Gunshot Detection Systems Market Size, Share & Trends Analysis Report By End Use (Commercial, Defense & Government), By Application, By Installation, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-374-9

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Gunshot Detection Systems Market Trends

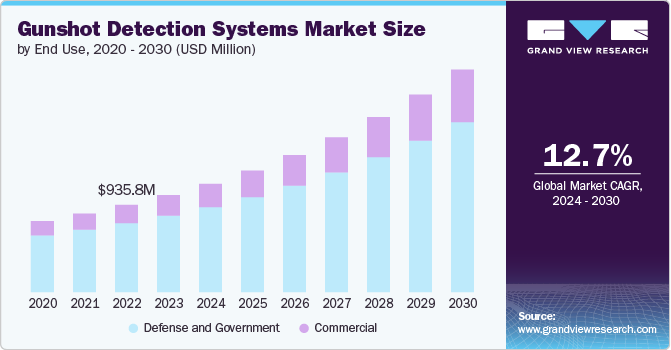

The global gunshot detection systems market size was estimated at USD 1.04 billion in 2023 and is expected to expand at a CAGR of 12.7% from 2024 to 2030. The market is experiencing significant growth due to rapid technological advancements, including improvements in acoustic sensors, data analytics, and machine learning algorithms. These advancements are enhancing the accuracy and reliability of detection systems, reducing false alarms, and providing more precise location data. Additionally, the development of portable and drone-mounted gunshot detection units is expanding the potential applications of these systems in various environments.

Urban areas are increasingly adopting gunshot detection systems to enhance public safety and reduce response times to shooting incidents. These systems are being installed in cities worldwide to provide real-time alerts to law enforcement, thereby improving the efficiency of emergency responses and helping to reduce crime rates. The trend is driven by rising concerns over gun violence in densely populated areas, prompting municipalities to invest in advanced surveillance technologies.

Furthermore, gunshot detection systems are being integrated into broader smart city frameworks, leveraging existing infrastructure such as streetlights and traffic cameras. This integration enables a more cohesive and comprehensive approach to public safety, where gunshot detection is part of a larger network of interconnected devices and systems. The synergy between gunshot detection and other smart city components enhances the overall effectiveness of urban safety measures and supports data-driven decision-making, thereby driving the market growth.

Governments and military organizations are significant adopters of gunshot detection systems, utilizing them for border security, military bases, and conflict zones. These systems provide critical situational awareness and enhance the protection of personnel and assets. The trend is supported by increased defense budgets and a focus on modernizing military infrastructure with advanced surveillance and monitoring technologies.

Moreover, gunshot detection systems are increasingly being adopted by commercial and private entities such as schools, hospitals, shopping malls, and corporate campuses. These organizations are investing in gunshot detection technology to protect their facilities and ensure the safety of employees, customers, and visitors. The trend reflects a growing recognition of the need for proactive security measures in environments where large numbers of people gather.

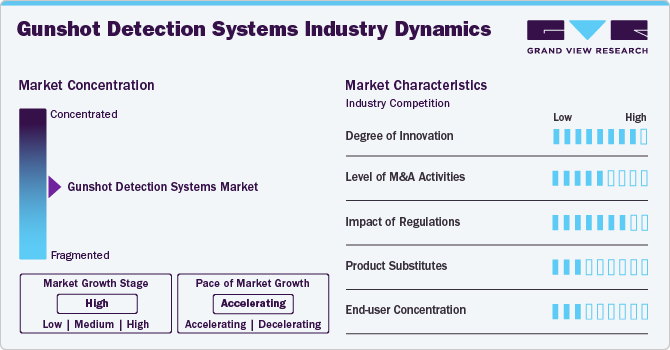

Industry Dynamics

The degree of innovation in the market is high. This market is characterized by rapid technological advancements, including the development of sophisticated acoustic sensors, real-time data analytics, and integration with AI and machine learning algorithms. These innovations significantly enhance the accuracy, reliability, and response times of gunshot detection systems, reducing false alarms and providing precise location data.

