- Home

- »

- Sensors & Controls

- »

-

Handheld Imagers Market Size, Share, Industry Report, 2030GVR Report cover

![Handheld Imagers Market Size, Share & Trends Report]()

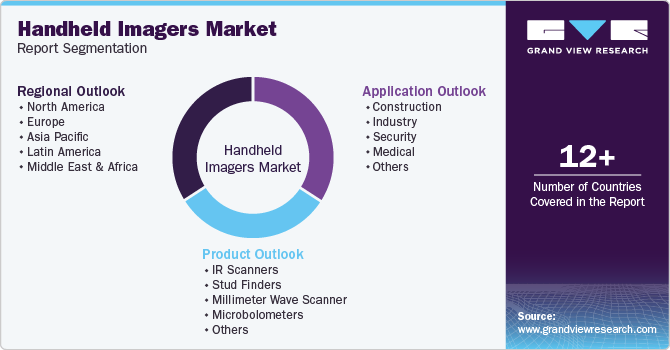

Handheld Imagers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (IR Scanners, Stud Finders, Millimeter Wave Scanner, Microbolometers, Others), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-442-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Handheld Imagers Market Size & Trends

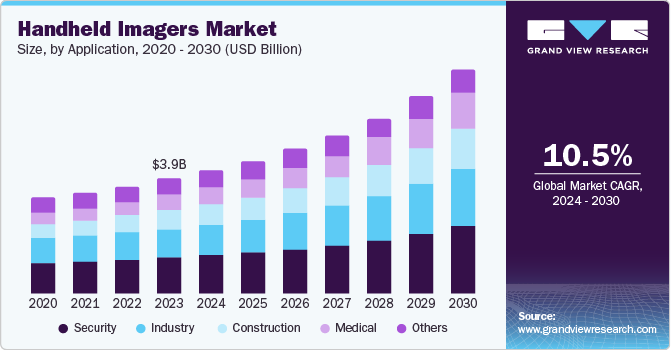

The global handheld imagers market size was valued at USD 3.90 billion in 2023 and is projected to grow at a CAGR of 10.5% from 2024 to 2030. Handheld imagers have been vital in public safety and security, widely employed across diverse applications such as border control, airport security, and law enforcement. These portable imaging solutions are pivotal in enhancing situational awareness, enabling rapid threat detection, and ensuring the safety of both personnel and the public. Their ability to provide high-resolution images in real time aids in identifying concealed weapons, unauthorized intrusions, and other security threats, thereby greatly improving the effectiveness of security protocols.

The demand for advanced imaging tools is even more pronounced in the military and defense sectors. Handheld imagers with night vision capabilities, thermal imaging, and target acquisition features are crucial for surveillance, reconnaissance, and combat operations. Advances in imaging technology in recent years have significantly transformed the handheld imagers market, creating more sophisticated, portable, and user-friendly devices. Innovations in infrared, thermal, and multispectral imaging have broadened these devices' functionality and application spectrum, allowing for superior image quality and enhanced detection capabilities across various sectors, including medical diagnostics, industrial inspection, and environmental monitoring.

Integrating artificial intelligence (AI) and machine learning (ML) algorithms has transformed the image analysis and interpretation space. These technologies enable automated and more accurate diagnostics, reducing the chances of human errors and expediting decision-making processes. AI-driven enhancements in image processing also facilitate real-time data analysis, predictive maintenance, and advanced analytics, thereby enhancing the efficiency and reliability of handheld imagers. Combining cutting-edge imaging technologies with AI and ML has propelled their adoption in increasingly complex and diverse applications. Research institutes and imaging companies invest significantly in this industry to develop innovative solutions. For instance, in June 2024, researchers from Seoul National University and The University of Texas developed an imager chip that could be integrated into mobile devices and used to detect wirings or wooden beams behind walls, cracks in pipes, studs, and package objects. The technology has also been highly useful in the medical sector.

Application Insights

The security segment held a leading revenue share of 31.6% in the market in 2023. Handheld imagers are extensively used in security applications for their operational efficiency, offering a cost-effective solution characterized by high mobility and ease of use. These devices deliver rapid and accurate results, eliminating the need for complex setup or maintenance, which has driven their appeal among security agencies. Their portability allows for quick deployment in various scenarios, providing real-time imaging crucial for immediate threat assessment and response. Additionally, handheld imagers contribute to resource optimization by enabling precise and timely threat detection, allowing security agencies to allocate personnel and resources more effectively. This improves the overall operational effectiveness and ensures a higher level of security and responsiveness in critical situations.

