- Home

- »

- Next Generation Technologies

- »

-

Ground Support Equipment Market Size, Share Report, 2033GVR Report cover

![Ground Support Equipment Market Size, Share & Trends Report]()

Ground Support Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Equipment (Non-Electric, Electric, Hybrid), By Application (Aircraft Handling, Cargo Handling), By Ownership, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-441-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ground Support Equipment Market Summary

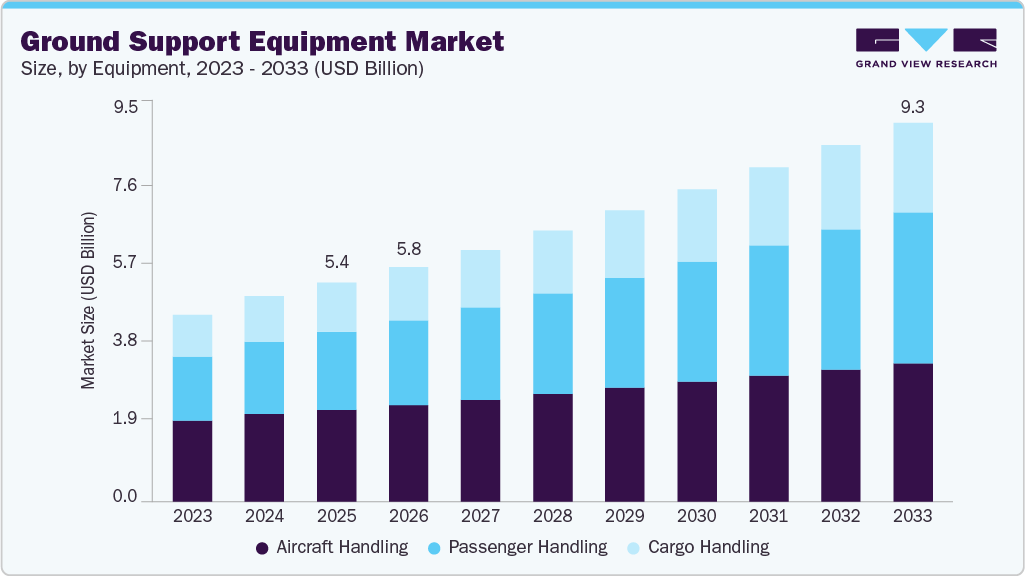

The global ground support equipment market size was estimated at USD 5,406.1 million in 2025 and is projected to reach USD 9,336.5 million by 2033, growing at a CAGR of 7.1% from 2026 to 2033. This market expansion is driven by increasing air passenger traffic, the expansion of airport infrastructure, and a rising demand for efficient aircraft turnaround operations.

Key Market Trends & Insights

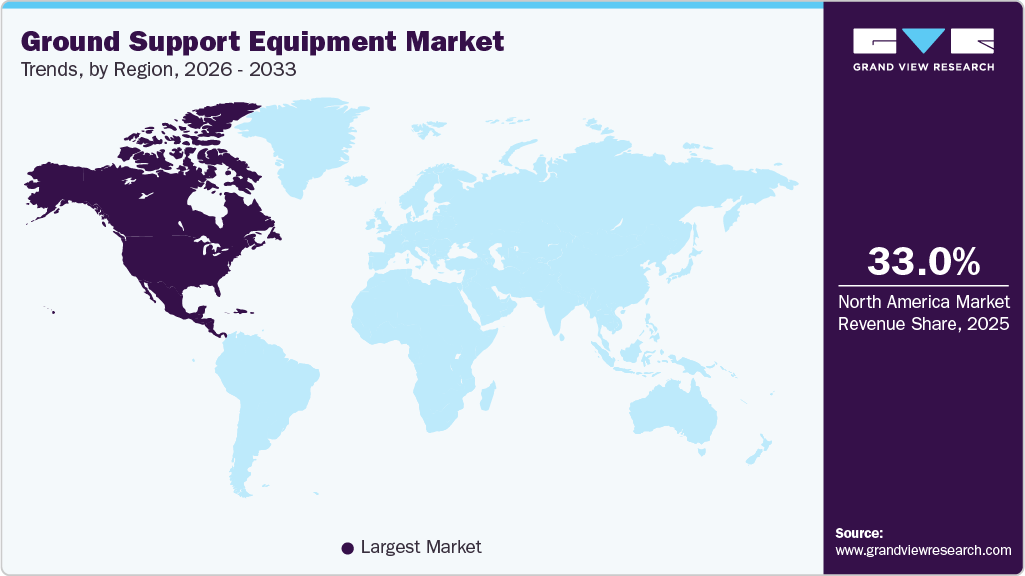

- North America dominated the global ground support equipment industry with the largest revenue share of over 33% in 2025.

