Hand Cream Market Size, Share & Trends Analysis Report By Product (Moisturizing Hand Creams, Anti-Aging Hand Creams), By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-426-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Hand Cream Market Size & Trends

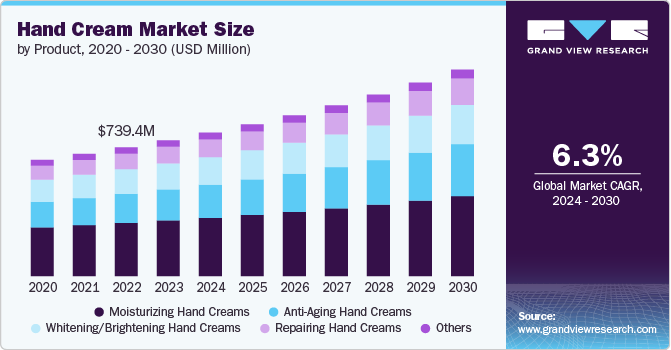

The global hand cream market size was estimated at USD 779.7 million in 2023 and is expected to grow at a CAGR of 6.3% from 2024 to 2030. The market growth is majorly driven by the increased consumer awareness of hand hygiene and the benefits of moisturizing, growing demand for natural and organic products, and the introduction of innovative products with added features like SPF or aromatherapy. With the rise of the COVID-19 pandemic, there has been a heightened focus on handwashing and the use of sanitizers, leading consumers to seek moisturizing solutions that can counteract the drying effects of frequent hand cleansing. This shift in consumer behavior has expanded the demand for hand creams that not only provide hydration but also enhance skin health. As a result, brands have responded by innovating their product lines, incorporating advanced formulations that include natural ingredients, vitamins, and soothing agents to attract health-conscious consumers.

In addition to the pandemic's influence, the growth of the e-commerce sector has revolutionized the way consumers purchase personal care products, including hand creams. Online retail platforms have made it easier for consumers to access a wide variety of products from global brands, facilitating informed purchasing decisions through product reviews and detailed descriptions. The convenience of home delivery and the ability to compare prices across different platforms have further boosted sales. As a result, traditional brick-and-mortar retailers are increasingly adopting omnichannel strategies, blending physical and digital experiences to reach a broader audience and enhance customer engagement.

The market has witnessed a significant shift with the growing inclusion of active ingredients such as retinol and niacinamide in product formulations. This trend is driven by increasing consumer demand for multifunctional skincare solutions that go beyond basic moisturization. Retinol, known for its anti-aging properties, and niacinamide, recognized for its ability to improve skin texture and tone, are being incorporated into hand creams to offer enhanced benefits. These active ingredients appeal to consumers who are increasingly seeking products that deliver visible results, such as reducing signs of aging, brightening skin, and improving overall skin health.

Manufacturers are responding to this trend by innovating their product lines to include these potent ingredients, positioning their offerings as advanced skincare solutions for the hands. For example, Nécessaire Inc., a prominent player in the personal care industry, offers a hand cream named The Hand Retinol | 0.25% Retinol. This product is formulated with 0.25% pure retinol and is complemented by AHA, peptides, vitamins, and glycerin. It is specifically designed to address and prevent common signs of aging, such as crepiness, lines, wrinkles, spots, and marks, thereby promoting younger-looking hands. Moreover, the use of active ingredients like retinol and niacinamide is expanding the demographic reach of hand creams. While traditionally marketed towards older consumers concerned with anti-aging, these advanced formulations are now attracting younger audiences who are interested in preventive skin care.

Sustainability is also a key factor propelling growth in the hand cream market. With consumers becoming more environmentally conscious, there is a growing preference for products that utilize eco-friendly packaging and sustainably sourced ingredients. Brands that prioritize sustainability in their business models are not only appealing to eco-conscious consumers but are also setting trends within the industry. For example, L'Occitane offers its Shea Butter Hand Cream as a key product within its portfolio. This nourishing and softening hand cream, formulated with 20% organic shea butter, is highly effective in addressing dry hands. Widely trusted by consumers, this best-selling hand cream ensures hands remain supple, hydrated, and protected year-round, making it a cornerstone of L'Occitane's skincare offerings. As companies respond to this demand by reformulating products and adopting responsible sourcing practices, the hand cream segment is witnessing an influx of natural and organic options that cater to this emerging consumer base.

