Green Logistics Market Size, Share & Trends Analysis Report By Business Type (Warehousing, Distribution, Value Added Services), By Mode Of Transportation (Roadways, Railways), By End-use (Healthcare, Automotive), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-514-0

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Green Logistics Market Size & Trends

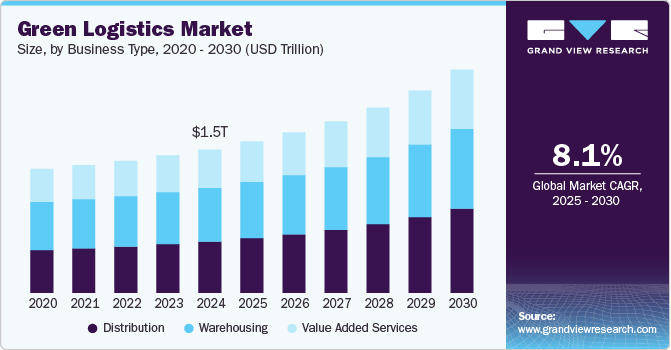

The global green logistics market size was estimated at USD 1,507.0 billion in 2024 and is expected to register a CAGR of 8.1% from 2025 to 2030. The green logistics market is experiencing significant growth, driven by stringent environmental regulations, technological advancements, and shifting consumer and corporate preferences. Governments worldwide are implementing stricter policies to reduce carbon emissions, with initiatives such as the EU Green Deal, the U.S. Clean Energy Plan, and China’s Carbon Neutrality Goal pushing logistics providers to adopt sustainable practices. Regulations related to fuel efficiency, packaging waste reduction, and emission control are compelling businesses to transition towards greener supply chain solutions. Companies that fail to comply with these evolving standards risk facing legal penalties and losing competitive ground.

In addition, the rising demand for carbon-neutral supply chains, as corporations set ambitious Net-Zero targets to align with global sustainability goals. Industry giants such as Amazon, Walmart, and Maersk are investing in electric trucks, hydrogen-powered fleets, and green warehouses to reduce their environmental impact. This shift is further fueled by the rapid growth of e-commerce, which demands efficient yet sustainable last-mile delivery models. Logistics companies are increasingly adopting electric delivery vans, bicycle couriers, and urban micro-fulfillment centers to meet consumer expectations for environmentally responsible delivery options.

Technological advancements are also reshaping the green logistics landscape. The development of electric and hydrogen-powered trucks, AI-based route optimization software, and IoT-enabled smart warehouses is significantly improving operational efficiency while reducing emissions. Blockchain technology is being leveraged to enhance supply chain transparency and track carbon footprints, ensuring compliance with sustainability goals. In addition, warehouse automation solutions are helping logistics providers cut energy consumption by integrating AI-driven energy management systems and renewable energy sources such as solar and wind power.

Investment in renewable energy and alternative fuels is another key factor propelling the green logistics market forward. The increasing use of biofuels, hydrogen fuel cells, and liquefied natural gas (LNG) in transportation is significantly reducing emissions in freight logistics. Furthermore, the adoption of Sustainable Aviation Fuel (SAF) in air freight is gaining momentum, as airlines and logistics providers seek to reduce their carbon footprint. Alongside fuel innovations, governments are providing substantial incentives such as tax credits, subsidies, and green financing options to accelerate the adoption of sustainable logistics solutions.

Despite the promising growth of the green logistics market, several challenges hinder its widespread adoption and scalability. One of the most significant barriers is the high initial investment costs associated with transitioning to sustainable logistics. Deploying electric and hydrogen-powered trucks, renewable energy infrastructure, and automated warehouses requires substantial capital expenditure. Many small and medium-sized logistics providers struggle to justify these costs, especially in markets with low-profit margins. While long-term savings in fuel and operational efficiency can offset these expenses, the upfront financial burden remains a major deterrent.

Business Type Insights

The warehousing segment led the market and accounted for more than 37% share of the global revenue in 2024. The increasing adoption of sustainable warehouse solutions is a key driver behind the warehousing segment's dominance in the Green Logistics Market. Companies are investing heavily in green warehouses that incorporate energy-efficient buildings, automation, and renewable energy integration to reduce carbon footprints and operational costs. Many warehouses now leverage solar and wind power, LED lighting, and AI-driven energy management systems, significantly improving energy efficiency and sustainability.

