- Home

- »

- Consumer F&B

- »

-

Groundnut Oil Market Size, Share & Growth Report, 2030GVR Report cover

![Groundnut Oil Market Size, Share & Trends Report]()

Groundnut Oil Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Refined, Unrefined), By Product (Cold Pressed, Hot Pressed), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-447-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Groundnut Oil Market Summary

The global groundnut oil market size was estimated at USD 10.86 billion in 2024 and is projected to reach USD 14.14 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. The market growth is driven by factors such as rising consumer preference for healthy and natural cooking oils, increased awareness of the nutritional benefits of groundnut oil, and the growing demand for plant-based food products.

Key Market Trends & Insights

- The Asia Pacific groundnut oil market held the largest revenue share of 44.2% in 2023.

- The groundnut oil market in the U.S. is expected to grow at a CAGR of 3.9% from 2024 to 2030.

- By type, the refined groundnut oil segment accounted for the largest revenue share of 64.1% in 2023.

- By product, the hot pressed groundnut oil segment held the revenue share of 70.2% in 2023.

- By application, the food application segment held the largest revenue share of 76.2% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 10.86 Billion

- 2030 Projected Market Size: USD 14.14 Billion

- CAGR (2025-2030): 4.6%

- Asia Pacific: Largest market in 2023

Its rich flavor and versatility in cooking enhance its appeal, while advancements in extraction technologies, such as cold pressing, improve product quality and efficiency. The expansion of distribution channels, including the rise of online grocery shopping and strategic product innovations by major players, further supports market growth. In addition, increasing health consciousness and the popularity of groundnut oil in various cuisines globally contribute to its sustained demand and market expansion.One of the primary drivers of the market is the increasing health consciousness among consumers. As people become more aware of the impact of their dietary choices on overall health, there is a growing demand for natural and healthy cooking oils. Groundnut oil is rich in monounsaturated fats, which are known to reduce bad cholesterol levels, thereby lowering the risk of heart disease. In addition, it contains vitamin E, an antioxidant that helps protect cells from damage. The rise in lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions has led consumers to seek out healthier alternatives to traditional cooking oils, further boosting the demand for groundnut oil.

Recent studies have highlighted the benefits of consuming oils with a high content of unsaturated fats, which has positively influenced consumer perception of groundnut oil. For example, according to a study published in the American Journal of Clinical Nutrition, replacing saturated fats with unsaturated fats, such as those found in groundnut oil, can significantly reduce the risk of heart disease. This growing body of evidence supports the health benefits of groundnut oil, making it a preferred choice for health-conscious consumers.

Groundnut oil's versatility in culinary applications is another significant factor driving its market growth. It is widely used in various cuisines, particularly in Asian and African countries, for frying, sautéing, and as a salad dressing. Its high smoke point makes it ideal for deep-frying, as it can withstand high temperatures without breaking down, ensuring that food retains its nutritional value and taste. The nutty flavor of groundnut oil also enhances the taste of dishes, making it a popular choice among chefs and home cooks alike.

The preference for natural flavors and ingredients is increasing globally, with consumers moving away from synthetic and heavily processed products. Groundnut oil, being a natural product with minimal processing, aligns well with this trend. The shift towards natural and organic food products is particularly strong in developed markets such as North America and Europe, where consumers are willing to pay a premium for high-quality, natural ingredients. This trend is expected to continue, providing a sustained boost to the market growth.

The global shift towards plant-based diets has had a positive impact on the market growh. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-based cooking oils has risen. Groundnut oil, being plant-derived, fits well into these dietary preferences. The growing awareness of the environmental and ethical implications of animal-based products has led consumers to seek out plant-based alternatives, including oils and fats. Groundnut oil is often highlighted as a sustainable and eco-friendly option in plant-based diets. Compared to animal fats like butter or lard, groundnut oil has a lower carbon footprint and is less resource-intensive to produce. This environmental advantage is particularly appealing to millennials and Gen Z consumers, who prioritize sustainability in their purchasing decisions

Type Insights

Refined groundnut oil accounted for a revenue share of 64.1% in 2023 due to its widespread consumer acceptance and versatility in cooking. The refining process involves removing impurities, color, and odor from the oil, resulting in a neutral taste and high smoke point, which makes it suitable for various culinary applications like frying, baking, and sautéing. Its longer shelf life compared to unrefined oil also contributes to its dominance in the market. In addition, the large-scale availability and lower price point of refined groundnut oil make it more accessible to consumers globally. The ease of refining and consistent quality control further strengthens its position in the market, making it the preferred choice for both households and foodservice industries.

