Grow Light Market Size, Share & Trends Analysis Report By Application (Indoor Farming, Vertical Farming, Commercial Greenhouse), By Product, By System, By Technology, By Installation, By Spectrum, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-891-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

The global grow light market size was valued at USD 4.23 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 15.0% from 2022 to 2030. Growing urban cultivation, vertical farming and growing adoption of environment-friendly production of fruits and vegetables is boosting the growth of the market. The unprecedented growth of the global population has also increased the demand for urban agriculture. Furthermore, the practice of vertical farming for producing food in a vertically stacked-layer such as a used warehouse, skyscraper, or shipping container is boosting the market growth.

Grow light helps in extending the hours of the natural daylight which further increases the health, growth rate, and yield of the plants. Artificial lighting, such as high-pressure sodium lighting, LED lighting and plasma lighting can extend the availability of crops (throughout a season). Growing awareness regarding the importance of alternative farming, owing to the less availability of fertile agricultural land and increasing population, are the key factors anticipated to spur the industry demand.

Unlike traditional farming, indoor farming can produce crops throughout the year, which results in increased productivity. Furthermore, indoor farming can protect crops from extreme weather conditions through the usage of techniques such as the controlled environment agriculture technology, where the facilities use artificial environmental control, control of light, and fertigation.

COVID Impact Analysis

The COVID-19 pandemic has had a negative impact on the grow light market. The emergence of the pandemic and the subsequent lockdowns imposed by the governments in various nations, coupled with the severe travel restrictions, affected the market. The supply chain disruptions impacted the supply of raw materials and the distribution of the end product. Moreover, there was a significant drop in the demand for grow lights as compared to pre-COVID levels. However, the market started to recover as the restrictions were eased. Due to prolonged stay at home, work-from-home professionals, students were engaged in gardening, especially growing vegetables. Many people adopted indoor farming and vertical farming techniques such as hydroponics for home gardens. The demand for grow light started picking pace and post lifting of restrictions there was stabilization in the demand for the grow lights. Also, as the supply chains were normalized and shipments became regular, the supply of grow lights was also restored.

Product Insights

Based on product, the industry has been classified into < 300 Watt and > 300 Watt. The < 300 Watt segment dominated the industry in terms of revenue in 2021 with a market share of more than 64% and is expected to remain dominant over the forecast period. The growth is attributed to technological advancements in energy conservation and efficiency. The <300 Watt segment is expected to grow at the highest CAGR during the forecast period. The grow lights with low power (< 300 Watt) are more efficient as compared to high power grow lights. Low power lights generate a lesser amount of heat and can be used for an extended period of time without harming plants.

The >300 Watt segment is expected to hold a lesser market share as compared to other segments as higher wattage leads to more light and heat output which can result in wilting, browning, or even dying of plants. However, some growers use it for faster growth by counteracting the high wattage with more nutrients. This is costlier but a faster way of growing plants with the aid of grow lights. These are majorly used in the horticulture sector to obtain a quicker harvest of vegetables. Also, the commercial greenhouses make use of high-watt grow lights. The >300 watt grow lights sometimes need to be supplemented with cooling systems to maintain the temperature of growing units. This factor further adds up to the energy costs.

System Insights

Based on system, the industry has been classified into hardware and software. The hardware segment dominated the industry with a market share of about 75% in terms of revenue in 2021. It is expected to remain dominant over the forecast period. Hardware segment includes various types of grow lights such as LEDs, plasma lights, high intensity discharge (HID) lights, and ballasts. Whereas software segment is expected to show the highest growth rate over the forecast period. This growth is attributed to the increasing penetration of Controlled-Environment Agriculture (CEA) to control various environmental factors using software.

