- Home

- »

- Beauty & Personal Care

- »

-

Hair Texturizer Market Size, Share & Growth Report, 2030GVR Report cover

![Hair Texturizer Market Size, Share & Trends Report]()

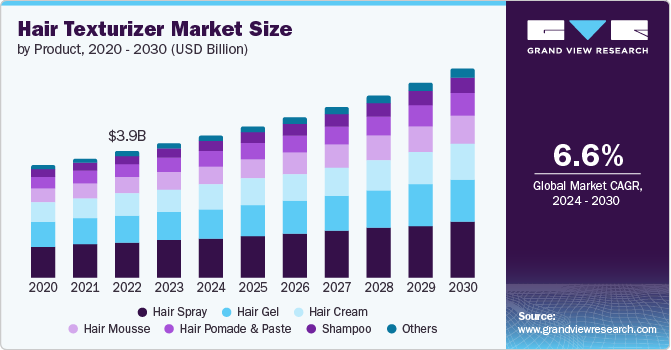

Hair Texturizer Market Size, Share & Trends Analysis Report By Product (Hair Spray, Hair Gel, Hair Cream, Hair Mousse), By Source, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-334-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Hair Texturizer Market Size & Trends

The global hair texturizer market size was estimated at USD 4.14 billion in 2023 and is expected to grow at a CAGR of 6.6% from 2024 to 2030. The market is experiencing substantial growth, driven by the significant and increasing demand for targeted solutions. According to Syensqo, a chemical manufacturer, over 65% of the global consumer population-around 1 billion people have textured hair, representing a major opportunity for the hair texturizer market.

As per the source mentioned above, women with textured hair, in particular, spend 78% more on hair products compared to those with straight hair. The natural hair movement and the rising preference for specialized care products further fuel this trend. Additionally, shampoos and conditioners tailored for textured hair are propelling industry growth, while textured styling products dominate the market share.

The key chemical ingredients in traditional hair texturizers include sodium lauryl sulfate (SLS), silicone, various types of alcohol, and preservatives like paraben. Such ingredients may provide an instant style and shine but render the hair fragile, unhealthy, or itchy, along with other side effects due to prolonged use and exposure. The new generations of consumers are quite aware of such facts and refrain from the use of products containing chemicals. They are proactively choosing the right natural ingredients, which provide problem-specific solutions with long-term benefits.

There is a significant shift towards formulations that use clean, natural, and ethically sourced ingredients. Products are increasingly free from sulfates, parabens, and silicones, focusing instead on plant-based components that provide moisture and nourishment without harmful side effects.

For instance, Briogeo offers a hair texturizer product, Curl Charisma Rice Amino + Avocado Leave-In Defining Cream, which is formulated with natural ingredients like rice amino acids and avocado oil. This cream enhances curl definition, reduces frizz, and provides lightweight hydration without using harsh chemicals. Consequently, the market faces significant challenges due to the growing awareness and popularity of natural products and home remedies. Many bloggers and influencers advocate for achieving desired results with cost-effective home remedies, such as coconut oil, avocado and banana masks, aloe vera gel, and fenugreek seed treatments.

This shift in consumer preference towards cheaper, natural alternatives threatens market growth. Additionally, the high cost of hair texturizers poses a challenge, as numerous affordable options from small and unorganized players in the beauty and personal care market become more attractive.

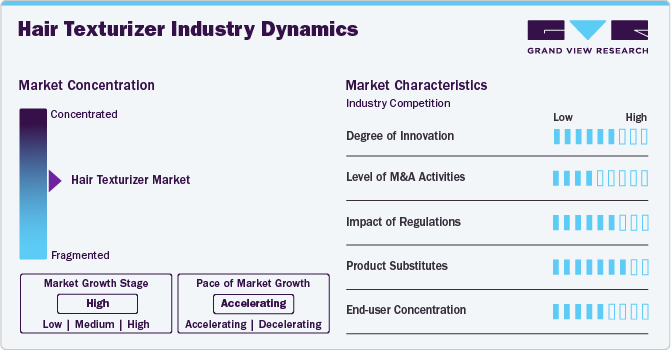

Industry Dynamics

The market is characterized by a high degree of innovation. Companies are continually developing new formulations that incorporate natural and ethically sourced ingredients, advanced technologies, and multi-functional products. Innovations include clean and natural ingredient-based products, tailored solutions for different hair textures, and eco-friendly packaging.