The medical segment is expected to witness the fastest growth during the forecast period. Handheld imagers provide immediate diagnostic capabilities at the point of care, enabling healthcare providers to make quick and accurate decisions during medical procedures. This accessibility and convenience are particularly beneficial in emergency settings, rural areas, and home healthcare, where traditional imaging equipment may not be readily available. These devices' portability and ease of use ensure that essential diagnostic services can be delivered efficiently and effectively, regardless of the patient’s location. The rapid diagnosis and initiation of treatment facilitated by handheld imagers significantly enhance patient outcomes by reducing the time between the onset of symptoms and medical intervention.

Product Insights

Stud finders held the largest revenue share in the global market in 2023. The availability of affordable stud finders has increased their accessibility to diverse consumers, including DIY enthusiasts, small contractors, and large construction firms. This cost-effectiveness has driven widespread adoption and usage of these devices across various sectors. Modern stud finders are designed with user-friendly interfaces and simple operations, ensuring they are accessible to users with varying levels of expertise. Stud finders can be magnetic or electronic, with the former being more affordable and useful in commercial construction activities.

Meanwhile, electronic stud finders send out signals and read the signals that bounce back to determine the presence of studs. More advanced products leverage technologies such as ground-penetrating radar, which creates subsurface images. A combination of affordability and user-friendly features has played a crucial role in driving the popularity and widespread deployment of stud finders in construction and renovation projects, enabling segment expansion.

The IR scanners segment is expected to expand at a substantial CAGR over the forecast period. Continuous improvements in infrared (IR) imaging technology, including higher resolution sensors and enhanced thermal sensitivity, significantly boost the performance and utility of IR scanners. These advancements enable more accurate and detailed thermal imaging, which expands the application scope of these products across various industries. For instance, these capabilities facilitate precise, non-invasive diagnostics and monitoring in the medical field. In industrial settings, they improve predictive maintenance and quality control processes by detecting thermal anomalies with greater accuracy. Furthermore, advancements in IR imaging technology have strengthened the effectiveness of security and surveillance operations by providing clearer and more reliable thermal images in various environmental conditions.

Government and private organizations and research institutes are developing advanced solutions to cater to the widest possible range of applications. For instance, in May 2024, NASA launched an infrared camera for Earth and space exploration. The camera features high-resolution and sensitive superlattice sensors developed at the organization’s Goddard Space Flight Center in Maryland. The new technology, characterized by a compact and lightweight design, enhances environmental monitoring and planetary science capabilities by providing detailed thermal imaging results. These advanced sensors, integrated with lightweight filters, are also expected to improve the prediction and detection of forest fires, enhancing the safety of firefighters and protecting life & property.

Regional Insights

North America held the highest revenue share of 45.2% in 2023. The constant rise in usage of consumer electronics and smart devices, such as smartphones and tablets with integrated imaging capabilities, significantly drives the regional demand for handheld imagers. These devices appeal to technologically aware consumers seeking advanced imaging functionalities for personal and professional use. Integrating high-quality cameras in everyday devices allows users to access sophisticated imaging tools that were previously limited to specialized equipment. This trend is driven by the increasing consumer preference for versatile, portable technologies that enhance their photography, video recording, and augmented reality experiences, further fueling market growth.

U.S. Handheld Imagers Market Trends

The U.S. has witnessed a substantial demand for handheld imaging solutions. The rising adoption of the Internet of Things (IoT) and smart technologies across the country's healthcare, manufacturing, and home automation sectors has led to the increased integration of real-time data collection and analysis capabilities. In healthcare, handheld imagers are a pivotal part of IoT-driven solutions, enabling healthcare professionals to conduct immediate diagnostics and monitor patient conditions remotely with high precision. These imagers facilitate early detection of medical issues, enhance treatment planning, and improve patient outcomes through timely interventions. In manufacturing, handheld imagers play a crucial role in quality control, predictive maintenance, and process optimization by providing instant visual insights into equipment performance and product integrity. In the home automation segment, these devices offer enhanced security surveillance, environmental monitoring, and energy efficiency management, empowering homeowners to make informed decisions by leveraging actionable data.

Europe Handheld Imagers Market Trends

Supportive government policies and regulations are pivotal in driving the adoption of handheld imagers in Europe, as they enhance security measures and promote industrial advancements. European governments have implemented stringent security protocols to counteract rising threats, mandating advanced imaging technologies for surveillance and screening in public spaces, transportation hubs, and critical infrastructure. Additionally, policies aimed at bolstering industrial growth have created a conducive environment for adopting handheld imagers in various sectors, including manufacturing and aerospace, where non-destructive testing and maintenance of components are crucial procedures.

