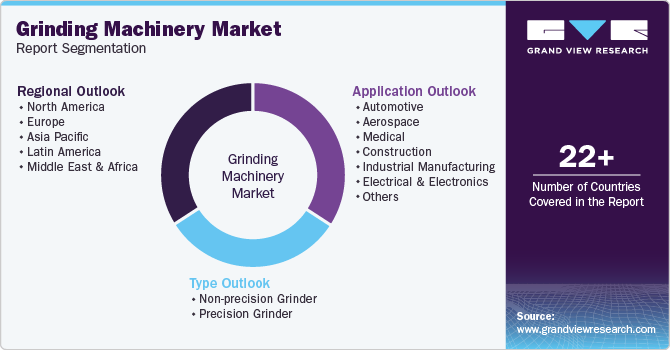

Grinding Machinery Market Size, Share & Trends Analysis Report By Type (Non-Precision Grinder, Precision Grinder), By Application (Automotive, Aerospace, Medical, Construction, Others), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-367-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Grinding Machinery Market Size & Trends

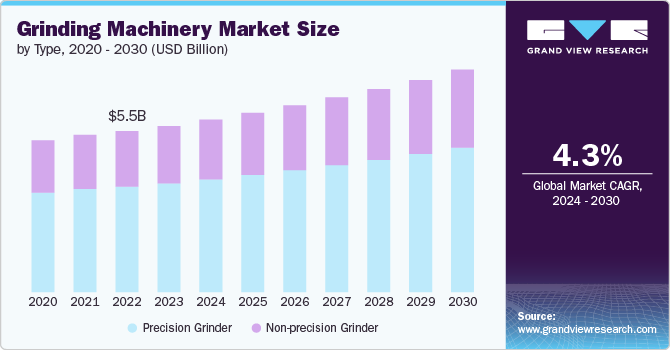

The global grinding machinery market size was estimated at USD 5.94 billion in 2024 and is expected to expand at a CAGR of 4.4% from 2025 to 2030. The growing construction and automotive industries are expected to drive the demand for grinding machinery. The automotive industry demands high-precision components with tight tolerances and fine surface finishes for engine parts, transmission components, and chassis elements. Moreover, the aerospace industry requires components with the highest level of quality, reliability, and safety, leading to a growing demand for grinding equipment to machine complex aerospace components such as turbine blades, engine casings, and structural components.

The expansion of the construction sector, particularly in regions such as East Asia, where infrastructure development is a priority, is one of the key factors favoring the demand for grinding machinery. Grinding machines are essential for processing construction materials such as concrete, stone, ceramics, and asphalt, enabling the precise shaping and finishing of these materials. India has become a key player in the global aerospace industry over the past decade, with major companies such as Boeing, Airbus, and GE establishing manufacturing and supply chain operations. Boeing’s Bengaluru facility and Airbus’s partnerships with Indian firms have driven the demand for grinding machinery to meet the precision and production requirements of the aerospace industry.

In medical devices, a flawless surface is essential for ensuring biocompatibility and patient safety, especially for implantable devices such as joint replacements, to prevent tissue discomfort and infection. Grinding machines are highly effective at improving material surface quality, converting rough, uneven surfaces into smooth, polished finishes. A superior surface finish enhances a product’s resistance to corrosion and wear, prolonging its lifespan and reducing maintenance costs. This is especially important in industries such as marine and offshore. Additionally, with China, South Korea, and Japan being major shipbuilders, their extensive shipyards drive the demand for grinding machinery in these countries.

Type Insights

The precision grinder segment dominated the grinding machinery market and accounted for the largest revenue share of 65.8% in 2024. The demand for precision grinder machines is on the rise, driven by the growing need for precision components across various industries, such as aerospace, automotive, electronics, machinery, and construction, which rely on precision grinding for manufacturing critical components with tight tolerances, fine surface finishes, and exceptional dimensional accuracy. For instance, the automotive industry extensively uses precision grinder machines to manufacture components, such as brake cylinders, gear shafts, and brake pistons, in order to achieve the precise fitting required for these parts.