Software segment of the grow light market includes Controlled-Environment Agriculture (CEA) to control various environmental factors such as humidity, temperature, water and light. Software solutions are used in grow lights to improve plant quality. Every plant has a different requirement with respect to optimal lighting duration, optimal lighting intensity which can maximize the production output from the plants. Designing specialized software based on the specifics of each plant can enable maximum output with the optimal utilization of the grow lights. Many companies in the market also offer services such as maintenance and repair of the grow lights as well as software services for the provided solutions.

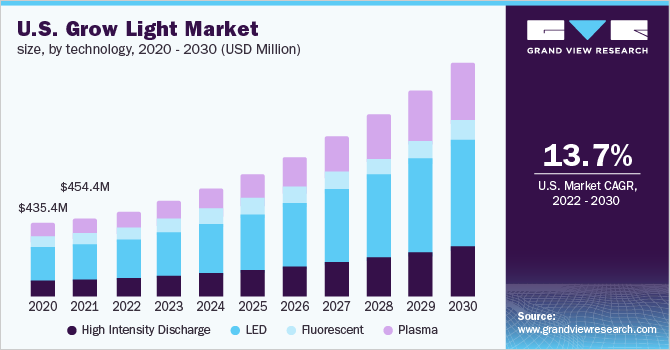

Technology Insights

Based on technology, the industry has been classified into High Intensity Discharge (HID), LED, fluorescent and plasma. The HID segment dominated the industry in terms of revenue in 2021 commanding a market share of more than 36%. The HID is majorly used for commercial growing such as commercial greenhouses, and vertical farms. Whereas the LED segment is expected to dominate over the forecast period. Increasing urban cultivation and government initiatives to adopt energy efficient LEDs are expected to drive LED segment. LED lamps are most efficient at a higher price point. LEDs produces exact wavelength of desired light. It can produce dual band spectrum (red & blue) simultaneously. LEDs are good for all growth phases. LEDs are more expensive at initial stage but gets cheaper over the period of time.

The plasma segment is expected to grow at the highest CAGR during the forecast period. Plasma lights offer full-spectrum light similar to that of sunlight. These lights have longer service period and produce less amount of heat. The plasma lights also consume very less energy as compared to other technology types even though it produces light with comparable intensity to that of HID and LED. Plasma lights have high initial costs but get cheaper over the longer run. Plasma lights are useful in vegetative growth as well as flowering.

Spectrum Insights

Based on spectrum, the industry has been classified into partial spectrum and full spectrum. The partial spectrum segment marginally dominated the industry with a market share of about 42% in 2021. The partial spectrum grow lights emits light of a specific spectrum such as yellow, blue, or green. These light spectrums are useful at various growth stages of plants. These are targeted to specific stages of plant growth, and they considerably reduce the growth time of plants and also improve yields. Red and blue wavelengths are conducive for the vegetative growth stage while for the flowering red and far-red wavelengths promote better growth.

Whereas full spectrum segment is expected to dominate over the forecast period. It is also expected to grow at a higher CAGR as compared to partial spectrum. Full spectrum lamps emit light similar to sunlight. These lamps are useful at every growth stage of a plant. Full spectrum light provides light across the 400 nm to 700 nm wavelengths. It is referred to as Photosynthetic Active Radiation (PAR). Full spectrum light can serve dual purpose as it can provide comfortable lighting for the space along with plants. It may allow growers to reduce or even remove additional light sources in the growing space.

Application Insights

Based on applications, the industry has been classified into indoor farming, vertical farming, commercial greenhouse, and others. The commercial greenhouse segment dominated the industry in terms of revenue in 2021 with a market share of more than 44%. This growth is attributed to technological advancements and the increasing use of grow lights. Vertical farming segment is expected to grow the highest over the forecast period.

Factors such as growing technological advancements in grow lights and increasing penetration of vertical and indoor farming are anticipated to drive the application segment over the forecast period. The vertical farming segment is widely accepted in countries like Japan, China, Netherlands.