The market is seeing an increasing segmentation of product offerings to cater to diverse consumer needs. Specialized formulations targeting specific skin concerns, such as anti-aging, sensitive skin, or irritation relief, are becoming more prevalent. Additionally, the emergence of premium and luxury hand creams, often featuring unique textures and fragrances, has attracted affluent consumers willing to invest in high-quality skincare products. This segmentation is further supported by targeted marketing campaigns that educate consumers about the benefits of these specialized formulations, thus enhancing brand loyalty and encouraging repeat purchases.

The market's growth trajectory is also bolstered by strategic partnerships and collaborations among key industry players. Brands are increasingly engaging in mergers and acquisitions to expand their product portfolios and market reach. Collaborations with influencers and skincare experts have become commonplace, driving brand awareness and consumer trust. These strategies enable companies to capitalize on emerging trends and adapt to shifting consumer preferences, ensuring that they remain competitive in an increasingly crowded marketplace. As a result, the hand cream market is poised for continued growth, supported by a combination of consumer demand, innovative product development, and effective marketing strategies.

Product Insights

Moisturizing hand creams accounted for a market share of 41.04% in 2023. The demand for moisturizing hand creams is growing due to increasing consumer awareness of skin health, heightened exposure to environmental stressors, and rising incidences of skin dryness. Urban lifestyles, frequent hand washing, and exposure to harsh weather conditions further contribute to skin hydration needs. Additionally, the trend toward multifunctional products offering hydration, protection, and anti-aging benefits is driving market expansion. Brands are responding with innovative formulations that incorporate natural ingredients, vitamins, and botanicals, appealing to consumers seeking effective and sustainable skincare solutions. This convergence of factors positions moisturizing hand creams as essential products in contemporary personal care routines.

The demand for anti-aging hand creams is projected to grow at a CAGR of 7.7% from 2024 to 2030. The demand for these products is growing due to the increasing consumer focus on comprehensive skincare, extending beyond the face to include the hands, which are often the first to show signs of aging. As awareness rises about the impact of environmental factors, UV exposure, and frequent hand washing on skin aging, consumers are seeking targeted solutions to combat wrinkles, age spots, and loss of skin elasticity. The inclusion of active ingredients like retinol, peptides, and antioxidants in anti-aging hand creams has further fueled demand, offering consumers products that not only moisturize but also provide long-term benefits. This trend is particularly strong among aging populations and skincare-conscious consumers, driving market growth in this segment.

End Use Insights

The demand for hand creams among women held a market share of 74.84% in 2023. The growing demand for hand creams among women is driven by heightened awareness of skincare and the increasing emphasis on personal grooming. As women increasingly prioritize maintaining youthful and healthy skin, hand creams, particularly those enriched with active ingredients like retinol and niacinamide, are becoming essential in daily skincare routines. The rise of remote work and frequent handwashing due to health concerns has also spurred demand, as women seek solutions to combat dryness and maintain skin softness. Additionally, the expanding range of targeted products catering to specific needs, such as anti-aging or hydration, further propels market growth, aligning with women's evolving preferences and lifestyles.

The men’s demand for hand creams is anticipated to grow with a CAGR of 6.9% from 2024 to 2030. Modern men are more conscious of maintaining healthy skin, leading to greater adoption of hand creams that offer moisturizing, anti-aging, and protective benefits. Additionally, the rise of targeted marketing campaigns and product formulations specifically designed for men has contributed to this trend. The shift towards a more holistic approach to personal care, coupled with the growing availability of male-focused skincare products, has further fueled the demand for hand creams in this demographic. This trend reflects a broader societal change where male grooming is increasingly normalized and valued.

