- Home

- »

- Renewable Energy

- »

-

Green Hydrogen Market Size & Share, Industry Report, 2033GVR Report cover

![Green Hydrogen Market Size, Share & Trends Report]()

Green Hydrogen Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology(Alkaline Electrolyzer, PEM Electrolyzer, SOEC Electrolyzer) By Distribution Channel (Pipeline, Cargo), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-800-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Hydrogen Market Summary

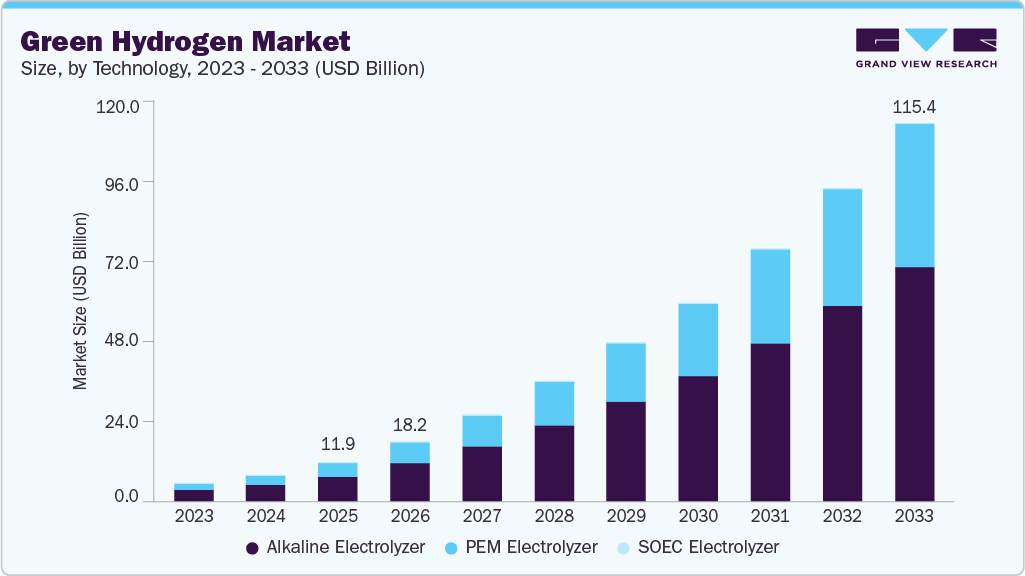

The global green hydrogen market was estimated at USD 11.86 billion in 2025 and is projected to reach USD 115.35 billion by 2033, expanding at a CAGR of 30.2% from 2026 to 2033. The growth is primarily driven by the rising adoption of green hydrogen as a clean and zero-carbon energy source across industrial, transportation, and power generation sectors.

Key Market Trends & Insights

- The Europe green hydrogen market held the largest share of 46.9% of the global market in 2025.

- UK led the Europe regional market in 2025, in terms of revenue.

- Based on the distribution channel, the pipeline segment accounted for a notable revenue share of about 61.7% in 2025.

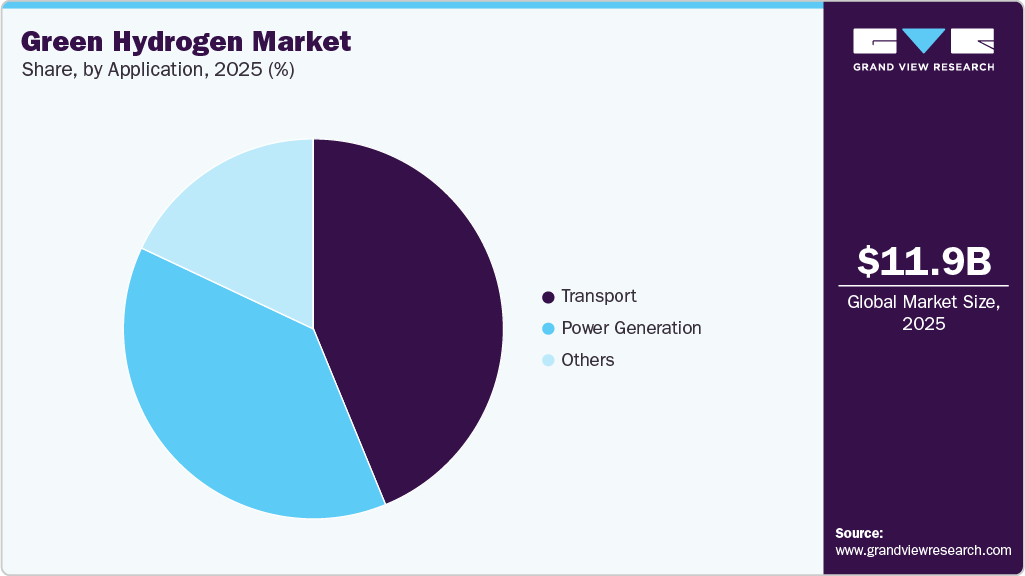

- By application, the transport segment led the market with the largest revenue share in 2025.