The non-precision grinder segment is expected to grow at the fastest CAGR over the forecast period. These machines are primarily used for removing stock from heavy workpieces without concerning the precision or accuracy of the job. They are typically used in industries where rough shaping and material removal are the primary goals, such as the construction sector, where materials such as concrete, stone, ceramics, and asphalt are processed. Therefore, the demand for grinding machinery is expected to increase with the projected rise in construction spending from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037, driven by the major construction markets of China, the U.S., and India and huge opportunities in the global green economy.

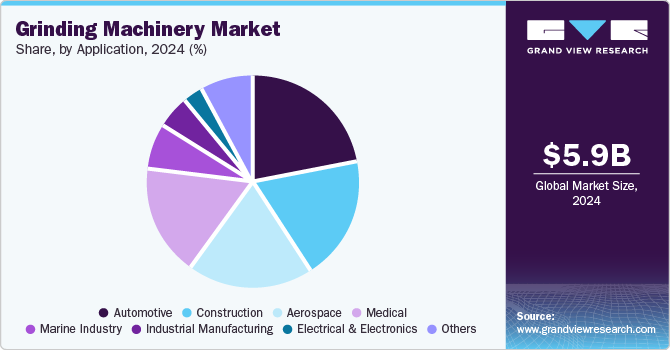

Application Insights

The automotive industry led the grinding machinery market with the largest revenue share in 2024. The automotive industry has a significant reliance on precision grinding machines to manufacture critical components such as engine parts, transmission components, and chassis elements. These components require tight tolerances and fine surface finishes, which can only be achieved through precision grinding. In 2024, global car production reached 75.5 million units. Car production in South America increased by 1.7% in 2024 compared to 2023, with Brazil driving the growth, recording a 6.3% rise and manufacturing approximately 1.9 million vehicles. This surge in production has further fueled the demand for grinding machinery in the automotive industry.

The demand for grinding machinery in the electrical and electronics industry is expected to grow at the fastest CAGR over the forecast period. Electronic products demand precise thin metal components, which is achievable only through grinding tools for exact measurements and dimensions. For instance, NUM, a CNC application provider, is helping Chien Wei Precise Technology, a Taiwanese machine tool company, develop innovative CNC grinding machines to produce specialist gears for use in various robotics applications. Therefore, these applications have increased the demand for grinding machinery in the industry.

Regional Insights

The North America grinding machinery market is primarily driven by the automotive and aerospace industries. In the U.S., the automotive sector is one of the key consumers of grinding machines, demanding precision equipment for manufacturing critical components such as transmission components, engine parts, and chassis elements. The American aerospace and defense industry, driven by strong economic contributions and a focus on national security, continues to excel, fueling the demand for grinding machinery. In 2023, the industry played a crucial role in global trade, technological leadership, and security. With a skilled workforce, advanced supply chains, and innovative developments, the industry remains a strategic asset, maintaining leadership in aviation and providing cutting-edge equipment to warfighters, which increases the need for precision grinding machinery in manufacturing and defense applications.

U.S. Grinding Machinery Market Trends

The U.S. led the regional grinding machinery market with the largest revenue share in 2024. The demand for grinding machinery in the U.S. market is being driven by several key sectors, including automotive, aerospace, and metalworking, all of which require precision and efficiency in their production processes. The U.S. aerospace parts manufacturing market, estimated at approximately USD 520 million in 2024, is a major contributor, driven by the country's prominent role in global aerospace production and military advancements. Furthermore, in the automotive sector, with 10.6 million vehicles produced in 2023 and a significant increase in manufacturing jobs in 2024, there was an increase in the need for grinding machinery.

Asia Pacific Grinding Machinery Market Trends

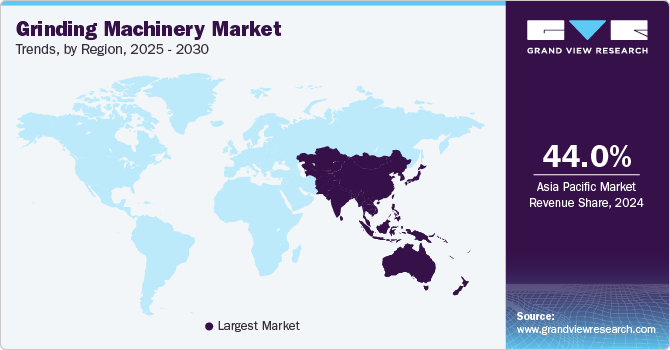

Asia Pacific grinding machinery market dominated the global market with the largest revenue share of 44.0% in 2024. This growth is fueled by the expansion of the construction and automotive sectors. In China, the construction industry is a major consumer of grinding machines. The industry relies on these machines to process various materials, including concrete, ceramics, stones, and asphalt. Moreover, with high material removal rates and robust growth in construction activities, these machines are in high demand from construction contractors to achieve efficient surface preparation, material processing, and finishing operations. The rising use of these machines in enhancing productivity & quality in construction projects has favored the dominance of the regional market.