- The ground support equipment industry in the U.S. led the North America market and held the largest revenue share in 2025.

- By equipment, the non-electric segment led the market and held the largest revenue share of over 65% in 2025.

- By application, the aircraft handling segment led the market and held the largest revenue share of over 42% in 2025.

- By ownership, the airport owned segment led the market and held the largest revenue share of over 38% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5,406.1 Million

- 2033 Projected Market Size: USD 9,336.5 Million

- CAGR (2026-2033): 7.1%

- North America: Largest market in 2025

Growing adoption of electric and hybrid GSE to reduce emissions and operational costs, coupled with technological advancements in automation and safety systems, is further fueling demand. The growth of the ground support equipment industry is driven by the convergence of digitalization, automation, and sustainable technologies that redefine operational efficiency across airport ecosystems. The adoption of electric and hybrid-powered GSE units is accelerating as airports and airlines align with global carbon-neutral targets, reducing fuel dependency and maintenance costs. Advanced telematics, IoT sensors, and edge computing enable real-time fleet monitoring, predictive maintenance, and data-driven decision-making, minimizing downtime and enhancing turnaround efficiency.Artificial intelligence (AI) and machine learning integration further enhance ground operations by enabling autonomous towing, baggage handling, and aircraft servicing systems. These intelligent platforms continuously learn from operational data to optimize routing, improve safety standards, and reduce human error. The integration of AI-based analytics also supports adaptive scheduling and resource allocation, ensuring faster aircraft turnaround times and improved asset utilization.

In addition, the market is witnessing a significant shift toward digital twins and remote management technologies that are revolutionizing equipment lifecycle management. By simulating operational conditions and predicting wear patterns, digital twin models enable operators to make informed decisions regarding maintenance and procurement. This transition to connected, intelligent infrastructure supports airports’ goals for higher throughput and reliability amid growing air traffic volumes.

Moreover, the increasing adoption of 5G connectivity and advanced communication systems enhances coordination between ground crews, aircraft systems, and airport operations centers. This ultra-low latency network infrastructure supports the synchronization of automated ground handling, smart parking, and cargo tracking systems, ensuring efficient workflows and real-time visibility across operations.

Furthermore, sustainability mandates and regulatory frameworks are key drivers of growth for the adoption of green technologies in the ground support equipment industry manufacturing and operations. Companies are increasingly investing in battery-electric, hydrogen-fueled, and solar-powered GSE fleets to comply with emissions standards and achieve environmental certifications. This evolution toward sustainable and connected ground support infrastructure is positioning airports as smart, efficient, and environmentally responsible hubs of future aviation.

Equipment Insights

The non-electric segment accounted for the largest market share of over 65% in 2025, owing to its essential role in supporting heavy-duty, high-performance operations across airports where reliability, power density, and long operational hours are critical. The non-electric segment benefits from well-established maintenance frameworks, extensive spare part availability, and proven operational durability. Their ability to operate continuously without dependency on downtime for charging ensures uninterrupted operations and high equipment availability.

The electric segment is expected to witness the fastest CAGR of over 10% from 2026 to 2033. The rising focus on high-performance battery systems capable of operating in extreme weather is driving the growth of the ground support equipment industry. The advanced batteries enable electric equipment to perform reliably, even in challenging temperature conditions. Their enhanced durability and long cycle life make electric GSE more practical for continuous use, reducing downtime and maintenance costs. This reliability encourages airports to replace traditional diesel-powered units with electric alternatives in the global market.

Application Insights

The aircraft handling segment accounted for the largest market share in 2025, owing to its critical role in ensuring safe, efficient, and timely aircraft operations across global airports. The growing emphasis on operational efficiency and on-time performance has driven airports and airlines to invest heavily in advanced handling equipment equipped with automation, telematics, and real-time monitoring systems. With air traffic volumes continuing to grow and sustainability mandates tightening, the aircraft handling segment remains crucial to airport modernization strategies, solidifying its dominant position in the ground support equipment industry.

The passenger handling segment is expected to witness the fastest CAGR from 2026 to 2033. The growing emphasis on enhancing passenger experience and operational efficiency is driving the growth of the passenger handling segment. Increasing air traffic volumes and heightened service expectations have accelerated the adoption of advanced technologies, including automated boarding bridges, self-service check-in systems, and smart baggage handling solutions. Airports' focus on automation, safety, and comfort drives rapid expansion in the passenger handling segment of the ground support equipment industry.

