Size & Trends

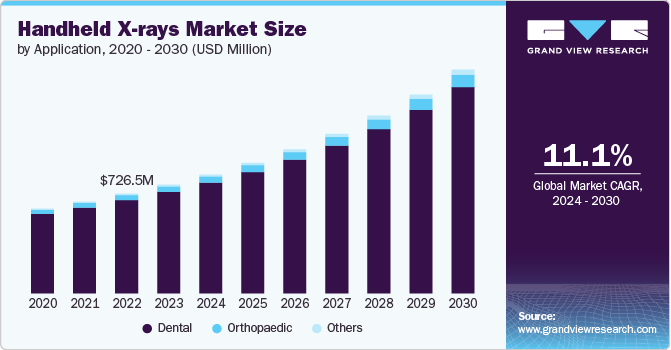

The global handheld X-rays market size was valued at USD 865.4 million in 2024 and is expected to grow at a CAGR of 11.4% from 2025 to 2030. The rising demand for portable and efficient diagnostic imaging solutions, especially in dental and point-of-care applications, is one of the major factors driving market growth. Moreover, technological advancements, including the integration of artificial intelligence (AI) and digital imaging, have enhanced image quality, operational efficiency, and ease of use. Additionally, the expansion of mobile healthcare services, in remote and underserved regions, is driving market adoption. Furthermore, the growing preference for handheld X-rays over traditional systems due to their cost-effectiveness, ease of mobility, and lower radiation exposure also contribute to their increasing demand globally.

The increasing prevalence of dental disorders and the growing adoption of cosmetic dentistry are further fueling demand. The WHO Global Oral Health Status Report (2022) estimates that nearly 3.5 billion people around the world are affected by oral diseases, with approximately three-quarters of those impacted residing in middle-income countries. Moreover, around 2 billion individuals globally suffer from caries in permanent teeth, while 514 million children experience carries in their primary teeth. This high prevalence of dental or oral diseases significantly increased the demand for effective and advanced portable solutions, thereby contributing to the rising adoption of handheld X-rays.

Handheld X-rays are commonly used in dentistry to diagnose and monitor oral health conditions. Here are some common uses of dental X-rays:

-

Detecting tooth decay: X-rays can reveal cavities that may not be visible to the naked eye, particularly those between teeth.

-

Assessing bone density: X-rays can show the bone structure supporting the teeth and help identify signs of bone loss due to gum disease or other conditions.

-

Evaluating tooth root health: X-rays can help dentists diagnose and treat root canal problems, such as abscesses or infections.

-

Planning orthodontic treatment: X-rays can help orthodontists evaluate the alignment of the teeth and the development of the jaw to determine the best course of treatment.

-

Assessing impacted teeth: X-rays can help identify teeth that are unable to emerge from the gum line (impacted teeth), which may require extraction or other treatment.

The growing use of handheld X-ray devices beyond dental care is expected to significantly boost market growth. Although these devices are well-established in dental settings due to their portability and ease of use, their potential in other critical areas is becoming increasingly evident. For instance, in emergency care, handheld X-rays offer advantages by allowing first responders to quickly assess injuries. This immediate imaging capability provides crucial information that aids in making immediate treatment decisions, such as determining whether a patient needs urgent transport to a medical facility or if immediate on-site intervention is required. The versatility of handheld X-rays enables their use in various challenging environments, from accident sites to disaster areas, thus enhancing the efficiency and effectiveness of emergency medical response. As their application expands into these areas, handheld X-ray devices are proving to be invaluable tools in improving patient care, driving their increased adoption and contributing to overall market growth.

Moreover, technological advancements have played a crucial role in the rising adoption of handheld X-ray devices. Market players are taking various initiatives to offer advanced handheld X-ray systems to meet the rising demand for advanced devices. For instance, in October 2021, Oxos Medical and Emergent Connect partnered to provide an integrated handheld X-ray system for the urgent care market. The package will include Oxos' Micro C handheld x-ray system, Emergent's cloud-based radiology software, and access to Rapid Radiology's teleradiology services, creating an all-in-one point-of-care solution. Such developments have encouraged healthcare providers to invest in handheld X-ray systems as cost-effective alternatives to stationary imaging units, even in regions with limited access to full-scale radiology departments.