The market is significantly influenced by regulations, particularly concerning ingredient safety and product labeling. Regulatory bodies like the FDA (Food and Drug Administration) in the U.S., the European Medicines Agency (EMA), and other global entities enforce strict guidelines on the use of chemicals in hair texturizer products.

The end-user concentration in the market is relatively high, with a significant focus on consumers with textured hair, including curly, wavy, and coiled hair types. This demographic is highly engaged and often seeks specialized products that cater to their unique hair styling needs. The market also sees a strong presence of women of various ethnic backgrounds who spend significantly more on hair styling products compared to those with straight hair.

Product Insights

The hair spray accounted for a revenue share of around 28% in the year 2023. Hair sprays are convenient and easy to use, providing quick results with minimal effort. The spray format allows for even distribution, making it simple to cover large sections of hair efficiently. Hair sprays offer a wide range of hold levels, from light to extra strong, allowing users to achieve and maintain various styles. This versatility makes hair spray a go-to product for many consumers looking for reliable texturizing options. Furthermore, players are offering vegan and chemical-free hair spray that reduces exposure to potentially harmful substances. For instance, UNITE HAIR based in the U.S. offers TEXTURIZA Hair Texturizing Spray that is paraben-free and also vegan. The hair spray maintains the texture and delivers weightless volume.

The hair pomade & paste is projected to grow at a CAGR of 8.2% over the forecast period of 2024-2030. The shift towards natural and ethically sourced ingredients in pomades and pastes is attracting consumers looking for healthier hair styling options. Products like Baxter of California Clay Pomade, which uses beeswax and kaolin clay, appeal to those who prefer natural ingredients, enhancing the overall attractiveness of the hair texturizer market.

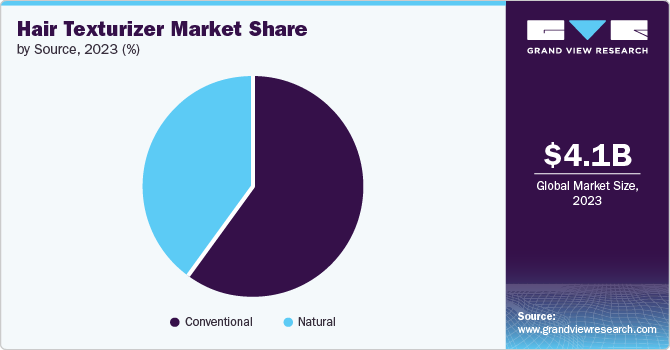

Source Insights

The conventional hair texturizer accounted for a revenue share of around 60% in the year 2023. Many conventional texturizers provide long-lasting performance, ensuring that hairstyles stay intact for extended periods without needing frequent touch-ups. This durability is particularly valued by consumers who require hairstyles to withstand various environmental conditions and activities. Most key players in the hair styling products industry have built trust and credibility over the years. Consumers often gravitate towards familiar brands that have a proven track record of delivering quality products.

The natural hair texturizer is projected to grow at a considerable CAGR over the forecast period of 2024-2030. Chemical-free hair texturizer products often contain natural ingredients such as plant extracts, essential oils, and botanicals. These ingredients can offer additional benefits like moisturizing, nourishing, and protecting the hair while providing styling hold.

Distribution Channel Insights

The offline segment accounted for a revenue share of around 60% in 2023. The offline channel dominates the market. This is due to their wide product variety, accessibility, and ability to cater to diverse consumer preferences in one convenient location. In January 2023, Function of Beauty introduced four new styling products at Target stores tailored for various hair types: a texturizing spray for straight hair, a styling mousse for wavy hair, a shaping curl cream for curly hair, and a styling gel for coily hair. This launch represents Function of Beauty's initial venture into personalized styling products within physical retail, following the earlier introduction of a direct-to-consumer e-commerce styling primer in October 2022.