The distribution segment is expected to register the highest CAGR of 9.1% over the forecast period due to several factors driving its adoption. One of the primary drivers is the rising demand for sustainable last-mile delivery solutions as e-commerce and omnichannel retail continue to expand. Companies are increasingly focusing on eco-friendly transportation modes, including electric delivery vans, cargo bikes, and autonomous delivery robots, to reduce carbon emissions and meet sustainability targets.

Mode Of Transportation Insights

The roadways segment dominated the market and accounted for more than a 40% share of the global revenue in 2024. This dominance is largely attributed to the high reliance on road transportation for freight movement across industries, particularly in e-commerce, retail, and fast-moving consumer goods (FMCG). As companies strive to reduce carbon emissions, the adoption of sustainable road transport solutions has gained momentum, driving significant market growth. The increasing deployment of electric and hydrogen-powered trucks is a major factor contributing to the segment’s expansion. Companies are transitioning their fleets toward zero-emission vehicles (ZEVs) to comply with stringent environmental regulations and reduce operational costs linked to fuel consumption.

The airways segment is anticipated to register the highest growth over the forecast period. The increasing emphasis on sustainable aviation fuels (SAF), advancements in fuel-efficient aircraft, and the adoption of carbon offset programs are key factors contributing to this rapid growth. Airlines and logistics providers are prioritizing low-emission air freight solutions to meet global sustainability targets and reduce their environmental impact. In addition, rising demand for time-sensitive deliveries, particularly in industries such as pharmaceuticals, electronics, and high-value goods. As e-commerce and international trade expand, companies are looking for ways to balance speed and sustainability by integrating greener air freight solutions.

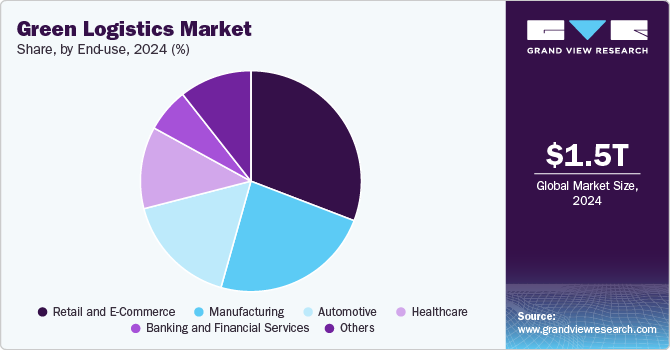

End-use Insights

The retail and e-commerce segment led the market and accounted for 30.8% share of the global revenue in 2024. This dominance is driven by the rapid expansion of online shopping, omnichannel retailing, and growing consumer demand for sustainable supply chains. E-commerce giants and retailers are increasingly integrating eco-friendly logistics solutions to reduce carbon emissions, enhance operational efficiency, and meet rising regulatory and consumer expectations for green practices. In addition, regulatory mandates and corporate sustainability goals are pushing retailers and e-commerce businesses to invest in carbon-neutral logistics strategies. Leading companies, including Amazon.com, Inc., Walmart, Inc., and Alibaba.com, have committed to achieving net-zero emissions by implementing renewable energy-powered warehouses, AI-driven route optimization, and sustainable freight solutions.

The manufacturing segment is anticipated to register the highest growth over the forecast period in the Green Logistics Market, driven by the increasing emphasis on sustainable supply chains, energy-efficient production processes, and eco-friendly transportation solutions. As industries strive to reduce their carbon footprint and comply with stringent environmental regulations, manufacturers are adopting green logistics practices across sourcing, production, and distribution.

Regional Insights

One of the most significant trends in the North American green logistics market is the widespread adoption of electric vehicles (EVs) and alternative fuel solutions. Companies such as FedEx, UPS, and DHL are investing heavily in electric delivery vehicles and alternative fuel trucks such as compressed natural gas (CNG) vehicles to reduce their carbon footprints. The rise of electric trucks for last-mile delivery, especially in urban areas, is contributing to the reduction of greenhouse gas emissions in logistics operations. In addition, the development of electric vehicle charging infrastructure across the U.S. and Canada is supporting the growth of EVs in logistics. This infrastructure expansion enables logistics providers to adopt electric fleets more easily and efficiently.