- By technology, the alkaline electrolyzer segment holds a largest revenue share in 2025

Market Size & Forecast

- 2025 Market Size: USD 11.86 Billion

- 2033 Projected Market Size: USD 115.35 Billion

- CAGR (2026-2033): 30.2%

- Europe: Largest market in 2025

- Latin America: Fastest growing market

Increasing government initiatives and subsidies aimed at achieving net-zero emissions, coupled with growing investments in renewable hydrogen production infrastructure, are accelerating market expansion. Technological advancements in green hydrogen production methods, particularly electrolysis powered by renewable energy sources such as solar and wind, and the development of cost-effective and efficient storage and distribution solutions are further fueling market growth. Additionally, the growing demand for green hydrogen in refineries, chemical manufacturing, steel production, and fuel cell applications is creating significant opportunities.

Regionally, Europe is expected to dominate due to strong policy support and large-scale hydrogen projects, while Asia Pacific and North America are witnessing the rapid adoption of green hydrogen for clean mobility and renewable energy integration. As industries and governments increasingly focus on decarbonization, the green hydrogen market is poised to witness robust growth through 2033.

Drivers, Opportunities & Restraints

The growing global focus on decarbonization and the shift toward renewable energy systems is driving the green hydrogen market. Governments and industries are increasingly adopting green hydrogen to meet net-zero targets, particularly in hard-to-abate sectors such as steel, chemicals, refining, and heavy transportation. Continuous advancements in electrolyzer technologies and the declining cost of renewable power are improving production efficiency and enhancing the viability of green hydrogen as a clean energy carrier.

Green hydrogen production using solar and wind energy presents significant growth opportunities. The expanding use in fuel cell electric vehicles, public transportation, shipping, and aviation fuels, along with the growing demand for green ammonia and green methanol, is opening up new application areas. Investments in large-scale electrolyzer projects, hydrogen hubs, storage solutions, pipelines, and refuelling infrastructure further support market expansion. Strong policy support in regions such as Europe, Asia-Pacific, and the Middle East is accelerating adoption.

However, high production costs compared to conventional and blue hydrogen remain a key restraint, particularly due to electrolyzer capital costs and renewable energy integration expenses. Limited hydrogen storage, transportation, and distribution infrastructure, along with efficiency losses in conversion processes, also constrain market growth. Additionally, regulatory uncertainties, lack of standardized certification for green hydrogen, and competition from alternative low-carbon technologies pose challenges to widespread adoption.

Technology Insights

Based on technology, the Alkaline Electrolyzer segment held the largest revenue share of 65.1% in 2025 in the green hydrogen market. Alkaline electrolysis is one of the most established and commercially mature technologies for green hydrogen production, offering high reliability, long operational lifetimes, and comparatively lower capital costs than newer electrolyzer technologies. Its widespread adoption across industrial-scale hydrogen production projects is supported by proven performance, scalability, and compatibility with large renewable energy installations. Additionally, strong deployment in chemical processing, refining, and power-to-hydrogen applications, along with supportive government policies and funding for renewable hydrogen infrastructure, has reinforced the dominance of alkaline electrolyzers in the market.

In contrast, the Solid Oxide Electrolyzer Cell (SOEC) segment is expected to register the fastest compound annual growth rate (CAGR) of 42.8% over the forecast period. SOEC technology operates at high temperatures, enabling significantly higher electrical efficiency and lower electricity consumption when integrated with waste heat or industrial processes. The growing focus on improving system efficiency, reducing long-term hydrogen production costs, and decarbonizing energy-intensive industries such as steel and chemicals is driving interest in SOEC electrolyzers. Ongoing advancements in materials, durability, and system integration, along with increasing pilot and demonstration projects, are expected to accelerate the adoption of SOEC technology in the green hydrogen market.