China dominated the grinding machinery market in Asia Pacific and accounted for the largest revenue share in 2024. The automotive industry in China is a major consumer of grinding machines, relying on them to produce high-precision components such as engine parts, transmission components, and chassis elements. These components require tight tolerances and fine surface finishes, which can only be achieved using precision grinding machines. The car production industry in China saw a robust growth of 5.2% in 2024, further strengthening its position as the world’s largest car producer with a market share of 35.4%. In the final quarter of 2024, China recorded car sales of nearly 23 million units, representing 31% of global car sales. These factors have contributed to the growth of the grinding machinery industry in China.

Latin America Grinding Machinery Market Trends

The Latin America grinding machinery market is expected to grow at the fastest CAGR of 4.9% over the forecast period. In March 2024, Stellantis unveiled a record investment plan of USD 6.04 billion for the South American region from 2025 to 2030. This marked the largest investment in the history of the Brazilian and South American automotive industries. Mexico and Brazil boast the most advanced automotive sectors in the region, with approximately four million vehicles produced by Mexico in 2023 and approximately 2.3 million units produced by Brazil in the same year. Both countries rank among the largest motor vehicle producers globally. These factors are increasing the demand for grinding machinery in the automotive sector in the region.

Brazil dominated the grinding machinery industry in Latin America and accounted for the largest revenue share in 2024. Technological advancements and Industry 4.0 adoption in Brazil are driving the demand for advanced machinery, including grinding tools, with automation and digitization playing key roles. Government initiatives, such as the National Industry 4.0 Initiative and tax incentives, also support the growth of the grinding machinery industry. Brazil’s Mercosur membership removes tariffs on imported machinery, easing market access. This surge in demand for grinding machinery is especially notable in sectors such as automotive, aerospace, and manufacturing, requiring high precision and quality.

Key Grinding Machinery Company Insights

Some of the major players in the grinding machinery industry are AMADA MACHINERY CO., LTD.; Danobat; ANCA; and Junker. These companies invest in advanced technologies, such as automation, AI, and Industry 4.0 innovations. They continuously improve product quality, enhance precision, and expand their product range to meet diverse industry needs. Strategic partnerships, global supply chains, and customer-focused services also help them maintain a strong presence in the global market.

-

AMADA MACHINERY CO., LTD. offers diversified products specializing in automation machines, combination machines, high precision CNC lathe machines, bending, joining, and cutting machines, such as laser combination machines, punch machines, and shearing machines. The company also offers AMADA Industry 4.0 solutions, V-factory, AMADA Order Manager, and IoT Remote Support to meet challenging production deadlines, complex production processes, and limited access to real-time data innovations. Incorporating advanced IoT-based support helps the company penetrate the CNC machining and turning centers market. The company is in over 100 countries and has 35 manufacturing facilities worldwide.

-

Danobat is a global manufacturer of precision grinding machinery, offering innovative solutions for various industries, including automotive, aerospace, and energy. Known for advanced technology and high-quality standards, the company provides customized grinding machines and services that enhance efficiency, productivity, and precision in manufacturing processes worldwide.

Key Grinding Machinery Companies:

The following are the leading companies in the grinding machinery market. These companies collectively hold the largest market share and dictate industry trends.

- AMADA MACHINERY CO., LTD.

- Danobat

- ANCA

- Junker

- Körber AG

- Fives

- Rieter

- Saurer Intelligent Technology AG

- Murata Machinery USA

- LMW Limited

- Trützschler Group SE

Recent Developments

-

In August 2024, Coventry-based Advanced Grinding Solutions (AGS) partnered with Spanish manufacturer Danobat to promote its range of internal, external, and multi-tasking grinding machines in the UK. The collaboration, initiated at the Mach show and formalized at the BIEMH exhibition, expands AGS’s offerings, particularly with Danobat’s high-precision solutions for large parts. Danobat’s global presence and extensive machine capabilities enhance AGS’s portfolio, enabling it to provide a wider range of grinding solutions to UK and Irish customers.