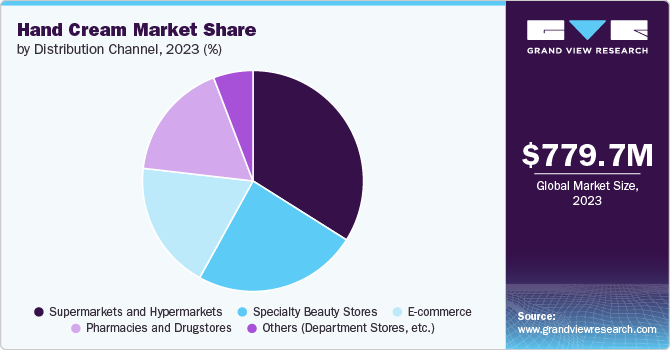

Distribution Channel Insights

The sales through supermarkets and hypermarkets accounted for a share of 33.95% in 2023. The growth in hand cream sales through supermarkets and hypermarkets is attributed to their high visibility and convenience, enabling consumers to purchase these products during regular shopping trips. These retail channels offer extensive product variety, allowing customers to easily compare brands and formulations. Additionally, frequent promotions and discounts make hand creams more appealing to price-sensitive buyers. The strong reputation of supermarkets and hypermarkets as reliable one-stop shopping destinations enhances consumer trust, driving higher sales volumes for hand creams in these settings.

The e-commerce sales channels are projected to grow at a CAGR of 7.9% over the forecast period of 2024 to 2030. The convenience and accessibility offered by online platforms enable consumers to shop from the comfort of their homes, allowing for easy access to a vast array of hand cream products without the constraints of geographical location. This shift in shopping behavior has been further accelerated by an increase in overall online spending, as consumers have developed greater confidence in purchasing personal care items online, bolstered by secure payment systems and reliable delivery options.

Companies are increasingly leveraging online platforms to launch their product lines, recognizing the strategic advantages offered by digital marketplaces. In December 2023, Rare Beauty, a brand founded by Selena Gomez, successfully launched the Find Comfort Body Collection through the Sephora app. This collection includes a hand cream, body lotion, and fragrance mist, with prices ranging from $18 to $28.

Regional Insights

The hand cream market in North America held a share of 36.83% of the global revenue in 2023. The growth of the regional market is driven on account of the heightened awareness of skincare routines, particularly following the increased focus on hand hygiene during the COVID-19 pandemic, which has led to a significant rise in the usage of hand creams. Consumers are now prioritizing moisturizing products that protect against dryness, resulting in an uptick in demand for products that offer both functional benefits and sensory experiences.

U.S. Hand Cream Market Trends

The hand cream market in the U.S. is expected to grow at a CAGR of 6.3% from 2024 to 2030. The growing trend of self-care has prompted consumers to invest in premium hand creams that offer soothing and nourishing properties, leading to an expansion in product offerings. Brands are capitalizing on this trend by introducing formulations with innovative ingredients, such as hyaluronic acid and botanical extracts, appealing to consumers seeking effective and luxurious hand care solutions.

Asia Pacific Hand Cream Market Trends

Asia Pacific accounted for a revenue share of around 23.05% in the year 2023. As consumers in countries like China and India adopt Western beauty standards, there is a noticeable shift towards skincare products that enhance personal grooming and overall wellness. The popularity of K-beauty products is also contributing to this growth, as consumers are drawn to the innovative formulations and packaging aesthetics. Furthermore, the increasing awareness of skincare routines among younger demographics is driving demand for specialized hand creams that address specific concerns, such as anti-aging and hydration.

Europe Hand Cream Market Trends

The European market is projected to grow at a CAGR of 6.5% from 2024 to 2030. The regional demand is being significantly influenced by the growing emphasis on sustainability and clean beauty. European consumers are becoming increasingly conscious of the ingredients in their personal care products, opting for hand creams that are formulated with natural and organic components. This shift towards ethical consumption is prompting brands to develop products that not only deliver performance but also align with eco-friendly practices, including sustainable sourcing and biodegradable packaging.