Unrefined groundnut oil is expected to grow at a CAGR of 4.6% from 2024 to 2030 due to the rising consumer preference for natural and minimally processed products. Unrefined oil retains more of the natural flavors, nutrients, and antioxidants, which appeal to health-conscious consumers. The trend towards organic and clean-label products is also driving the demand for unrefined groundnut oil, as consumers seek out products with fewer additives and preservatives. In addition, the increasing awareness of the benefits of cold-pressed and traditional extraction methods, which are often associated with unrefined oils, is contributing to its growth.

Product Insights

Hot pressed groundnut oil accounted for a revenue share of 70.2% in 2023. The hot-pressing method, which involves applying heat to the groundnuts before pressing, helps extract more oil from the seeds, making it more cost-effective for producers. This method also enhances the flavor of the oil, which is favored in many culinary traditions, particularly in Asian and African cuisines. The widespread availability and lower cost of hot-pressed oil make it the go-to option for bulk consumers such as restaurants, food manufacturers, and households.

Cold pressed groundnut oil is expected to grow at a CAGR of 5.5% from 2024 to 2030 due to the increasing demand for premium, health-focused products. The cold-pressing process preserves the natural nutrients, flavors, and antioxidants found in groundnuts, making the oil more appealing to health-conscious consumers. This method is also associated with the production of organic and non-GMO oils, which are becoming increasingly popular in developed markets. The growth of the cold-pressed segment is further fueled by the rise in small-scale, artisanal production, which caters to niche markets that value quality over quantity. As consumers become more educated about the benefits of cold-pressed oils, this segment is likely to see robust growth, particularly in regions like North America and Europe.

Application Insights

Food applications held a revenue share of 76.2% in 2023 due to the oil's extensive use in cooking and food preparation. Groundnut oil is a staple in many cuisines around the world, particularly in Asia and Africa, where it is used for frying, sautéing, and as a salad dressing. Its high smoke point makes it ideal for high-temperature cooking, while its mild flavor makes it versatile for various dishes. The food industry's demand for groundnut oil is further driven by the growing popularity of ethnic and traditional foods in global markets, where groundnut oil is a key ingredient. In addition, the oil's nutritional profile, being rich in healthy fats and vitamins, aligns with the increasing consumer preference for healthier cooking oils.

The personal care applications of groundnut oil are expected to grow at a CAGR of 5.7% from 2024 to 2030 due to the rising demand for natural and organic beauty products. Groundnut oil's moisturizing and emollient properties make it a valuable ingredient in skincare, haircare, and cosmetic products. The trend towards using plant-based and chemical-free ingredients in personal care formulations is driving this growth. As consumers become more aware of the benefits of using natural oils for skin and hair health, the demand for groundnut oil in this segment is expected to increase. In addition, the growth of the global wellness industry, which emphasizes holistic and natural approaches to beauty and personal care, is likely to boost the use of groundnut oil in this category.

