- Home

- »

- Clothing, Footwear & Accessories

- »

-

Halal Fashion Market Size, Share And Trends Report, 2030GVR Report cover

![Halal Fashion Market Size, Share & Trends Report]()

Halal Fashion Market Size, Share & Trends Analysis Report By Product (Apparel, Footwear, Accessories), By Gender (Men, Women), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-451-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Halal Fashion Market Size & Trends

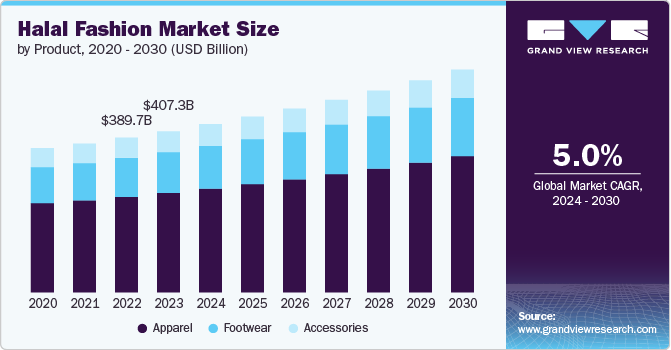

The global halal fashion market size was estimated at USD 407.3 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. There is a marked increase in religious and cultural awareness within Muslim communities. More individuals are seeking to align their lifestyle choices with their faith, including their clothing. Halal fashion, which adheres to Islamic principles of modesty and ethical considerations, allows Muslims to express their cultural and religious identity with confidence. This heightened awareness and commitment to religious values are driving the demand for apparel that meets halal standards, offering both spiritual comfort and a sense of authenticity.

Another significant factor is the diversification and modernization of halal fashion offerings. The industry has evolved beyond traditional attire to include a wide range of contemporary and stylish clothing options. Designers and brands are blending modesty with modern trends, creating fashionable garments that appeal to a broad audience. This evolution has expanded the appeal of halal fashion, especially among younger generations and fashion-conscious consumers, who can now find clothing that aligns with both their personal style and religious principles.

Social media and the rise of Muslim fashion influencers have also played a crucial role in the growing demand for halal fashion. Influencers and bloggers use social platforms to showcase how modest fashion can be both stylish and trendy. Their visibility and influence have raised awareness about the variety of halal fashion options available, inspiring more Muslims to explore and adopt these styles. The ability to see real-life examples of how to integrate modesty into modern fashion has significantly contributed to the increasing interest in halal fashion.

In addition, the trend towards ethical and sustainable consumer preferences is impacting the halal fashion market. Many halal fashion brands emphasize ethical sourcing, fair trade practices, and environmental sustainability. This alignment with broader ethical concerns resonates with consumers who are not only focused on religious compliance but also on the social and environmental impact of their purchases. As a result, halal fashion is attracting consumers who prioritize both faith-based and ethical considerations, further fueling the demand for these products.

In June 2022, Lululemon, the popular athletic apparel and footwear brand, launched a line of workout hijabs to cater to gym-going hijabis. The collection features three unique styles and a couple of colorways designed in consultation with hijab wearers across Lululemon's global collective. The debut range includes the Lightweight Performance Hijab and the Scarf-Style Hijab. The Lightweight Performance Hijab comes in black and poolside blue, with sizes S/M and M/L. It has a pinless and pull-on style with an adjustable toggle at the back to hold the wearer's bun or ponytail in place while ensuring a snug fit for running and intense workouts.

Product Insights

Apparel accounted for a revenue share of 61.6% in 2023. Halal fashion apparel caters to the needs of Muslim consumers who seek clothing that aligns with Islamic principles of modesty. This includes garments that are loose-fitting, cover the body appropriately, and are made from materials that comply with halal guidelines. As more individuals prioritize their religious practices in their everyday lives, the demand for apparel that meets these criteria is increasing. The emphasis on modesty is not only a religious requirement but also a cultural preference for many Muslim consumers.

Footwear is expected to grow at a CAGR of 5.5% from 2024 to 2030. There is a growing demand for modest and comfortable footwear that complements halal fashion. Consumers are looking for shoes that provide coverage, comfort, and practicality, while also adhering to Islamic principles. Brands offering a range of stylish, modest, and halal-certified footwear are seeing increased interest as they cater to this niche market. As the halal fashion market expands, more brands are offering halal-certified footwear options, raising awareness and making it easier for consumers to find footwear that aligns with their values. With increased visibility and availability of halal footwear in the market, more consumers are opting for shoes that are both fashionable and halal-compliant, contributing to the growth in demand.