Key Hand Cream Company Insights

The competitive landscape of the market is characterized by a dynamic mix of established brands and emerging players, each vying for market share through innovation and differentiation. Major players, including industry leaders like L'Oréal, Unilever, and Beiersdorf AG, dominate the market with extensive product portfolios that cater to diverse consumer preferences. These companies leverage their strong distribution networks and brand recognition to maintain a competitive edge.

Emerging brands, particularly those focused on clean beauty and sustainability, are gaining traction by appealing to environmentally conscious consumers. This trend has led to a proliferation of niche players that offer specialized formulations, often emphasizing natural and organic ingredients. The rise of e-commerce has further intensified competition, allowing smaller brands to reach global audiences without the constraints of traditional retail channels.

Key Hand Cream Companies:

The following are the leading companies in the hand cream market. These companies collectively hold the largest market share and dictate industry trends.

- L'Occitane Groupe S.A.

- Natura & Co

- Johnson & Johnson

- Nécessaire Inc.

- The Clorox Company

- Beiersdorf AG

- L'Oréal S.A.

- Kao Corporation

- Unilever PLC

- Pierre Fabre S.A

Recent Developments

-

In March 2024, TATA Harper Skincare entered into a partnership with Sky High Farm Universe, a nonprofit organization based in Hudson Valley, New York, dedicated to addressing food insecurity. This collaboration aimed to develop a distinctive hand cream specifically designed to rejuvenate the rough and fatigued hands of gardeners, farmers, and urban dwellers. The initiative underscored TATA Harper’s commitment to social responsibility, as 100% of the proceeds from the hand cream were directed towards supporting Sky High Farm’s food sovereignty mission. This partnership not only enhanced the brand's product offerings but also contributed to a meaningful cause, reinforcing TATA Harper’s position as a leader in sustainable and purpose-driven skincare.

-

In April 2023, Almora Botanica unveiled its latest skincare line, blending Ayurvedic principles with contemporary science and adaptogenic elements. The new offerings include a Purifying Gel Cleanser, Nourishing Night Face Oil, Hydrating & Resilience Face Lotion, Restorative Night Face Oil, Radiance Day Face Oil, Serum for Fine Lines, and Restorative Hand Cream.

Hand Cream MarketReport Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 823.6 million |

|

Revenue forecast in 2030 |

USD 1.19 billion |

|

Growth rate |

CAGR of 6.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, distribution channel, region |

|

Regional scope |

North America; Europ; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa |

|

Key companies profiled |

L'Occitane Groupe S.A.; Natura & Co; Johnson & Johnson; Nécessaire Inc.; The Clorox Company; Beiersdorf AG; L'Oréal S.A.; Kao Corporation; Unilever PLC; Pierre Fabre S.A |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hand Cream Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hand cream market report based on the product, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Moisturizing Hand Creams

-

Anti-Aging Hand Creams

-

Repairing Hand Creams

-

Whitening/Brightening Hand Creams

-

Others (Exfoliating Hand Creams, etc.)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Beauty Stores

-

Pharmacies & Drugstores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hand cream market was estimated at USD 779.7 million in 2023 and is expected to reach USD 823.6 million in 2024.

b. The global hand cream market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 1.19 billion by 2030.

b. North America dominated the hand cream market with a share of over 36.83% in 2023. The regional demand is driven by a growing trend of self-care prompting consumers to invest in premium hand creams that offer soothing and nourishing properties.

b. Some of the key players operating in the hand cream market include L'Occitane Groupe S.A., Natura & Co, Johnson & Johnson, Nécessaire Inc., The Clorox Company, Beiersdorf AG, L'Oréal S.A., Kao Corporation, Unilever PLC, and Pierre Fabre S.A.

b. The global hand cream market's growth is majorly driven by the increased consumer awareness of hand hygiene and the benefits of moisturizing, growing demand for natural and organic products, and the introduction of innovative products with added features like SPF or aromatherapy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."