U.S. Green Logistics Market Trends

The U.S. government is implementing stringent policies to promote sustainable logistics. Agencies such as the Environmental Protection Agency (EPA) and the Department of Transportation (DOT) are enforcing emissions reduction targets, encouraging logistics firms to adopt cleaner transportation solutions. Programs such as the EPA’s SmartWay initiative help logistics companies measure and reduce their environmental impact. In addition, state-level incentives-such as California’s Advanced Clean Fleets (ACF) regulations are accelerating the transition toward electric and alternative fuel vehicles in logistics operations. Federal and state tax credits for EV adoption and sustainable warehousing further support the industry's green transformation.

Asia Pacific Green Logistics Market Trends

The Asia Pacific region dominated the Green logistics market and accounted for 36.2% share of the global revenue in 2024. This dominance can be attributed to several key factors driving the adoption of sustainable logistics solutions across the region. One of the primary drivers is the rapid growth of e-commerce in countries such as China, India, Japan, and Southeast Asia, which has significantly increased the demand for efficient, sustainable logistics systems. As a result, businesses are increasingly adopting green transportation solutions, such as electric vehicles, energy-efficient warehouses, and eco-friendly packaging.

China has made substantial strides in promoting green logistics as part of its broader push toward environmental sustainability. The country has committed to achieving carbon neutrality by 2060 and peaking carbon emissions by 2030, which has led to increased investments in green logistics technologies and infrastructure. Policies that focus on emission reduction, energy efficiency, and clean transportation are driving businesses to adopt sustainable practices. For instance, subsidies and tax incentives are being offered to companies investing in electric vehicles (EVs), renewable energy-powered facilities, and green supply chain solutions.

The India green logistics market held a market share of more than 21% in 2024. As the demand for e-commerce and retail logistics continues to grow, India is witnessing a rise in green warehouses and sustainable storage solutions. Warehousing companies are incorporating energy-efficient technologies, such as LED lighting, solar panels, and automated energy management systems, to reduce energy consumption and lower operational costs. In addition, smart warehouses equipped with AI, IoT, and robotics are enabling more efficient inventory management and reducing the need for extensive human labor, thereby lowering the carbon footprint of logistics operations.

Europe Green Logistics Market Trends

The European Union (EU) has implemented ambitious climate policies such as the European Green Deal and the Fit for 55 package, which aim to reduce greenhouse gas (GHG) emissions by 55% by 2030 and achieve net-zero emissions by 2050. These regulations are compelling logistics firms to adopt low-emission transportation, alternative fuels, and energy-efficient warehousing solutions to comply with sustainability mandates. In addition, the Emissions Trading System (ETS) and Carbon Border Adjustment Mechanism (CBAM) are increasing costs for high-emission logistics operations, pushing companies toward eco-friendly freight transport.

The UK green logistics market is rapidly transitioning toward electric and hydrogen-powered vehicles. With the government's incentives for electric vehicle adoption and investments in charging infrastructure, many logistics companies are integrating electric trucks and vans into their fleets. Firms such as DHL, Hermes, and Royal Mail are already operating electric delivery vehicles in urban areas. Moreover, hydrogen-powered trucks are gaining traction in the UK as a solution for long-haul transportation. Companies such as Hydrogen Transport Solutions and JCB are developing hydrogen-powered vehicles, which are seen as a key alternative to electrification for heavy-duty logistics. The UK is also investing in hydrogen refueling stations, and initiatives such as the Hydrogen for Transport Program are pushing the transition to cleaner fuels.

Key Green Logistics Company Insights

The green logistics market is currently consolidated and in the growth stage, with competition expected to intensify over the forecast period. Leading players are employing strategies such as partnerships, joint ventures, mergers and acquisitions, and geographical expansion to strengthen their market position. In addition, companies are heavily investing in research and development (R&D) to enhance the performance, efficiency, and cost-effectiveness of green logistics solutions. This includes advancements in fuel storage, fuel cells, and lightweight materials. As the market continues to mature, competition will such also escalate, driven by new entrants who will foster innovation, lower costs, and promote wider adoption of green logistics in the global transportation sector.

-

DB Schenker is one of the global leaders in the logistics and supply chain management industry, offering a wide range of services that include land, air, and ocean freight, as well as contract logistics and supply chain management. The company operates in over 130 countries and offers a wide range of services, including road, rail, air, and ocean freight, contract logistics, and supply chain management solutions. The company offers IT services to various industries, such as automotive, retail, pharmaceuticals, consumer goods, aerospace, electronics, and energy.