The level of mergers and acquisitions (M&A) in the market is moderate to high. The market is witnessing a significant amount of M&A activity as established security and technology companies seek to enhance their product portfolios and expand their market reach. These acquisitions enable larger companies to quickly incorporate new technologies and expertise, accelerating their ability to offer comprehensive and state-of-the-art gunshot detection solutions to a broader customer base.

The impact of regulations on the market is high. Government regulations and policies play a crucial role in driving the adoption and implementation of these systems, particularly in public and urban areas. Regulatory frameworks often mandate stringent security measures to combat rising gun violence, encouraging the deployment of advanced surveillance and detection technologies. Compliance with these regulations ensures that gunshot detection systems meet specific safety, performance, and privacy standards, thereby boosting market growth and innovation.

The level of product substitutes in the market is low. Gunshot detection systems offer a unique and specialized capability to accurately detect and locate gunfire in real-time, which is not effectively replicated by other technologies. While traditional surveillance cameras and manual reporting can assist in post-incident analysis, they do not provide the immediate detection and automated alert features critical for rapid response to gunfire incidents.

The end-user concentration in the market is low. The market serves a diverse range of end-users, including municipal governments, law enforcement agencies, educational institutions, commercial enterprises, and military organizations. This wide array of applications reflects the universal need for enhanced security measures across various sectors, from urban public safety to private sector protection and military operations.

End Use Insights

The defense & government segment dominated the market in 2023 with a market share of around 78%, due to heightened security concerns and the increasing need for advanced surveillance solutions in critical areas. Governments and defense agencies are prioritizing investments in these systems to enhance national security, protect military bases, and ensure rapid response to potential threats. The rising incidence of gun violence and terrorist activities has further propelled the adoption of gunshot detection technologies, which offer real-time situational awareness and improved emergency response capabilities, thereby driving significant market growth in this segment.

The commercial segment is expected to record a significant CAGR of over 14% from 2024 to 2030, due to the increasing adoption of these systems by businesses and organizations to enhance safety and security measures. Additionally, the integration of artificial intelligence and machine learning technologies in gunshot detection systems is improving their accuracy and reducing false alerts, making them more appealing to commercial users. The growing demand for these systems in various commercial settings, such as schools, hospitals, and public venues, is driving the market growth in this segment.

Installation Insights

The fixed installations segment accounted for the highest market share in 2023, primarily due to its robust and permanent deployment in key locations. Fixed installations offer continuous monitoring and reliable detection capabilities in critical areas such as urban centers, government buildings, transportation hubs, and military bases. The stability and effectiveness of fixed installations make them essential for maintaining heightened security levels and mitigating risks in high-threat locations, driving their dominant market position.

The soldier mounted systems segment is anticipated to expand at the highest CAGR from 2024 to 2030, due to increasing emphasis on soldier safety and battlefield awareness. These systems are designed to provide individual soldiers with real-time alerts and situational awareness in combat zones, enhancing their ability to react swiftly to threats. The demand for portable, lightweight, and integrated solutions is expected to drive significant growth in this segment.

Application Insights

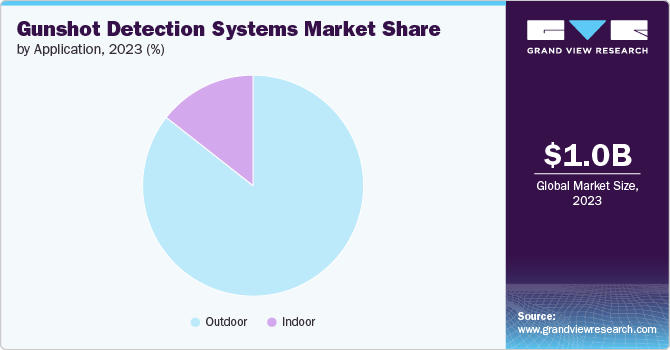

The outdoor segment held the highest revenue share in 2023, due to the widespread need for enhanced security in public spaces such as city streets, parks, and large venues. Increasing incidents of gun violence in urban areas have prompted municipalities and law enforcement agencies to deploy gunshot detection systems outdoors to improve public safety and emergency response times. The ability of these systems to cover large areas and provide real-time alerts is crucial for effectively managing and mitigating gun-related incidents, leading to significant investment and adoption in outdoor applications.