Distribution Channel Insights

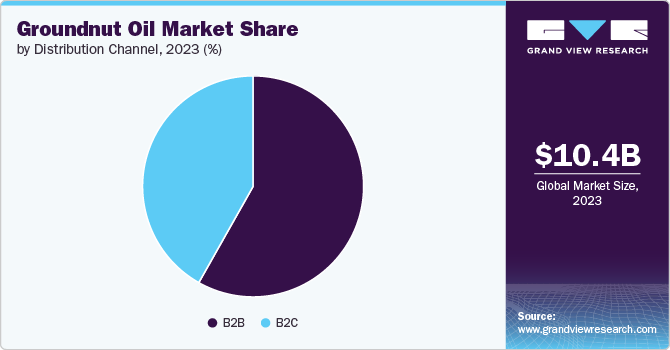

The sales of groundnut oil through B2B distribution channel accounted for a revenue share of 58.2% in 2023 due to its essential role in supplying bulk quantities of oil to food manufacturers, restaurants, and other commercial establishments. The B2B segment benefits from long-standing relationships between groundnut oil producers and industrial buyers, ensuring a steady demand for large volumes of oil. In addition, the B2B market is driven by the growing foodservice industry, particularly in emerging markets, where groundnut oil is used extensively in commercial kitchens. The ability to meet large-scale orders and provide consistent quality also contributes to the dominance of the B2B channel in the market.

The sales of groundnut oil through B2C distribution channel is expected to grow at a CAGR of 4.8% from 2024 to 2030 as consumer purchasing habits shift toward online and direct-to-consumer models. The rise of e-commerce platforms and the increasing convenience of online shopping have made it easier for consumers to access a wide variety of groundnut oil products, including specialty and artisanal options. In addition, the growing health and wellness trend is leading consumers to seek out high-quality, organic, and cold-pressed groundnut oils, which are often marketed directly to consumers. The B2C segment also benefits from targeted marketing strategies, such as social media campaigns and influencer partnerships, which help drive consumer awareness and demand for groundnut oil products.

Regional Insights

The North America groundnut oil market is expected to grow at a CAGR of 3.8% from 2024 to 2030, due to the increasing consumer awareness of its health benefits and the growing demand for plant-based and natural cooking oils. The region's rising interest in ethnic and gourmet foods, where groundnut oil is often used, also contributes to its rapid growth. In addition, the trend toward healthier eating habits, driven by concerns about heart health and weight management, is leading more consumers to choose groundnut oil over other cooking fats. The expansion of the organic and specialty food market in the U.S. and Canada further accelerates the growth of the groundnut oil market in North America.

U.S. Groundnut Oil Market Trends

The groundnut oil market in the U.S. is expected to grow at a CAGR of 3.9% from 2024 to 2030. The market is driven by several factors, including the increasing consumer awareness of the health benefits associated with groundnut oil, such as its high content of monounsaturated fats and antioxidants. The growing popularity of ethnic cuisines, particularly Mexican and Asian dishes that use groundnut oil, is also boosting demand. In addition, the trend toward healthier cooking options and the rising interest in plant-based diets are encouraging more consumers to incorporate groundnut oil into their diets. The U.S. market is further supported by the availability of various groundnut oil products, including organic and cold-pressed options, which cater to diverse consumer preferences.

Asia Pacific Groundnut Oil Market Trends

The Asia Pacific groundnut oil market held a revenue share of 44.2% in 2023, due to its high consumption levels, driven by the large population and the cultural significance of groundnut oil in local cuisines. Countries such as China and India, which are among the largest producers and consumers of groundnut oil, contribute significantly to the region's market dominance. The extensive use of groundnut oil in traditional cooking, combined with the region's rapidly growing food processing industry, supports the strong demand. In addition, the availability of raw materials and established production infrastructure further strengthens APAC's market.

Europe Groundnut Oil Market Trends

The Europe groundnut oil market is expected to grow at a CAGR of 4.5% from 2024 to 2030, due to the increasing demand for natural and healthy cooking oils, driven by the region's health-conscious consumers. The growing popularity of Mediterranean and ethnic cuisines, where groundnut oil is commonly used is also contributing to the market's growth. In addition, the rise in veganism and plant-based diets in Europe is leading to greater consumption of plant-based oils like groundnut oil. The European Union's stringent regulations on food quality and safety also support the market growth, as consumers in the region seek high-quality, non-GMO, and organic groundnut oil products.

