Green Mining Market Size, Share & Trends Analysis Report By Type (Surface, Underground), By Technology (Power Reduction, Emission Reduction, Water Reduction, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-269-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Green Mining Market Size & Trends

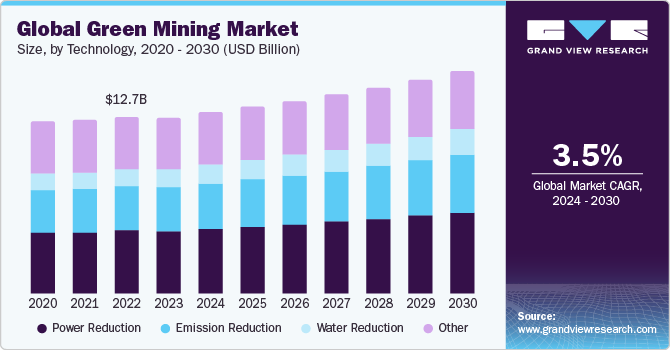

The global green mining market size was estimated at USD 12.59 billion in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. Concerns about environmental degradation and the need for sustainable development have led to an increase in green mining. Governments worldwide are undertaking steps to promote sustainable mining practices. The mining industry has extensive connections to other areas of the economy, and adopting a more sustainable path can lead to improved environmental performance in existing linkages while also creating new ones.

This involves supporting the integration of new technologies, such as automation and digitalization, as well as promoting renewable energy, environmental service providers, and green infrastructure.

There are around 17,750 mine land sites spanning 1.5 million acres in the U.S. These sites pose a risk to nearby populations by exposing them to harmful pollutants, thereby contaminating the air, land, and water quality of the surrounding areas. As a result, the country is investing in green mining techniques to reduce the harmful impact of mining.

For instance, in April 2023, the Bipartisan Infrastructure Law provided up to USD 450 million to the U.S. Department of Energy (DOE) to support clean energy demonstration projects on former and current mine lands. The deployment of clean energy projects in mining communities across the nation is a crucial step towards boosting rural economies, generating new employment opportunities, and curbing harmful greenhouse gas emissions that threaten public health and damage local ecosystems.

Key miners are undertaking various measures to reduce emissions and increase sustainability, which is propelling the demand for the product in the country. For instance, Warrior Met Coal, Inc. is currently conducting final evaluations toward its goal of installing the first full-scale Regenerative Thermal Oxidizer (RTO) to address VAM emissions on its property. The company obtained the necessary permits in 2023, and fabrication is anticipated to begin in 2024. This RTO system is regarded as a significant step towards their emission reduction goals. In addition, Warrior Met Coal, Inc. is evaluating other locations where this technology would be environmentally beneficial.

Market Concentration & Characteristics

The demand for environmentally conscious practices in the mining industry has increased significantly in recent years due to growing concerns about the impact on the environment and the need to reduce carbon emissions. As a result, green mining technologies, including renewable energy sources, water treatment, and waste management solutions, are expanding rapidly. Green mining practices aim to reduce resource depletion, environmental pollution, and the negative impact on local communities. The industry is expected to continue growing as more companies adopt eco-friendly practices and governments implement policies to promote sustainability.

The market for green mining has witnessed a considerable degree of innovation in recent years as companies and governments strive to discover more sustainable and eco-friendly mining practices. Mining operations are increasingly utilizing technologies such as automation, digitalization, and renewable energy sources to reduce resource depletion, environmental pollution, and negative impacts on local communities. In addition, waste management solutions and water treatment technologies are being developed and implemented to minimize the environmental impact of mining activities. As more innovative and sustainable practices are developed and adopted, the industry is expected to continue growing.

Technology Insights

The power reduction technology segment dominated the market in 2023 with a 36.0% revenue share. Companies are investing in power reduction using renewable energy and power-efficient machines, which positively influences market growth. For instance, Anglo American is planning to shift to renewable energy in Australia by 2025, with the aim of drawing around 60% of its global grid supply from renewable sources by that time.

Emission reduction technology is expected to register a revenue growth rate of over 4.0% in the forecast period. Rising government regulation and initiatives to reduce carbon emissions from the mining sector are expected to influence market growth positively.

Surface Insights

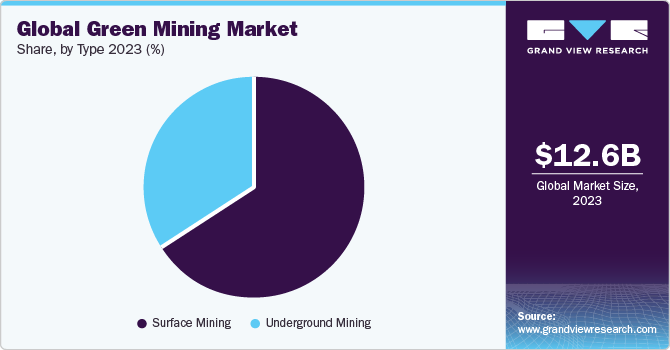

The surface segment held the largest revenue share, over 66.0%, in 2023. Green mining practices can be implemented in surface mining to lessen the environmental impact of mining activities. One way to achieve this is by utilizing renewable energy sources in surface mining operations, which helps decrease the reliance on fossil fuels, which are major contributors to greenhouse gas emissions.