Ownership Insights

The airport-owned segment accounted for the largest market share in 2025, driven by the need for operational control and efficiency. The airport-owned ground support equipment segment is growing as airports invest directly in GSE to manage maintenance, deployment, and upgrades, thereby reducing downtime in high-traffic environments. This approach ensures consistent service quality amid rising passenger and cargo volumes, supported by airport expansion and modernization projects that demand reliable, readily available fleets. Larger airports, particularly those with high air traffic demands, favor ownership to streamline ground operations.

The leased segment is expected to witness the fastest CAGR from 2026 to 2033, driven by cost flexibility and reduced capital expenditure. The leased ground support equipment segment appeals to airports seeking scalable solutions that require minimal upfront investment, enabling quick adaptation to fluctuating traffic and operational needs. Leasing supports eco-friendly transitions, such as electric GSE, while minimizing ownership risks such as maintenance burdens and asset depreciation in dynamic aviation environments. This model thrives with the growth of global air travel and infrastructure upgrades, enabling airlines and operators to access advanced equipment efficiently.

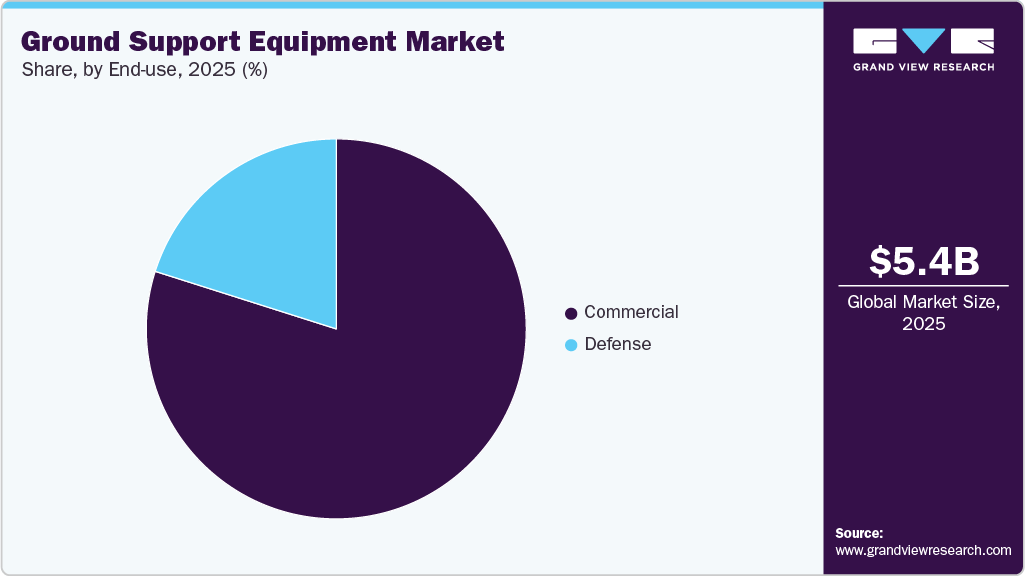

End Use Insights

The commercial segment accounted for the largest market share in 2025, owing to its extensive reliance on ground support equipment to ensure efficient, reliable, and safe operations across airports worldwide. The integration of digital monitoring systems, telematics, and AI-driven fleet management tools enhances real-time visibility, predictive maintenance, and asset utilization. With the expansion of global air travel and the modernization of airports to manage growing traffic, the commercial segment continues to dominate the market.

The defense segment is expected to witness a significant CAGR from 2026 to 2033. This growth is driven by the increasing adoption of advanced ground support equipment to enhance military readiness, mobility, and operational efficiency. Defense forces worldwide are modernizing their airbases with next-generation towing vehicles, refueling systems, and aircraft maintenance platforms capable of operating in harsh environments and supporting diverse aircraft fleets. This convergence of modernization programs, sustainability goals, and enhanced operational requirements positions the defense segment as the fastest-growing sector within the market.

Regional Insights

North America Ground Support Equipment Market Trends

North America ground support equipment industry significantly dominated the global market with a share of over 33% in 2025, driven by the increasing air passenger and cargo traffic, and the rapid adoption of electric and hybrid GSE to meet sustainability goals. The presence of major airlines and cargo operators, along with stringent emission regulations, is accelerating the shift toward cleaner and more efficient equipment. The rising investments in airport modernization, automation technologies, and digitalized fleet management systems are further boosting market growth across both commercial and military aviation sectors in the region.