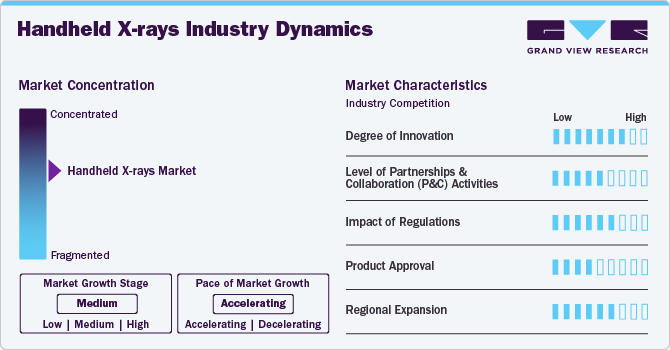

Market Concentration & Characteristics

The industry is experiencing exponential growth, propelled by a combination of technological advancements and increasing demand across diverse sectors. Key to this expansion is the continual improvement in device technology, including enhanced image resolution, faster processing speeds, and more compact and efficient components. These innovations make handheld X-rays more effective and versatile, increasing their adoption.

Leading companies in the industry are involved in advancing technology, enhancing product features, and expanding industry reach to maintain their competitive edge. These companies invest in research and development to improve the functionality and efficiency of their devices, focusing on innovations such as higher image resolution, longer battery life, and more user-friendly designs. They also work to incorporate the latest advancements in materials and digital imaging technology to enhance performance and safety.

The degree of innovation in this industry is high owing to advancements in digital imaging technology, which have significantly enhanced the quality and accuracy of the images produced by these devices, enabling more precise diagnostics. Furthermore, integration with AI is also a major contributor to industry growth.

Companies in the industry are actively pursuing partnerships and collaborations as a strategic move to strengthen their industry position, broaden their product offerings, and fuel growth. For instance, in February 2023, Mylab entered into a partnership with Qure.ai to enhance TB diagnosis using AI-powered X-ray technology. Mylab's is soon set to launch a handheld X-ray device, MyBeam, which will incorporate Qure.ai's advanced AI software, qXR, to boost both the accuracy and speed of TB detection.

Regulations affecting handheld X-ray devices vary significantly across different regions and countries, impacting their development, approval, and use. In the U.S., for instance, the FDA sets stringent standards for safety and efficacy, requiring comprehensive testing and validation before these devices can be marketed. European countries follow guidelines established by the European Medicines Agency (EMA) and conform to the EU Medical Device Regulation (MDR).

The industry faces a moderate threat from substitute technologies, primarily driven by advancements in alternative imaging modalities such as stationary digital radiography (DR), cone-beam computed tomography (CBCT), and ultrasound. While handheld X-rays offer portability, flexibility, and cost-effectiveness, stationary DR systems provide higher image resolution, faster processing, and integration with hospital information systems, making them preferred for high-volume imaging. However, handheld X-rays have a competitive edge in point-of-care, emergency, and field settings, where mobility and rapid imaging are essential.

The industry is witnessing significant regional expansion, driven by increasing demand for portable diagnostic solutions across developed and emerging economies. As manufacturers expand their geographic footprint through strategic partnerships, product approvals, and distribution agreements, competition is increasing, driving innovation and affordability across multiple regions in the handheld X-ray industry. For instance, in September 2023, Remedi, a Korean radiology equipment company, introduced the REMEX KA-6 handheld X-ray device to India. This lightweight, low-dose device aims to enhance healthcare accessibility by enabling quick and accurate diagnoses, particularly in ICU settings and community screening programs targeting diseases such as tuberculosis.

Application Insights

The dental segment dominated the market with a share of 93.1% in 2024 and is expected to grow at a significant rate over the forecast period. An increasing number of people suffering from several dental problems and a rise in the availability of products are expected to help the segment dominate. Moreover, increasing product launches in this segment is further propelling the market segment. For instance, in October 2022, Videray Technologies, Inc. announced the launch of PX Ultra. PX Ultra was the industry’s first handheld X-ray machine with 160 keV. Therefore, such launches are expected to help the segment's growth.

The orthopedic segment is expected to witness significant growth over the forecast period due to the increasing demand for point-of-care imaging in fracture management, post-surgical evaluations, and joint assessments. Handheld X-ray devices provide orthopedic surgeons with a portable, efficient, and immediate imaging solution. The ability of handheld X-rays to provide real-time imaging during orthopedic procedures, such as closed reduction of fractures and intraoperative hardware placements, further drives their adoption in orthopedic practices, ensuring better patient outcomes and streamlined workflow efficiency.