The underground segment is anticipated to register the fastest CAGR in the projected forecast period. Waste management solutions can also be implemented to reduce the amount of waste produced by mining operations and to dispose of hazardous waste properly. Rising investment in the development of new underground mines is expected to propel the demand for green mining solutions in the forecast period.

Regional Insights

The green mining market in North America had a global revenue share of more than 27.0% in 2023. The mining sector's increasing focus on reducing carbon emissions is expected to propel the demand for these products in the forecast period.

U.S. Green Mining Market Trends

The green mining market in the U.S. is one of the largest in North America. The market growth is attributed to favorable government policies and initiatives, which are forcing key miners to focus on green mining solutions.

Asia Pacific Green Mining Market Trends

The Asia Pacific green mining market dominated globally, with a revenue share of 38.65% in 2023. Rising investment in the development of new mines is expected to propel the market growth.

In 2023, the China green mining market held a revenue share of approximately 41.39% in Asia Pacific. The rising focus on power reduction and water management techniques in mining is positively influencing the product market.

The green mining market in India is the fastest-growing market in the Asia Pacific. Increasing investment by private players to develop new mines is expected to propel the consumption of green mining solutions in the country.

Europe Green Mining Market Trends

The green mining market in Europe accounted for 16.7% of the global revenue in 2023. The region is implementing sustainable methods and technologies to reduce environmental impact.

The Turkey green mining market heldover 11.0% revenue share in the European region in 2023.The increasing government regulation is expected to propel the demand for the product in the country.

Central & South America Green Mining Market Trends

The green mining market in Central & South America held a global revenue share of over 7.0% in 2023. Rising private investments in countries such as Chile, Argentina, Brazil, and Peru to develop new mines are anticipated to propel the demand for the product.

The Brazil green mining market held a revenue share of approximately 29.0% in Central & South America in 2023. Rising consumption of new mining techniques is expected to propel the demand for green mining in the country.

Key Green Mining Company Insights

Some of the key players operating in the market include Rio Tinto and Anglo American.

-

Rio Tinto, a global mining group, was established in 1873. The Group is headquartered in London, UK. It is primarily involved in the exploration, mining, and processing of minerals and has a presence in 35 countries. It has 17 iron ore, four bauxite, three copper, and six mineral mining facilities globally. The group’s business structure comprises four segments: iron ore, copper, aluminum, and minerals.

-

Anglo American is a global mining company based in London, United Kingdom. It is one of the world's largest mining companies, with operations in Africa, Europe, South and North America, and Australia. The company produces a range of commodities, including diamonds, platinum, copper, iron ore, and coal.

Key Green Mining Companies:

The following are the leading companies in the green mining market. These companies collectively hold the largest market share and dictate industry trends.

- Anglo American

- Antofagasta PLC

- ArcelorMittal

- BHP

- CODELCO

- Freeport-McMoRan, Inc.

- Glencore Plc

- Rio Tinto

- Vale S.A

- Zijin Mining Group Co., Ltd.

Recent Developments

-

In February 2024, Anglo American announced that its Barro Alto nickel mines and Minas-Rio iron ore in Brazil had been evaluated according to the Initiative for Responsible Mining Assurance's (IRMA) mining standard. The mines have successfully achieved the IRMA 75 standard of performance, which demonstrates the company's commitment to sustainability and transparency in its pursuit of responsible metal production.

-

In February 2024, Petrobras and ArcelorMittal Brazil signed a MoU to explore beneficial business models in the low-carbon economy. This extensive collaboration is based on collaborations identified in a joint study to develop a Carbon Capture and Storage (CCS) hub in the state of Espírito Santo.

Green Mining Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 12.95 billion |

|

Revenue forecast in 2030 |

USD 15.92 billion |

|

Growth rate |

CAGR of 3.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Russia; Turkey; China; Australia; India; Brazil; South Africa |

|

Key companies profiled |

Anglo American; Antofagasta PLC; ArcelorMittal; BHP; CODELCO; Freeport-McMoRan, Inc; Glencore Plc; Rio Tinto; Vale S.A.; Zijin Mining Group Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Green Mining Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global green mining market report based on type, technology, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Surface Mining

-

Underground Mining

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Reduction

-

Emission Reduction

-

Water Reduction

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green mining market size was estimated at USD 12.59 billion in 2023 and is expected to reach USD 12.95 billion in 2024.

b. The global green mining market is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 15.92 billion by 2030.

b. Surface technology segment dominated the global market with a revenue share of over 66.0% in 2023. Increasing investments in emerging nations to meet their resource needs is spurring a growth in surface mining.

b. Some of the key players operating in the green mining market include Anglo American, Antofagasta PLC, ArcelorMittal, BHP, CODELCO, Freeport-McMoRan, Inc, Glencore Plc, Rio Tinto, Vale S.A, Zijin Mining Group Co., Ltd., among others.

b. Rising focus towards sustainability and reduction in carbon emission is propelling the demand for green mining.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."