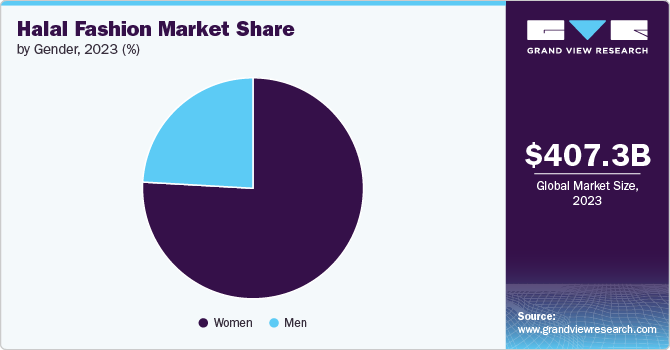

Gender Insights

Halal fashion market for women accounted for a revenue share of 75.9% in 2023. With rising awareness and religious observance, more women are becoming aware of the importance of dressing modestly according to Islamic guidelines. This increased awareness, coupled with a stronger adherence to religious practices, has led to a higher demand for clothing that aligns with their values, such as halal fashion that respects modesty requirements.

The market has expanded significantly, offering a wide variety of stylish and contemporary clothing that caters to different tastes and preferences. As more designers and brands enter the market, women have access to a broader range of fashionable yet modest clothing, making it easier to find outfits that suit their personal style while adhering to religious guidelines.

The market for men is expected to grow at a CAGR of 5.5% from 2024 to 2030. Many Muslim men are becoming more conscious of their religious obligations, including the importance of dressing modestly and in accordance with Islamic principles. The market is expanding, with more brands offering a diverse range of modest clothing options for men, including traditional wear, modern attire, and activewear. This increased availability makes it easier for men to find clothing that suits their needs, preferences, and religious requirements, encouraging more men to adopt halal fashion.

Distribution Channel Insights

Sales of halal fashion products through specialty stores accounted for a revenue share of 38.8% in 2023. Specialty stores that focus on halal fashion provide a carefully curated selection of products that are guaranteed to meet Islamic guidelines for modesty and material use. This targeted approach gives consumers confidence that they are purchasing items that align with their religious and ethical values, which can be more challenging to ensure in general retail environments. The personalized shopping experience in specialty stores builds customer trust and loyalty, driving demand.

Sales of halal fashion products through online is expected to grow at a CAGR of 5.6% from 2024 to 2030. Online shopping provides unparalleled specialty and accessibility for consumers seeking halal fashion. With the ability to browse and purchase from anywhere, at any time, shoppers can easily access a wide range of halal fashion products without the limitations of physical store hours or geographical constraints. This specialty is particularly appealing to consumers who may not have local access to specialty stores that offer halal apparel.

Regional Insights

The halal fashion market in North America is expected to grow at a CAGR of 4.7% during the forecast period from 2024 to 2030. There is a rising awareness and acceptance of diverse cultural practices and religious observances in North America, driven by increasing inclusivity within the fashion industry. Mainstream brands are recognizing the importance of catering to the Muslim consumer market by launching halal fashion lines and modest clothing collections. This shift towards inclusivity is making halal fashion more accessible and appealing to a wider audience.

U.S. Halal Fashion Market Trends

The halal fashion market in the U.S. is facing intense competition and innovation. The Muslim population in the U.S. is growing, leading to a higher demand for products that cater to their specific cultural and religious needs, including halal fashion. As this diverse community grows, so does the desire for clothing that aligns with Islamic principles of modesty and halal standards, prompting more brands to offer appropriate fashion choices.

Europe Halal Fashion Market Trends

The halal fashion market in Europe is expected to grow at a CAGR of 5.0% during the forecast period. There is a broader trend in Europe towards modest fashion, not only among Muslim consumers but also among those who appreciate the style and comfort it offers. This trend is being driven by a growing awareness and acceptance of diverse cultural practices, as well as a desire for more versatile and modest clothing options. As a result, halal fashion is becoming increasingly popular among a wider audience, not just within Muslim communities.