The demand for handheld imagers in Germany is expected to contribute substantially to the regional market's expansion in the coming years. The presence of a highly advanced manufacturing industry in the economy, coupled with a strong focus on improving process efficiency and productivity, has resulted in the extensive usage of solutions such as handheld imagers. Additionally, the well-established medical sector has acted as a major demand driver in this market, as these tools help offer personalized healthcare delivery and improve patient outcomes. The presence of companies such as Robert Bosch GmbH and Testo SE has further enabled the development of this market in the economy.

Asia Pacific Handheld Imagers Market Trends

Asia Pacific is anticipated to witness the fastest growth in the market from 2024 to 2030. Increasing investments in the healthcare sector, particularly in rapidly emerging economies such as China and India, significantly drive the demand for advanced diagnostic tools, including handheld imagers. Governments and private investors are prioritizing the modernization of medical facilities and the adoption of cutting-edge diagnostic equipment to improve healthcare outcomes. This is driven by a combination of factors, including the rising prevalence of chronic diseases, an aging population, and increasing awareness regarding the importance of early and accurate diagnosis. Healthcare providers increasingly seek portable, efficient, high-resolution imaging solutions to enhance patient care. Handheld imagers, with their advanced features and high convenience, are becoming essential tools in this ecosystem, supporting the broader goal of achieving more accessible and effective healthcare delivery in these economies.

The healthcare and manufacturing sectors have progressed substantially in China in recent years due to the increasing acceptance of modern technologies in these sectors and the growing presence of international manufacturers. Furthermore, the construction industry is also growing at a strong pace, owing to the higher disposable income of consumers and government initiatives to encourage modernization and industrialization in the economy. As a result, products such as stud finders have assumed greater importance in this segment to ensure reliability and structural integrity.

Key Handheld Imagers Company Insights

Some key companies in the handheld imagers market include Zoro Tools, Inc.; Fluke Corporation; and Teledyne FLIR LLC, among others.

-

Zoro Tools, Inc. supplies industrial supplies and equipment, catering to a wide range of industries with a comprehensive range of products designed to meet various operational needs. The company offers a diverse array of handheld imagers, which are notable for their precision, portability, and ease of use. These handheld imagers are utilized across multiple sectors, including healthcare, security, and industrial inspection, providing reliable and high-quality imaging solutions. Zoro Tools’ product offerings in the handheld imager category include thermal imagers, infrared cameras, and ultrasound devices, all designed to deliver accurate and efficient diagnostic and inspection capabilities.

-

Fluke Corporation caters to a diverse range of industries, including industrial, electrical, and electronic sectors. The company’s product portfolio includes a wide range of handheld imagers in demand for thermal imaging and infrared inspection applications. These handheld imagers have been designed to provide precise temperature measurements, detailed thermal images, and advanced diagnostic capabilities. They are necessary for predictive maintenance, electrical inspections, and building diagnostics segments.

Key Handheld Imagers Companies:

The following are the leading companies in the handheld imagers market. These companies collectively hold the largest market share and dictate industry trends.

- Zoro Tools, Inc.

- Fluke Corporation

- Teledyne FLIR LLC

- Leonardo DRS

- General Dynamics Corporation

- BAE Systems

- Robert Bosch GmbH

- Raytek Direct

- Zebra Technologies Corp.

- Opgal Optronics Industries Ltd.

Recent Developments

-

In June 2024, Teledyne FLIR announced the release of its next-gen Hadron 640 series, a line of dual radiometric thermal and visible camera modules. The models have been specifically designed for unmanned ground vehicles, unmanned aircraft systems, emerging AI applications that use the company’s PRISM software, and robotic platforms. The products, which include the radiometric Hadron 640R+ and the ITAR-free Hadron 640+, offer an advanced level of thermal sensitivity. This strategic development highlights the company’s commitment to advancing imaging technology for sophisticated applications.

Handheld Imagers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.18 billion

Revenue forecast in 2030

USD 7.62 billion

Growth Rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Zoro Tools, Inc.; Fluke Corporation; Teledyne FLIR LLC; Leonardo DRS; General Dynamics Corporation; BAE Systems; Robert Bosch GmbH; Raytek Direct; Zebra Technologies Corp.; Opgal Optronics Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Handheld Imagers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global handheld imagers market report based on application, product, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

IR Scanners

-

Stud Finders

-

Millimeter Wave Scanner

-

Microbolometers

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Industry

-

Security

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.