Key Groundnut Oil Company Insights

The global groundnut oil industry is characterized by the presence of numerous players such as Georgia-Pacific Chemicals LLC, De Hekserij, and PAG KIMYA SAN. TIC. LTD. STI.; GrantChem, Inc.; and Fujian Qina Trading Co. Ltd., among others. These companies, along with several emerging players, contribute to a competitive landscape that fosters continuous innovation. The market is marked by efforts to enhance product quality, expand product portfolios, and cater to varying consumer preferences across different regions. Companies are increasingly focusing on developing sustainable and organic groundnut oil products to meet the growing demand for natural and health-oriented food options. In addition, advancements in extraction technologies, such as cold-pressing and the introduction of fortified groundnut oils with added nutritional benefits, are becoming key differentiators in the market.

Key Groundnut Oil Companies:

The following are the leading companies in the groundnut oil market. These companies collectively hold the largest market share and dictate industry trends.

- Georgia-Pacific Chemicals LLC

- De Hekserij

- PAG KIMYA SAN. TIC. LTD. STI.

- GrantChem, Inc.

- Eurovanille

- LLC PK “XimProm”

- Fujian Qina Trading Co. Ltd.

- Matole Ltd

- Gemini Edibles & Fats India Ltd

Recent Developments

-

In August 2023, Tata Consumer Products launched a range of 100% pure, unrefined cold-pressed oils under the brand 'Tata Simply Better.' The collection includes four variants: Virgin Cold Pressed Coconut Oil, Cold Pressed Groundnut Oil, Cold Pressed Mustard Oil, and Cold Pressed Sesame Oil, marking Tata's entry into the premium cold-pressed oils market.

-

In June 2022, Gujarat's FMCG giant Gulab Oils, known for its market-leading Groundnut Oil, revamped its entire range of edible oils as part of its nationwide expansion. With a turnover of USD 2.5 Billion in FY 2021-2022, Gulab Oils aims to expand to 10 states by 2024. To meet growing demand, a new production unit is under construction, expected to boost daily capacity from 100 to 1000 tons.

-

In April 2022, Gemini Edibles & Fats India Ltd (GEF India) introduced a new 5-liter jar of Freedom Groundnut Oil, expanding their Freedom Healthy Cooking Oil range. Known for its nutty flavor and health benefits, this oil is popular for making traditional pickles in Telangana, Andhra Pradesh, and Karnataka.

Groundnut Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.32 billion

Revenue forecast in 2030

USD 14.14 billion

Growth Rate (Revenue)

CAGR of 4.6% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Georgia-Pacific Chemicals LLC; De Hekserij; PAG KIMYA SAN. TIC. LTD. STI.; GrantChem, Inc.; Eurovanille; LLC PK “XimProm”; LLC PK “XimProm”; Fujian Qina Trading Co. Ltd.; G.C. RUTTEMAN & Co. B.V.; Matole Ltd; Gemini Edibles & Fats India Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Groundnut Oil Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global groundnut oil market report based on type, product, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Refined

-

Unrefined

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold Pressed

-

Hot Pressed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Personal Care

-

Pharmaceuticals

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global groundnut oil market size was estimated at USD 10.43 billion in 2023 and is expected to reach USD 10.85 billion in 2024.

b. The global groundnut oil market is expected to grow at a compounded growth rate of 4.5% from 2024 to 2030 to reach USD 14.14 billion by 2030.

b. Refined groundnut oil held a 64.1% revenue share in 2023 due to its versatile use, neutral taste, and high smoke point, making it suitable for various culinary applications. Its longer shelf life and lower price point enhance its global accessibility and consumer preference

b. Some of the key players in groundnut oil market are Georgia-Pacific Chemicals LLC; De Hekserij; PAG KIMYA SAN. TIC. LTD. STI.; GrantChem, Inc.; Eurovanille; LLC PK “XimProm”; LLC PK “XimProm”; Fujian Qina Trading Co. Ltd.; G.C. RUTTEMAN & Co. B.V.; Matole Ltd; Gemini Edibles & Fats India Ltd

b. Factors factors such as including rising consumer preference for healthy and natural cooking oils, increased awareness of the nutritional benefits of groundnut oil, and growing demand for plant-based food products are driving the market. Its rich flavor and versatility in cooking enhance its appeal, while advancements in extraction technologies, such as cold pressing, improve product quality and efficiency

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.