Asia Pacific Halal Fashion Market Trends

The halal fashion market in Asia Pacific accounted for a market share of 49.7% in 2023. The Asia Pacific region is home to some of the largest Muslim populations in the world, including countries like Indonesia, Malaysia, and Bangladesh. As the Muslim population continues to grow, so does the demand for clothing that aligns with Islamic principles of modesty and halal standards. This demographic trend is a significant driver of the increasing demand for halal fashion in the region. In addition, the increased availability and accessibility of halal fashion in both physical and online retail channels are making it easier for consumers to find products that align with their values, further driving demand.

Middle East & Africa Halal Fashion Market Trends

The halal fashion market in Middle East & Africa is expected to grow at a CAGR of 4.5% during the forecast period. The market in the Middle East and Africa is witnessing rapid growth, driven by a confluence of cultural, religious, and socio-economic factors. With a significant Muslim population in the region, the demand for halal fashion that aligns with Islamic principles, including modesty and ethical production practices, is on the rise. Consumers are increasingly seeking clothing that not only meets their religious beliefs but also reflects contemporary fashion trends. Traditional garments such as abayas, kaftans, and hijabs are being reimagined by local designers who infuse modern aesthetics with traditional craftsmanship, appealing to a younger demographic eager for stylish yet modest options.

Key Halal Fashion Company Insights

The halal fashion market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Halal Fashion Companies:

The following are the leading companies in the halal fashion market. These companies collectively hold the largest market share and dictate industry trends.

- Aab Collection

- Modanisa

- Haute Hijab

- SUKAINA

- An-Nahar

- Dolce & Gabbana

- Inayah

- SHUKR Islamic Clothing

- Haf & Haf

- The WRDS Clothing

Recent Developments

-

In March 2024, The Indonesian Ministry of Religious Affairs launched the Indonesia Global Halal Fashion (IGHF) initiative, aimed at promoting the development of Muslim fashion and establishing Indonesia as a global center for halal fashion. Muhammad Aqil Irham, head of the ministry's Halal Product Guarantee Organizing Agency, emphasized the importance of certified halal textile products as essential raw materials for Indonesian designers. The government plans to assist local halal fashion products in entering export markets, particularly in the Middle East and Europe.

-

In December 2023, Maheen Sadiq launched a convertible clothing line called Polko, designed to reduce fashion waste and promote sustainability. The innovative collection allows for fourteen different styles, making it versatile enough for various occasions, from work to casual outings. Sadiq emphasizes the importance of addressing the 92 billion tonnes of textile waste produced annually, advocating for conscious and ethical shopping practices.

Halal Fashion Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 426.1 billion

Revenue forecast in 2030

USD 571.4 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, gender, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Malaysia; India; Indonesia; Australia & New Zealand; Brazil; Saudi Arabia; UAE

Key companies profiled

Aab Collection; Modanisa; Haute Hijab; SUKAINA; An-Nahar; Dolce & Gabbana; Inayah; SHUKR Islamic Clothing; Haf & Haf; The WRDS Clothing

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Halal Fashion Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global halal fashion market report based on product, gender, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Apparel

-

Footwear

-

Accessories

-

-

Gender Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

Malaysia

-

India

-

Indonesia

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global halal fashion market size was estimated at USD 407.3 billion in 2023 and is expected to reach USD 426.1 billion in 2024.

b. The global halal fashion market is expected to grow at a compounded growth rate of 5.0% from 2024 to 2030 to reach USD 571.4 billion by 2030.

b. Halal fashion for women accounted for a share of 75.9% in 2023. More women are becoming aware of the importance of dressing modestly in accordance with Islamic guidelines. This increased awareness, coupled with a stronger adherence to religious practices, has led to a higher demand for clothing that aligns with their values, such as halal fashion that respects modesty requirements.

b. Some key players operating in the halal fashion market include Aab Collection, Modanisa, Haute Hijab, SUKAINA, An-Nahar, Dolce & Gabbana, Inayah, SHUKR Islamic Clothing, Haf & Haf, and The WRDS Clothing. .

b. Key factors that are driving the market growth include rising awareness and demand for modest fashion and increasing Muslim population, globally. Social media and the rise of Muslim fashion influencers have also played a crucial role in the growing demand for halal fashion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."