U.S. Ground Support Equipment Market Trends

The U.S. ground support equipment industry dominated the North American region in 2025, driven by expanding airport modernization programs, increasing air traffic volumes, and strong federal initiatives promoting sustainability and electrification in aviation operations. The Federal Aviation Administration (FAA) and state-level programs are incentivizing the replacement of conventional diesel-powered GSE with electric and hybrid alternatives to reduce emissions and enhance efficiency. The growing investments from major airlines and airport authorities in digitalized fleet management, automation, and smart charging infrastructure are further accelerating market growth.

Europe Ground Support Equipment Market Trends

Europe ground support equipment industry is expected to grow at a CAGR of over 5% from 2026 to 2033. The European market is driven by stringent environmental regulations, rapid airport modernization, and the region’s strong focus on sustainability and decarbonization in aviation operations. The European Union’s Green Deal and Fit for 55 initiatives are accelerating the adoption of electric and hybrid GSE across major airports. Airport operators and ground handling service providers are increasingly focused on electrifying their fleets and adopting smart, energy-efficient systems to improve operational efficiency.

The UK ground support equipment industry is expected to grow significantly in the coming years, driven by increasing airport modernization, strong government support for net-zero aviation goals, and rapid adoption of electric and automated GSE to enhance operational efficiency and reduce carbon emissions. Major industry players invested in advanced electric and hybrid GSE technologies. Reflecting this shift toward cleaner and more efficient ground handling solutions in the country.

The Germany ground support equipment industry is driven by strong airport modernization initiatives, rapid adoption of electric and automated GSE, and government-backed sustainability programs aimed at reducing emissions and improving operational efficiency across major airports. Germany’s robust aerospace ecosystem, supported by government-backed green aviation initiatives, encouraged strategic collaborations between equipment suppliers and aircraft manufacturers to enhance operational efficiency and reduce environmental impact.

Asia Pacific Ground Support Equipment Market Trends

The Asia-Pacific ground support equipment industry is expected to grow at the fastest CAGR of over 9% in 2025, driven by rapid airport expansion, air passenger and cargo traffic, and rising investments in electric and automated GSE to enhance operational efficiency and sustainability across emerging aviation hubs. The adoption of electric and automated GSE to reduce emissions and improve efficiency is aimed at enhancing sustainability, operational efficiency, and cost-effectiveness in the Asia-Pacific region.

The Japan ground support equipment industry is gaining traction owing to airport expansion, increasing air passenger and cargo traffic, and rising investments in electric and automated GSE to enhance operational efficiency and sustainability. Governments and airport authorities across countries are actively encouraging the adoption of electric and automated GSE to reduce emissions and improve efficiency.

The China ground support equipment industry is rapidly expanding, driven by the rapid expansion of airport infrastructure, rising domestic and international air traffic, and strong government initiatives. China’s Civil Aviation Administration (CAAC) is actively supporting the electrification of GSE fleets and the integration of intelligent systems to enhance operational efficiency and reduce emissions. Collaborations between domestic manufacturers and international players are accelerating innovation and technological advancements in China’s GSE market.

Key Ground Support Equipment Company Insights

Some of the key players operating in the market are Oshkosh Aerotech LLC and Textron Inc., among others.

-

Oshkosh Aerotech LLC provides advanced ground support and airport mobility solutions designed to enhance airside operations and aircraft servicing efficiency. The company offers a comprehensive range of products, including aircraft loaders, tow tractors, deicers, and passenger boarding bridges, integrated with digital control systems for improved safety and productivity. Oshkosh Aerotech presence and continuous innovation in electric GSE platforms position it as a leading player in modern airport infrastructure development.

-

Textron Inc. specializes in manufacturing tow tractors, belt loaders, and ground power units that serve both commercial and military aviation sectors. Textron’s focus on electrification, telematics integration, and fleet management solutions enhances operational visibility and sustainability. With a robust global service network and strong OEM relationships, Textron continues to lead the GSE market through innovation, reliability, and its commitment to advancing next-generation electric and hybrid ground support equipment (GSE) solutions.

Mallaghan and TCR Group are some of the emerging market participants in the ground support equipment industry.

-

Mallaghan is an emerging innovator in the ground support equipment industry, specializing in the design and manufacture of high-quality passenger stairs, catering trucks, medical lifts, and aircraft maintenance platforms. The company emphasizes customization, safety, and eco-efficiency, offering electric-powered variants to meet evolving airport sustainability requirements. Mallaghan is gaining recognition for its advanced engineering capabilities and flexible design approach, enabling airports and airlines to optimize ground handling operations.