In vertical farming food, herbs and medicine can be produced in vertically stacked layers which are integrated in a used warehouse, skyscraper or shipping container. It uses Controlled-Environment Agriculture (CEA) to control various environmental factors such as humidity, temperature, water and light. Some vertical farms use greenhouse methods, where sunlight can be improved with metal reflectors and grow lights. Multiple vertical farms are being established across major cities in Japan, China owing to the space crunch for establishing conventional farms. Big companies such as Panasonic, Toshiba are venturing into vertical farming and are making huge investments in the sector. This factor is expected to provide impetus to the growth of grow light market.

Regional Insights

In terms of revenue, the Europe region dominated the industry in 2021 commanding a market share of more than 32% and is expected to remain dominant over the forecast period. Growing awareness regarding the importance of alternative farming, owing to the less availability of fertile agricultural land and increasing population, are the key factors anticipated to spur the industry demand.

Asia Pacific regional market is anticipated have significant growth over the projected period owing to the growing expansion of genetically modified crop technology. Furthermore, various countries in this region are shifting towards energy-efficient LED lights to reduce energy consumption. Replacing traditional incandescent light bulbs with LEDs would help to decrease greenhouse gas emissions.

Growing urban population and commercialization of indoor farming are anticipated to drive the African regional demand. However, lack of financial resources to build modern vertical farms and limited access to water and land is expected to restrain the Africa regional growth. To overcome such challenges various models followed in the region include vertically stacked wooden crates and sack gardens.

Key Companies & Market Share Insights

The key market players engage in strategies such as partnerships and new product developments to expand their market share. Companies are also acquiring competitors’ businesses to strengthen their position in the market. For instance, in December 2021, Signify Holding B.V. announced an agreement with Osram to acquire Fluence, an agriculture lighting division of Osram to strengthen its agriculture lighting business. The acquisition has also strengthened the company’s position in North America horticulture lighting market. Some prominent players in the global grow light market include:

-

AeroFarms

-

EVERLIGHT ELECTRONICS CO., LTD.,

-

GAVITA Holland bv

-

Heliospectra AB

-

Hortilux Schréder

-

Illumitex

-

LumiGrow Inc

-

Osram Licht AG

Grow Light Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 4.69 billion |

|

Revenue forecast in 2030 |

USD 14.31 billion |

|

Growth Rate |

CAGR of 15.0% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Application, product, system, technology, installation, spectrum, region |

|

Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa (MEA) |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; China; India; Japan; Brazil |

|

Key companies profiled |

AeroFarms; EVERLIGHT ELECTRONICS CO., LTD.; GAVITA Holland bv; Heliospectra AB; Hortilux Schréder; Illumitex; LumiGrow Inc; Osram Licht AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global grow light market based on application, product, system, technology, installation, spectrum, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor Farming

-

Vertical Farming

-

Commercial Greenhouse

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

< 300 Watt

-

> 300 Watt

-

-

System Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

High Intensity Discharge (HID)

-

LED

-

Fluorescent

-

Plasma

-

-

Installation Outlook (Revenue, USD Million, 2017 - 2030)

-

New Installation

-

Retrofit

-

-

Spectrum Outlook (Revenue, USD Million, 2017 - 2030)

-

Partial Spectrum

-

Full Spectrum

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global grow light market size was estimated at USD 4.23 billion in 2021 and is expected to reach USD 4.69 billion in 2022.

b. The global grow light market is expected to grow at a compound annual growth rate of 15% from 2022 to 2030 to reach USD 14.31 billion by 2030.

b. Europe dominated the grow light market with a share of 32.05% in 2021. This is attributable to growing awareness regarding the importance of alternative farming, owing to the less availability of fertile agricultural land and increasing population in the region.

b. Some key players operating in the grow light market include eroFarms, Illumitex, Inc., and GAVITA Holland bv.

b. Key factors that are driving the grow light market growth include growing urban cultivation & vertical farming and growing adoption of environment-friendly and organic production of fruits and vegetables.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."