Distribution Channel Insights

Based on distribution channel, the pipeline segment held the largest revenue share of 60.2% in 2025 in the green hydrogen market. Pipeline-based distribution is widely preferred for large-scale and continuous hydrogen supply due to its cost efficiency, safety, and ability to transport high volumes over long distances. This distribution mode is particularly suitable for industrial clusters, hydrogen hubs, and regions with established gas pipeline infrastructure, enabling seamless integration of green hydrogen into refining, chemical processing, and power generation operations. Growing investments in dedicated hydrogen pipelines and the repurposing of existing natural gas networks are further strengthening the dominance of the pipeline segment.

In contrast, the cargo segment is expected to register the fastest CAGR of 31.4% over the forecast period. Cargo-based transportation, including liquefied hydrogen and hydrogen carriers such as ammonia and liquid organic hydrogen carriers (LOHCs), is gaining traction for long-distance and international trade. Rising cross-border green hydrogen projects, increasing demand from regions with limited domestic renewable resources, and expanding maritime export-import infrastructure are driving rapid growth in this segment. Advancements in liquefaction, storage, and shipping technologies are further enhancing the feasibility and scalability of cargo-based green hydrogen distribution.

Application Insights

Based on application, the transport segment held the largest revenue share of 43.8% in 2025 in the green hydrogen market. The dominance of this segment is driven by the increasing adoption of hydrogen as a zero-emission fuel across fuel cell electric vehicles (FCEVs), public transport buses, heavy-duty trucks, rail, and maritime applications. Green hydrogen is gaining strong traction in the transport sector due to its high energy density, fast refueling capability, and suitability for long-range and heavy load mobility, where battery-electric solutions face limitations. Government incentives, emission reduction mandates, and large-scale deployment of hydrogen refueling infrastructure are further supporting the segment’s leading market position.

In addition to holding the largest market share, the transport segment is also expected to register the fastest CAGR of 31.9% over the forecast period. This rapid growth is fueled by expanding investments in hydrogen mobility ecosystems, increasing commercialization of fuel cell vehicles, and rising adoption in shipping and aviation through green hydrogen-based fuels such as e-fuels and green ammonia. Strong policy support, pilot projects, and public-private partnerships aimed at decarbonizing the transportation sector are expected to significantly accelerate green hydrogen consumption in transport applications.

Regional Insights

Europe dominated the global green hydrogen market in 2025, capturing approximately 46.9% of total revenue. This leadership position is driven by aggressive decarbonization targets, strong regulatory frameworks, and comprehensive hydrogen strategies adopted by the European Union and its member states. Large-scale investments in electrolyzer capacity, renewable energy integration, and hydrogen backbone infrastructure across countries such as Germany, France, the Netherlands, and Spain have significantly accelerated market growth. Additionally, strong demand from industrial decarbonization, clean mobility, and power-to-X applications continue to reinforce Europe’s leading position.

Latin America Green Hydrogen Market Trends

Latin America is projected to register the fastest compound annual growth rate (CAGR) of 47.3% over the forecast period, driven by abundant renewable energy resources, particularly solar and wind, and increasing foreign investments in green hydrogen projects. Countries such as Chile, Brazil, and Argentina are emerging as key production hubs due to favorable renewable generation costs, export-oriented hydrogen strategies, and supportive government policies. Growing interest in green hydrogen exports, green ammonia production, and industrial decarbonization is further accelerating market expansion across the region.

North America Green Hydrogen Market Trends

The North American green hydrogen market is expanding steadily, supported by increasing investments in clean energy infrastructure, hydrogen hubs, and industrial decarbonization initiatives. Demand from transportation, refining, and power generation sectors, along with strong federal and state-level incentives, is driving adoption. The region is witnessing rapid deployment of large-scale electrolyzer projects and hydrogen refueling networks, particularly in the U.S. and Canada, strengthening its position in the global green hydrogen landscape.

The green hydrogen market in the U.S. is anticipated to grow significantly over the forecast period, supported by favorable policy frameworks, funding programs, and hydrogen hub development initiatives. U.S.-based players are actively investing in renewable-powered hydrogen production and expanding domestic and international operations to meet rising demand. Increasing adoption of green hydrogen in clean mobility, industrial processes, and energy storage applications is expected to accelerate market growth further.

Asia Pacific Green Hydrogen Market Trends

The Asia Pacific green hydrogen market is witnessing steady growth, supported by rapid industrialization, rising energy demand, and strong government commitments toward clean energy transition. Major economies such as China, Japan, South Korea, Australia, and India are actively investing in green hydrogen production, electrolyzer manufacturing, and hydrogen infrastructure to support industrial decarbonization and clean mobility. National hydrogen roadmaps, subsidies, and pilot projects for hydrogen-powered transport and power generation are encouraging large-scale adoption across the region.