The indoor segment is estimated to register the highest growth rate from 2024 to 2030, due to increasing concerns over workplace and institutional safety. There is a growing recognition of the need to protect indoor environments such as schools, offices, malls, and healthcare facilities from potential threats like active shooters. Gunshot detection systems offer proactive monitoring and immediate alerts in indoor settings, enhancing security protocols and emergency response capabilities. As regulations and security standards evolve to address indoor safety, the demand for these systems is expected to surge, driving rapid growth in the indoor application segment.

Regional Insights

The gunshot detection systems market in North America accounted for the highest revenue share, over 40%, in 2023. The trend of increasing urban violence and proactive government initiatives to enhance public safety are driving the growth of gunshot detection systems. Cities are heavily investing in these technologies to improve emergency response times and reduce crime rates.

U.S. Gunshot Detection Systems Market Trends

The U.S. gunshot detection systems market is anticipated to grow at a CAGR of over 11% from 2024 to 2030. There is a strong focus on high investment in advanced security technologies, with widespread adoption by law enforcement agencies. The focus on integrating real-time surveillance and response capabilities is propelling the market forward.

Asia Pacific Gunshot Detection Systems Market Trends

The gunshot detection systems market in Asia Pacific accounted for a significant revenue share of over 22% in 2023. The rising trend of security concerns coupled with government initiatives to develop smart cities is boosting the demand for gunshot detection systems. Countries in this region are prioritizing public safety and technological advancements in urban planning.

India gunshot detection systems market is estimated to record the highest growth rate from 2024 to 2030. Urbanization and government-led initiatives to enhance public safety infrastructure are key growth drivers. Modernizing security measures in rapidly growing cities is increasing the adoption of gunshot detection systems.

The gunshot detection systems market in China is projected to grow at a CAGR from 2024 to 2030. Expanding smart city projects and significant investments in advanced surveillance technologies are major trends. The focus on integrating these systems into broader urban security frameworks is driving market growth.

Japan gunshot detection systems market is projected to grow at a CAGR from 2024 to 2030. There is a strong trend towards technological advancements and an increased focus on public safety and disaster management. Japan is investing in innovative solutions to ensure comprehensive security measures.

Europe Gunshot Detection Systems Market Trends

The gunshot detection systems market in Europe is anticipated to register a CAGR of over 10% from 2024 to 2030. Government regulations and funding for public safety technologies are supporting the regional market growth. Furthermore, enhancing urban security through advanced technologies is gaining momentum across European cities.

U.K. gunshot detection systems market is projected to grow at a CAGR from 2024 to 2030. The increasing adoption of gunshot detection systems in response to urban crime and terrorism threats is significant. The UK is focusing on integrating these systems into existing security infrastructure for better response and prevention.

The gunshot detection systems market in Germany is estimated to record a CAGR from 2024 to 2030. A strong emphasis on technological innovation and integration into smart city frameworks is driving the market. Germany's trend towards adopting cutting-edge security technologies is enhancing public safety measures.

Middle East And Africa (MEA) Gunshot Detection Systems Market Trends

Middle East and Africa (MEA) gunshot detection systems market is anticipated to grow at the highest CAGR of over 13% from 2024 to 2030. Growing regional conflicts and urbanization are creating a trend towards increased need for security solutions. Investments in advanced security technologies are helping to address these challenges.

The gunshot detection systems market in Saudi Arabia accounted for a considerable revenue share in 2023. Investment in advanced security infrastructure as part of Vision 2030 and urban development plans is a key trend. The focus on modernizing cities and enhancing public safety is driving the adoption of gunshot detection systems.

Key Gunshot Detection Systems Company Insights

Some of the key players operating in the market are RTX Corporation and ACOEM Group among others.

-

RTX Corporation is an aerospace and defense company that provides a range of technology products and services, including gunshot detection systems. RTX's gunshot detection systems use dual-mode acoustic and infrared sensors to rapidly detect and locate gunshots with over 99.9% accuracy, and automatically alert law enforcement and security personnel to enable a quick response to active shooter incidents.