The online segment is estimated is projected to grow at a considerable CAGR over the forecast period of 2024-2030. Over the past few years, e-commerce has been gaining popularity as it offers high levels of convenience. Buyers worldwide are increasingly turning to online shopping for their daily necessities, including hair texturizers. This trend has also been witnessed in developing countries such as India and Brazil, as well as several countries in Africa.

According to a report published by the Associated Chambers of Commerce and Industry of India (ASSOCHAM), about 62% of young consumers in the Indian city of Delhi prefer purchasing beauty and grooming products such as shampoos, serums, conditioners, and tablets online. This is expected to have a positive impact on the sale of hair texturizers through online channels over the forecast period.

Regional Insights

The North America hair texturizer market held 30% of the global revenue in 2023. Consumers in North America are also sophisticated buyers, expecting higher-quality products, better product performance, and enhanced package aesthetics at an affordable cost. Organic and natural hair texturizers are witnessing increased demand in the region. Strong consumer interest in pesticide- and hormone-free products is also expected to fuel the demand for organic and premium hair texturizer products.

U.S. Hair Texturizer Market Trends

The hair texturizer market in the U.S. is expected to grow at a CAGR of 5.4% from 2024 to 2030. The growing spending capacity of consumers, along with an increased focus on complex hair grooming styles, is expected to fuel the market in the U.S. in the coming years. The presence of key players in the country that are focusing on product launches, innovations, and R&D is likely to complement the country-level growth. In December 2021, Procter & Gamble U.S. acquired Ouai, a prestigious hair care and styling brand founded by celebrity hairstylist and entrepreneur Jen Atkin, which includes a range of hair texturizers.

Middle East & Africa Hair Texturizer Market Trends

Middle East & Africa hair texturizer market is projected to grow at a CAGR of 16% from 2024 to 2030. In South African culture, hair styling is an important aspect of personal grooming and identity. Texturizers help women achieve desired hairstyles that are culturally significant and valued within the community.

Key Hair Texturizer Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Hair Texturizer Companies:

The following are the leading companies in the hair texturizer market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever Plc.

- Proctor & Gamble Company

- Oribe Hair Care LLC

- L’Oréal

- Hain Celestial Group

- Henkel AG & Co KGaA

- Beiersdorf, Inc

- Kavella

- Verb Products

- Forest Essentials

Recent Developments

-

In April 2023, Hain Celestial Group launched Alba Botanica Texturizing Cream, designed to define and control hair while aligning with the growing consumer preference for natural and organic ingredients.

-

In December 2021,Procter & Gamble U.S. expanded its portfolio by acquiring Ouai, a high-end hair care and styling brand founded by celebrity hairstylist Jen Atkin. This acquisition aims to strengthen P&G’s presence in the premium hair care market, leveraging Ouai’s reputation and innovative products.

Hair Texturizer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.39 billion

Revenue forecast in 2030

USD 6.45 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Actual period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Unilever Plc.; Proctor & Gamble Company; Oribe Hair Care LLC; L’Oréal; Hain Celestial Group; Henkel AG & Co KGaA ; Beiersdorf, Inc; Kavella; Verb Products; Forest Essentials

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hair Texturizer Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hair texturizer market report based on product, source, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hair Spray

-

Hair Gel

-

Hair Cream

-

Hair Mousse

-

Hair Pomade & Paste

-

Shampoo

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Natural

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Pharmacies/Drugstores

-

Salons/Parlors

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The hair texturizer market was estimated at USD 4.14 billion in 2023 and is expected to reach USD 4.39 billion in 2024.

b. The hair texturizer market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 6.45 billion by 2030.

b. North America dominated the hair texturizer market, with a share of around 30% in 2023. The region is witnessing a rise in demand for natural hair styling products and increasing spending on personalized beauty products.

b. Some of the key players in the hair texturizer market include Unilever Plc., Proctor & Gamble Company, Oribe Hair Care LLC, L’Oréal, Hain Celestial Group, Henkel AG & Co KGaA, Beiersdorf, Inc, Kavella, Verb Products, and Forest Essentials.

b. Key factors that are driving the hair texturizer market growth include rising demand for natural hair styling products, increased spending among consumers on textured hair care, and technological advancements in hair products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."