-

In May 2024, UNITED GRINDING, a leading manufacturer of grinding machinery, launched two innovative products, namely HELITRONIC VISION 400 L and HELICHECK PLUS, to enhance automation and productivity in the tool-grinding industry. HELITRONIC VISION 400 L is a tool-grinding machine that offers advanced capabilities. HELICHECK PLUS is a fully automatic measuring machine, which is part of the "Automated Tool Production" (ATP) system. The launch of these new products demonstrates the company's commitment to providing advanced grinding machinery that improves efficiency, productivity, and automation in tool manufacturing applications.

-

In February 2024, Nidec Machine Tool Corporation, a subsidiary of Nidec Corporation, revealed the creation of the world's first high-precision polishing technique for mass-producing internal gears used in automotive drive units, transmissions, and robotic joints. While advanced polishing methods for external gears in mass production already exist, Nidec's innovation tackles the challenge of achieving the necessary accuracy and efficiency for internal gears, a task that traditional grinding, honing, or skiving methods have struggled to accomplish.

-

In February 2024, Koyo Machinery USA, a prominent supplier of precision grinding machines, was integrated into JTEKT Machinery's range of products, services, and customer support operations as part of JTEKT’s global brand consolidation strategy. This merger formally incorporated Koyo into JTEKT's operational infrastructure, thereby expanding its customer support, service responsiveness, spare parts availability, engineering resources, and machine rebuild capabilities and enhancing the value and benefits offered to customers across the U.S.

Grinding Machinery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.18 billion |

|

Revenue forecast in 2030 |

USD 7.69 billion |

|

Growth Rate |

CAGR of 4.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, South Korea, Australia, Saudi Arabia, UAE, South Africa, Brazil, Argentina |

|

Key companies profiled |

AMADA MACHINERY CO., LTD.; Danobat; ANCA; Junker; Körber AG; Fives; Rieter; Saurer Intelligent Technology AG; Murata Machinery USA; LMW Limited; Trützschler Group SE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Grinding Machinery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global grinding machinery industry report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-precision Grinder

-

Bench Grinder

-

Portable Grinder

-

Pedestal Grinder

-

Flexible Grinder

-

Precision Grinder

-

-

Precision Grinder

-

Cylindrical Grinding Machines

-

Surface Grinding Machines

-

Centre-less Grinding Machines

-

Tool and Cutter Grinding Machines

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Medical

-

Construction

-

Industrial Manufacturing

-

Electrical and Electronics

-

Marine Industry

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global grinding machinery market size was estimated at USD 5.63 billion in 2023 and is expected to reach USD 5.83 billion in 2024.

b. The grinding machinery market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 7.53 billion by 2030.

b. The Asia Pacific region is experiencing rapid growth in the grinding machinery market, fueled by the expansion of the construction and automotive sectors. In China, the construction industry is a major consumer of grinding machines, relying on them for processing materials such as stone, concrete, ceramics, and asphalt. Moreover, these machines with high material removal rates, and robust construction enable construction contractors to achieve efficient surface preparation, material processing, and finishing operations, enhancing productivity & quality in construction projects.

b. Some of the key players operating in the grinding machinery market include Amada Machine Tools Co., Ltd, DANOBAT, ANCA Pty Ltd, Junker, Korber AG, Fives, Rieter, Saurer Intelligent Technology AG, Murata Machinery USA, Inc., LAKSHMI MACHINE WORKS LIMITED, Trützschler, KIRLOSKAR TOYOTA TEXTILE MACHINERY PVT LTD., A.T.E. Private Limited, Itema S.p.A., Marzoli Grinding Solutions, Savio Macchine Tessili S.p.A., United Grinding North America, Mitsubishi Heavy Industries, Ltd.

b. The growing construction and automotive industry is expected to drive the demand for grinding machinery market. The automotive industry demands high-precision components with tight tolerances and fine surface finishes for engine parts, transmission components, and chassis elements, driving the demand for precision grinding machines.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."