-

ACOEM is a provider of environmental monitoring and industrial reliability solutions, including advanced gunshot detection systems. ACOEM's Acoustic Threat Detection (ATD) technology uses a network of compact, lightweight acoustic sensors to rapidly detect, locate and identify gunshots, sending instant alerts to dispatch centers, law enforcement, and security cameras to improve response times and save lives.

SoundThinking, Inc., and Databuoy are two of the emerging market participants in the gunshot detection systems market.

-

SoundThinking, Inc. is a public safety technology company that provides transformative solutions and strategic advisory services for law enforcement and civic leadership, including its flagship ShotSpotter gunshot detection system. SoundThinking's SafetySmart platform combines acoustic gunshot detection, law enforcement search and investigation tools, and AI-powered weapons detection to help communities improve public safety outcomes and strengthen police-community relationships.

-

Databuoy Corporation is a provider of advanced gunshot detection and localization systems, specializing in public safety technology. The company's flagship product, ShotPoint, uses a network of acoustic sensors to rapidly detect, locate and report the exact time and position of gunfire, enabling emergency responders to react quickly and effectively to active shooter situations.

Key Gunshot Detection Systems Companies:

The following are the leading companies in the gunshot detection systems market. These companies collectively hold the largest market share and dictate industry trends.

- ACOEM Group

- RTX Corporation

- Thales Group

- QinetiQ Group

- IAI

- ArianeGroup

- SoundThinking, Inc.

- Tracer Technology Systems, Inc.

- Databuoy

- Omnilert LLC

Recent Developments

-

In March 2024, SoundThinking, Inc., a leading public safety technology company, announced the expansion of its ShotSpotter gunshot detection system to 7 new customers and expanded coverage areas in the first quarter of 2024. The deployments include both new implementations and significant expansions of existing ShotSpotter systems across municipalities in the Northeast, Midwest, and West Coast regions of the United States.

-

In February 2024, Omnilert LLC introduced its third-generation AI visual gun detection system, which includes substantial improvements aimed at enhancing the industry's most advanced gun detection technology.

-

In December 2023, SoundThinking, Inc. deployed its acoustic gunshot detection system, ShotSpotter, in Montevideo, the capital city of Uruguay. This marks the expansion of SoundThinking's technology into the Latin American market.

Gunshot Detection Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.16 billion |

|

Revenue forecast in 2030 |

USD 2.38 billion |

|

Growth rate |

CAGR of 12.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

End Use, application, installation, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

ACOEM Group; RTX Corporation; Thales Group; QinetiQ Group; IAI; ArianeGroup; SoundThinking, Inc.; Tracer Technology Systems, Inc.; Databuoy; Omnilert LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Gunshot Detection Systems Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global gunshot detection systems market report based on end use, application, installation, and region.

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Defense and Government

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Outdoor

-

Indoor

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Installation

-

Vehicle Installation

-

Soldier Mounted System

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gunshot detection systems market size was estimated at USD 1,041.2 million in 2023 and is expected to reach USD 1,162.5 million in 2024.

b. The global gunshot detection systems market is expected to grow at a compound annual growth rate of 12.7% from 2024 to 2030 to reach USD 2,386.4 million by 2030.

b. The gunshot detection systems market in North America accounted for a significant revenue share of over 40% in 2023. The trend of increasing urban violence and proactive government initiatives to enhance public safety are driving the growth of gunshot detection systems. Cities are heavily investing in these technologies to improve emergency response times and reduce crime rates.

b. Some key players operating in the gunshot detection systems market include ACOEM Group, RTX Corporation, Thales Group, QinetiQ Group, IAI, ArianeGroup, SoundThinking, Inc., Tracer Technology Systems, Inc., Databuoy, Omnilert LLC.

b. Key factors that are driving gunshot detection systems market growth include rapid technological advancements, including improvements in acoustic sensors, data analytics, and machine learning algorithms. Additionally, the development of portable and drone-mounted gunshot detection units is expanding the potential applications of these systems in various environments.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."