-

TCR Group is rapidly expanding as a key player in GSE rental, leasing, and fleet management services, offering comprehensive end-to-end solutions that maximize equipment uptime and operational efficiency. The company provides electric and hybrid ground support vehicles, telematics-based monitoring, and maintenance support to leading airlines and ground handlers. TCR’s service-driven model and strategic expansion make it one of the fastest-growing companies in the global ground support equipment market.

Key Ground Support Equipment Companies:

The following are the leading companies in the ground support equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Oshkosh Aerotech LLC

- Textron Inc.

- TCR Group

- Tronair

- Weihai Guangtai Airport Equipment Co., Ltd.

- China International Marine Containers (Group) Co., Ltd.

- TLD Group

- Cavotec Group

- Toyota Material Handling, Inc.

- TREPEL Airport Equipment GmbH

- Global Ground Support LLC

- Mallaghan

- Jalux Inc.

- Rheinmetall AG

Recent Developments

-

In October 2025, Oshkosh Aerotech LLC Defense introduced its Family of Multi-Mission Autonomous Vehicles (FMAV) at the AUSA Annual Meeting & Exposition in Washington, D.C., presenting three production-ready variants: X-MAV, M-MAV, and L-MAV. The FMAV lineup. The company aims to support a variety of missions, including missile launching, counter-unmanned aerial systems, and resupply operations, providing versatility and adaptability for evolving battlefield requirements in the ground support equipment industry.

-

In September 2025, TLD Group and ASARA Mobility partnered with BKJ Airports to deploy next-generation electric ground support equipment across its managed airports in India. The initiative aims to improve operational efficiency by introducing electric coaches and ramp cars for ground handling operations. It also seeks to reduce fuel consumption and support India’s goal of achieving net-zero emissions.

-

In May 2025, Global Ground Support LLC introduced the GTV-5000, an advanced glycol transfer vehicle designed to enhance deicing operations. The vehicle aims to improve efficiency by reducing turnaround times and operational costs through direct dispensing to deicers. It also focuses on sustainability by minimizing fluid waste, lowering emissions, and supporting environmental goals through optimized transfer processes and real-time monitoring.

Ground Support Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5,776.3 million

Revenue forecast in 2033

USD 9,336.5 million

Growth rate

CAGR of 7.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, ownership, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Oshkosh Aerotech LLC; Textron Inc.; TCR Group; Tronair; Weihai Guangtai Airport Equipment Co., Ltd.; China International Marine Containers (Group) Co. Ltd.; TLD Group; Cavotec Group; Toyota Material Handling, Inc.; TREPEL Airport Equipment GmbH; Global Ground Support LLC; Mallaghan; Jalux Inc.; Rheinmetall AG

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Ground Support Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the ground support equipment market report based on equipment, application, ownership, end use, and region:

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Non-Electric

-

Electric

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aircraft Handling

-

Passenger Handling

-

Cargo Handling

-

-

Ownership Outlook (Revenue, USD Million, 2021 - 2033)

-

Airport Owned

-

Airline Owned

-

Service Provider

-

Leased

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ground support equipment market was estimated at USD 5,406.1 million in 2025 and is expected to reach USD 5,776.3 million in 2026.

b. The global ground support equipment market is expected to grow at a compound annual growth rate of 7.1% from 2026 to 2033 and to reach USD 9,336.5 million by 2033.

b. The North America ground support equipment market accounted for the largest market share of over 33% in 2025, primarily driven by expanding airport modernization programs, increasing air traffic volumes, and strong federal initiatives promoting sustainability and electrification in aviation operations. The Federal Aviation Administration (FAA) and state-level programs are incentivizing the replacement of conventional diesel-powered GSE with electric and hybrid alternatives to reduce emissions and enhance efficiency. The growing investments from major airlines and airport authorities in digitalized fleet management, automation, and smart charging infrastructure are further accelerating market growth.

b. The key players in the ground support equipment market are Oshkosh Aerotech LLC, Textron Inc., TCR Group, Tronair, Weihai Guangtai Airport Equipment Co., Ltd., China International Marine Containers (Group) Co., Ltd., TLD Group, Cavotec Group, Toyota Material Handling, Inc., TREPEL Airport Equipment GmbH, Global Ground Support LLC, Mallaghan, Jalux Inc., Rheinmetall AG

b. Key drivers of the ground support equipment market include the increasing air passenger traffic, the expansion of airport infrastructure, rising demand for efficient aircraft turnaround operations, and growing adoption of electric and hybrid GSE to reduce emissions and operational costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.