Middle East & Africa Green Hydrogen Market Trends

The Middle East & Africa green hydrogen market is gradually gaining momentum, supported by vast renewable energy potential, particularly solar, and strong government-led initiatives. Countries such as Saudi Arabia, the UAE, and Namibia are investing heavily in large-scale green hydrogen and green ammonia projects aimed at domestic consumption and exports. Strategic location advantages, growing industrial demand, and long-term energy diversification plans are positioning the region as an emerging global green hydrogen production hub.

Key Green Hydrogen Company Insights

Some of the key players operating in the global green hydrogen market include Nel ASA and Siemens Energy AG, among others.

-

Nel ASA is a leading pure-play green hydrogen technology company headquartered in Norway, with operations across Europe, North America, and Asia-Pacific. Founded in 1927, the company specializes in renewable-powered hydrogen production and refueling infrastructure. Nel ASA offers both alkaline and proton exchange membrane (PEM) electrolyzer systems, which are widely deployed in industrial decarbonization, renewable energy storage, and hydrogen mobility applications. The company plays a critical role in advancing green hydrogen adoption by providing scalable electrolyzer solutions integrated with solar and wind power.

-

Siemens Energy AG is a global energy technology company headquartered in Germany, with a strong presence across Europe, North America, Asia-Pacific, and the Middle East. Siemens Energy is a major supplier of PEM electrolyzer technology through its hydrogen solutions portfolio, supporting large-scale green hydrogen production for industrial, power-to-X, and clean fuel applications. The company leverages its expertise in power generation, grid integration, and digital energy systems to deliver end-to-end green hydrogen solutions, positioning itself as a key enabler of global decarbonization efforts.

Key Green Hydrogen Companies:

The following are the leading companies in the green hydrogen market. These companies collectively hold the largest Market share and dictate industry trends.

- Air Liquide

- Air Products Inc.

- Bloom Energy

- Cummins Inc.

- Engie

- Linde plc.

- Nel ASA

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Uniper SE

Recent Developments

- In November 2025, Nel ASA strengthened its position in the green hydrogen market by winning a major contract for its PEM electrolyzer technology, securing a confirmed order worth more than USD 50 million for a 40 MW green hydrogen project in Norway. The order was placed by Kaupanes Hydrogen AS and HyFuel AS, with project development led by Hydrogen Solutions AS in partnership with regional stakeholders. The project will utilize Nel’s MC 500 modular PEM electrolyzer systems to enable renewable hydrogen production.

Green Hydrogen Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 18.16 billion

Revenue forecast in 2033

USD 115.35 billion

Growth rate

CAGR of 30.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, Volume in Million Metric Tons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Air Liquide; Air Products Inc.; Bloom Energy; Cummins Inc.; Engie; Linde plc.; Nel ASA; Siemens Energy; Toshiba Energy Systems & Solutions Corporation; Uniper SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Hydrogen Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global green hydrogen market report based on technology, application, distribution channel, and region.

-

Technology Outlook (Revenue, USD Million; Volume, Kilo Tons; 2021 - 2033)

-

Alkaline Electrolyzer

-

PEM Electrolyzer

-

SOEC Electrolyzer

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Kilo Tons; 2021 - 2033)

-

Pipeline

-

Cargo

-

-

Application Outlook (Revenue, USD Million; Volume, Kilo Tons; 2021 - 2033)

-

Power Generation

-

Transport

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green hydrogen market size was estimated at USD 11.86 billion in 2025 and is expected to reach USD 18.16 billion in 2026.

b. The global green hydrogen market is expected to grow at a compound annual growth rate of 30.2% from 2026 to 2033 to reach USD 115.35 billion by 2033.

b. Based on the application segment, transport held the largest revenue share of approximately 43.8% in the green hydrogen market in 2025.

b. Some of the key vendors operating in the global green hydrogen market include Air Liquide International S.A., Linde plc, Air Products and Chemicals, Inc., Cummins Inc. (Hydrogenics), Nel ASA, Bloom Energy Corporation, Messer Group GmbH, INOX Air Products Ltd., Iwatani Corporation, and Taiyo Nippon Sanso Corporation, among others.

b. The green hydrogen market is primarily driven by the accelerating global transition toward clean and low-carbon energy systems, supported by stringent emission regulations, net-zero targets, and government incentives promoting renewable hydrogen adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.