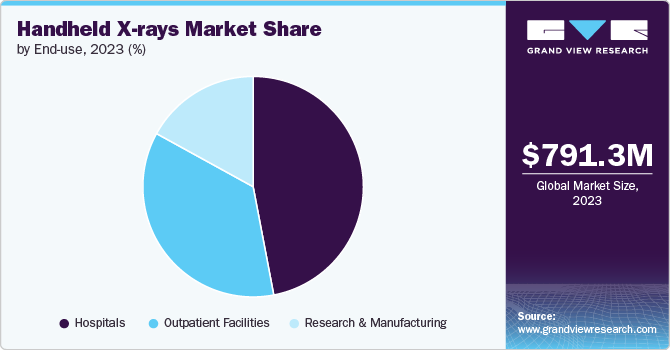

End-use Insights

The hospital segment dominated the market with a share of 47.0% in 2024. This can be attributed to the growing hospital industry, increasing number of orthopedic surgeries, and rising patient pool across all age groups. For instance, according to the India Brand Equity Foundation, the country's hospital sector is expected to grow to a value of USD 132 billion by 2023, representing about 80.0% of India's overall healthcare market. Additionally, the number of orthopedic surgical cases is increasing globally. these factors, the demand for handheld X-rays is projected to increase globally.

Additionally, the rise in orthopedic surgical cases is further expected to fuel the demand for handheld X-rays, as these devices are essential for pre-operative assessments, intraoperative imaging, and post-operative monitoring. Together, these factors provide the growing need for portable, efficient imaging solutions in hospitals, leading to a projected increase in global demand for handheld X-ray devices.

The outpatient facilities segment is projected to witness the fastest growth rate of 11.7% during the forecast period 2025 to 2030. The outpatient facilities segment includes specialty clinics such as dental clinics, diagnostic labs such as pathology & imaging, and ambulatory surgical centers. Diagnostic labs provide a comprehensive range of diagnostic and preventative health services. Moreover, radiologists have a chance to offer independent outpatient imaging facilities because of the rising number of patients with chronic illnesses. Therefore, as a result of the aforementioned factors, the outpatient facilities segment is anticipated to witness a significant growth rate.

Regional Insights

North America handheld X-rays market held the largest share of 34.0% in 2024. This can be attributed to the presence of key market players and the high volume of surgical procedures conducted in the region. The extensive network of established healthcare facilities and advanced medical infrastructure in North America drives the adoption of advanced technologies, including handheld X-rays.

U.S. Handheld X-Rays Market Trends

The handheld X-rays market in the U.S. held the largest market share in 2024 in the North America region. This dominance is primarily due to the increasing frequency of dental clinic visits by patients, which often necessitates X-ray interventions for further treatment. According to data from the CDC, in 2022, 63.7% of adults aged 65 and older had visited a dental clinic in the past year, with women (64.9%) being more likely than men (62.3%) to have had such visits. This high rate of dental visits drives the demand for handheld X-rays to facilitate necessary diagnostic procedures.

Europe Handheld X-Rays Market Trends

The handheld X-rays market in Europe held a significant market share in 2024. The region's advanced healthcare infrastructure and strong emphasis on innovative medical technologies contribute to its substantial market presence. Increased adoption of handheld X-rays in various medical fields, including dental, orthopedic, and emergency care, is driven by the need for portable and efficient imaging solutions. Additionally, supportive regulatory environments and investment in healthcare infrastructure further boost market growth.

The UK handheld X-rays market is expected to grow due to a growing focus on early diagnosis and management of chronic disorders. This expansion is supported by advancements in imaging technology and increased investments in healthcare.

The handheld X-rays market in France is expected to grow over the forecast period due to the technological advancements that enhance diagnostic capabilities such as the integration of features such as wireless connectivity and advanced software for data analysis that further supports their functionality and ease of use.

Germany handheld X-rays market is expected to grow over the forecast period this can be attributed to the country’s advanced healthcare infrastructure and a strong focus on integrating innovative medical technologies into clinical practice. Additionally, government initiatives and funding aimed at enhancing medical care and diagnostic capabilities provide further support for market expansion.

Asia Pacific Handheld X-Rays Market Trends

The handheld X-rays market in Asia Pacific is estimated to witness the fastest CAGR of 11.8% during the forecast period. The growth can be attributed to the growing population, growing medical tourism, increased demand for better imaging devices and supportive government initiatives for improving healthcare infrastructure in the region. Additionally, the increasing prevalence of chronic disorders and the rising number of surgical cases in this region may further increase the usage of handheld X-rays across the Asia Pacific region.

handheld X-rays market in China is expected to grow at a notable growth rate over the forecast period, driven by the increasing incidence of chronic diseases and the growing demand for efficient diagnostic tools. The rising prevalence of conditions such as cardiovascular diseases, respiratory disorders, and cancer fuels the need for advanced imaging solutions. Additionally, the expansion of healthcare infrastructure and investments in medical technology further support the adoption of handheld X-rays, enhancing diagnostic capabilities and accessibility across the country.