-

Bowling Green Logistics is a logistics and supply chain management company headquartered in Bowling Green, Kentucky, USA. The company specializes in offering a comprehensive range of services, including warehousing, distribution, transportation, and supply chain management solutions. Bowling Green Logistics serves a variety of industries, including automotive, retail, consumer goods, and manufacturing. The company’s ability to offer customized logistics solutions makes it a valuable partner for businesses in need of reliable, cost-effective options for managing their goods.

Key Green Logistics Companies:

The following are the leading companies in the green logistics market. These companies collectively hold the largest market share and dictate industry trends.

- United Parcel Service

- Bowling Green Logistics

- GEODIS

- Yusen Logistics Co., Ltd

- DHL International GmbH

- XPO Logistics

- DB SCHENKER

- Kuehne + Nagel

- CEVA Logistics

- Agility Public Warehousing Company K.S.C.P.

Recent Developments

-

In July 2024, DHL International GmbH and Envision Group announced a new partnership focused on advancing sustainable logistics and energy solutions, with a primary emphasis on sustainable aviation fuel (SAF). Envision, a Shanghai-based green technology provider, will supply SAF to DHL and work on renewable feedstock sources to accelerate decarbonization in air transport. DHL aims to achieve 30% SAF blending in its air transport by 2030 as part of its sustainability roadmap.

-

In November 2024, CEVA Logistics launched the FORPLANET sub-brand to further its commitment to sustainable logistics and support global decarbonization efforts. The FORPLANET suite includes low-carbon transport solutions and promotes circular economy practices, such as closed-loop supply chains and reverse logistics. CEVA Logistics aims to reduce emissions through alternative fuels, modal shifts, and the use of electric vehicles.

Green Logistics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1,592.4 billion |

|

Revenue forecast in 2030 |

USD 2,347.2 billion |

|

Growth rate |

CAGR of 8.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Business type, mode of transportation, end-use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

United Parcel Service; Bowling Green Logistics; GEODIS; Yusen Logistics Co., Ltd; DHL International GmbH; XPO Logistics; DB SCHENKER; Kuehne + Nagel; CEVA Logistics; Agility Public Warehousing Company K.S.C.P. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

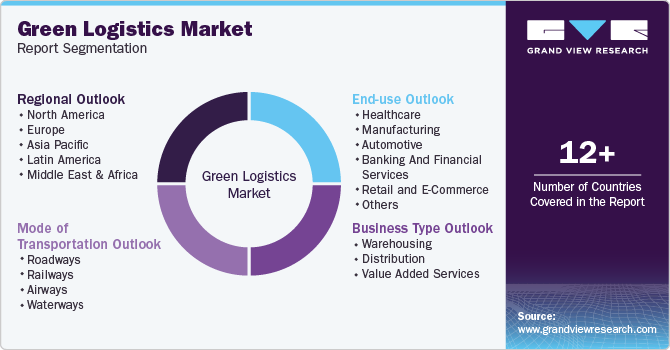

Global Green Logistics Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the green logistics market report based on business type, mode of transportation, end-use, and region.

-

Business Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Warehousing

-

Distribution

-

Value added services

-

-

Mode of Transportation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Roadways

-

Railways

-

Airways

-

Waterways

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Manufacturing

-

Automotive

-

Banking and financial services

-

Retail and E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green logistics market size was estimated at USD 1,507.0 billion in 2024 and is expected to reach USD 1,592.4 billion in 2025.

b. The global green logistics market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 2,347.2 billion by 2030.

b. The roadways segment dominated the green logistics market with a 40.1% share in 2024 due to the rapid adoption of electric, hydrogen, and biofuel-powered trucks, driven by government incentives, carbon regulations, and fleet electrification initiatives by major logistics players like Deutsche Post AG, United Parcel Service of America, Inc., and FedEx.

b. Some key players operating in the green logistics market include United Parcel Service; Bowling Green Logistics; GEODIS; Yusen Logistics Co., Ltd; DHL International GmbH; XPO Logistics; DB SCHENKER; Kuehne + Nagel; CEVA Logistics; Agility Public Warehousing Company K.S.C.P.;

b. Key factors that are driving the market growth include stringent environmental regulations, rising corporate ESG commitments, and increasing consumer demand for sustainable supply chains. The adoption of electric trucks, hydrogen fuel cells, and biofuels, along with expanding EV charging and hydrogen refueling infrastructure, is driving the shift to eco-friendly transport. Additionally, the e-commerce boom has accelerated the need for green last-mile delivery solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."