The Japan handheld X-rays market is expected to grow, over the forecast period. This growth is mainly driven by the increasing demand for advanced diagnostic tools and the country's emphasis on early disease detection and management.

Latin America Handheld X-Rays Market Trends

The handheld X-rays market in Latin America is expected to see moderate growth during the forecast period, due to increasing investments in healthcare infrastructure and rising demand for portable diagnostic solutions. As healthcare systems in the region continue to develop and improve access to medical technologies, the need for versatile and cost-effective imaging tools like handheld X-rays grows. Thus, boosting market growth in the region.

MEA Handheld X-Rays Market Trends

The handheld X-rays market in the Middle East & Africa (MEA) is anticipated to witness growth due to the increasing investments in healthcare infrastructure and the rising demand for advanced diagnostic tools in the region. Efforts to improve healthcare access and quality, coupled with growing awareness of the benefits of portable imaging solutions, are driving the adoption of handheld X-rays.

Key Handheld X-Rays Company Insights

Key players in the handheld X-ray market are adopting strategies such as geographic expansion, strategic partnerships, and technological innovation to enhance their market presence. Geographic expansion allows companies to tap into emerging markets with growing healthcare needs, increasing their reach and customer base. Strategic partnerships with healthcare providers and technology firms enable the development of advanced solutions and the integration of new technologies. Additionally, ongoing technological innovation focuses on improving device functionality, image quality, and user experience, ensuring that companies remain competitive and responsive to evolving market demands. These strategies collectively drive market growth and strengthen the position of leading players in the handheld X-ray industry.

Key Handheld X-rays Companies:

The following are the leading companies in the handheld X-rays market. These companies collectively hold the largest market share and dictate industry trends.

- Dental Imaging Technologies Corporation

- REMEDI Co Ltd

- Genoray

- OXOS Medical

- MaxRayCocoon.com

- Digital Doc LLC.

- EVIDENT

- Carestream Dental LLC

Recent Developments

-

In January 2024, Oxos Medical received FDA clearance for its MC2 ultraportable x-ray system. The cordless and lightweight MC2 offers digital radiography, fluoroscopy, and static imaging. Its patented positioning system aids image capture, while its small scatter area and low radiation output reduce space and infrastructure needs.

-

In July 2024, Turner Imaging Systems released the Enduro DR X-ray system, a portable digital x-ray solution. It includes a 6 lb scanner, a wireless flat panel detector, and a software-equipped laptop. Designed for diverse clinical environments, the system can be used handheld or mounted on a tripod or stand.

-

In February 2024, Mid America Dental Sales announced its new X-ray device, the X4 Handheld. This innovative technology features a Carbon Nano Tube (CNT) X-ray tube, which enhances efficiency while maintaining a lightweight design of just 4 pounds. The X4 Handheld is noted for its power efficiency, capable of capturing up to 800 images on a single charge. Additionally, the device's smaller battery compared to standard models further contributes to its lightweight nature.

Handheld X-Rays Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 950 million |

|

Revenue forecast in 2030 |

USD 1.63 billion |

|

Growth rate |

CAGR of 11.4% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Dental Imaging Technologies Corporation; REMEDI Co. Ltd; Genoray; OXOS Medical; MaxRayCocoon.com; Digital Doc LLC.; EVIDENT; Carestream Dental LLC. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Handheld X-rays Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global handheld X-rays market report on the basis of application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental

-

Orthopedic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global handheld X-rays market size was estimated at USD 865.4 million in 2024 and is expected to reach USD 950.0 million in 2025.

b. The global handheld X-rays market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2030 to reach USD 1.63 billion by 2030.

b. North America dominated the handheld X-rays market with a share of 34% in 2024. This is attributable to rising growing number of surgical procedures being conducted in this region.

b. Some key players operating in the handheld X-rays market include Dental Imaging Technologies Corporation, REMEDI Co.,Ltd, Genoray, OXOS Medical, MaxRayCocoon.com, EVIDENT, Carestream Dental LLC.

b. Key factors that are driving the ethylene oxide sterilization services market include increasing technological advancements, rising number of dental procedures, growing orthopedic surgical cases, and surge in chronic disorders globally.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."